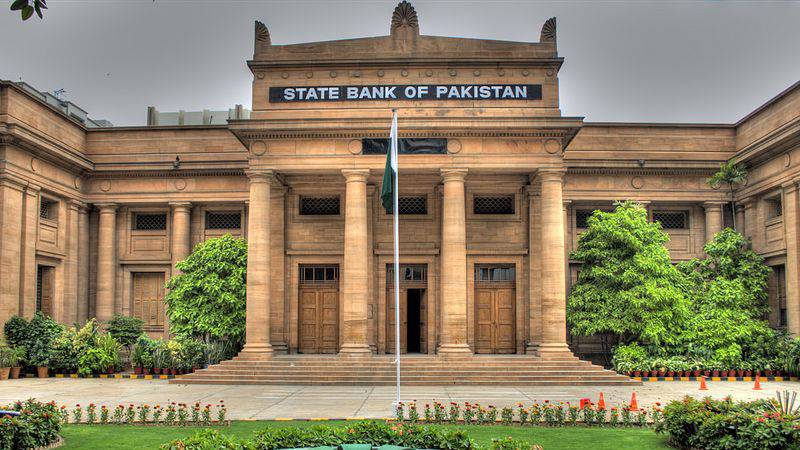

The State Bank of Pakistan has announced to increase the interest rate by 300 basis points to 20 percent, which is the highest since October 1996.

The development comes following a meeting of the bank's Monetary Policy Committee, on Thursday.

According to the central bank, the decision reflects “deterioration in inflation outlook” and its expectation amid recent external and fiscal adjustments.

"MPC believes this outlook warrants a strong policy response to anchor inflation expectations around the medium-term target of 5-7 percent," it said.

The participants of the meeting noted that reduction in the current account deficit is crucial but requires concerted efforts to improve external situation.

"It emphasised that any significant fiscal slippage would undermine monetary policy effectiveness in the context of achieving the price stability objective," the central bank said.

The policy rate hike comes a few hours after Finance Minister Ishaq Dar said that the negotiations with the IMF have neared their conclusion and the staff-level agreement is likely to be signed by next week.

“Our negotiations with IMF are about to conclude and we expect to sign Staff Level Agreement with IMF by next week,” Dar said in a Twitter post earlier today.

Read this too: Deadlock With IMF: Rupee Tumbles To Nearly 289 Against US Dollar

He added that anti-Pakistan elements were spreading malicious rumours that Pakistan may default. “This is not only completely false but also belie the facts.”

According to the minister, SBP forex reserves have been increasing and are almost $1 billion higher than four weeks ago despite making all external due payments on time.

Dar also highlighted that the foreign commercial banks have also started extending facilities to Pakistan.

The government is struggling to implement certain measures to finalise an agreement with the Fund to unlock a critical $1.1 billion loan.

One of the things the international lender wants Pakistan to do is switch to a market-based currency exchange rate regime. If the IMF’s board approves this measure, a funding tranche of over $1 billion would be released that has been held up since late last year over a policy framework.

The Fund’s requirements are designed to make sure Pakistan reduces its fiscal deficit before presenting its annual budget in June.

The majority of the steps, such as increasing the cost of fuel and energy, ending subsidies in the export and power industries, and raising extra revenue through new taxes in a supplemental budget, have already been taken by Pakistan.

The steps will likely increase the already record-high inflation rate, which reached 31.5 percent in February.

The IMF has also asked Pakistan to increase policy rates and fulfil bilateral and multilateral external financing commitments.

Pr-02-Mar-2023

The development comes following a meeting of the bank's Monetary Policy Committee, on Thursday.

According to the central bank, the decision reflects “deterioration in inflation outlook” and its expectation amid recent external and fiscal adjustments.

"MPC believes this outlook warrants a strong policy response to anchor inflation expectations around the medium-term target of 5-7 percent," it said.

The participants of the meeting noted that reduction in the current account deficit is crucial but requires concerted efforts to improve external situation.

"It emphasised that any significant fiscal slippage would undermine monetary policy effectiveness in the context of achieving the price stability objective," the central bank said.

The policy rate hike comes a few hours after Finance Minister Ishaq Dar said that the negotiations with the IMF have neared their conclusion and the staff-level agreement is likely to be signed by next week.

“Our negotiations with IMF are about to conclude and we expect to sign Staff Level Agreement with IMF by next week,” Dar said in a Twitter post earlier today.

Read this too: Deadlock With IMF: Rupee Tumbles To Nearly 289 Against US Dollar

He added that anti-Pakistan elements were spreading malicious rumours that Pakistan may default. “This is not only completely false but also belie the facts.”

According to the minister, SBP forex reserves have been increasing and are almost $1 billion higher than four weeks ago despite making all external due payments on time.

Dar also highlighted that the foreign commercial banks have also started extending facilities to Pakistan.

The government is struggling to implement certain measures to finalise an agreement with the Fund to unlock a critical $1.1 billion loan.

One of the things the international lender wants Pakistan to do is switch to a market-based currency exchange rate regime. If the IMF’s board approves this measure, a funding tranche of over $1 billion would be released that has been held up since late last year over a policy framework.

The Fund’s requirements are designed to make sure Pakistan reduces its fiscal deficit before presenting its annual budget in June.

The majority of the steps, such as increasing the cost of fuel and energy, ending subsidies in the export and power industries, and raising extra revenue through new taxes in a supplemental budget, have already been taken by Pakistan.

The steps will likely increase the already record-high inflation rate, which reached 31.5 percent in February.

The IMF has also asked Pakistan to increase policy rates and fulfil bilateral and multilateral external financing commitments.

Pr-02-Mar-2023