The Mughals were among the most eminent rulers of the South Asian Subcontinent. They, while ruling the world’s most populous country of that time, had a thriving economy. It is to be noted that even before the Mughals came here, India was not a poor country. In the Baburnama, the first Mughal emperor accounted that Hindustan had an excellent accounting system – with the units of measurement including arabs, kharabs, padams and saangs. The need for calculation up to saangs indicates that indeed India was a rich place. With the advent of the Mughals, the economy continued to flourish. The major source of its income was land taxes and war booty. The economy was mainly agrarian. Some non-agriculture products were also there. India had its own trimetallic currency. There was inland trade inside the country as well as with the other countries. The foreign trade was mainly the monopoly of the Muslims, and then the Dutch and the English. There was also an effective tax collection system.

Agriculture:

As already mentioned, India during the Mughal era was perhaps the most populous country of the world. Agriculture was the main industry of India and a chief source of revenue. The crops cultivated were not largely different from the present-day crops - except that today, wheat and sugar cane are the prime ones. Peasant farming was prevalent. The output as compared to that of England or France of that time was less. Large areas were associated with production of low-quality grains like bajra or jawar because of the harsh climate conditions. The state demanded more of the produce which left little for the people. Agricultural techniques used were backward. Farm implements were poor and ploughs made of wood were used. Cattle dung, unlike in China, was not used as manure but as fuel and for construction. Pest growth was not checked. Although in numbers cows were more than those in Europe, overall milk production was less. Farmers mainly depended on monsoon rains which resulted in fluctuating produce. There was a lack of artificial irrigation. Due to English and Dutch merchants' demand, people started growing silk and cotton.

Tobacco cultivation is intriguing in this regard. It was brought to India by the Portuguese in Gujarat in 1613. More people started smoking and the cultivation saw a boom. Jehangir prohibited smoking but it didn’t have any immense effect. This can be seen from the fact that Aurangzeb used to earn a huge sum from a tobacco farm near Delhi.

An interesting fact is that despite begin an agrarian country, most of the land was uncultivated. This also indicates that the most fertile land was cultivated usually. The uncultivated land mostly remained covered with the forest and the products obtained from it were major exports.

Non-agricultural products:

These products consisted of fisheries, minerals, salt, saltpetre, sugar, opium, indigo and liquor etc. During Akbar’s reign, copper production was at its height from mines in Rajputana and Central India. Iron production was also significant because of its demand. Some other metals like zinc and tin were imported. Salt, much more cherished than today, was extracted from mines in Punjab and from the sea also. Bengal was leading producer of sugar. As such, sugar was considered a great luxury as it was expensive (costed 128 dams per maund). Local people used molasses (gur) as a sweetener. Opium was also cultivated in great amounts; its production saw an increase when there was an increased European demand. Liquor production saw its ups and downs. Akbar tried to restrict its production. Jehangir, despite begin a heavy drinker, tried to curtail its production but both failed as the production continued uninterrupted. The production of saltpetre (KNO3) saw its height during Akbar’s rule as the demand for explosive material increased.

Industry:

Throughout Mughal rule, industry did not see any modern organization. There were weavers, carpenters, artisans and blacksmiths. The main crafts were wooden bedsteads, chests, stools, boxes of leather, textiles, paper, pottery, bricks and carpets etc. Women labourers were spinners and weavers at home, and lime makers, brick and stone carriers at construction sites. The towns had a large amount of manufacturers, extractive industry and construction industry. The products which were of low cost were produced by artisans themselves. The used to sell them at the place of production or sometimes in a bazaar or mela. Blacksmiths used to have their karkhanas. But mostly the common artisan was a middle man, quite dependent. As merchants used to take their products, they might buy the things from artisans at a price of their own. As the artisans had no direct interaction with the ultimate customers, they depended on merchants to know about the consumer’s demands. Merchants, thus, were able to make them produce things of their own choice. So, the monopoly of middlemen or merchants was in play.

