The Pakistan Stock Exchange on Friday continued its recent bullish run, climbing to an unprecedented height of over 66,000 points.

Former federal finance minister, Miftah Ismail, in a message posted on the social media site 'X' (formerly Twitter), stated that this was an indicator that the economy could show signs of improvement in the coming weeks and months.

The index opened the day at 64,718.07 points. From the opening bell, the bourse continued its positive momentum of recent weeks and surged by 1,436.95 points in the opening session to first rise past the 65,000 points psychological barrier and then the 66,000 points psychological barrier to close the opening session at 66,155.02 points.

When the bourse resumed after the extended Friday break, it initially carried the positive momentum to rise to its highest point of the day at 66,273.73 points before sliding by 524.36 points to 65,749.37 points level as investors indulged in some profit-taking before the index finished in the green at 66,223.63 points.

Compared to the previous day's close, the bourse closed Friday up 1,505.56 points, or 2.33%. The day saw some 1.327 billion shares trade hands worth some Rs33.3 billion.

For the week, the index gained 4,532.38 points over the 61,691.25 point level it closed the previous week.

Investment firm Topline Securities noted that the current bull run in stock exchange has seen it gain over 24,600 points (up over 59%) since FY24TD.

"Investor participation in the market continued to remain on a higher side as average daily traded volume and value stood at 1,026 million shares (up 64%) and Rs34 billion (up 48%), respectively."

Topline attributed the increased activity to anticipation over the disbursement of a $700 million tranche from the International Monetary Fund (IMF) after its executive board gave the nod at its meeting on January 11, 2024, under the ongoing Stand-by Arrangement (SBA).

Friday's activity at the bourse was also impacted by the government's decision to float sovereign ijara sukuk bonds with a one-year validity for the first time on the exchange to raise funds locally.

Other positives were a nine percent month-on-month increase in sales by oil marketing companies (OMCs). SSGC has also decided to list its subsidiary, SSGC LPG (Private) Limited - which manages its LPG supply division - as a publicly listed company and issue 33.3 million shares through an initial public offering (IPO).

However, Topline CEO Mohammad Sohail noted that despite the phenomenal gain of nearly 1% daily on the back of foreign investment and a 'justified and expected recovery when compared to the last few abnormal years', the main cause was that companies were still selling shares at a relatively lower level.

"Despite this growth, the KSE 30 PE stands at four times, a relatively low and attractive level," he said.

The New Normal

— Mohammed Sohail (@sohailkarachi) December 8, 2023

PSX skyrocketed 11000 points, 20% in just 4 weeks – that's a gain of 1% every day

This is a justified and expected recovery when compared to the last few abnormal years.

Despite this growth, the KSE 30 PE stands at 4 times, a relatively low and attractive…

Economic indicator

Former federal finance minister with the Pakistan Muslim League-Nawaz (PML-N) Miftah Ismail, however, noted that the bourse was an early economic indicator and its current performance was indicative of economic improvement ahead.

"The stock exchange index is considered a leading economic indicator," he said in his social media message.

"Meaning it generally goes up a few months before a pick up in economic activity (expansion) and goes down a few months before an economic downturn (recession)," he explained.

Consequently, he said that the current activity of the bourse would suggest that we have seen the bottom of our economic cycle and "hopefully the economic situation will improve."

The stock exchange index is considered a leading economic indicator, meaning it generally goes up a few months before a pick up in economic activity (expansion) and goes down a few months before an economic downturn (recession). This would then suggest that we have seen the… https://t.co/wHtFDXXCvB

— Miftah Ismail (@MiftahIsmail) December 8, 2023

His comments came as the rupee continues to appreciate in the forex market while inflation continues to creep to a crushing 42.7% year on year.

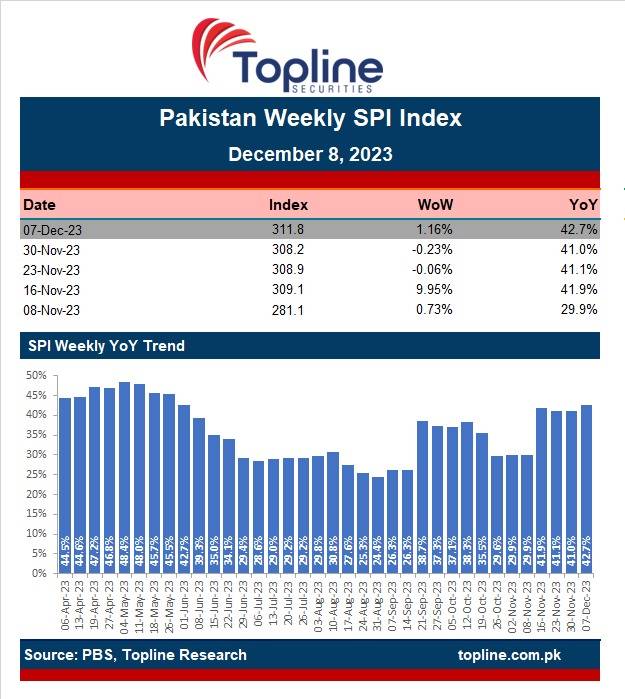

On the inflation front, the sensitive price index -- which tracks prices of essential commodities, crept up to a whopping 42.7% year on year, amongst the highest ever.

Week-on-week, it increased by 1.16% due to rising energy prices.

In the forex market, the rupee gained another Rs0.25. It improved its value by 0.09% from Rs284.12 to Rs283.87 at the end of the day.

Interbank closing #ExchangeRate for todayhttps://t.co/pnuj60fyol#SBPExchangeRate pic.twitter.com/lLPdpmSUWf

— SBP (@StateBank_Pak) December 8, 2023

This was the fifth consecutive session when the rupee made gains after opening the week at Rs284.97 and gained Rs1.1 throughout the week.

By the end of the week, the State Bank of Pakistan said the country had received a boost of $2.3 billion in worker remittances from abroad in November 2023. This, however, was down from the $2.5 billion the country had received in October but up from the $2.2 billion it received in the same period last year.

In November 2023, workers’ remittances recorded an inflow of US$2.3 billion.

— SBP (@StateBank_Pak) December 8, 2023

For details see https://t.co/rPOvn9Dr8Nhttps://t.co/7XBd4uOcHC#SBPRemittances pic.twitter.com/C9myRoSAaG