The former Finance Minister of Pakistan, Shaukat Tarin, alongside the former governor of the State Bank of Pakistan (SBP), Reza Baqir, have found themselves on the receiving end of allegations regarding their alleged involvement in disbursing billions of dollars in free loans, including to Hascol.

According to allegations, Raza Baqir, serving as the Governor of the State Bank of Pakistan (SBP), and Shaukat Tareen, who held the position of Finance Minister, allegedly approved a loan of $3 billion at zero interest rate to various corporate entities, including Hascol Group. Shortly after receiving the loan, Hascol encountered financial difficulties and eventually filed for bankruptcy. Following this, Shaukat Tareen appointed Raza Baqir's firm as an advisor to Hascol. Additionally, it is claimed that Shaukat Tareen had a personal stake in Hascol but did not publicly disclose the $3 billion loan obtained from the SBP, as his own group had also borrowed $1 billion from the same source.

https://twitter.com/shaukat_tarin/status/1675410196330364929

To assess the validity of these allegations, it is essential to carefully examine the two incidents in question: Hascol's default and the $3 billion Temporary Economic Refinance Facility (TERF).

The Hascol Saga

Hascol Petroleum entered the Pakistani market in 2001 and quickly established itself as the second-largest player in the industry, following the state-owned PSO. However, rapid growth brought about cash flow issues, exacerbated by the sharp drop in global oil prices during the pandemic, which significantly reduced the value of Hascol's substantial oil stock.

In order to navigate through the crisis, Hascol's management allegedly resorted to fraudulent activities, leading to the scandal. The company was accused of siphoning off billions from banks through deceptive means. This had a significant impact on several major public sector banks in Pakistan that had exposure to Hascol's credit facilities. As a result of Hascol's failure to fulfill its liabilities, the Federal Investigation Agency (FIA) initiated an investigation.

According to the FIA report, Hascol was accused of colluding with Byco to exploit Letters of Credit (LCs), which are non-funded facilities rather than lending instruments. The alleged scheme involved Hascol entering into fraudulent agreements with Byco for the purchase of oil. Hascol's bankers would issue LCs to Byco, who would then cash them by presenting them to their own banks. Byco would deduct a small fee before transferring the remaining funds back to Hascol, perpetuating the cycle.

