Extracting raw materials from colonised territories, Europe in general, and Britain and France in particular, embarked rather rapidly on the path to industrialisation from 1850 to 1950. Fueled by fossil fuel, they covered significant miles of industrial growth, technological, and economic development in the next semi-sesquicentennial and monopolised international trade. In other words, the Industrial Revolution marked the beginning of a rapid increase in methane, CO2, and other greenhouse gas emissions into the atmosphere, mainly due to coal burning and the deforestation of large tracts of land.

Ignoring the initial warnings of global warming in the sixth and seventh decade of the last century, it was in the late 1990s and in the first couple of decades of the new century that the world began feeling the heat. We ended up with climate change, erratic patterns of weather, heat waves, and flooding of epic proportions, including urban flooding, glacial meltdowns, massive forest fires, cyclones, hurricanes, and typhoons. These emerging symptoms have caused havoc from the global north to the south.

Though Africa and Asia, skipping India and China, have limited carbon footprints, they have emerged as the worst sufferers of the global climate crisis. Nevertheless, with rising temperatures and shifting weather patterns, the contours of the climate-change crisis are becoming increasingly sharp, foreshadowing far-reaching consequences transcending traditional boundaries and causing concerns for national security and geopolitical dynamics. Climate change knows no boundaries, making it a quintessential global concern.

In recent years, Pakistan has experienced significant fluctuations in its per capita CO2 emissions, with an average annual growth rate exceeding 3.4%. The primary sources of these emissions include cement plants, transportation, agriculture, gas processing, power plants, and refineries. In terms of geographical contributions, Sindh accounts for over 22 million tons of CO2 emissions. It is followed closely by Punjab, which exceeds 20 million tons. With the use of coal, this is likely to rise sharply.

In relative terms, while Pakistan is the least contributor to global carbon footprints (roughly around 0.7% globally), it is one of the ten most affected countries by global warming and climate crisis. But it doesn't mean Pakistan and its industrial sector absolved of decarbonisation responsibilities. The country's steady transition from an agriculture-led economy to an industry-led economy is increasing its energy consumption as well as carbon emissions.

Obviously, it is a worrying sign because our industrial sector uses over 98% of the polluting energy sources. Our neighbouring country, India, the world's third-largest CO2 emitter, also holds a significant challenge ahead as its energy-intensive industries — like chemicals, steel, and cement — need to be decarbonised. Similarly, Bangladesh, despite having a smaller size of industry, must also be mindful of adopting renewable sources of energy for being a delta and low-lying country. A slight rise in the sea level may prove catastrophic for its overpopulated tracts of dry land.

Despite the commitment of all South Asian countries to the Paris Agreement and setting targets for minimising carbon intensity and increasing non-fossil-fuel power, the current emission ratios of these countries are likely to rise significantly by 2050. It is in this context that we turn our attention to Pakistan, a country whose complex geography and socio-economic conditions render it utterly vulnerable to the effects of global warming.

Industries, carbon emissions and climate change

Industries, undoubtedly, are an important basis for social and economic growth. At the same time, they are also substantial contributors to greenhouse gas (GHG) emissions. Since 2010, the net anthropogenic CO2 emissions have increased across all major sectors. In 2019, approximately 34% and 24% of the net anthropogenic GHG emissions were attributed to the energy supply sector and industry, respectively.

Reallocating emissions from electricity and heat production to sectors using the final energy in the industry increased their relative emission shares. In this frame, the majority, i.e. 34% of emissions in 2019, was allocated to industries. (The role of industries in climate change mitigation - 2019).

Many large textile-producing countries have energy mixes that rely heavily on coal, leading to substantial carbon footprints associated with their production.

