Our export sector has never been as despondent as it is today. Exports are stagnant or falling. Companies are going bankrupt. The banks are refusing to continue the existing lines of finance for the exporting industry, let alone agree to fresh projects. This malaise has spread to almost the entire range of the export sector—not just textiles. And all the while, all around us there is great success and growth. Bangladeshi and Indian exports are booming and they see a great future for their exporting and textile sectors. Bangladesh has set its target for an export of 55 billion dollars! Yet they do not produce a single bale of cotton. While the actual fall in export earnings is a recent phenomenon, the decline has been taking place for the last 15 years. In the year 2000, exports accounted for 14% of our GNP. Today they comprise only 7%. So while other sectors of the economy grew, the export sector has been stagnating.

Why have our exporters become so inept and indolent in the last ten years?

The main cause of our failure is not entirely economic; it is the perception of Pakistan as a fundamental terrorist state, as a country embroiled in a war of attrition with its neighbours. It is the perception that we are a country torn apart by terrorists, who are hell bent on destroying the structure of our state and society. They openly threaten whom they please, kidnap and murder at will, and carry out violence with impunity. They openly declare that they will impose their own system of governance by force—and if thwarted will destroy the entire country, its economy and society. As a consequence Pakistan is considered a dangerous place to travel to and an unstable trading partner.

Almost all manufactured items and even base agricultural products need to be marketed consistently over years to make a place for themselves to the consumers of the world. Gone are the days of a single deal or transaction. Nowadays the buyers assess each supplier carefully, weigh the long and midterm prospects and then begin to place orders. So if a store group is to stock and display Pakistani made garments, sports goods, mangoes or rice etc., it needs to be assured that contracted supplies will arrive—as promised. Now and in the future. They will be consistent in quality and price and will always be on time. The store cannot afford to allow any of its counters to go empty. That would constitute not only lost sales but also a loss of repute and face.

Modern stores do not simply “sell” products to a starved public. They have to market their products and their stores to an already jaded and well-served consumer. They follow concepts, themes, colour palettes, new designs and fashions to appeal to their customers. To do this a store must work with its suppliers continuously. They jointly design and redesign their products, colour coordinate them with the trends of the season and with other items on sale. They have to package them as per the convenience of the store’s warehouse, electronic accounts and control systems, and then produce and ship the required product line. It’s not a one-shot deal but a continuous activity in which the supplier must perform to the standards of the buyer. It is not good enough, to say, place lovely mangoes from Pakistan on the shelves and hope they will sell. The taste and appetite for mangoes have to be promoted, the public informed and educated in all the intricacies of mangoes, year after year. Then the market will be built up. It cannot be done for a single year and then dropped.

A perception has been built that a Pakistani manufacturer or supplier will not be able to “live up to their commitments,” not because they do not wish to but because they cannot do so. Even if their factory or farm is running smoothly despite the endless power cuts, gas shortages, there may be a bomb blast, or civil unrest to disrupt the supply chain. The factory may be fine but what if the port is incapacitated or the railway track is blown up? Or there is civil unrest? So it is best not to deal with risky Pakistan and buy elsewhere. Most foreigners are loathe to travel to Pakistan and are reluctant to live here. Many large store groups have made it a company policy not to buy from such risky states and have instructed their buyers explicitly. Many large retailers in the West especially have specifically passed directives to their staff to avoid trading with Pakistan. So almost all the buyers of advanced countries will only buy from Pakistan as a last resort.

We, of course, have compounded the situation by our own policies.