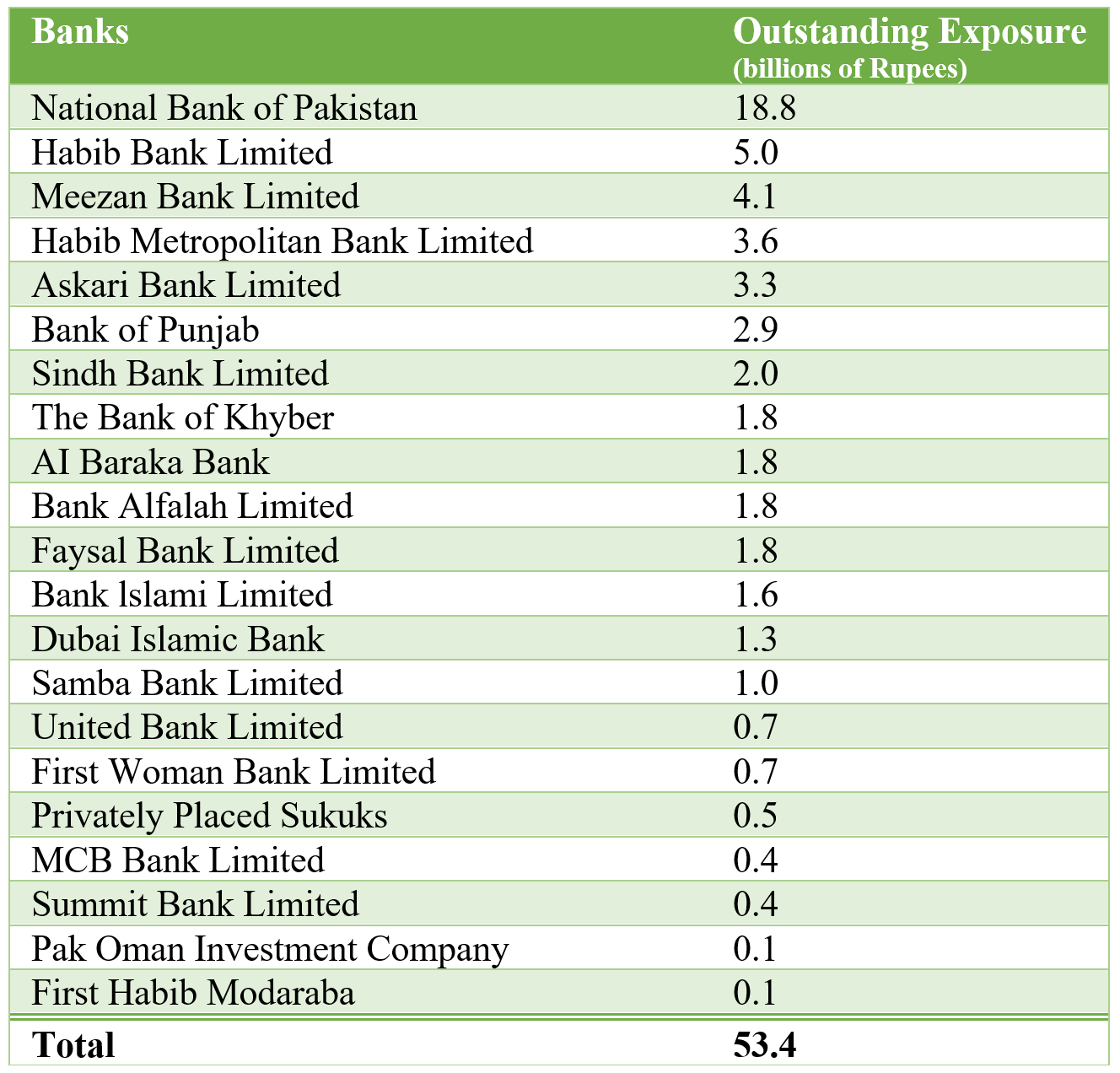

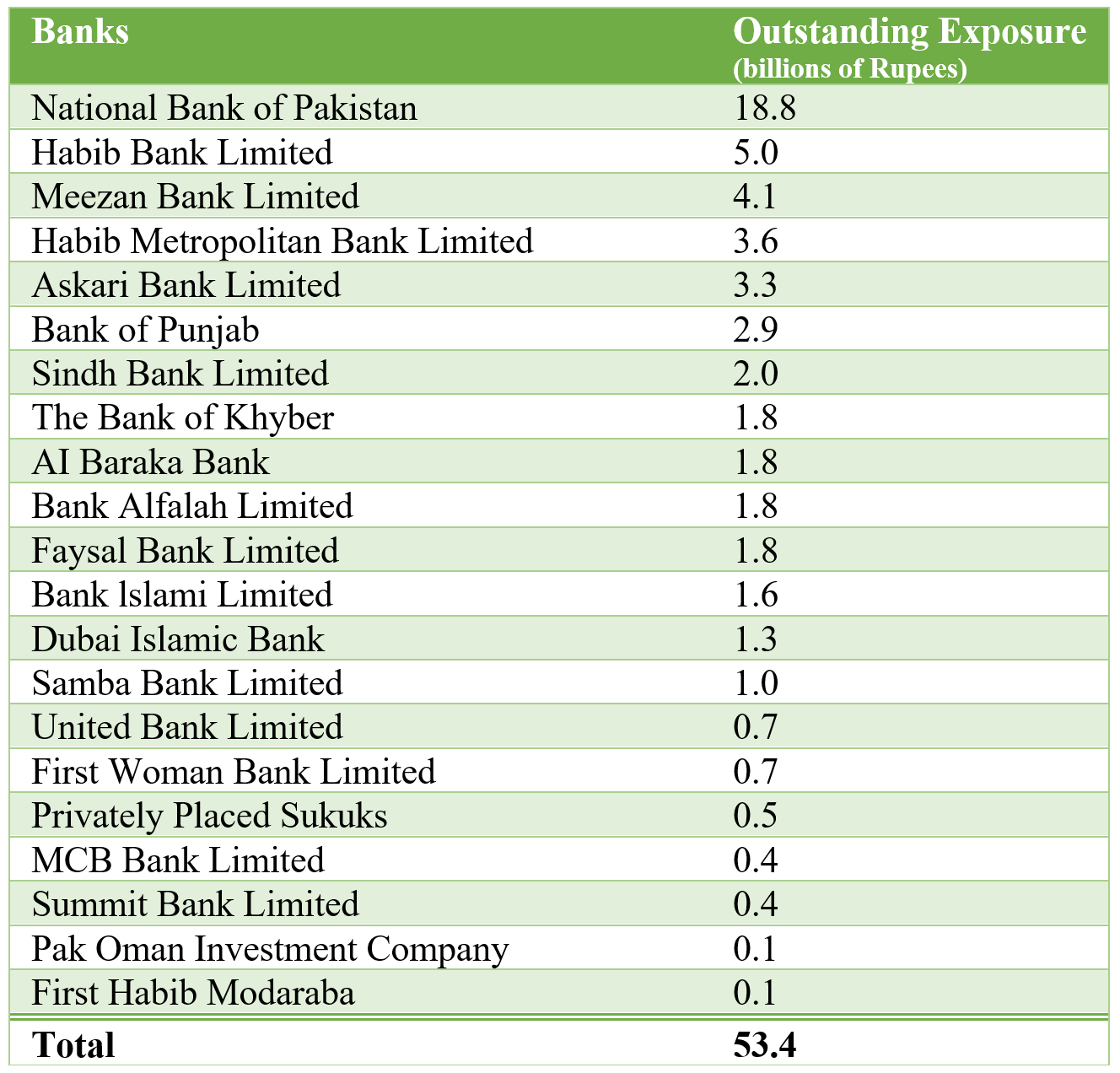

As the circular debt continued to mount, Hascol resorted to opening new LCs to repay the previous ones. However, this strategy became unsustainable, eventually leading to the company's default on its repayments of around Rs. 54 billion.

Source: Profit Magazine

$3 Billion through TERF

During a meeting of the National Assembly’s standing committee on finance in April, Dr. Inayat Hussain, the Deputy Governor of the State Bank of Pakistan (SBP), shared that nearly $3 billion in concessional loans were distributed to approximately 600 borrowers during the PTI government’s tenure. While this news may come as a surprise to some, the controversial nature of the Temporary Economic Refinance Facility (TERF), through which the loans were issued by commercial banks, has been widely discussed and documented. The pitfalls of this scheme have been a topic of much debate.

TERF was introduced by the PTI government during the pandemic to provide support to businesses amidst uncertain economic conditions. The scheme aimed to alleviate the unprecedented challenges faced by businesses by encouraging investment in new projects and the modernization of existing ones through concessionary refinance. Its goal was to provide respite to businesses and stimulate economic activity. Yet, one of the most undesirable but imminent outcomes of such schemes is blatant abuse by those in a position of power by earmarking funds for personal investments.

Read More: Did PTI Really Provide $3 Billion Of Free Loans Through TERF?

What about the allegations?

Regarding Hascol's case, the allegations seem to lack a solid foundation. First, the FIA has been conducting an investigation into the company for a substantial period, and there is no mention of Tarin, the former finance minister, being implicated. Second, the audited financial statements of the company do not indicate any direct or indirect holdings by Tarin. Additionally, the claim of $1 billion in loans appears to be an exaggerated figure, as it exceeds three times the Balance Sheet footing of Hascol in 2021 based on the then prevailing exchange rate. Moreover, there is no mention of TERF financing in the official documents.

While concerns may exist regarding Shaukat Tarin's malintent specially after his leaked call indicating potential sabotage of the IMF deal and the fact that his Silk Bank was on the Fund’s radar.

However, the matter regarding Hascol and TERF seems to be exaggerated and inaccurate.