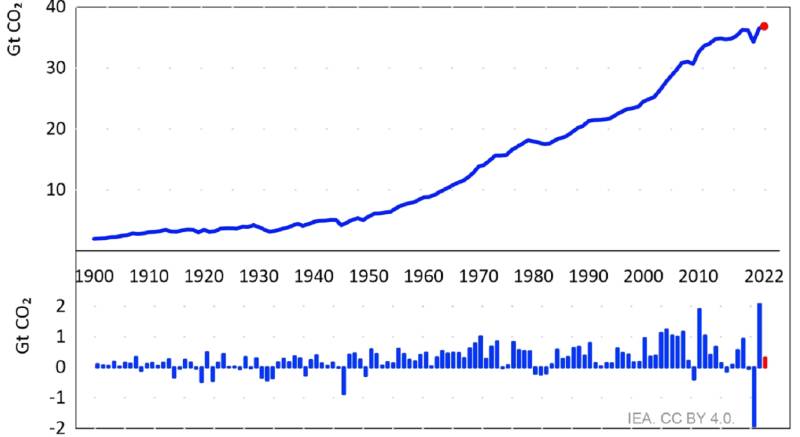

Carbon emissions have been continuously increasing due to increased industrial activities since the beginning of the industrial revolution. Since many of the industrial processes are based on electricity and a major proportion of electricity is produced through the combustion of hydrocarbons, ultimately, increased use of electricity is directly linked to greater production and emission of carbon across sectors. Figure #1 shows the temporal carbon emissions trend due to energy consumption and industrial processes.

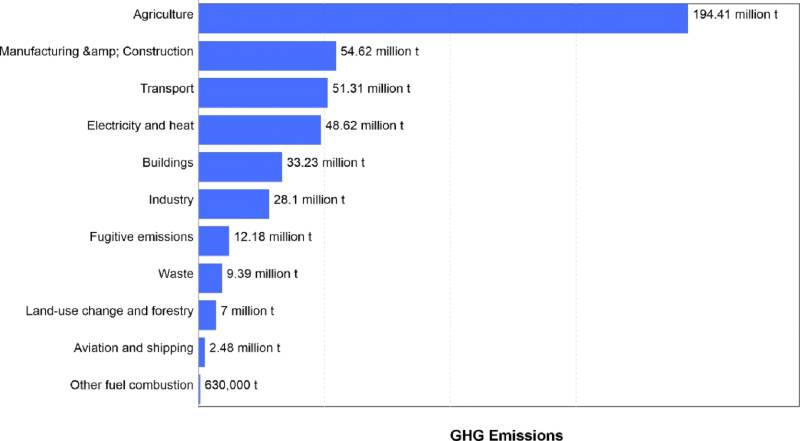

Figure 1 also reveals the reduced state of carbon emissions from 2019 to 2021 - the COVID-19 period of lockdown around the world, while Figure 2 shows carbon emissions by a range of sectors. Coincidentally, Pakistan's industrial sector is responsible for 28.1 million tons of carbon emissions in 2019, which has continued to rise since.

Industrial emissions in Pakistan and the decarbonisation process

It is clear from the above-mentioned values that industrial emissions have risen to alarming levels. Therefore, it is necessary to reduce industrial emissions to mitigate their climate impact. The government of Pakistan (GoP) claims to be struggling to reduce carbon emissions and make a shift towards renewable sources of energy, but the fact is the country's pace of transition is considerably slow.

The National Energy Efficiency and Conservation Authority (NEECA) has made certain commitments to reduce carbon emissions by 2030. These can be accomplished by conducting the required industrial energy audits, optimising thermal utilities, and enhancing the energy efficiency of electrical systems. Table #1, in this regard, shows the energy demand. The primary energy source in Pakistan is hydrocarbons – reflecting that by properly regulating the existing supply system, about 5.3 MtCO2-e of GHG emissions can be slashed.

