In a recent press briefing, Julie Kozack, the Communications Director of the IMF, emphasized the need for Pakistan to double down on its efforts on both the fiscal and monetary fronts. This, as per Kozack, is necessary to protect vulnerable segments of society from the ongoing cost of living crisis.

Kozack’s response came after being questioned about the restrictive nature of the IMF agreement, which has hindered the Pakistani government from providing much-needed relief to the general public. However, according to the IMF representative, the ability for providing relief ultimately lies with the government itself. To further understand this statement, it is important to consider both the fiscal and the monetary side of things.

The country has historically experienced significant fiscal deficits in its effort to stimulate economic growth. This approach has proven effective only in the short term, thanks to the economy's consumption-driven nature. However, the current situation is primarily a result of the excessively high costs associated with debt servicing, rather than being focused on promoting growth.

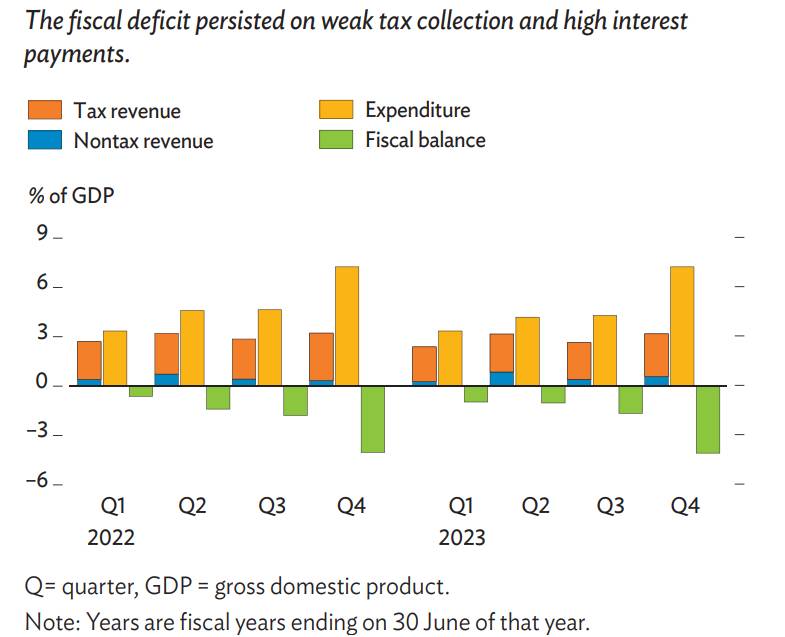

As explained in the latest Asian Development Outlook September 2023 by the Asian Development Bank, Pakistan’s fiscal deficit remained high due to weak tax collection and higher interest outlays. Despite tax revenues growing by 15.7% in FY2023, they decreased to 9.2% of GDP, primarily due to poor collections of sales taxes and customs duties resulting from the economic slowdown and decline in imports and industrial output. Further, interest payments accounted for 6.9% of GDP, consuming almost three quarters of tax revenues. Resultantly, the government reduced development and noninterest current spending.

Source: Asian Development Bank

However, it is crucial to consider that the deficit cannot be evaluated in isolation. One must also take into account the monetary aspects and have an understanding of the past in order to provide appropriate context.

In 2020, State Bank of Pakistan (SBP), like many central banks globally implemented measures such as cutting interest rates and engaging in large-scale asset purchases to combat the economic impact of the COVID-19 pandemic. This led to significant monetary stimulus to keep individuals and businesses afloat. Further, the country was able to experience an impressive GDP growth for a couple of years.

However, the massive injection of money created the potential for inflation down the road, particularly due to disrupted supply chains and rising oil and food prices. The situation was further aggravated by the Russia-Ukraine War in 2022.

SBP was not adequately prepared for this inflationary risk, as it believed that the extensive quantitative easing measures would not lead to significant or lasting inflation. This is evident from its medium-term inflation expectation over the past three years.

Some quotes from the @StateBank_Pak about its medium-term inflation outlook:

— Uzair Younus عُزیر یُونس (@UzairYounus) April 4, 2023

January 2020: “The MPC also viewed the current monetary policy stance as appropriate to bring inflation down to the medium-term target range of 5 – 7 percent over the next six to eight quarters.”

While the interest rate has been raised subsequently, to curb the inflationary pressures, experts believe that SBP should have taken this course of action earlier.

Now, due to the significant amount of domestic debt held by the government, it faces a dilemma where further increases in interest rates could potentially exacerbate the fiscal deficit situation.

In a comment on SBP’s decision to hold the interest rates earlier this month, Mustafa Pasha, Chief Investment Officer at Lakson Investments, remarked, “SBP's decision to keep the interest rate unchanged may not necessarily be a bad idea. This is because the government is already implementing fiscal consolidation measures through higher taxation and levies, and this might not be the ideal time to double down on that through monetary tightening given that the private sector credit has already been choked out and the impact of a hike would be increased debt servicing cost for the government, leading to a higher fiscal deficit.”

Coming back to the comments by the fund’s representative, it appears evident that the message from the IMF is clear: if relief is to be granted, the government must create fiscal space for it. One apparent method to achieve this would be through taxing the wealthy.

However, as reiterated by many, including former Federal Board of Revenue (FBR) Chief, Shabbar Zaidi, significant tax reforms are often blocked by the powers that be, who seek to safeguard their own personal interests. Additionally, political forces often lack the bravery to confront the affluent, as former finance minister Miftah Ismail learned the hard way.

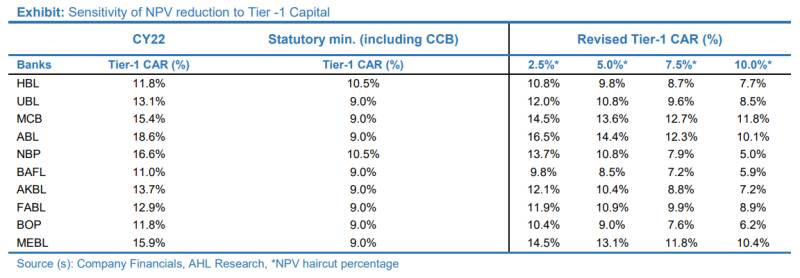

This leaves us with another option: seeking debt relief. The largest portion of the government's revenue is allocated to domestic debt servicing. Therefore, fiscal space could be created by implementing a domestic debt haircut. Unfortunately, the country's banking sector lacks sufficient depth to withstand such shocks.

https://twitter.com/AmanNasirX/status/1706709614505390302

As per a report published by Arif Habib Limited in May 2023, “According to the analysis, every 5% NPV reduction (PKR 1.3 trillion) erodes Tier-1 CAR of coverage banks by 292bps. Based on the workings below, Tier 1 CAR of 5-7 out of 10 coverage banks falls below minimum threshold if NPV haircuts are more than 5%, while 2 out of 10 banks will face a capital call at even 5% NPV haircut.”

Therefore, options remain constrained. The government is likely to continue with the imposed austerity while the masses will experience more pain. It remains to be seen who will blink first.