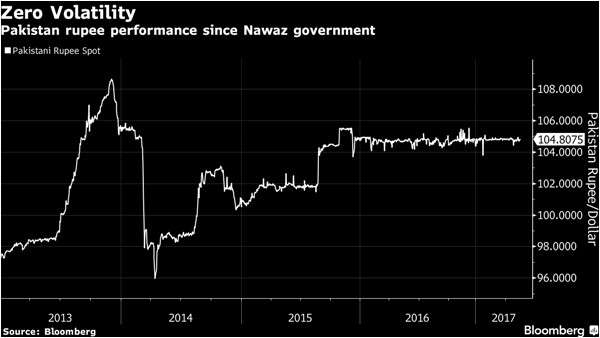

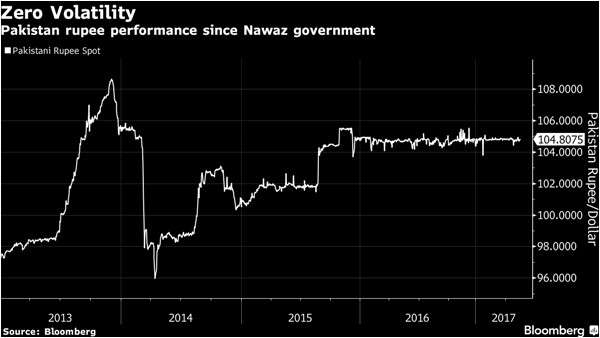

The government policy to keep the value of the Pakistan rupee fixed against the US dollar for the last few years has played havoc with whatever exports we were doing. The dollar has risen in value against all major currencies of the world—and so has the Pakistani rupee! Almost all the major currencies of the world have depreciated over the last four years. The British pound, the euro, the yen and the yuan, have all depreciated against the dollar by ten to twenty percent. The Pakistan rupee stays miraculously at around a 104-5 per US dollar. In a world where almost all developing states consciously hold down the value of their currency, to help export-led growth, we do the exact contrary! There are obvious results. Exports are languishing and imports are booming. The government mistakenly assumes that the strength of the currency reflects the strength of the country. Hence we are far stronger than the EU, Great Britain, and China etc. A foolhardy assumption.

The consequences of our exchange rate policy are clearly visible. The country is awash with foreign products. Low import duties have helped promote imports as well. The resulting trade imbalance is now in danger of causing a default. If that happens, the consequences will be catastrophic for our economy. The high rate of the rupee has bought us a few years of relative price stability—but at what cost? If we are to contain inflation, then the only remedy is to reduce consumption and promote production. The false exchange rate has allowed us to live in a fool’s paradise for the last four years. When the reserves run out, the re-adjustment needed will not be a mere 10 percent to 15 percent but much more, triggering an economic crisis which will be acutely uncomfortable, not only for the common person, but for the government as well. A large depreciation of the rupee will set off an unmanageable economic storm.

It would be best to devalue the rupee now in controlled small steps, while we still have some foreign exchange reserves and credibility left rather than take a desperate plunge a year from now. The reserves are melting away at an alarming rate and the 20 billion dollars that we have today may be reduced to ten in six months to a year. An increase in the price of oil may serve as another jolt. The budget indicates that our planners are unaware of the dangers looming ahead. There are no measures to curb imports or encourage exports, just a childish belief that all will be well.

There are many other factors that haunt our exports, yet the exchange rate policy is a basic tool used by others and ourselves in the past, which we are neglecting badly.

The author has a Tripos in Economics from the University of Cambridge, has served as the chairman of the Towel Manufacturers Association of Pakistan for a number of terms and has participated in industry and national forums on exports and trade

Why have our exporters become so inept and indolent in the last ten years?

The main cause of our failure is not entirely economic; it is the perception of Pakistan as a fundamental terrorist state, as a country embroiled in a war of attrition with its neighbours. It is the perception that we are a country torn apart by terrorists, who are hell bent on destroying the structure of our state and society. They openly threaten whom they please, kidnap and murder at will, and carry out violence with impunity. They openly declare that they will impose their own system of governance by force—and if thwarted will destroy the entire country, its economy and society. As a consequence Pakistan is considered a dangerous place to travel to and an unstable trading partner.

The high rate of the rupee has bought us a few years of relative price stability-but at what cost? If we are to contain inflation, then the only remedy is to reduce consumption and promote production

Almost all manufactured items and even base agricultural products need to be marketed consistently over years to make a place for themselves to the consumers of the world. Gone are the days of a single deal or transaction. Nowadays the buyers assess each supplier carefully, weigh the long and midterm prospects and then begin to place orders. So if a store group is to stock and display Pakistani made garments, sports goods, mangoes or rice etc., it needs to be assured that contracted supplies will arrive—as promised. Now and in the future. They will be consistent in quality and price and will always be on time. The store cannot afford to allow any of its counters to go empty. That would constitute not only lost sales but also a loss of repute and face.