Table 1: Industrial climate mitigation in industrial sector by 2030

| Sector | Energy demand reduction (Ktoe) | GHG emission reduction (MtCO2-e)* |

| Textile | 359.3 | 1.45 |

| Food and beverage industry | 136.1 | 0.32 |

| Brick/Kiln | 404.4 | 0.94 |

| Cement | 250.1 | 0.91 |

| Wood and paper | 63.6 | 0.15 |

| Fertilizer | 665.1 | 1.56 |

| Total | 1,878.6 | 5.33 |

Challenges faced by industry in transforming from fossil fuel to clean energy

All industries, specifically the textile, food, steel and cement industries, face various challenges in transitioning from fossil fuels to clean energy. Key factors include governmental support, cost, investment, availability and replacement of technology, heat generation, import, export and profitability fluctuation, along with a system for energy management and provision in a particular country.

While there is evidently a need to use more renewable energy, barriers to that goal include legislation, fossil fuel subsidies, and limitations in the availability of advanced technology. The transition to renewable energy is more challenging in developing countries due to fewer accessible pathways, support for renewables and a lack of energy space to make the transition.

Challenges faced by the textile industry: The textile industry faces a significant barrier to maintaining a complex and fragmented sector – comprising a range of small and medium enterprises (SMEs) with limited resources. These companies often lack information on how to implement energy-efficiency measures and possess limited resources to acquire this information, let alone implement them. Despite the availability of cost-effective energy-efficiency opportunities, they are often not implemented due to these constraints.

With rapid changes in fashion trends, textile and apparel companies are pressured to produce new and unique clothing to stay competitive. This leads to increased production, often using conventional, non-eco-friendly materials and processes due to cost and time constraints.

Adopting sustainable manufacturing practices for textiles requires specific knowledge and skills. Many labourers and artisans trained in conventional methods struggle to adapt to new and advanced technologies, leading to resistance or difficulty in implementing sustainable techniques. Natural and eco-friendly raw materials like organic cotton and silk are significantly more expensive than their non-sustainable counterparts. Many companies face challenges in sourcing these materials locally, often leading to higher costs due to imports.

The industry relies heavily on chemicals for dyeing and finishing textiles, with natural alternatives often failing to meet the desired quality and consistency. Eco-friendly chemicals for dyeing and printing are limited in availability, posing a substantial challenge.

The textile industry is one of the least energy-efficient sectors, with a significant proportion of energy lost through manufacturing, mostly derived from unsustainable sources such as coal and natural gas. Some textile companies have started investing in renewable energy sources such as solar power, but these investments face challenges such as ensuring consistent supply and overcoming initial costs.

In countries like India, the government is promoting decentralised renewable energy to reduce reliance on expensive and emissions-heavy fuels such as diesel, especially in rural areas. However, erratic power supply, high tariffs, and limited access to technology remain barriers to this transition.

Challenges faced by Food and Beverage Industry (FBI): In the food and beverage industry, the transition to green energy is hindered by a reliance on natural gas and the slow adoption of renewable energy. Although energy costs are relatively low compared to their total costs, the stable demand for food means companies have not reduced production in response to higher energy prices.

Nevertheless, it has options like installing solar photovoltaic systems, waste-heat capture, and using biomass and biogas to reduce the use of fossil fuel, but costs and technical limitations, along with grid congestion, prove to be barriers.

Government policy, cost savings, sustainability goals, and customer demands are drivers for greener energy use, but investments and payback periods are obstacles.

Challenges faced by the cement industry: The cement industry is one of the largest contributors to CO2 emissions, responsible for around six percent to nine percent of global emissions. Cement manufacturing is energy-intensive, and the industry relies heavily on coal, which accounts for about 40% of production costs.

Reducing these emissions is challenging due to the need for significant research and investment in carbon capture and storage (CCS) and carbon capture and usage (CCU).

The industry needs to shift from thermal-based energy to using innovative technologies. It should also transition from a commodity focus to a differentiated production approach and market strategies which leverage carbon consciousness. Value-and-usage-based pricing, research and development, and customer and market-centric perspectives can also advance the cause.

