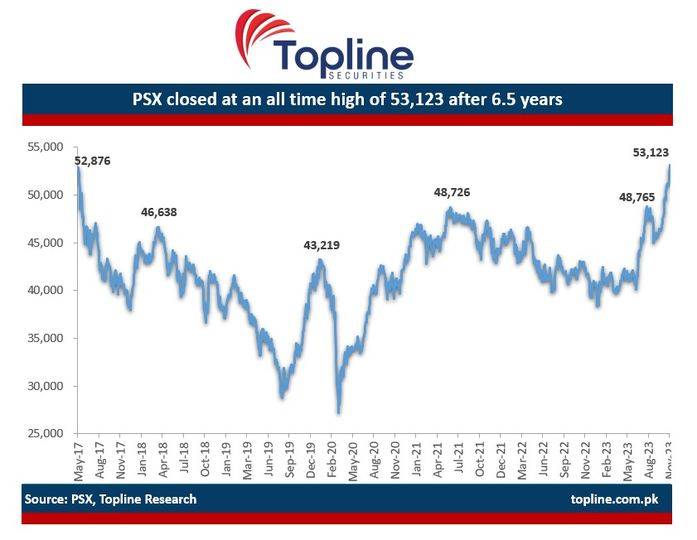

The Pakistan Stock Exchange on Friday closed a bumper week to rise to a six-and-a-half-year high, surpassing the psychological barrier of 53,000 points.

During trading on Friday, the exchange opened at 52,656.76 points. With companies still posting profits, the positive trend in the market continued.

After a slight dip at the beginning of the session, the index saw a flurry of activity as it rose to a height of 53,263.07 points. In doing so, it rose past the peak of 53,127 points, which the index had reached on May 25, 2017. However, brokerage firm Topline Securities noted at that moment, valuations were a third as of May 2017.

After the extended Friday break, the index resumed a downward trend it had picked up before the break, and the index dipped to 52,921.89 points before recovering and closing the day at 53,123.03 points.

This was up by 466.27 points from the previous day's close.

The index had a turnover of 509.1 million shares traded on Friday worth Rs15.6 billion, with a market capitalisation of Rs7.677 trillion.

Over the past week, the index gained 2,179.19 points, having opened the week at 50,943.84 points.

Rupee slips

In the money market, the rupee lost 88 paisas against the US dollar on Friday as its slump continues.

According to data released by the State Bank of Pakistan (SBP) on Friday, the rupee closed in the interbank market at Rs284.31, down 0.31% from its Thursday value of Rs283.43.

Interbank closing #ExchangeRate for todayhttps://t.co/6d8DAW2nWg#SBPExchangeRate pic.twitter.com/kbazNtev9d

— SBP (@StateBank_Pak) November 3, 2023

Since October 20, the rupee has lost Rs5.51 after regaining over Rs30 in the interbank in the preceding six weeks.

The slide came on the back of the falling foreign exchange reserves of the country, which have shrunk to $12.577 billion from $12.656 billion the previous week.

Total liquid foreign #reserves held by the country stood at US$ 12.58 billion as of October 27, 2023.

— SBP (@StateBank_Pak) November 3, 2023

For details https://t.co/WpSgomnKT3#SBPReserves pic.twitter.com/RYxfFuio0i

Data from the State Bank showed that reserves held with the central bank rose week-on-week by $13.6 million from $7.494 billion for the week ending October 20 to $7.508 billion for the week ending October 27.

At the same time, reserves held by commercial banks shrunk from $5.161 billion at the end of October 20 by $92.6 million to $5.069 billion by the end of October 27.