According to allegations, Raza Baqir, serving as the Governor of the State Bank of Pakistan (SBP), and Shaukat Tareen, who held the position of Finance Minister, allegedly approved a loan of $3 billion at zero interest rate to various corporate entities, including Hascol Group. Shortly after receiving the loan, Hascol encountered financial difficulties and eventually filed for bankruptcy. Following this, Shaukat Tareen appointed Raza Baqir's firm as an advisor to Hascol. Additionally, it is claimed that Shaukat Tareen had a personal stake in Hascol but did not publicly disclose the $3 billion loan obtained from the SBP, as his own group had also borrowed $1 billion from the same source.

https://twitter.com/shaukat_tarin/status/1675410196330364929

To assess the validity of these allegations, it is essential to carefully examine the two incidents in question: Hascol's default and the $3 billion Temporary Economic Refinance Facility (TERF).

The Hascol Saga

Hascol Petroleum entered the Pakistani market in 2001 and quickly established itself as the second-largest player in the industry, following the state-owned PSO. However, rapid growth brought about cash flow issues, exacerbated by the sharp drop in global oil prices during the pandemic, which significantly reduced the value of Hascol's substantial oil stock.

In order to navigate through the crisis, Hascol's management allegedly resorted to fraudulent activities, leading to the scandal. The company was accused of siphoning off billions from banks through deceptive means. This had a significant impact on several major public sector banks in Pakistan that had exposure to Hascol's credit facilities. As a result of Hascol's failure to fulfill its liabilities, the Federal Investigation Agency (FIA) initiated an investigation.

According to the FIA report, Hascol was accused of colluding with Byco to exploit Letters of Credit (LCs), which are non-funded facilities rather than lending instruments. The alleged scheme involved Hascol entering into fraudulent agreements with Byco for the purchase of oil. Hascol's bankers would issue LCs to Byco, who would then cash them by presenting them to their own banks. Byco would deduct a small fee before transferring the remaining funds back to Hascol, perpetuating the cycle.

As the circular debt continued to mount, Hascol resorted to opening new LCs to repay the previous ones. However, this strategy became unsustainable, eventually leading to the company's default on its repayments of around Rs. 54 billion.

Source: Profit Magazine

$3 Billion through TERF

During a meeting of the National Assembly’s standing committee on finance in April, Dr. Inayat Hussain, the Deputy Governor of the State Bank of Pakistan (SBP), shared that nearly $3 billion in concessional loans were distributed to approximately 600 borrowers during the PTI government’s tenure. While this news may come as a surprise to some, the controversial nature of the Temporary Economic Refinance Facility (TERF), through which the loans were issued by commercial banks, has been widely discussed and documented. The pitfalls of this scheme have been a topic of much debate.

TERF was introduced by the PTI government during the pandemic to provide support to businesses amidst uncertain economic conditions. The scheme aimed to alleviate the unprecedented challenges faced by businesses by encouraging investment in new projects and the modernization of existing ones through concessionary refinance. Its goal was to provide respite to businesses and stimulate economic activity. Yet, one of the most undesirable but imminent outcomes of such schemes is blatant abuse by those in a position of power by earmarking funds for personal investments.

Read More: Did PTI Really Provide $3 Billion Of Free Loans Through TERF?

What about the allegations?

Regarding Hascol's case, the allegations seem to lack a solid foundation. First, the FIA has been conducting an investigation into the company for a substantial period, and there is no mention of Tarin, the former finance minister, being implicated. Second, the audited financial statements of the company do not indicate any direct or indirect holdings by Tarin. Additionally, the claim of $1 billion in loans appears to be an exaggerated figure, as it exceeds three times the Balance Sheet footing of Hascol in 2021 based on the then prevailing exchange rate. Moreover, there is no mention of TERF financing in the official documents.

While concerns may exist regarding Shaukat Tarin's malintent specially after his leaked call indicating potential sabotage of the IMF deal and the fact that his Silk Bank was on the Fund’s radar.

However, the matter regarding Hascol and TERF seems to be exaggerated and inaccurate.