The industry is affected by supply issues, cartelisation, and fluctuations in global coal prices, which makes the transition to clean energy even more challenging.

Usually, the industry's growth is influenced by government spending on infrastructure projects – affecting the demand for cement. Rising environmental concerns related to cement manufacturing pressure the industry to reduce emissions and transition to cleaner energy sources.

The transition requires significant technological upgradation, for which the industry needs to be prepared to invest. But at the same time, the use of dwindling natural resources and reliance on imported coal pose risks, including fluctuating exchange rates and supply disruption.

Challenges faced by the sports industry: The sports industry faces several challenges in transitioning to green and clean energy sources. Efforts are underway to align it with environmental sustainability and climate action.

UN's Sports for Climate Action Framework (UN-SCFF) is also facilitating industry's transition to carbon neutrality. In certain countries, sustainable operations and fan engagement, emphasising environmental stewardship to generate awareness and encourage positive behaviour, are also ongoing.

Price hike and rising tariff posing barrier to green transition: In Pakistan, the industry, in general, is trapped between rising gas and thermal energy tariffs and is looking for sustainable alternatives. Under conditions of the International Monetary Fund (IMF), it has constantly raised energy tariffs over the past decade, particularly since 2022, when the government renegotiated its credit line with the Fund. The trend may bring down circular debt, which has risen to Rs2,100 billion as claimed by the government, but it is adversely affecting industrial growth and the country's export potential.

By early November 2023, the government had increased gas prices for commercial consumers by 137% and 193% for cement manufacturers.

According to the chairman of the Businessmen Group (BMG), "rising tariffs, coupled with the gas price hike, are going plunge Karachi's industry into a deep crisis by increasing the cost of production and decreasing their competitiveness".

"The situation is causing the closure of small and medium-sized units, rendering thousands of employees jobless," he added.

On the other hand, given the discrepancy in gas prices in Sindh and Punjab, industrialists in both provinces argue that the other is doing business in an advantageous position. The industrial lobby in Sindh argues that the price hike is not seriously affecting industries in Punjab as they are shifting to other energy sources such as coal, bagasse, etc. Independent Power Producers (IPPs), power plants, and fertiliser manufacturers in Punjab are switching to coal, while the export-oriented industrial units in Sindh have limited space to pile up diversified resources. Theoretically, they too can switch to dirty energy sources, violating environmental compliance regulations (some of which are insisted upon by their clients) and risking export orders.

Industry representatives were unhappy when an amnesty scheme awarded by the previous government was withdrawn, and ironically, despite considering green sources of energy, they still persist on energy subsidies. Recently, they pleaded again with Caretaker Prime Minister Anwaarul Haq Kakar to lower power tariffs and deal effectively with the ongoing gas load shedding and low gas pressure. Sticking to the same demand, they assert that without smooth provision and lower gas prices, industrialists may not perform their operations to meet the export targets.

Workable tools and strategies for industrial decarbonisation

Industrial decarbonisation is a key strategy for reducing GHGs. Industries such as steel, cement, iron, textile, food and beverage, and chemicals account for about 20% of global CO2 emissions. Obviously, by decarbonising these industries, we can significantly reduce global emissions. Some eminent means industries can use to reduce the spread of GHGs are listed below.

India and Pakistan may benefit from comprehensive policy interventions that provide robust incentives to the corresponding industries for adopting clean energy technologies. Bangladesh is already making strides with solar power, and similar investments could be made in Pakistan and India as the most feasible and impactful forms of renewable energy.

In India's case, carbon pricing can be an effective tool to reduce emissions, especially in hard-to-abate sectors. Encouraging foreign investment and technology transfer could help these countries leapfrog to more advanced, less polluting industrial technologies.

Across the three countries, improving energy efficiency in industries can reduce the consumption of fossil fuels and associated carbon emissions.

