If one institution in Pakistan stands out, whether for good or bad, it would most likely be the Armed Forces. However, beyond warfare, it is their involvement in the sociopolitical landscape of the country that makes them the institution that receives the most attention.

This has been true for the majority of the country's history and been further emphasized by the recent consolidation of power and heavy-handed approach of the military leadership. One group that have experienced the consequences of this approach are money exchange companies.

A nationwide crackdown on these companies resulted in the suppression of speculative demand, which caused the Pakistani rupee to appreciate to around 290 against the greenback. This drop occurred after the exchange rate depreciated to a high of 330 earlier last month.

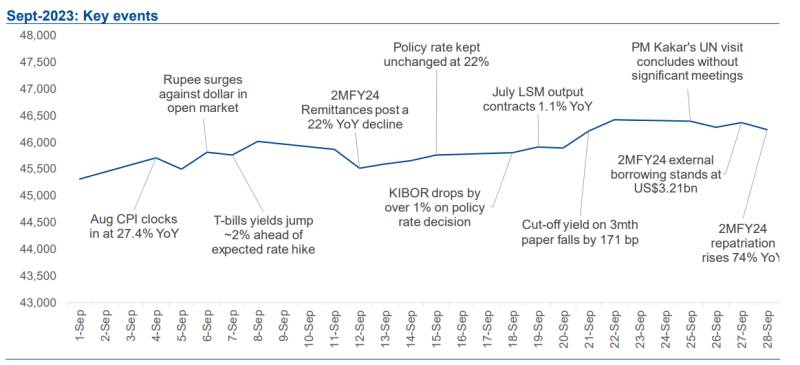

“PKR/US$ movement during Sep-2023 was among the key highlights of the month. The month witnessed a sharp appreciation of 6% in PKR against US$, recovering all depreciation recorded in August 2023, led by swift action towards reforms that pertained to exchange companies and the foreign exchange market. The appreciation led to PKR/US$ closing almost flat on a QoQ basis. The monthly appreciation was among the highest recorded in the country’s history,” read a report by JS Global.

This led to the Rupee being one of the best performing currencies globally in the last month.

However, in parallel to this, the harsh reality of the cost-of-living crisis remains unabated, affecting the average Pakistani. The recently released inflation figures for September only serve to highlight the immense failure of successive administrations in controlling and curbing rising prices.

In her analysis, Amreen Soorani, Head of Research at JS Global, highlights that the Consumer Price Index (CPI) for September 2023 showed a year-on-year increase of 31.4% due to the low base effect. Soorani further mentions that core inflation continues to expand.

Looking ahead, the recent appreciation of the Pakistani rupee has led to a decrease in petroleum and oil product (POL) prices by approximately Rs. 10 per liter. However, it is expected that the correlation between POL prices and food prices may not be as strong during this downward movement. Additionally, an anticipated increase in gas prices in November 2023 is likely to contribute to the monthly inflation rate.

Source: Asian Development Bank

Therefore, the obsession with the currency exchange rate serves no real purpose other than to divert attention away from more crucial economic issues. Furthermore, the gains made by the rupee are likely to be temporary unless there are massive changes in the country's foreign exchange reserves and economic fundamentals.

We don't have to look far to understand this; just across the western border, Afghani currency's performance over the past three months was the best in the world. While the Taliban regime's effective administrative measures may be partially credited for this appreciation, the main factor driving it is the continuous flow of humanitarian aid which, if halted can send the Afghani into a downward spiral.

FX clampdown boosts Pakistani rupee 6.1% to become September's top currency

— Ariba Shahid (@AribaShahid) September 28, 2023

Chart by @KarinStrohecker pic.twitter.com/fZ9xMH5YCc

Furthermore, Sri Lanka, another regional peer, exemplifies the volatility in currency trends for emerging markets. In a Bloomberg article titled "Sri Lanka Rupee Goes From Asia's Best to Worst in Three Weeks" published in July, it was explained that the Island nation's currency experienced a significant decline following an interest rate cut and the relaxation of import restrictions.

Source: JS Global

The reality for Pakistan is also quite similar. The government is posting massive fiscal deficits, while the central bank continues to fund it through frequent PKR liquidity injections.

The situation is explained by Yousuf Farooq, Director of Research at Chase Securities, “the government finances its substantial fiscal deficit by borrowing from local banks. This deficit is of such magnitude that deposits alone are insufficient to bridge the gap, prompting the SBP to inject money through Open Market Operations, thereby expanding the money supply.”

The continuous expansion of the money supply has led to an excessive supply of rupees relative to the limited availability of dollars, consequently exerting downward pressure on the exchange rate.

Therefore, the focus should be on allowing the currency to follow its natural course and avoiding frequent bouts of volatility. Investors can incorporate currency depreciation into their investment decisions, but volatility tends to unsettle them and this could be detrimental to Pakistan’s FDI ambitions.