Pakistan finds itself in the midst of an unprecedented crisis with troubles on the political, economic and security fronts. The current situation has deteriorated to a position where those at the helm might soon find themselves without a recourse.

What doesn’t help either is the precarious condition of the global economy with the international financial system being jolted by recent bank failures. Therefore, it raises a question that does the country have the ability to weather the storm heading its way specially when the IMF deal is surrounded by uncertainty?

Crisis at Home

Currently the Pakistani economy faces a severe liquidity crunch as its $4.6 billion reserves are well short of the country’s near term financing requirements. Further, there is no respite at the export and foreign direct investments (FDI) front as the recent data released by the State Bank of Pakistan shows some concerning trends.

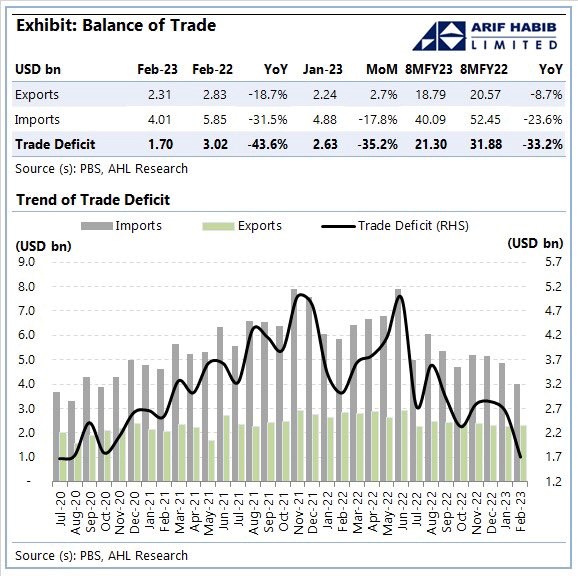

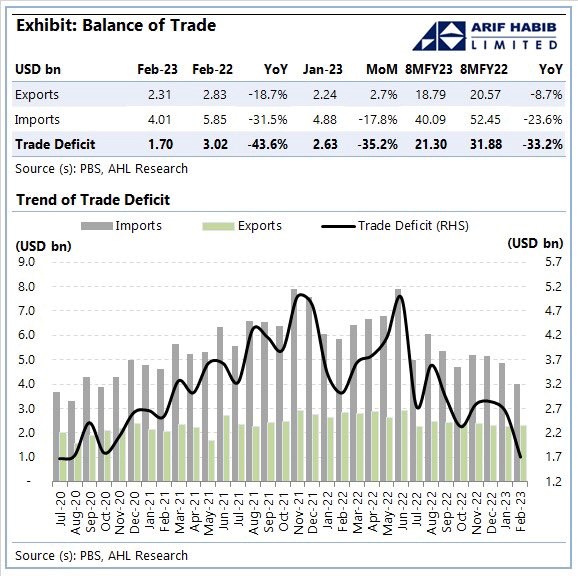

FDI plummeted by around 40% in the first eight months of the fiscal year. While exports fell by 8.7% during the same period and remittances saw a drop of 19%. Yet, the current account deficit (CAD) was kept in check as the government continued with import restrictions. However, with the SBP recently removing the condition of 100% advance payment on various imported items, the artificially controlled CAD is likely to pick up.

Source: ARHL

Sectors like IT services on which the government’s hope of export growth were pinned, have also slowed down.

“Slowdown in IT exports are mainly indicative of a global slowdown in IT spending. In its latest report, Gartner has revised down its growth forecast of global IT spending to 2.4% in 2023 from earlier 5.1%,” read a report by Topline Securities.

“IT ministry of Pakistan has set an export target of $5 billion for FY23. Current fiscal year monthly average run rate of $215 million indicates that Pakistan will be missing the export target by a big margin,” the report further added.

Source: PBS

Simultaneously, inflation at 31.5% is crippling the general public’s purchasing power, with long queues and stampedes at ration distribution centers reinforcing the severity of the situation.

