“People should pay their bills, as we are also going to launch a grand policy to recover bills from those who did not pay in the past”— Caretaker Prime Minister Anwaarul Haq Kakar

The government has been charging an overwhelming total of nine distinct taxes and duties on an average electricity bill. This unwavering imposition of taxes has ignited debates regarding the financial burden placed upon the citizens, as electricity bills become increasingly burdensome due to these numerous levies—QLink News

Despite being victimized by dilapidated road infrastructure, high air pollution, gas shortage, ever-increasing street crime, unemployment, etc, Karachi is the only city where the Federal Board of Revenue (FBR) is collecting double income tax on electricity bills—Business Recorder, January 5, 2023

The Federal government….admitted before the Parliament that the Federal Board of Revenue is charging up to 58% tax on commercial and 29% on household electricity bills—Pakistan Today, November 23, 2022

This deprivation [collecting taxes in advance] results in unjustly enriching and benefitting the department—Syed Mansoor Ali Shah J, Sui Northern Gas Pipelines v Deputy Commissioner of Inland Revenue etc. (2014) 110 TAX 221 (H.C. Lah.)

One slogan that is not raised enough by the economic or political agents in the country is 'taxpayers ko izzat do'. The matter cannot be overemphasized—Ali Khizar, Respect the taxpayers, Business Recorder, November 1, 2020.

“Inflation is taxation without legislation—Milton Friedman—Editorial of November 11, 2009 in Wall Street Journal, titled, Taxation without Legislation

Our rulers, including the caretakers, politicians and the crafty bureaucrats keep on fleecing ordinary citizens through oppressive taxes and then malign them as “tax thieves.” The so-called “informed” analysts and all-knowing TV anchors also join the bandwagon with often-repeated popular jargon that only “1% of the population pays income tax.” This is blatant fabrication that exposes the hollowness of all those who subscribe to it.

The reality is that millions of Pakistanis, subjected to over 50 withholding taxes under the Income Tax Ordinance, 2001 (both adjustable and non-adjustable), contributed Rs. 2006 billion, nearly 65% of total direct tax collection in fiscal year (FY) 2023, according to official figures! Likewise, million of consumers have been making income tax and sales tax payments on a monthly basis, along with electricity bills. This exploded the fallacy and myth of “narrow tax base” that has become Gospel’s truth in Pakistan that nobody is ready to refute, despite the fact that in electricity bills, the burden of indirect and advance income taxes and other levies is highly inflationary. In majority cases, it is also against the supreme law of the land—the 1973 Constitution of Islamic Republic of Pakistan.

Law does not require those having income below taxable threshold of Rs. 600,000 to file income tax returns, but they are dubbed as “non-filers” even after tax is extorted from them in the name of advance income tax. As per Pakistan Telecommunication Authority (PTA), total cellular subscribers as on May 31, 2023 were 192 million (81.03% mobile teledensity). Out of these, 124 million were broadband subscribers (54.43% mobile broadband penetration), 3 million fixed telephony subscribers (1.09% fixed teledensity) and 127 million broadband subscribers (53.65% broadband penetration). Not less than 120 million unique mobile users (many having multiple SIMs) have been paying advance and adjustable income tax of 15% since July 1, 2022. Collection under this head in FY 2023 was Rs. 87.28 billion.

Why should an individual file tax return when there is no taxable income? Why should cost be incurred just to get refund? What is the assurance that money held be paid back without any hassle and harassment?

Through all pervasive withholding tax provisions, non-filers have been penalized and are forced to pay higher advance tax on various transactions and incomes. Coercive measures are used to make them filers even if they have no taxable income. They are being advised to file returns just to get the money that was withheld without any lawful justification. This is a blatant violation of fundamental rights guaranteed under the Constitution. A person cannot be deprived of money/property that he does not owe to the State.

