Pakistan and the International Monetary Fund (IMF) have reached an agreement at the staff level for a $3 billion bailout package under a stand-by arrangement (SBA). This new agreement will replace Pakistan's previous Extended Fund Facility (EFF) program, which was set to expire. The staff-level agreement is currently under review and awaiting approval from the IMF board, expected in mid-July.

As part of the new agreement, the IMF has stressed the importance of Pakistan rebalancing tariffs in the power sector to ensure cost recovery. Additionally, the IMF has called on Pakistan's central bank to lift import restrictions and commit to a market-determined exchange rate.

Furthermore, this agreement is expected to open doors for additional financing of approximately $3 billion from Saudi Arabia and the United Arab Emirates. Pakistan is also planning to seek the implementation of pledges obtained from an international donor conference held earlier this year, particularly funds designated for climate-related recovery efforts following the devastating floods in 2022.

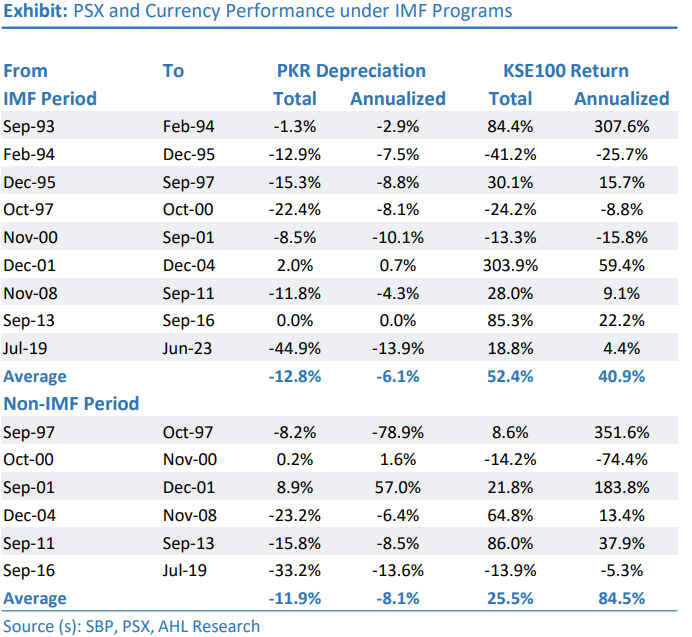

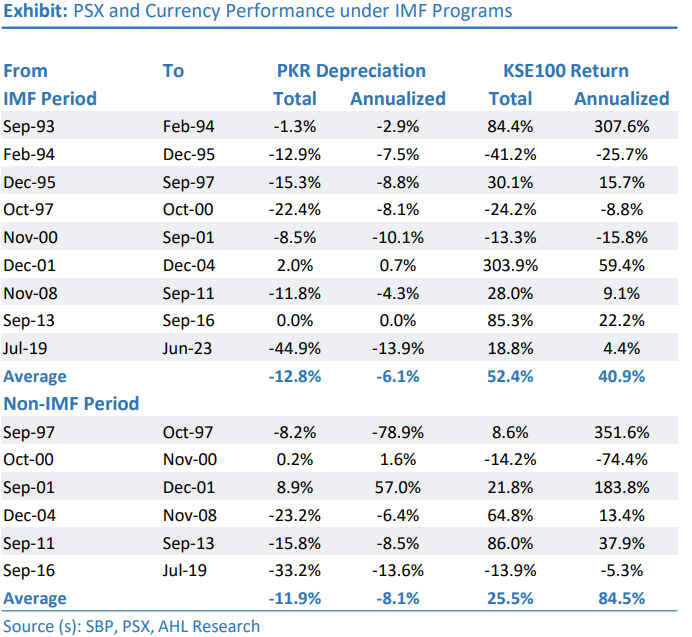

As per a report by Arif Habib Limited the signing of the SBA has had a positive impact on the international Pakistan bonds market. Following the agreement, there has been an improvement in market sentiment towards Pakistan's bonds, leading to a favorable reaction among international investors.

The SBA is expected to create a favorable environment for financial inflows from other institutions and countries, which can help increase foreign exchange reserves and alleviate external pressures. This is likely to result in a short-term appreciation of the Pakistani Rupee. Additionally, the program provides clarity and certainty regarding the economic roadmap, which can be beneficial for the markets and enable investors to make informed decisions based on the outlined framework.

How it all started

Former Deputy Governor of the State Bank of Pakistan, Murtaza Syed, explains in an article for Express Tribune that the current crisis in Pakistan has its roots in events that unfolded after July 2021. According to Syed, Pakistan implemented a hyper-expansionary budget after two years of frugality, relying heavily on fiscal largesse without paying enough attention to structural reform. This approach resulted in overheating, inflation, and pressure on the current account.