Amongst all this chaos, the deadlock with the IMF for the release of $1.1 billion tranche continues as the global lender is seeking written confirmations from Pakistan’s bilateral creditors for the promised funding amount. Meanwhile China is, for the time being, keeping Pakistan afloat with a $2 billion loan facility and a rollover of its $2 billion SAFE deposit with the SBP.

https://twitter.com/NajamAli2020/status/1639518799798890496?t=RQmYQPbSFRENUtiAZ3x9fQ&s=09

However, the officials from the government’s side have resorted to political gimmickry by first claiming that the IMF requires Pakistan to compromise on its nuclear program and later introducing a petrol subsidy without consulting the Fund.

“It seems like that the government of Pakistan has given up on the IMF and now all roads lead to China,” Economist, Uzair Younus, opined on his Podcast.

Brewing Global Crisis

The global financial system is experiencing extraordinary volatility as two major banks, SVB and Credit Suisse have failed while there is a looming threat of a global liquidity crisis.

Read More: Does The Fall Of Silicon Valley Bank Indicate Another Global Financial Crisis?

Also, many Central Banks across the globe are raising interest rates due to the mounting inflationary pressures.

In such a situation, one might wonder that would Pakistan be able to handle any further exogenous shocks? The answer to this, perhaps, lies in what transpired after the 2008 global financial crisis.

“By March 2008, when the new government – led by the Pakistan Peoples Party (PPP) – came into office, the fiscal deficit was well on its way to above 7.5% of the total size of the economy and the current account deficit was even higher at 8.5% of gross domestic product (GDP). The impact on the country’s foreign exchange reserves was particularly dire: before the crisis started in late 2007, Pakistan had $16 billion in foreign exchange reserves. A year later, that number was down to less than $5 billion,” wrote Farooq Tirmizi in an article for Profit.