Why should an individual file tax return when there is no taxable income? Why should cost be incurred just to get refund? What is the assurance that money held be paid back without any hassle and harassment? The Intelligentsia of Pakistan has become so insensitive and callous that it is not agitating against this highhandedness and violation of fundamental rights. The weak and helpless have accepted unconstitutional withholding taxes as fait accompli. The nations that demonstrate such apathy and lethargy about their rights end up endorsing and promoting injustice, besides becoming victims in the hands of exploiters. The courts, tax bars and other bars, supposed to safeguard the rights of citizens against such violations of Constitutional provisions, are also guilty of inaction and silence.

It is an irrefutable fact that billions have been squandered by FBR as extortionist agency from small traders not chargeable to tax under section 235(4)(a) of the Income Tax Ordinance, 2001, during the last many years and yet they have been dubbed as tax evaders! The vital and valid question is why a person having no taxable income is being forced to pay higher advance income tax or file income tax return?

There exists a wrong notion that traders do not pay income tax. All traders, filer or non-filers, have been paying advance income tax with electricity and mobile bills. Section 235(4)(a) of the Income Tax Ordinance, 2001 says that “in the case of a taxpayer other than a company, tax collected of Rs. 43,200 up to bill amount of thirty thousand rupees per month of a commercial electricity user shall be treated as minimum tax on the income of such persons and no refund shall be allowed.”

According to State of Industry Report 2022 by National Electric Power Authority (NEPRA), the total commercial and industrial electricity connections as on June 30, 2022 were 8,219,525. By excluding all not chargeable under the Act e.g. educational institutions, including deeni madrassas (religious schools), hospital/dispensaries, mosques, agricultural sector, service sector, retailers having annual bill of up to Rs. 1.2 million and cottage industries, the fair sales tax base out of 8.2 million commercial and industrial users comes to around 5 million. It is failure of FBR not to register them.

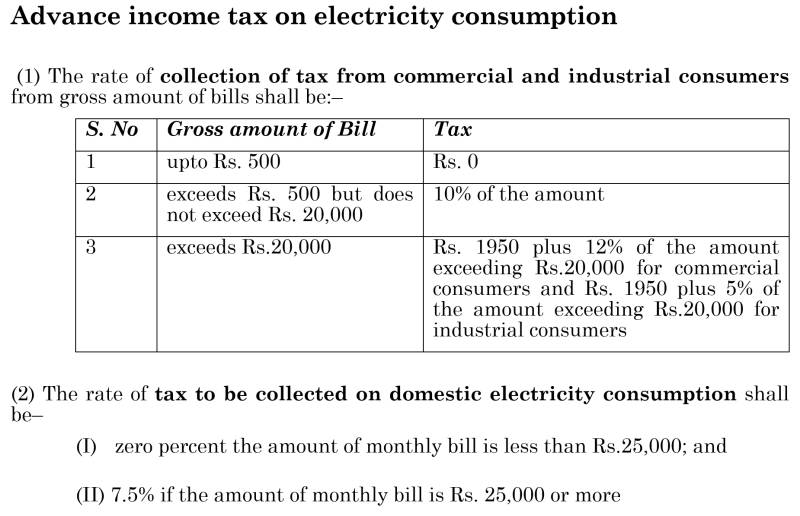

In the case of commercial and industrial connection, advance tax is imposed at the rate of 10% if monthly bill exceeds Rs. 500 and upto Rs. 20,000. Beyond Rs. 20,000, the rate is 12% for commercial and 5% for industrial consumers. For domestic consumers flat rate of 7.5 persons applies for non-filers if monthly bill exceeds Rs. 25,000. Law recognises payer of advance income tax with electricity bill as commercial or industrial electricity user “taxpayer” though no return is files, for which notice for filing of return can be issued. Is there a justification to impose on businessmen having commercial electricity connection, minimum tax paid up to Rs. 43,200 in a year with annual electricity bill of Rs. 360,000? This amount is not to be refunded even if a loss is suffered. So why to file a tax return?