Nobles or royalty, on the other hand, were not much interested in local products. Their interest lay mainly in foreign products. It was quite difficult for the locals to sell their products to such a market. They had to be highly skillful in order to meet the standards or demands of nobles. Also, there was not any high demand of their products in the foreign market. At home, they had to buy materials at a high cost, pay huge taxes and at the end receive low prices or wages. Craftsmen and industrial workers often had to pay fines and work for nothing.

The silk industry was suffering because of the same reason, as only nobles used to wear silk clothes. Their condition deteriorated after Akbar’s reign as his successors exploited them further. This in some cases resulted in migration. Akbar had a special interest in the silk, carpet and shawls industry. He encouraged workers from abroad to settle in India and teach the techniques related to them to the locals. This interest resulted in development of these as industries in areas such as Lahore, Agra and Fatehpur Sikri. Nobles were encouraged to wear the shawls locally produced. Woolen goods, primarily, consisted of coarse blankets as they were purchasable by locals.

The principal industry of India was of cotton goods, which were imported as well. Muslin of best quality was produced along with certain other items like carpets, coverlets, ropes, bed-tapes etc. Although the production was large, the people of Bengal due to scarcity of cotton clothes used to wear jute sacks. Exports were directed to the Middle Eastern countries. The cotton industry, which was performing well in Akbar’s reign, continued to perform well during his successors. Production of calico went high after arrival of English. Foreign merchants played a vital role in establishing relations with other countries.

Coinage system:

Mughals used trimetallic currency. As such, the one mainly used was imperial currency. Local currency was highly discouraged and sometimes confiscated. In all of India, other kinds of coins were slowly replaced with the silver rupee: even the gold coins of South were replaced. Primarily, the coins were silver rupees of 178-180 grains. Highly quality and metallic purity was ensured in making coins. In beginning of Akbar’s rule 21-gram copper paisa coins of the Surs were known as dams. In 1562, gold muhr of 10.9 grams based on the Delhi Sultanate were revived. In the 1570s and 1580s, square shaped coins were also experimented with.

There were minters who were responsible for production of coins. Akbar’s minter always ensured a high quality of coins. Gold coins were of utmost purity. Silver coins of at least 96% purity and copper coins of high quality were maintained. Open minting services were available for those willing to pay a fee and get their coins stuck. The monetization or the worth of coins was in relation to bullion reserves (the bulk metal of highest purity used in production of coins) in between a high of 10.77% for copper and a low of 5.63% for silver bullion. The central treasury accepted taxes in out-of-date coins of the Sur era but at a lesser amount. This was an attempt to devalue the old coins. The Suri coins were then melted and reissued.

Commonly, copper dams were used for all sorts of activities - for example, for revenue demand, purchases of items of daily use and for daily commodities etc. Their focus was, as explained above, on a centralized monetary system. There were mines in India of copper and silver. But even if the mines were exhausted, enough silver and copper was present in bullion for making coins. The coins, interestingly, remained in India, as foreigners had to pay for the Indian exports with the Indian coins. In late the 1500s, copper demand went high because of its use in military equipment. Gradually, copper dams were replaced by silver rupees. As such, the copper dam was replaced by the silver anna (1/16th part of a coin).

The institution of insurance (Bima) had its origin in India. However, the rates were very low. An important role was of Sarrafs (money changers). They were involved with payments. They accepted both deposits and hundis (deposit bills – an amount 'anth' is deducted if the payment is required before due time). The institution of brokerage also played its role. Banyas were famous as brokers. They especially met with the needs of smaller merchants. Some large institutions were present as well.