As a response, the IMF was called in to address the situation by the end of 2021. Although there were some challenges in the relationship with the IMF, Pakistan managed to regain control over the current account deficit. However, complications arose when the PTI government, with its ouster being imminent, decided to reduce and freeze fuel and electricity prices, contrary to their commitments with the IMF.

This strained the relationship even further. Political turmoil and fiscal slippages caused a delay in the IMF review process, resulting in increased import bills, inflation, and pressure on the national currency. Import restrictions were implemented to protect foreign exchange reserves. Eventually, Miftah Ismail assumed the role of finance minister and successfully negotiated with the IMF, leading to the completion of the review in August of last year.

However, shortly afterward, Miftah Ismail was replaced by Ishaq Dar as finance minister. Initially stubborn, Dar ultimately had to bow down and make several concessions, including lifting import restrictions, raising interest rates, mobilizing external support, and even revising the budget for FY24. Eventually, it was Prime Minister Shahbaz Sharif's direct intervention and outreach to the IMF that played an overarching role in the signing of the current SBA agreement.

So is this the end of our misery?

Amreen Soorani, Head of Research at JS Global, during an interview with Bloomberg, emphasized the significance of obtaining approval for the IMF agreement, as it has the potential to unlock market valuations and potentially restore investor confidence.

It would be an important development given that Pakistan's credit rating has been negatively affected by macroeconomic uncertainty, resulting in downgrades from three major rating agencies. Standard & Poor's has assigned a rating of CCC+ to Pakistan, while Moody's has assigned a rating of Caa3 and Fitch has assigned a rating of CCC-.

As per economic analyst, Yousuf Farooq, “The agreement is indeed a welcomed development, but it is important for everyone to be aware that it serves as bridge financing. It is crucial to acknowledge that by the time this program ends, there will be a need for another IMF program, and the best-case scenario would be a two-month import cover. The underlying issue lies in the fact that Pakistan faces debt repayments of over $20 billion for the next couple of years. One possible solution would be to acquire long-term debt to address short-term debt obligations or reprofile the existing short-term debt over a longer term to create some fiscal space.”

What Farooq is highlighting is the fact that the current IMF program would provide temporary relief which should be used to build on some meaning full reforms. Further, given the enormous amount of countries debt obligations over the next couple of years, it is important to take preemptive measures to avoid further economic pain.

“Regarding Pakistan's obligations, it is important to note that the debt to be repaid over the next twelve months is around $23 billion. Approximately 50% of this amount is expected to be rolled over. Considering the interest cost and current account deficit, the country's external financing requirement comes to around $20 billion. Continuously relying on IMF programs and taking on new debt is not a viable long-term strategy as it will require restrictive monetary and fiscal policy to keep growth and deficits in check for a prolonged period. The only way to exit this low growth scenario and stimulate the economy for job creation is an external debt rescheduling which would provide Pakistan with a 3-5 year window to implement necessary structural reforms,” stated, Mustafa Pasha, Chief Investment Officer, Lakson Investment limited.

A political master stroke

While the IMF deal was a battle at Pakistan’s economic front it has a massive impact on the current political landscape. Shahbaz Sharif, Ishaq Dar and PML(N) for all the flak it has received over the past several months, will now use the IMF deal as an election slogan building on its narrative that it has revived an economy destroyed by the PTI government.

However, if the elections are to take place, the IMF deal won’t be the only factor that would see PML(N) through. The Shahbaz led party’s election campaign, as per journalist Zarrar Khuhro, would be massively affected by the fate of PTI and Imran Khan. Further, a lot depends on fairness and transparency of the upcoming polls. The chances of pre-poll maneuvering, and a largely manufactured mandate can dampen the incumbent PML(N)’s chances at the elections.

Additionally, the Shahbaz-led party is facing a challenge from smaller political parties that could potentially attract its voter base. One example is TLP, a religious party that has gained prominence in Punjab by capitalizing on a sensitive religious issue. This party is allegedly backed by certain elements of the establishment. While TLP is not projected to secure a substantial number of seats in the national assembly during the 2023 elections, it is expected to disrupt closely contested seats in Punjab.

As part of the new agreement, the IMF has stressed the importance of Pakistan rebalancing tariffs in the power sector to ensure cost recovery. Additionally, the IMF has called on Pakistan's central bank to lift import restrictions and commit to a market-determined exchange rate.

Furthermore, this agreement is expected to open doors for additional financing of approximately $3 billion from Saudi Arabia and the United Arab Emirates. Pakistan is also planning to seek the implementation of pledges obtained from an international donor conference held earlier this year, particularly funds designated for climate-related recovery efforts following the devastating floods in 2022.

As per a report by Arif Habib Limited the signing of the SBA has had a positive impact on the international Pakistan bonds market. Following the agreement, there has been an improvement in market sentiment towards Pakistan's bonds, leading to a favorable reaction among international investors.

