Egypt’s recent currency debacle is a grim reminder of the failure of large doses of foreign aid and IMF bailouts to provide a sustainable way forward for development and growth in the absence of a country’s willingness and ability to reform and make economic development its top priority.

Authoritarian regimes delivered economic growth, reduced poverty, and raised living standards in many Asian countries, but that kind of progress has eluded Egypt which has been ruled by military and civilian autocrats for a large part of its modern history; most recently by General Abdel Fattah el-Sisi since 2013. Egypt has gone to the IMF roughly every 4 years since 1991, despite receiving generous assistance, unlike Pakistan, from the oil-rich Arab countries.

Egypt is the IMF’s second-largest borrower after Argentina and has been the sixth-largest recipient of foreign aid from the US government in the last five years.

The Egyptian currency plunged on March 6th by nearly 40% - to close at 49.4 to the U.S. dollar - touching levels far beyond previous records - from about 30.85 pounds, a level Egypt had for months tried to defend. According to ING Think, a research service, the devaluation brought the exchange rate towards the reported parallel rate and in line with the devaluation priced in by 3-month forward contracts. Markets expect a further weakening beyond 55 over the next year.

Since early 2022, when the foreign currency crisis worsened, the Egyptian pound has lost more than two-thirds of its value against the dollar in a series of staggered devaluations.

Egypt had already devalued its currency three times in recent years. But it had previously held back from fully floating the pound, citing concerns for the impact on Egyptians, two-thirds of whom live on or below the poverty line.

Egypt secured an expanded $8 billion deal on Wednesday with the International Monetary Fund, hours after the central bank decided to float its currency and delivered a 600-basis points rate hike (taking the key deposit rate to 27.25 percent) in a push to stabilize the economy and to relieve a foreign currency shortage.

The IMF said on Wednesday that Cairo had taken “decisive steps to move towards a credible flexible exchange rate regime.” Floating the currency and allowing market forces to set the pound's value was a key condition for the heavily indebted country, with a public debt-to-GDP ratio of 90 percent, to access more IMF funds as a condition of a $3 billion bailout in December 2022. In January 2024, US Treasury Secretary Janet Yellen met with the Egyptian Finance Minister Mohamed Maait in Washington to pledge US support for the Egyptian economy and reforms.

Gulf states provided vital financial support to Egypt in recent years because they feared the economic collapse of such a large country would further destabilise the region.

According to the Financial Times, the recent move by ADQ, an Abu Dhabi investment vehicle, to inject $35 billion into Egypt, the biggest single investment in the country’s history, provided the central bank with the buffer it needed to prevent the currency from going into freefall once controls had been lifted. However, $11 billion of that money would be converted into Egyptian pounds from existing UAE dollar deposits in Egypt's central bank. Thus, net new inflows from the UAE would be $24 billion.

Abu Dhabi’s investment is representative of the recent trend among the Gulf countries to make investment decisions on commercial considerations and encourage Egypt to reform and improve economic performance.

Gulf states provided vital financial support to Egypt in recent years because they feared the economic collapse of such a large country would further destabilise the region. When Russia invaded Ukraine in 2022 the UAE, Saudi Arabia, Kuwait and Qatar deposited $13 billion in Egypt’s central bank after an exodus of foreign bond investors in a flight to safety. However, they have also become less willing to provide no-strings-attached handouts, instead seeking commercial investments and expecting reforms by governments they support.

On November 11, 2016, the Executive Board of the International Monetary Fund (IMF) approved a three-year extended arrangement under the Extended Fund Facility (EFF) for Egypt for about US$12 billion (or 422 percent of quota) and declared that the Egyptian authorities had developed a program of policies and structural reforms to boost growth and create jobs while protecting vulnerable groups.

Egypt devalued its currency by 51 percent in November 2016. The Egyptian pound, which traded at 8.77 to a US dollar at the end of October 2016, closed at 17.75 at the end of November.

Following the devaluation in 2016, the inflation spiked to 29% in 2017 from 14% in 2016 but gradually declined to 5% in 2020 until Egypt was hit by COVID-19 and the Ukraine war.

The crisis built up throughout 2022 and escalated at the start of 2023. The exchange rate began falling in January 2023, reaching a low of 32 Egyptian pounds to the US dollar on 11 January before stabilizing at around 30. (Up until March 2022, the pound was trading at around fifteen to the dollar).

Since President Sisi took power in 2013, the government has pursued an economic model focused on government-run infrastructure projects funded by debt financing. Under Sisi, the country’s external debt to GDP ratio has more than doubled from 16 percent in 2013 to 36 percent.