Inland Trade:

Goods, both agricultural and non-agricultural, need to be transported. It was done by an efficient system of Banjaras – nomadic people who carried goods in bulk on the back of bullocks. They were famous particularly for transport of non-agricultural products. It is estimated that they carried about 821 million metric tons of products per annum. There were huge caravans who used to transport goods on the back of camels or bullocks. These caravans used to move on specific routes. If the routes were inside the imperial territory, they were well guarded and the tolls were regulated as well. Overall the security situation was good as indicated by low rates of insurance policies. As India is a large country, the goods inside the country were also transported by sea in boats.

An effective communication system was in play also. It was done through relays, relay runners, private persons and professional messengers. Special express messengers were the fastest. Bazaar qasids used to wait for mail to get collected and then relay it, so they were a bit slower. No separate communication or postal institution – like those in Europe – was present in India.

Foreign Trade:

Trade with foreign territories was done by both land and sea routes. The Portuguese had supremacy over sea routes. Akbar did not offer any resistance to him and simply obtained ship licenses from them to continue trade via sea. The major ports during Akbar’s reign were Cambay, Surat, Bengal and Malabar. There were two major land routes: from Lahore to Kabul and from Multan to Kandahar. Horses were used primarily. Land trade was slightly unpopular because of danger of robbery and violence.

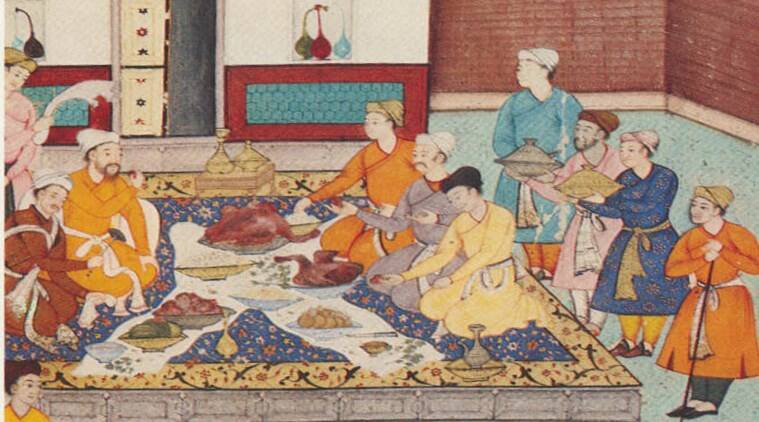

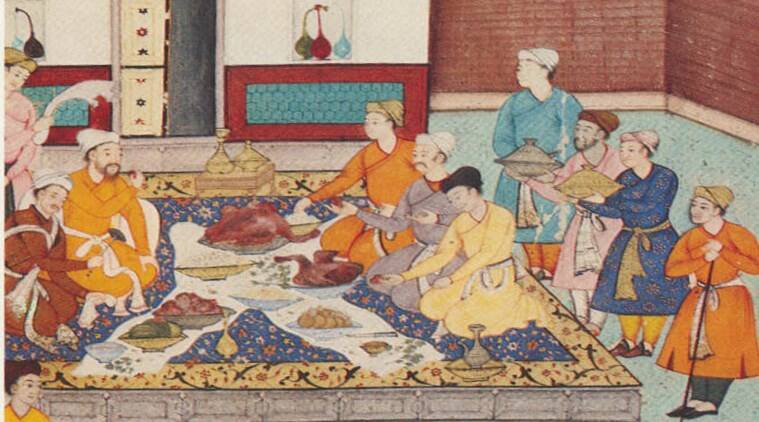

Major exports included textiles, indigo, pepper, opium and some other drugs. Slaves were also sold until Akbar prohibited their export. Imports included: bullion, horses, metals, ivory, coral, amber, precious stones, perfumes, European wines and African slaves etc. The major imports from China included porcelain. Akbar always had his dinner in porcelain dishes as they broke down if the food was poisoned.