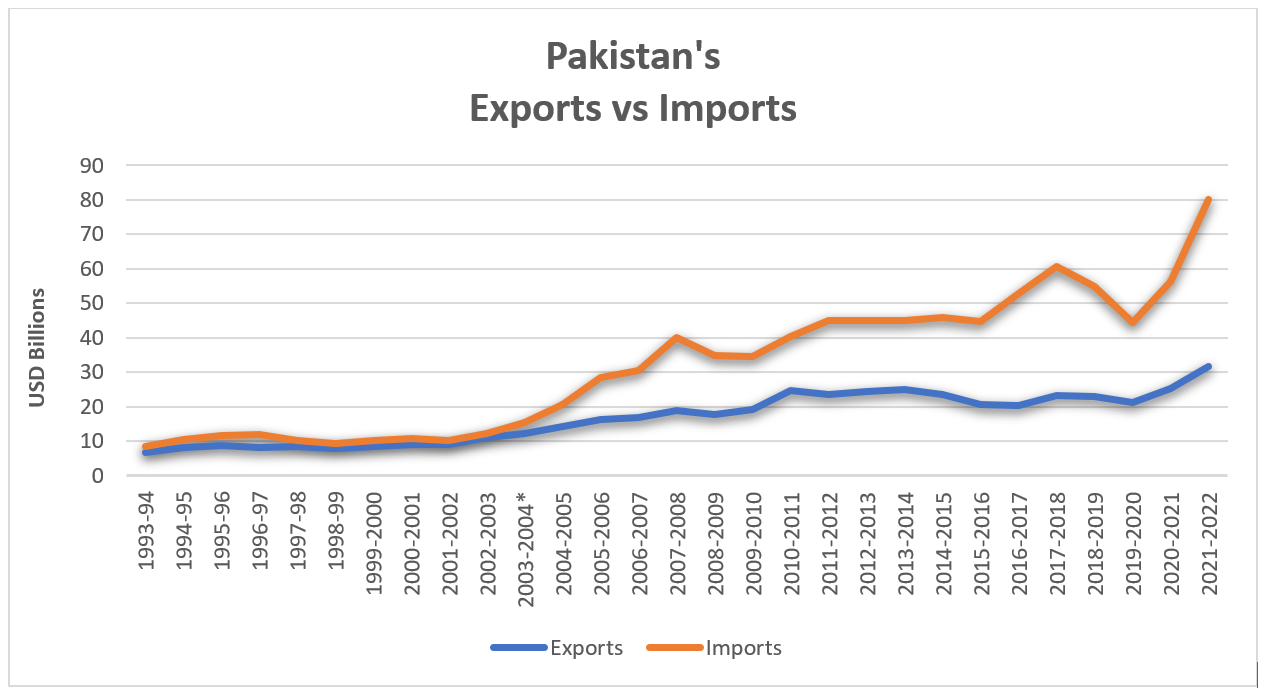

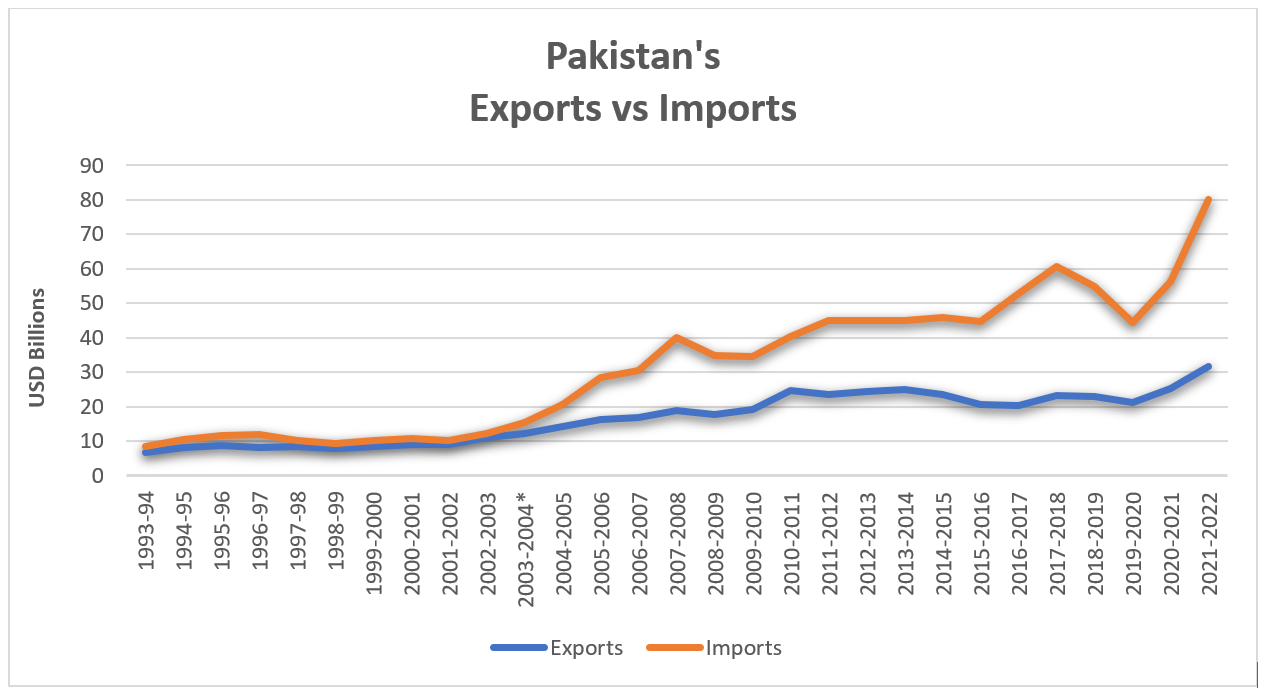

“Given its trade structure, Pakistan relies heavily on advanced economies as export markets, 25% of Pakistan’s exports were to the US in 2007. However, with the financial crisis, this share declined sharply to 19% in 2009. Pakistan’s dependence on the US and European markets is likely to have left it more vulnerable to the financial crisis, which severely affected the latter economies. Overall, the growth of exports declined from 12.2 percent in 2008 to –7.2 percent in 2009,” read a 2014 study published in The Lahore Journal of Economics.

The structure, however, haven’t changed much till date. What helped Pakistan maneuver the crisis back then was a resilient remittance flow and a timely disbursement of an IMF bailout package.

Yet, in the present day, the challenges faced by the country are multifold and it has very limited fiscal space due to massive debt repayment obligations.

Mihir Sharma, in his article for the Bloomberg, writes, “Pakistan will need to look for a decent debt restructuring package that helps its creditors get some of their money back while politically feasible reforms are implemented that allow for sustainable debt payments and imports in the future. Unfortunately, Pakistan needs a deal just when the systems that had, for decades, managed such sovereign debt restructurings are breaking down.”

What doesn’t help either is the precarious condition of the global economy with the international financial system being jolted by recent bank failures. Therefore, it raises a question that does the country have the ability to weather the storm heading its way specially when the IMF deal is surrounded by uncertainty?

