With cash-strapped Pakistan unable to wean itself off of monetary injections and development interventions from international financial institutions such as the International Monetary Fund (IMR) or the World Bank (WB), the inherent limitations of these programmes towards the climate and impoverished is hurting the country's climate and development goals.

This was claimed in a report produced by the Netherlands-based financial accountability group Recourse. The report was authored by Alternative Law Collective's Research Director Zain Moulvi, and Recourse IMF Campaign Manager Federico Sibaja.

The report explained that Pakistan was chosen as a case study on various climate-related impacts of programmes of international financial institutions within the Global South because it has had a record 23 IMF programmes (not all of which were completed) and World Bank Group (WBG) investments worth over $40 billion across diverse sectors such as energy, agriculture, and water spanning several decades.

Pakistan’s profile allows for cross-sectoral testing of the climate compatibility of IFI operations across multiple types of interventions and in various contexts.

Involved in Pakistan since 1958, the institutions have almost shaped the country's long-term trajectory. For example, the WBG played an instrumental role in developing Pakistan's development agenda, which was crucial in setting up the Water and Power Development Authority (WAPDA).

Prime amongst them, it said that the WBG-backed national energy policies provided incentives to independent power producers, which operated on expensive, imported fossil fuel. By stocking on these plants to the point of national overcapacity and an IMF-backed policy to phase out energy subsidies had a massive impact on Pakistan's economy with skyrocketing inflation, not to mention impacts on the climate.

Moreover, the WBG lobbied to include 'harmful' large hydro projects in the national renewables policy.

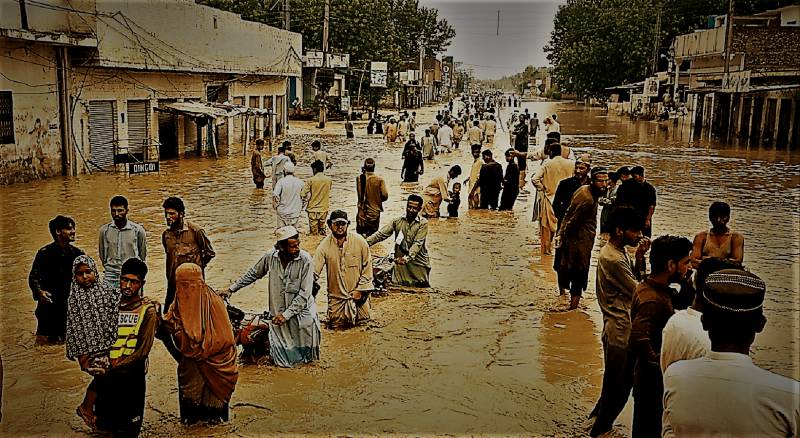

The WBG also backed the Left Bank Outfall Drain (LBOD) and Tarbela Dam projects. The first project, affectees living in Badin said, had caused floods to become an annual feature in their geography, profoundly impacting their lives.

"We learned to adapt through our own resources," said Aslam, a resident of Badin in Sindh, which was severely affected by the 2022 floods.

"Before the monsoon, we would sell a camel and migrate to another location. This year, the IMF negotiations increased petrol prices so much that we had to take loans just to put food on the table. We no longer have the option to migrate and are left with hoping there are no floods again this year," he added.

The report analysed projects by the two organisations and the structural failings in the underlying analytic and developmental logic of programmes implemented by both in Pakistan - including in their climate-related operations.

It said that over the past three decades, policy advice and developmental reforms led by the WBG and IMF have focused on three major sectors: energy, agriculture, and water.

Thus, it is in these areas that the climate-related impacts of their interventions are most visible.

"These institutions have generally followed an ahistoric and siloed approach that fails to recognise the interactive and dynamic interlinkages between their fiscal and macroeconomic policies, and the broader everyday realities of economic exploitation, gender inequality, and climate change – in both the short-term and longer-term time frames," Moulvi said.

The limited and weak ‘reform’ agenda of the IFIs, coupled with their expanding interventionist power under the guise of climate action, raises serious concerns for Global South nations struggling to chart an effective climate-compatible developmental path," said Sibaja.

At least the WBG has retrospectively admitted mistakes in its projects.

An Implementation Completion Report acknowledged the flawed nature of

its advice to Islamabad on providing excessive concessions such as a

post-tax equity return rate of 25%.

Moreover, in 2006, it admitted that the construction of the Tarbela Dam submerged 120 villages and that the group had proceeded "without adequate provisions to minimise the risks that the structures would give way."

With the WBG pushing for fossil fuel-based independent power plants (IPPs), Pakistan was burdened with overcapacity of power and capacity payments for the unused potential energy that ballooned its energy-fed circular debt to Rs2.5 trillion in 2023. Capacity charges accounted for Rs1.3 trillion of that debt.

The report calls on IFIs to be more accountable and democratic through a review of toolkits, including the need for impact assessments, debt sustainability analysis, proper compensation to affected communities, and immediate amendments to current loans, including the IMF’s Stand-by Arrangement (SBA) and WBG’s Pakistan Program for Affordable and Clean Energy (PACE).