Information and Communication Technology (ICT) sector, which generates some emissions, can potentially mitigate GHG emissions through smart management and communication facilities.

CCS technology, which extracts point-source carbon emissions and sequesters them underground, has the potential to remove up to 90% of CO2 emissions from an industrial facility, including both energy and process emissions. Without deploying CCS, the global costs of implementing the 2°C policy might sit higher by 12% by 2075 and 71% by 2100.

By implementing a net-zero supply chain, companies can amplify their climate impact, enable emission reductions in hard-to-abate sectors, and accelerate climate action in countries like India, China and Pakistan, where it would otherwise not be high on the agenda.

In addition to the rapid decarbonisation of the global economy, Nature Based Solutions (NBS) can also play a role in complying with the Paris Agreement to keep global warming below 1.5°C.

Industrial electrification is another fundamental pillar to reduce carbon emissions. Leveraging advancements in low-carbon electricity from grid and onsite renewable generation sources might prove critical for decarbonisation efforts.

As per the International Renewable Energy Agency (IREA), Pakistan's industrial sector's renewable energy consumption was 19% in 2020. Pakistan urgently requires a diverse portfolio of low-carbon technologies, a transition to renewable energy sources, and a viable solution for carbon capture and storage to swiftly reduce GHG emissions and mitigate the impact of climate change.

Like other countries, Pakistan is also exploring carbon capture and storage techniques for industries. Geological and exploration data suggests Pakistan has an estimated carbonate storage capacity of approximately 1.7 Gigatons of CO2 annually.

Energy efficiency is a foundational, crosscutting decarbonisation strategy seen as cost-effective. Pakistan's textile sector, which consumes 27% of all energy, offers the highest efficiency gains with approximate energy savings of 2,150 GWh. This can be achieved by enhancing efficiencies of compressors, heat transfer, recovery systems, power factor correction panels, process control, steam system optimisation, lights, and motors.

The Indicative Generation Capacity Expansion Plan's (IGCEP) goal is to optimise energy generating costs to supplement energy at the lowest possible cost to fulfil future energy demands. Transitioning away from domestic coal is excellent for decarbonisation and enables the development of variable renewable energy (VRE) and adoption of technologies such as concentrated solar power (CSP) and battery storage.

Industries should replace thermal-driven processes with renewable energy-driven systems, such as solar photovoltaic systems (PVs), in the energy mix to reduce carbon emissions.

Low-and no-carbon fuel and feedstocks also play a crucial role in reducing emissions associated with combustion in industrial processes. India and China produce more than five percent and three percent of their energy from biofuels, Pakistan lags in the use of biofuels for electricity generation. The incorporation of biofuels for power and heat generation has the potential to mitigate carbon emissions.

Unfortunately, renewable energy technologies (RETs) continue to be relatively expensive in Pakistan compared to their fossil fuel counterparts. Without a domestic manufacturing industry, the import of equipment further drives up the costs of RE projects.

Heavy government subsidies for fossil fuels also result in preference for thermal energy. Subsidies are intended to shield domestic prices from global market fluctuations, but inadvertently they deter businesses and citizens from adopting alternative, more efficient and sustainable energy technologies. Available financing for RE projects is inadequate in Pakistan. There is a lack of awareness about RETs coupled with the perception of high-risk investment and uncertain reliability of resources.

Tariffs for RE projects are inconsistent and unclear. This lack of consistency creates uncertainty for investors planning and financing projects. In addition, the relatively higher capital cost for RETs discourages potential financiers. An infrastructure challenge also emerges from the decentralised nature of RETs, while the country's current electric power system supports centralised systems.

Along with enhancing the role of the Alternate Energy Development Board (AEDB) under the Private Power and Infrastructure Board (PPIB), the government has introduced feed-in tariffs (FiTs) and power purchase agreements (PPAs) to promote RE projects. However, the rates and conditions offered under FiTs and PPAs are not financially attractive to investors. Some advantages and challenges in adopting renewable energy are mentioned in Table #2.