Majority of the electricity and mobile users do not have taxable income, yet they are subjected to advance income tax. If they want money back, they have to file a tax return and that too, electronically, which is quite challenging for professionals, what to speak of the common man. The ordinary citizens with no taxable income also fear becoming victims of the excesses of FBR officials and exploitation at the hands of unscrupulous tax advisers if they claim refund. However, to avoid higher withholding or no withholding, millions file NIL returns or below taxable limit (BTL) returns through non-professionals or FBR staff and they are seldom questioned.

This shows the extreme highhandedness of the government, especially when majority of the ultra-rich do not file tax returns. FBR till today has failed to tell the nation what happened to nearly three million rich people about which an ex-Chairman claimed he had solid information about lavish living from his NADRA days! These ultra-rich are happy with withholding provisions as these take only a fraction of their mammoth incomes. This confirms beyond any doubt the ineffectiveness and incompetence of FBR.

Our real dilemma is that the rich and mighty are not paying taxes according to their ability. FBR should determine income tax base from the data of about 120 million unique mobile users using details of their calling patterns, bills, handset ownership status, assets, travel abroad, payment of utility bills, fees for children etc. All of them are paying advance adjustable income tax of 15% but the gap between persons subjected to withholding provisions like advance and adjustable income tax of 15% under section 236 of the Ordinance and filers is very huge. Total returns received from individuals till August 28, 2023 at the Active Taxpayer List of FBR (updated every Monday) were 2,959,852 against the registered individual taxpayers of 7.2 million and actual potential of 20 million.

In Pakistan, the ultra-rich avoid tax obligations, but millions having no income or incomes below taxable limit are forced to pay advance tax and in a majority of cases at a higher rate.

At present the entire taxable population and even those having below taxable incomes are paying income tax at source as mobile users, yet politicians and FBR are engaged in a vicious propaganda that people of Pakistan are tax cheats. This is highly lamentable, especially when all persons using commercial or industrial electricity connections are paying advance income tax under section 235 of the Income Tax Ordinance, 2001 and in the case of individuals and associations of persons an amount up to Rs. 36,000 is treated as minimum tax.

Why FBR wants tax returns from even those who have no taxable income? Certainly, more “filers” means more “speed money,” more earnings for unscrupulous tax advisers, majority of whom comprises lower staff and even some officers of FBR working in the evening with some tax consultants or having their own independent offices. FBR stalwarts have failed to check this malpractice, though it has been pointed out repeatedly by many. It is an undeniable fact that FBR has miserably failed to get due tax from the rich and mighty and thus its main emphasis is on withholding taxes that constitute 65% of total income tax collection (bulk of this collection is from persons not liable to income tax). Another 30% comes from voluntary payments, advance tax and tax with returns. We have an army of employees in Inland Revenue Service (about 25,000) that hardly collect 5% of total direct taxes with their own efforts! But they make the life of honest taxpayers miserable and this is the main reason behind the absence of tax culture in Pakistan. In the face of these facts do we need an agency like this that cannot even justify its financial viability and that has to pay billions to taxpayers as refunds?

In Pakistan, the ultra-rich avoid tax obligations, but millions having no income or incomes below taxable limit are forced to pay advance tax and in a majority of cases at a higher rate. It is gross violation of Article 4 of the Constitution assuring that the State cannot force a person to do what the law does not require him to do. Why should poor people engage a tax adviser to file return and pay money to get refund?

It is FBR’s failure to enforce provisions relating to filing of returns by people having taxable income, for which it cannot blame the public at large. Are the people of Pakistan responsible for this pathetic performance? The responsible officials of FBR should be taken to task for this gloomy state of affairs. It is high time that FBR should put its own house in order and enforce tax laws across the board rather than blaming the already over-taxed people of Pakistan for its own managerial fiascoes and established record of protecting the rich and mighty. It must be remembered by all that non-collection of tax where due is as detestable as its collection, where it is not due.