Modern stores do not simply “sell” products to a starved public. They have to market their products and their stores to an already jaded and well-served consumer. They follow concepts, themes, colour palettes, new designs and fashions to appeal to their customers. To do this a store must work with its suppliers continuously. They jointly design and redesign their products, colour coordinate them with the trends of the season and with other items on sale. They have to package them as per the convenience of the store’s warehouse, electronic accounts and control systems, and then produce and ship the required product line. It’s not a one-shot deal but a continuous activity in which the supplier must perform to the standards of the buyer. It is not good enough, to say, place lovely mangoes from Pakistan on the shelves and hope they will sell. The taste and appetite for mangoes have to be promoted, the public informed and educated in all the intricacies of mangoes, year after year. Then the market will be built up. It cannot be done for a single year and then dropped.

A perception has been built that a Pakistani manufacturer or supplier will not be able to “live up to their commitments,” not because they do not wish to but because they cannot do so. Even if their factory or farm is running smoothly despite the endless power cuts, gas shortages, there may be a bomb blast, or civil unrest to disrupt the supply chain. The factory may be fine but what if the port is incapacitated or the railway track is blown up? Or there is civil unrest? So it is best not to deal with risky Pakistan and buy elsewhere. Most foreigners are loathe to travel to Pakistan and are reluctant to live here. Many large store groups have made it a company policy not to buy from such risky states and have instructed their buyers explicitly. Many large retailers in the West especially have specifically passed directives to their staff to avoid trading with Pakistan. So almost all the buyers of advanced countries will only buy from Pakistan as a last resort.

We, of course, have compounded the situation by our own policies.

The government policy to keep the value of the Pakistan rupee fixed against the US dollar for the last few years has played havoc with whatever exports we were doing. The dollar has risen in value against all major currencies of the world—and so has the Pakistani rupee! Almost all the major currencies of the world have depreciated over the last four years. The British pound, the euro, the yen and the yuan, have all depreciated against the dollar by ten to twenty percent. The Pakistan rupee stays miraculously at around a 104-5 per US dollar. In a world where almost all developing states consciously hold down the value of their currency, to help export-led growth, we do the exact contrary! There are obvious results. Exports are languishing and imports are booming. The government mistakenly assumes that the strength of the currency reflects the strength of the country. Hence we are far stronger than the EU, Great Britain, and China etc. A foolhardy assumption.

The consequences of our exchange rate policy are clearly visible. The country is awash with foreign products. Low import duties have helped promote imports as well. The resulting trade imbalance is now in danger of causing a default. If that happens, the consequences will be catastrophic for our economy. The high rate of the rupee has bought us a few years of relative price stability—but at what cost? If we are to contain inflation, then the only remedy is to reduce consumption and promote production. The false exchange rate has allowed us to live in a fool’s paradise for the last four years. When the reserves run out, the re-adjustment needed will not be a mere 10 percent to 15 percent but much more, triggering an economic crisis which will be acutely uncomfortable, not only for the common person, but for the government as well. A large depreciation of the rupee will set off an unmanageable economic storm.

It would be best to devalue the rupee now in controlled small steps, while we still have some foreign exchange reserves and credibility left rather than take a desperate plunge a year from now. The reserves are melting away at an alarming rate and the 20 billion dollars that we have today may be reduced to ten in six months to a year. An increase in the price of oil may serve as another jolt. The budget indicates that our planners are unaware of the dangers looming ahead. There are no measures to curb imports or encourage exports, just a childish belief that all will be well.

There are many other factors that haunt our exports, yet the exchange rate policy is a basic tool used by others and ourselves in the past, which we are neglecting badly.

The author has a Tripos in Economics from the University of Cambridge, has served as the chairman of the Towel Manufacturers Association of Pakistan for a number of terms and has participated in industry and national forums on exports and trade