When America talks about its projections for the dollar, global markets listen. The greenback is, after all, the standard unit of measurement across the world and the most widely accepted form of currency. This is why, at a gathering of financial czars from all over the globe last week in Davos, US Treasury Secretary Steven Mnuchin took the opportunity to discuss its prospects, how the dollar has weakened over the last few weeks, and what this means for the world’s largest economy. He has since said that his remarks were taken out of context. He had said that a weak dollar benefited American trade. His words sent the currency to a three-year low.

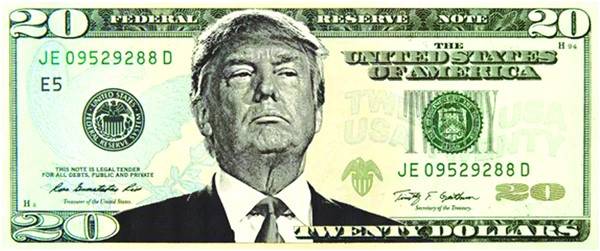

When President Trump started to deliver on his election promises, he weakened the dollar. US exports became cheaper overnight, and people started to believe him. Trump had spoken of boosting the US economy, and he had exuded confidence when he mentioned moving manufacturing back to the US. With such a high cost of labour, though, not many thought it was possible. When Trump was elected, stock markets had tanked. However, a year or so later, equities are inching to new highs. What had changed? Trump did what he had said he would do: He offered tax cuts, and weakened the US dollar.

Weaker better?

A weaker dollar is not good news for many economies, including ours. Many people think that a cheaper dollar means a stronger rupee. But this is not really accurate. It doesn’t work like this. It means the pound and euro become more expensive for Pakistanis, but a dollar doesn’t get cheaper.

A cheaper dollar is meant to boost the US economy. On the face of it, it really shouldn’t matter to Pakistan. But since we are deeply hedged against the dollar, it means a great deal if there is even a slight movement in the greenback.

In dollar terms, since the rupee will not get any stronger, our external debt in absolute terms doesn’t change. We will owe the same amount of over $85 billion. However, since the dollar gets cheaper internationally, we would be inclined to import more. This goes back to the argument that US exports become cheaper.

When we import more, our bill will will be bigger. If that happens, our trade deficit and current account deficit widen further. The gap—between exports and imports or dollars coming in and leaving the country—will get bigger. Our foreign exchange reserves of less than $14 billion (held by the State Bank of Pakistan) will come under more pressure. External debt servicing and repayments have already caused them to fall more than 20% in the last few months. As reserves fall, we will be forced to borrow more, raising external debt and its servicing cost. It’s a spiral in which Pakistan stands to lose.

On the other hand, since the rupee-dollar parity would remain the same, our exports to the US are unlikely to increase as much. Pakistani exporters have already shown their worth. They are faced with a high cost of doing business, stuck refunds and load-shedding. Exports have plunged more than 20% in the last four years.

But there is a silver lining and an opportunity to tap. Given that the euro and pound have become expensive, Pakistan’s exporters potentially have an expensive market in the European Union as well as in the UK. We need to start referring to them separately. There is a chance that foreign shipment orders could increase. While value-addition should have been the way to go, textile exports have found it difficult to compete with those of Bangladesh, Vietnam and India to make a name and market for themselves.

Global effect

The ‘currency war’ the US wants to undertake with China could also result in one other aspect that is likely to go against Pakistan. The day China starts depreciating its currency in retaliation, Pakistan is likely to see a surge in imports from its best friend as well. While the bill would get cheaper, a greater number of orders could offset the less expensive products. We already run a deficit of around $12 billion in our bilateral trade with China.

Pakistan has never been a price-setter when it comes to the global economy. It follows the price of oil, gold, dollar and many other commodities. It is self-sufficient in a lot of products, agricultural mostly, but when it comes to energy it has remained deficient.

But for now, Pakistan is faced with several other challenges on the economic front. Oil is going back to its expensive levels, exports have not grown as much, debt is rising continuously and this is an election year. As fiscal slippages are more likely in the year a government looks to win votes, Pakistan’s monetary needs are likely to slip out of control. We have already been warned by several institutions that our budget deficit is likely to exceed the target this year.