Table 2: Advantages and challenges in adoption of renewable energy

| Aspects | Advantages | Challenges |

| Environmental Impact | Reduce GHG emissions and pollution | Initial investment in renewable technology |

| Energy Security | Reduce dependence on volatile fossil fuel markets | Variability in renewable energy generation |

| Cost Saving | Reduce dependence on volatile fossil fuel markets | Upfront capital costs and infrastructure upgrades |

| Innovation | Drive innovation and technological advancements | Integration with existing infrastructure |

| Regulatory Compliance | Meets environmental regulations and standards | Policy and regulatory uncertainties |

In general, these factors collectively pose significant barriers to the widespread adoption of renewable energy technologies in Pakistan's industrial sectors. Overcoming these challenges and creating a more conducive environment for RET adoption is essential for Pakistan (and other countries in the region) to harness the benefits of renewable energy and move towards a more sustainable energy future – particularly in the industrial sector.

Other key strategies and tools that industries can adopt across the region include: Capturing CO2 emissions after the combustion of fossil fuels, oxy-fuel, direct air capture (DAC), etc.

Coastal and marine ecosystems can also capture and store large amounts of carbon in a strategy known as blue carbon sequestration. Instead of storing captured CO2, carbon capture and utilisation (CCU) involves converting it into useful products such as chemicals, fuels, and construction materials.

A combination of these methods can significantly impact mitigating the effects of carbon emissions on the planet.

[Conclusion and recommendations]

To sum up, industrialisation and its contribution to climate change through GHG emissions worldwide in general, and Pakistan and South Asia in particular, are severe. Countries like Pakistan face the dual challenge of industrial growth and climate vulnerability. Therefore, there is a need for industrial decarbonisation in Pakistan to ensure its carbon-conscious, sustainable economic and technological growth.

Industries like textiles, sports, food and beverages, cement, steel, and chemicals face different challenges in transitioning from fossil fuels to clean energy. These challenges include technological limitations, cost considerations, and regulatory obstacles.

Thus, various strategies and tools for industrial decarbonisation, including policy interventions, adoption of renewable energy sources, CCS) technology, and energy efficiency measures, are proposed. The potential role of RETs in reducing carbon emissions is significant, but in countries like Pakistan, indigenisation and their wider acceptability are posed with various challenges, including high initial costs, regulatory uncertainties, and infrastructure limitations.

Strategically, a combination of Direct Air Capture (DAC), Blue Carbon Sequestration, Mineral Reactions with CO2, and CCU, may work to mitigate carbon emissions produced by industries. Given the scale of the crisis, industrial decarbonisation is urgently needed.

A few of the multi-pronged approaches that can be adopted are highlighted below:

⦁ Under the Ministry of Energy, regulatory bodies like the National Electric Power Regulatory Authority (NEPRA), Private Power and Infrastructure Board (PPIB), Competitive Trading Bilateral Contract Market (CTBCM) and DISCOs need to implement competitive FiTs and PPAs to encourage private sector investment in RE projects. These agreements should offer attractive rates for wind, solar, and other renewable technologies. The energy ministry should strengthen and enforce existing policies on renewable energy integration, energy efficiency, and emissions reduction in industries.

⦁ GoP should develop and implement specific incentives and subsidies for adoption of renewable energy technologies, such as solar panels and biomass boilers;

⦁ Relevant authorities and the ministries of industry, commerce and production should encourage industries to conduct regular energy audits to identify energy-saving opportunities and implement energy-efficient innovative technologies and practices. There is a need to set up a mandatory energy efficiency standard, including the optimum use of REs for industrial processes, machinery, and equipment, ensuring continuous improvement in energy performance and outcome;

⦁ GoP should force companies and industries to routinely report their carbon emissions data to the Ministry of Climate Change and Environmental Protection (MoCC & EP) to promote transparency and responsibility.