The devaluation caused a spike in inflation, which reached 38 per cent in September 2023 year on year, up from 15 per cent in September 2022. It is currently around 30 percent. Food inflation is currently around 67 percent but down from its peak of 107.7 percent in September 2023.

Remittances from Egyptians working abroad, the country's top single source of foreign currency, have slowed sharply amid expectations that the pound would fall.

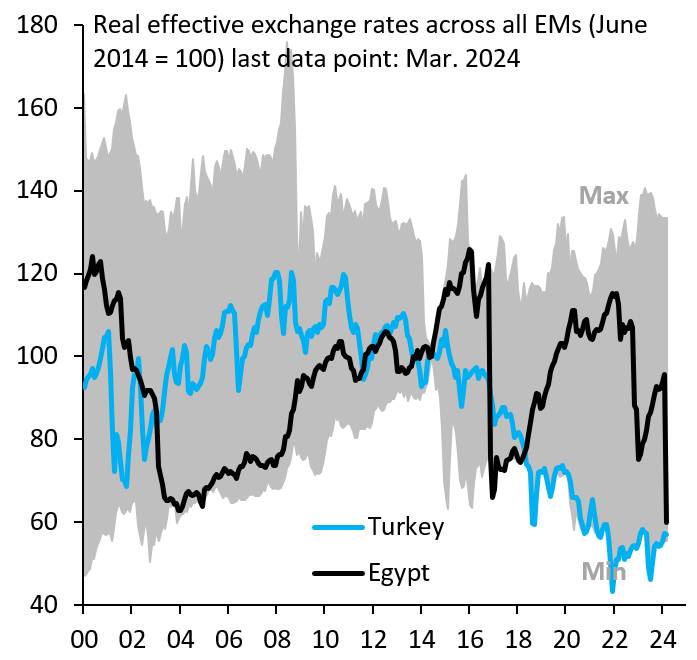

Robin Brooks of the Brookings Institution, and former chief economist of the Institute of International Finance, advises that the single most important thing for Egypt - after yesterday's devaluation - is to leave behind the boom-bust pattern in its exchange rate management (black). He believes that the best example to follow is Turkey (blue in the chart), which has allowed the Lira to float freely. That helped Turkey boost its exports.

However, it would be a gross simplification to pin Egypt’s crisis on just foreign currency mismanagement and alignment of the real effective exchange rate with the market. Turkey has a much larger and diversified industrial base and the sector accounts for over 31 percent of its GDP compared to just 16 percent in Egypt’s case.

Tourism and the Suez Canal are two of Egypt’s major sources of foreign exchange.

The crisis has a history that stretches back years. Since President Sisi took power in 2013, the government has pursued an economic model focused on government-run infrastructure projects funded by debt financing. Under Sisi, the country’s external debt to GDP ratio has more than doubled from 16 percent in 2013 to 36 percent.

According to Giorgio Cafiero of Gulf State Analytics, a Washington, DC-based geopolitical risk consultancy, Egypt’s troubled economy appears poised to take a hit from Israel’s war on Gaza and the spiralling tensions in the Red Sea. The country’s challenges are being compounded by the war, as it edges closer and closer to Egypt’s border, with a large chunk of Gaza’s population pushed into Rafah, after four months of displacement as a result of Israel’s relentless attacks.

Tourism and the Suez Canal are two of Egypt’s major sources of foreign exchange. According to S&P Global Ratings, Egypt’s tourism revenues are set to experience a 10-30 percent fall from last year, which could cost the country 4-11 percent of its foreign exchange reserves and shrink GDP.

According to a report by the Crisis Group, President Sisi’s government has pursued an economic model focused on government-run infrastructure projects funded by debt financing, and led by military-owned companies. These firms came to dominate many sectors, while crony capitalists associated with President Husni Mubarak – who ruled for 30 years before being ousted amid Egypt’s 2011 popular uprising – lost clout and private businesses were crowded out. This arrangement reflected Sisi’s statist worldview, secured for him the army’s political loyalty and supported a modest economic expansion. It failed, however, to reduce unemployment, while exacerbating poverty and external imbalances.

In summary, Egypt’s near to medium-term outlook appears to be bleak. The economic situation may stabilize in the short term due to foreign aid, but given the unwillingness of the country’s ruling elites to open up the economy through deregulation and liberalization, the bailouts are unlikely to provide a sustainable way forward.