Austerity measures don’t win votes. As the race gets fierce, and it is much closer than in previous elections, one can only hope that taxes don’t go in vain. But they will. Because when all is said and done, Pakistan doesn’t learn. Neither do its citizens. We will continue to evade taxes, find loopholes to exploit the system, take every opportunity to make a short-term, short-sighted, quick buck. We will continue to ignore education reforms, incur losses on very easily modifiable state-owned entities, and most of all, blame it on the previous governments.

One hopes that the currency war doesn’t take place, because if it does, Pakistan is likely to be collateral damage when the world’s two biggest economies clash.

The writer is a senior business editor based in Karachi

When President Trump started to deliver on his election promises, he weakened the dollar. US exports became cheaper overnight, and people started to believe him. Trump had spoken of boosting the US economy, and he had exuded confidence when he mentioned moving manufacturing back to the US. With such a high cost of labour, though, not many thought it was possible. When Trump was elected, stock markets had tanked. However, a year or so later, equities are inching to new highs. What had changed? Trump did what he had said he would do: He offered tax cuts, and weakened the US dollar.

Weaker better?

A weaker dollar is not good news for many economies, including ours. Many people think that a cheaper dollar means a stronger rupee. But this is not really accurate. It doesn’t work like this. It means the pound and euro become more expensive for Pakistanis, but a dollar doesn’t get cheaper.

A cheaper dollar is meant to boost the US economy. On the face of it, it really shouldn’t matter to Pakistan. But since we are deeply hedged against the dollar, it means a great deal if there is even a slight movement in the greenback.

In dollar terms, since the rupee will not get any stronger, our external debt in absolute terms doesn’t change. We will owe the same amount of over $85 billion. However, since the dollar gets cheaper internationally, we would be inclined to import more. This goes back to the argument that US exports become cheaper.

When we import more, our bill will will be bigger. If that happens, our trade deficit and current account deficit widen further. The gap—between exports and imports or dollars coming in and leaving the country—will get bigger. Our foreign exchange reserves of less than $14 billion (held by the State Bank of Pakistan) will come under more pressure. External debt servicing and repayments have already caused them to fall more than 20% in the last few months. As reserves fall, we will be forced to borrow more, raising external debt and its servicing cost. It’s a spiral in which Pakistan stands to lose.

On the other hand, since the rupee-dollar parity would remain the same, our exports to the US are unlikely to increase as much. Pakistani exporters have already shown their worth. They are faced with a high cost of doing business, stuck refunds and load-shedding. Exports have plunged more than 20% in the last four years.

But there is a silver lining and an opportunity to tap. Given that the euro and pound have become expensive, Pakistan’s exporters potentially have an expensive market in the European Union as well as in the UK. We need to start referring to them separately. There is a chance that foreign shipment orders could increase. While value-addition should have been the way to go, textile exports have found it difficult to compete with those of Bangladesh, Vietnam and India to make a name and market for themselves.

Global effect

The ‘currency war’ the US wants to undertake with China could also result in one other aspect that is likely to go against Pakistan. The day China starts depreciating its currency in retaliation, Pakistan is likely to see a surge in imports from its best friend as well. While the bill would get cheaper, a greater number of orders could offset the less expensive products. We already run a deficit of around $12 billion in our bilateral trade with China.

Pakistan has never been a price-setter when it comes to the global economy. It follows the price of oil, gold, dollar and many other commodities. It is self-sufficient in a lot of products, agricultural mostly, but when it comes to energy it has remained deficient.

But for now, Pakistan is faced with several other challenges on the economic front. Oil is going back to its expensive levels, exports have not grown as much, debt is rising continuously and this is an election year. As fiscal slippages are more likely in the year a government looks to win votes, Pakistan’s monetary needs are likely to slip out of control. We have already been warned by several institutions that our budget deficit is likely to exceed the target this year.

Austerity measures don’t win votes. As the race gets fierce, and it is much closer than in previous elections, one can only hope that taxes don’t go in vain. But they will. Because when all is said and done, Pakistan doesn’t learn. Neither do its citizens. We will continue to evade taxes, find loopholes to exploit the system, take every opportunity to make a short-term, short-sighted, quick buck. We will continue to ignore education reforms, incur losses on very easily modifiable state-owned entities, and most of all, blame it on the previous governments.

One hopes that the currency war doesn’t take place, because if it does, Pakistan is likely to be collateral damage when the world’s two biggest economies clash.

The writer is a senior business editor based in Karachi