The overall foreign trade was small, particularly because Europeans goods were expensive, so they had little market demand in India. Indian exports demanded gold or silver in return, which at first was not acceptable. So, mainly textile trade was done. After Akbar’s death new markets for calico, saltpetre, indigo and raw silk were established. Europe wanted these products, consequently they had to pay with gold and silver. To put it in the words of Sir Thomas Roe “Europe bleedeth to enrich Asia.” Europe dominated the market form the 16th century onward – in particular, the Dutch East India Company and English East India Company. After some time they went on to establish their factories in the coastal regions. European techniques had a positive impact on the economy. Their companies were successful because they were organized. During Jehangir’s time particularly, the Europeans established their foothold. Around 1625, they had established trade in indigo and calico. Indigo was faster and cheaper than wood, thus it became an important export. The export of pepper also soared from 7 million lb. to 13.5 million lb. The famine of 1630-32 provided the English an opportunity to supplement the reduced food supply of Gujarat. From 1630 onwards, Indians started to build excellent ships based on Dutch and English models. In Aurangzeb’s era calico of Madras, silk and sugar of Bengal and saltpetre of Behar were important exports.

Europeans, on the other hand, benefited by importing, to put it in their own terms, “toys for the nobility.” Mughal emperors had a special interest in dogs. Horses from central Asia were imported in large numbers. In return, the foreign merchants could get special benefits like discounts or special farmans.

Taxation and the revenue system:

A high revenue was obtained from the land taxes. It was about one third or even more of the total revenue. Other levies like market taxes, toll taxes or feudal taxes were minimal in terms of revenue generation.

There were some peasant-held (ra’iyati) villages in which big men collected shares (behrimal) from each individual person or peasant (asami) to meet the jama or tax demand.

Some villages or parganas were under zamindars. They held the land either due to force or some kind of local respect for their lineage. The zamindar answered to the Mughal ruler and used to pay taxes. Zamindars used to receive nankars for tax collection. Their haqq from other peasents was also defined. Sometimes they also demanded their share in the other taxes collected from their territory. Their zamindaris were also saleable. In the pargana there were two local officers. One was Chaudry (in Northern India) or Deshmukhs (in the Deccan), who used to collect taxes for the revenue officials. The other was Qanunga, who used to keep a written account.

Sher Shah Suri is a notable figure regarding establishment of revenue collection. He demanded the land to be surveyed and taxes to be applied with efficient collection. The farmers were especially cared for and compensated in case of any problem.

In India, there was also the system of jagirs. Jagirs were land assignments under the jagirdar. Jagirs were held for a shorter period of time and the jagirdars were to maintain some troops. Jagirs were transferred after some time. In about 1574, under Akbar, the ranks were fixed with a pay. The system had its flaws as the assignees were interested only in immediate gain. The condition of the ordinary peasant deteriorated. They very exploited to a higher degree. A huge rift was there between the nobles and the common man. It grew with the passage of time. This system, without much change continued even under his successors.

Emperor Akbar had experimented with revenue collection. Although the taxes were heavy, there was much systematization. The weights were standardized with one imperial yard equal to 31.92 inches and one bigah equal to 60 gazh. Todar Mal was Akbar's minister. He went on to obtain more complete area and production statistics. Minimum and maximum prices were determined. In 1580, Todar Mal took a drastic step and all the land thereafter fell under treasury officials who would control them directly. Revenue circles were made with a revenue officer appointed in them. The land was again surveyed with the help of bamboo rods with iron joints. Data for about ten years of average yield, harvest and local prices was obtained. The tax was then fixed for ten years. Standard assessments were made. On rice and wheat, one-third of the harvest or its equivalent as tax was to be collected. On low crops such as indigo or sugar, one fifth of the harvest was to be collected. Revenue demand was determined by both the cropped area and standard rate of the crop in the local market. Under the Zabt system, written demands for the tax payments and corresponding written acceptances from the village headmen were to be made. Annual tax assessment could be done in four installments. This played an important role in increasing rural-to-urban grain trade.