The SBA is expected to create a favorable environment for financial inflows from other institutions and countries, which can help increase foreign exchange reserves and alleviate external pressures. This is likely to result in a short-term appreciation of the Pakistani Rupee. Additionally, the program provides clarity and certainty regarding the economic roadmap, which can be beneficial for the markets and enable investors to make informed decisions based on the outlined framework.

How it all started

Former Deputy Governor of the State Bank of Pakistan, Murtaza Syed, explains in an article for Express Tribune that the current crisis in Pakistan has its roots in events that unfolded after July 2021. According to Syed, Pakistan implemented a hyper-expansionary budget after two years of frugality, relying heavily on fiscal largesse without paying enough attention to structural reform. This approach resulted in overheating, inflation, and pressure on the current account.

As a response, the IMF was called in to address the situation by the end of 2021. Although there were some challenges in the relationship with the IMF, Pakistan managed to regain control over the current account deficit. However, complications arose when the PTI government, with its ouster being imminent, decided to reduce and freeze fuel and electricity prices, contrary to their commitments with the IMF.

This strained the relationship even further. Political turmoil and fiscal slippages caused a delay in the IMF review process, resulting in increased import bills, inflation, and pressure on the national currency. Import restrictions were implemented to protect foreign exchange reserves. Eventually, Miftah Ismail assumed the role of finance minister and successfully negotiated with the IMF, leading to the completion of the review in August of last year.

However, shortly afterward, Miftah Ismail was replaced by Ishaq Dar as finance minister. Initially stubborn, Dar ultimately had to bow down and make several concessions, including lifting import restrictions, raising interest rates, mobilizing external support, and even revising the budget for FY24. Eventually, it was Prime Minister Shahbaz Sharif's direct intervention and outreach to the IMF that played an overarching role in the signing of the current SBA agreement.

So is this the end of our misery?

Amreen Soorani, Head of Research at JS Global, during an interview with Bloomberg, emphasized the significance of obtaining approval for the IMF agreement, as it has the potential to unlock market valuations and potentially restore investor confidence.

It would be an important development given that Pakistan's credit rating has been negatively affected by macroeconomic uncertainty, resulting in downgrades from three major rating agencies. Standard & Poor's has assigned a rating of CCC+ to Pakistan, while Moody's has assigned a rating of Caa3 and Fitch has assigned a rating of CCC-.

As per economic analyst, Yousuf Farooq, “The agreement is indeed a welcomed development, but it is important for everyone to be aware that it serves as bridge financing. It is crucial to acknowledge that by the time this program ends, there will be a need for another IMF program, and the best-case scenario would be a two-month import cover. The underlying issue lies in the fact that Pakistan faces debt repayments of over $20 billion for the next couple of years. One possible solution would be to acquire long-term debt to address short-term debt obligations or reprofile the existing short-term debt over a longer term to create some fiscal space.”

What Farooq is highlighting is the fact that the current IMF program would provide temporary relief which should be used to build on some meaning full reforms. Further, given the enormous amount of countries debt obligations over the next couple of years, it is important to take preemptive measures to avoid further economic pain.

“Regarding Pakistan's obligations, it is important to note that the debt to be repaid over the next twelve months is around $23 billion. Approximately 50% of this amount is expected to be rolled over. Considering the interest cost and current account deficit, the country's external financing requirement comes to around $20 billion. Continuously relying on IMF programs and taking on new debt is not a viable long-term strategy as it will require restrictive monetary and fiscal policy to keep growth and deficits in check for a prolonged period. The only way to exit this low growth scenario and stimulate the economy for job creation is an external debt rescheduling which would provide Pakistan with a 3-5 year window to implement necessary structural reforms,” stated, Mustafa Pasha, Chief Investment Officer, Lakson Investment limited.

A political master stroke

While the IMF deal was a battle at Pakistan’s economic front it has a massive impact on the current political landscape. Shahbaz Sharif, Ishaq Dar and PML(N) for all the flak it has received over the past several months, will now use the IMF deal as an election slogan building on its narrative that it has revived an economy destroyed by the PTI government.

However, if the elections are to take place, the IMF deal won’t be the only factor that would see PML(N) through. The Shahbaz led party’s election campaign, as per journalist Zarrar Khuhro, would be massively affected by the fate of PTI and Imran Khan. Further, a lot depends on fairness and transparency of the upcoming polls. The chances of pre-poll maneuvering, and a largely manufactured mandate can dampen the incumbent PML(N)’s chances at the elections.

Additionally, the Shahbaz-led party is facing a challenge from smaller political parties that could potentially attract its voter base. One example is TLP, a religious party that has gained prominence in Punjab by capitalizing on a sensitive religious issue. This party is allegedly backed by certain elements of the establishment. While TLP is not projected to secure a substantial number of seats in the national assembly during the 2023 elections, it is expected to disrupt closely contested seats in Punjab.