Crisis at Home

Currently the Pakistani economy faces a severe liquidity crunch as its $4.6 billion reserves are well short of the country’s near term financing requirements. Further, there is no respite at the export and foreign direct investments (FDI) front as the recent data released by the State Bank of Pakistan shows some concerning trends.

FDI plummeted by around 40% in the first eight months of the fiscal year. While exports fell by 8.7% during the same period and remittances saw a drop of 19%. Yet, the current account deficit (CAD) was kept in check as the government continued with import restrictions. However, with the SBP recently removing the condition of 100% advance payment on various imported items, the artificially controlled CAD is likely to pick up.

Source: ARHL

Sectors like IT services on which the government’s hope of export growth were pinned, have also slowed down.

“Slowdown in IT exports are mainly indicative of a global slowdown in IT spending. In its latest report, Gartner has revised down its growth forecast of global IT spending to 2.4% in 2023 from earlier 5.1%,” read a report by Topline Securities.

“IT ministry of Pakistan has set an export target of $5 billion for FY23. Current fiscal year monthly average run rate of $215 million indicates that Pakistan will be missing the export target by a big margin,” the report further added.

Source: PBS

Simultaneously, inflation at 31.5% is crippling the general public’s purchasing power, with long queues and stampedes at ration distribution centers reinforcing the severity of the situation.

Amongst all this chaos, the deadlock with the IMF for the release of $1.1 billion tranche continues as the global lender is seeking written confirmations from Pakistan’s bilateral creditors for the promised funding amount. Meanwhile China is, for the time being, keeping Pakistan afloat with a $2 billion loan facility and a rollover of its $2 billion SAFE deposit with the SBP.

https://twitter.com/NajamAli2020/status/1639518799798890496?t=RQmYQPbSFRENUtiAZ3x9fQ&s=09

However, the officials from the government’s side have resorted to political gimmickry by first claiming that the IMF requires Pakistan to compromise on its nuclear program and later introducing a petrol subsidy without consulting the Fund.

“It seems like that the government of Pakistan has given up on the IMF and now all roads lead to China,” Economist, Uzair Younus, opined on his Podcast.

Brewing Global Crisis

The global financial system is experiencing extraordinary volatility as two major banks, SVB and Credit Suisse have failed while there is a looming threat of a global liquidity crisis.

Read More: Does The Fall Of Silicon Valley Bank Indicate Another Global Financial Crisis?

Also, many Central Banks across the globe are raising interest rates due to the mounting inflationary pressures.

In such a situation, one might wonder that would Pakistan be able to handle any further exogenous shocks? The answer to this, perhaps, lies in what transpired after the 2008 global financial crisis.

“By March 2008, when the new government – led by the Pakistan Peoples Party (PPP) – came into office, the fiscal deficit was well on its way to above 7.5% of the total size of the economy and the current account deficit was even higher at 8.5% of gross domestic product (GDP). The impact on the country’s foreign exchange reserves was particularly dire: before the crisis started in late 2007, Pakistan had $16 billion in foreign exchange reserves. A year later, that number was down to less than $5 billion,” wrote Farooq Tirmizi in an article for Profit.

“Given its trade structure, Pakistan relies heavily on advanced economies as export markets, 25% of Pakistan’s exports were to the US in 2007. However, with the financial crisis, this share declined sharply to 19% in 2009. Pakistan’s dependence on the US and European markets is likely to have left it more vulnerable to the financial crisis, which severely affected the latter economies. Overall, the growth of exports declined from 12.2 percent in 2008 to –7.2 percent in 2009,” read a 2014 study published in The Lahore Journal of Economics.

The structure, however, haven’t changed much till date. What helped Pakistan maneuver the crisis back then was a resilient remittance flow and a timely disbursement of an IMF bailout package.

Yet, in the present day, the challenges faced by the country are multifold and it has very limited fiscal space due to massive debt repayment obligations.

Mihir Sharma, in his article for the Bloomberg, writes, “Pakistan will need to look for a decent debt restructuring package that helps its creditors get some of their money back while politically feasible reforms are implemented that allow for sustainable debt payments and imports in the future. Unfortunately, Pakistan needs a deal just when the systems that had, for decades, managed such sovereign debt restructurings are breaking down.”