Expenditures:

A huge amount mainly went on maintaining a huge army, the pay of mansabdars and the expenditures of the emperor and his household. The nobles used to live an extravagant lifestyle. They spent their wealth in buying precious metals and stones, and the construction of buildings such as mausoleums. They even spent huge amounts on preparing dowries of their daughters. The families were very large, with a single person to depend on. Their expenditures can also be understood with the perspective that there was a rule according to which after their death, all their savings would go to imperial treasury.

Akbar, for example, had a revenue of 99 million silver rupees per annum. The bullion during his time expanded form 139 million to 166 million silver rupees. Until Aurangzeb’s time, there was not any budget deficit. The expenditures of Akbar’s empire can be studied for reference. Here, the emperor’s personal expenditures were relatively small. The imperial household’s expenditure was about 5%. The central military establishment spent 10%. The largest part was allotted to mansabdars.

Conclusion:

The Mughals’ economy had its problems, too. Productivity levels, as compared to the European nations at that time, were very low. There was inadequate production and faulty distribution of goods. Moreover, there was technological backwardness.

The administration was often considered evil. They had a lavish lifestyle with no productive investment. Savings were destroyed. Nobles were accustomed to indulge in pleasure. Producers were at the mercy of the merchants.

The Mughal Empire was one the richest empires ever. From having millions and billions in their treasury to the world’s most precious metals and stones, they had it all. Yet it did not do much to improve the lot of the common people.

History teaches us great lessons if we are but willing to learn them.

Agriculture:

As already mentioned, India during the Mughal era was perhaps the most populous country of the world. Agriculture was the main industry of India and a chief source of revenue. The crops cultivated were not largely different from the present-day crops - except that today, wheat and sugar cane are the prime ones. Peasant farming was prevalent. The output as compared to that of England or France of that time was less. Large areas were associated with production of low-quality grains like bajra or jawar because of the harsh climate conditions. The state demanded more of the produce which left little for the people. Agricultural techniques used were backward. Farm implements were poor and ploughs made of wood were used. Cattle dung, unlike in China, was not used as manure but as fuel and for construction. Pest growth was not checked. Although in numbers cows were more than those in Europe, overall milk production was less. Farmers mainly depended on monsoon rains which resulted in fluctuating produce. There was a lack of artificial irrigation. Due to English and Dutch merchants' demand, people started growing silk and cotton.

Tobacco cultivation is intriguing in this regard. It was brought to India by the Portuguese in Gujarat in 1613. More people started smoking and the cultivation saw a boom. Jehangir prohibited smoking but it didn’t have any immense effect. This can be seen from the fact that Aurangzeb used to earn a huge sum from a tobacco farm near Delhi.

An interesting fact is that despite begin an agrarian country, most of the land was uncultivated. This also indicates that the most fertile land was cultivated usually. The uncultivated land mostly remained covered with the forest and the products obtained from it were major exports.

Non-agricultural products:

These products consisted of fisheries, minerals, salt, saltpetre, sugar, opium, indigo and liquor etc. During Akbar’s reign, copper production was at its height from mines in Rajputana and Central India. Iron production was also significant because of its demand. Some other metals like zinc and tin were imported. Salt, much more cherished than today, was extracted from mines in Punjab and from the sea also. Bengal was leading producer of sugar. As such, sugar was considered a great luxury as it was expensive (costed 128 dams per maund). Local people used molasses (gur) as a sweetener. Opium was also cultivated in great amounts; its production saw an increase when there was an increased European demand. Liquor production saw its ups and downs. Akbar tried to restrict its production. Jehangir, despite begin a heavy drinker, tried to curtail its production but both failed as the production continued uninterrupted. The production of saltpetre (KNO3) saw its height during Akbar’s rule as the demand for explosive material increased.

