Pakistan's current economic dilemma stems from a lack of decisiveness in leadership and administration, leading to an unprecedented economic crisis. Instead of implementing policies that offer long-term solutions, those in charge insist on kicking the can down the road. One striking example is the recent instruction to the media, urging them to reduce coverage of protests against sky high electricity bills.

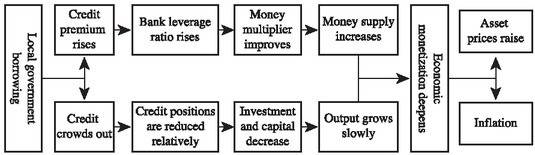

However, the roots of the current economic crisis can be traced back to a few years ago, when successive governments chose to run large fiscal deficits and finance them by printing money, which caused a significant increase in the money supply. Many experts, who initially held varying opinions on the contributing factors to the high inflation levels and devaluation of the rupee, are now converging on the money supply as the primary culprit.

Money Supply & Fiscal Problem

The Broad money supply, also known as M2, refers to the total amount of money in circulation in an economy. It includes currency in circulation (notes and coins), demand and time deposits held by individuals and businesses, and other liquid assets held by the non-bank financial sector.

Simply putting it, a surge in this money supply without a corresponding increase in the supply of goods and foreign exchange would lead to inflation and devaluation.

The phenomena of Pakistan’s money supply have been explained by Business and Economy Journalist, Khurram Husain, in a recent interview.

According to Husain, the governments have pursued an aggressive growth strategy in the past three years, particularly in 2020 and 2021, by infusing a significant amount of money into the system. This has resulted in an unchecked expansion of the money supply, which we are now facing the consequences of.

Husain further highlights that while the International Monetary Fund (IMF) predicted a similar growth in the broad money supply, it anticipated that the liquidity would come from injections of foreign reserves rather than an increase in the supply of the local currency, the rupee.

1/2 Almost 50% of Pakistan's money supply increased over just the last 5 years!

— Muneeb Sikander (@MuneebASikander) July 5, 2023

And we wonder why Pakistan has the highest rate of inflation in recent history!

And this isn't a "theory" but a fact that increase in money supply increases inflation (see 2/2)

CC: @rogueonomist pic.twitter.com/f8iYJqjIlF

By the end of 2021, the IMF did imposed restrictions on the government, prohibiting it from directly borrowing from the State Bank of Pakistan (SBP) to fund its deficit. Nevertheless, the state managed to find a workaround by borrowing from commercial banks, which, in turn, receive financing from the SBP, thereby perpetuating the cycle.

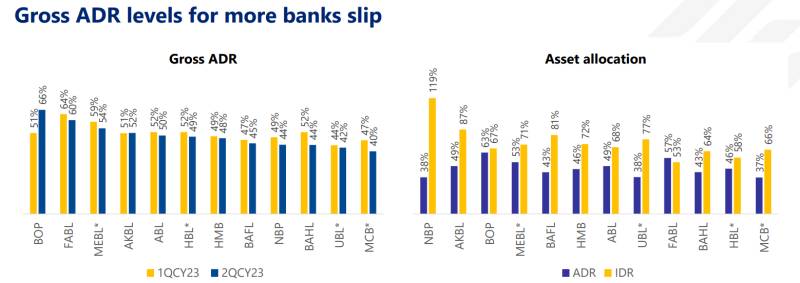

Source: JS Global

As per the JS Global report titled, Pakistan Banking Sector - 2QCY23 in pictures, “As the incentive of lower taxes for high Advance Deposit Ratio (ADR) banks was suspended for CY23, Gross ADR for more banks slipped below 50%. Asset allocation remained tilted towards Investments (Government Bonds), which also received financing from SBP OMO borrowings.”

The main issue at hand is that the government bears the primary responsibility for the current situation. Its large deficits require financing, but it faces limited options in terms of attracting foreign investments or securing financing.

According to Yousuf Farooq, Director of Research at Chase Securities, “the government finances its substantial fiscal deficit by borrowing from local banks. This deficit is of such magnitude that deposits alone are insufficient to bridge the gap, prompting the SBP to inject money through Open Market Operations, thereby expanding the money supply.”

The way out

An obvious approach to addressing the issue would involve restricting government borrowing and gradually reducing the asset allocation ratio of commercial banks. It would also require the banks to prioritize lending to private savers and non-bank financial institutions in order to help absorb the excess money supply.

However, in order to achieve these goals, it is crucial for the government to effectively manage its fiscal deficit. This would involve reducing expenditures and increasing revenues. While some reduction in expenditure may be possible, it is important to recognize that as a developing nation with a population of over 240 million people, Pakistan's spending is relatively low. On the other hand, its revenue collection is significantly inadequate.

“The government needs to address the issue by implementing taxation on untaxed sectors like agriculture and rationalizing expenses. It is essential to have a fair tax system that distributes the burden across all sectors of the economy, as it is not feasible to run a country where significant portions pay no taxes. Additionally, the dominance of the public sector has crowded out the private sector, and there is a lack of incentives for banks to lend to the private sector, which has hindered economic growth over the years,” Remarked, Yousuf Farooq.

However, given the current state of affairs, those in power seem to be focused on fulfilling the requirements of the IMF stand-by agreement and minimizing the damage that has already occurred. The road to recovery, even if pursued, remains a distant objective.