Major exports included: textiles, indigo, pepper, opium and some other drugs. Slaves were also sold until Akbar prohibited their export

Industry:

Throughout Mughal rule, industry did not see any modern organization. There were weavers, carpenters, artisans and blacksmiths. The main crafts were wooden bedsteads, chests, stools, boxes of leather, textiles, paper, pottery, bricks and carpets etc. Women labourers were spinners and weavers at home, and lime makers, brick and stone carriers at construction sites. The towns had a large amount of manufacturers, extractive industry and construction industry. The products which were of low cost were produced by artisans themselves. The used to sell them at the place of production or sometimes in a bazaar or mela. Blacksmiths used to have their karkhanas. But mostly the common artisan was a middle man, quite dependent. As merchants used to take their products, they might buy the things from artisans at a price of their own. As the artisans had no direct interaction with the ultimate customers, they depended on merchants to know about the consumer’s demands. Merchants, thus, were able to make them produce things of their own choice. So, the monopoly of middlemen or merchants was in play.

Nobles or royalty, on the other hand, were not much interested in local products. Their interest lay mainly in foreign products. It was quite difficult for the locals to sell their products to such a market. They had to be highly skillful in order to meet the standards or demands of nobles. Also, there was not any high demand of their products in the foreign market. At home, they had to buy materials at a high cost, pay huge taxes and at the end receive low prices or wages. Craftsmen and industrial workers often had to pay fines and work for nothing.

The silk industry was suffering because of the same reason, as only nobles used to wear silk clothes. Their condition deteriorated after Akbar’s reign as his successors exploited them further. This in some cases resulted in migration. Akbar had a special interest in the silk, carpet and shawls industry. He encouraged workers from abroad to settle in India and teach the techniques related to them to the locals. This interest resulted in development of these as industries in areas such as Lahore, Agra and Fatehpur Sikri. Nobles were encouraged to wear the shawls locally produced. Woolen goods, primarily, consisted of coarse blankets as they were purchasable by locals.

The principal industry of India was of cotton goods, which were imported as well. Muslin of best quality was produced along with certain other items like carpets, coverlets, ropes, bed-tapes etc. Although the production was large, the people of Bengal due to scarcity of cotton clothes used to wear jute sacks. Exports were directed to the Middle Eastern countries. The cotton industry, which was performing well in Akbar’s reign, continued to perform well during his successors. Production of calico went high after arrival of English. Foreign merchants played a vital role in establishing relations with other countries.

Coinage system:

Mughals used trimetallic currency. As such, the one mainly used was imperial currency. Local currency was highly discouraged and sometimes confiscated. In all of India, other kinds of coins were slowly replaced with the silver rupee: even the gold coins of South were replaced. Primarily, the coins were silver rupees of 178-180 grains. Highly quality and metallic purity was ensured in making coins. In beginning of Akbar’s rule 21-gram copper paisa coins of the Surs were known as dams. In 1562, gold muhr of 10.9 grams based on the Delhi Sultanate were revived. In the 1570s and 1580s, square shaped coins were also experimented with.

There were minters who were responsible for production of coins. Akbar’s minter always ensured a high quality of coins. Gold coins were of utmost purity. Silver coins of at least 96% purity and copper coins of high quality were maintained. Open minting services were available for those willing to pay a fee and get their coins stuck. The monetization or the worth of coins was in relation to bullion reserves (the bulk metal of highest purity used in production of coins) in between a high of 10.77% for copper and a low of 5.63% for silver bullion. The central treasury accepted taxes in out-of-date coins of the Sur era but at a lesser amount. This was an attempt to devalue the old coins. The Suri coins were then melted and reissued.

Commonly, copper dams were used for all sorts of activities - for example, for revenue demand, purchases of items of daily use and for daily commodities etc. Their focus was, as explained above, on a centralized monetary system. There were mines in India of copper and silver. But even if the mines were exhausted, enough silver and copper was present in bullion for making coins. The coins, interestingly, remained in India, as foreigners had to pay for the Indian exports with the Indian coins. In late the 1500s, copper demand went high because of its use in military equipment. Gradually, copper dams were replaced by silver rupees. As such, the copper dam was replaced by the silver anna (1/16th part of a coin).

The institution of insurance (Bima) had its origin in India. However, the rates were very low. An important role was of Sarrafs (money changers). They were involved with payments. They accepted both deposits and hundis (deposit bills – an amount 'anth' is deducted if the payment is required before due time). The institution of brokerage also played its role. Banyas were famous as brokers. They especially met with the needs of smaller merchants. Some large institutions were present as well.

Inland Trade:

Goods, both agricultural and non-agricultural, need to be transported. It was done by an efficient system of Banjaras – nomadic people who carried goods in bulk on the back of bullocks. They were famous particularly for transport of non-agricultural products. It is estimated that they carried about 821 million metric tons of products per annum. There were huge caravans who used to transport goods on the back of camels or bullocks. These caravans used to move on specific routes. If the routes were inside the imperial territory, they were well guarded and the tolls were regulated as well. Overall the security situation was good as indicated by low rates of insurance policies. As India is a large country, the goods inside the country were also transported by sea in boats.

An effective communication system was in play also. It was done through relays, relay runners, private persons and professional messengers. Special express messengers were the fastest. Bazaar qasids used to wait for mail to get collected and then relay it, so they were a bit slower. No separate communication or postal institution – like those in Europe – was present in India.

Foreign Trade:

Trade with foreign territories was done by both land and sea routes. The Portuguese had supremacy over sea routes. Akbar did not offer any resistance to him and simply obtained ship licenses from them to continue trade via sea. The major ports during Akbar’s reign were Cambay, Surat, Bengal and Malabar. There were two major land routes: from Lahore to Kabul and from Multan to Kandahar. Horses were used primarily. Land trade was slightly unpopular because of danger of robbery and violence.

Major exports included textiles, indigo, pepper, opium and some other drugs. Slaves were also sold until Akbar prohibited their export. Imports included: bullion, horses, metals, ivory, coral, amber, precious stones, perfumes, European wines and African slaves etc. The major imports from China included porcelain. Akbar always had his dinner in porcelain dishes as they broke down if the food was poisoned.

The overall foreign trade was small, particularly because Europeans goods were expensive, so they had little market demand in India. Indian exports demanded gold or silver in return, which at first was not acceptable. So, mainly textile trade was done. After Akbar’s death new markets for calico, saltpetre, indigo and raw silk were established. Europe wanted these products, consequently they had to pay with gold and silver. To put it in the words of Sir Thomas Roe “Europe bleedeth to enrich Asia.” Europe dominated the market form the 16th century onward – in particular, the Dutch East India Company and English East India Company. After some time they went on to establish their factories in the coastal regions. European techniques had a positive impact on the economy. Their companies were successful because they were organized. During Jehangir’s time particularly, the Europeans established their foothold. Around 1625, they had established trade in indigo and calico. Indigo was faster and cheaper than wood, thus it became an important export. The export of pepper also soared from 7 million lb. to 13.5 million lb. The famine of 1630-32 provided the English an opportunity to supplement the reduced food supply of Gujarat. From 1630 onwards, Indians started to build excellent ships based on Dutch and English models. In Aurangzeb’s era calico of Madras, silk and sugar of Bengal and saltpetre of Behar were important exports.

Europeans, on the other hand, benefited by importing, to put it in their own terms, “toys for the nobility.” Mughal emperors had a special interest in dogs. Horses from central Asia were imported in large numbers. In return, the foreign merchants could get special benefits like discounts or special farmans.

Until Aurangzeb’s time, there was not any budget deficit

Taxation and the revenue system:

A high revenue was obtained from the land taxes. It was about one third or even more of the total revenue. Other levies like market taxes, toll taxes or feudal taxes were minimal in terms of revenue generation.

There were some peasant-held (ra’iyati) villages in which big men collected shares (behrimal) from each individual person or peasant (asami) to meet the jama or tax demand.

Some villages or parganas were under zamindars. They held the land either due to force or some kind of local respect for their lineage. The zamindar answered to the Mughal ruler and used to pay taxes. Zamindars used to receive nankars for tax collection. Their haqq from other peasents was also defined. Sometimes they also demanded their share in the other taxes collected from their territory. Their zamindaris were also saleable. In the pargana there were two local officers. One was Chaudry (in Northern India) or Deshmukhs (in the Deccan), who used to collect taxes for the revenue officials. The other was Qanunga, who used to keep a written account.

Sher Shah Suri is a notable figure regarding establishment of revenue collection. He demanded the land to be surveyed and taxes to be applied with efficient collection. The farmers were especially cared for and compensated in case of any problem.

In India, there was also the system of jagirs. Jagirs were land assignments under the jagirdar. Jagirs were held for a shorter period of time and the jagirdars were to maintain some troops. Jagirs were transferred after some time. In about 1574, under Akbar, the ranks were fixed with a pay. The system had its flaws as the assignees were interested only in immediate gain. The condition of the ordinary peasant deteriorated. They very exploited to a higher degree. A huge rift was there between the nobles and the common man. It grew with the passage of time. This system, without much change continued even under his successors.

Emperor Akbar had experimented with revenue collection. Although the taxes were heavy, there was much systematization. The weights were standardized with one imperial yard equal to 31.92 inches and one bigah equal to 60 gazh. Todar Mal was Akbar's minister. He went on to obtain more complete area and production statistics. Minimum and maximum prices were determined. In 1580, Todar Mal took a drastic step and all the land thereafter fell under treasury officials who would control them directly. Revenue circles were made with a revenue officer appointed in them. The land was again surveyed with the help of bamboo rods with iron joints. Data for about ten years of average yield, harvest and local prices was obtained. The tax was then fixed for ten years. Standard assessments were made. On rice and wheat, one-third of the harvest or its equivalent as tax was to be collected. On low crops such as indigo or sugar, one fifth of the harvest was to be collected. Revenue demand was determined by both the cropped area and standard rate of the crop in the local market. Under the Zabt system, written demands for the tax payments and corresponding written acceptances from the village headmen were to be made. Annual tax assessment could be done in four installments. This played an important role in increasing rural-to-urban grain trade.

Expenditures:

A huge amount mainly went on maintaining a huge army, the pay of mansabdars and the expenditures of the emperor and his household. The nobles used to live an extravagant lifestyle. They spent their wealth in buying precious metals and stones, and the construction of buildings such as mausoleums. They even spent huge amounts on preparing dowries of their daughters. The families were very large, with a single person to depend on. Their expenditures can also be understood with the perspective that there was a rule according to which after their death, all their savings would go to imperial treasury.

Akbar, for example, had a revenue of 99 million silver rupees per annum. The bullion during his time expanded form 139 million to 166 million silver rupees. Until Aurangzeb’s time, there was not any budget deficit. The expenditures of Akbar’s empire can be studied for reference. Here, the emperor’s personal expenditures were relatively small. The imperial household’s expenditure was about 5%. The central military establishment spent 10%. The largest part was allotted to mansabdars.

Conclusion:

The Mughals’ economy had its problems, too. Productivity levels, as compared to the European nations at that time, were very low. There was inadequate production and faulty distribution of goods. Moreover, there was technological backwardness.

The administration was often considered evil. They had a lavish lifestyle with no productive investment. Savings were destroyed. Nobles were accustomed to indulge in pleasure. Producers were at the mercy of the merchants.

The Mughal Empire was one the richest empires ever. From having millions and billions in their treasury to the world’s most precious metals and stones, they had it all. Yet it did not do much to improve the lot of the common people.

History teaches us great lessons if we are but willing to learn them.