Debt-laden Pakistani fashion powerhouse Élan is selling half of its equity to multi-brand group SEFAM.

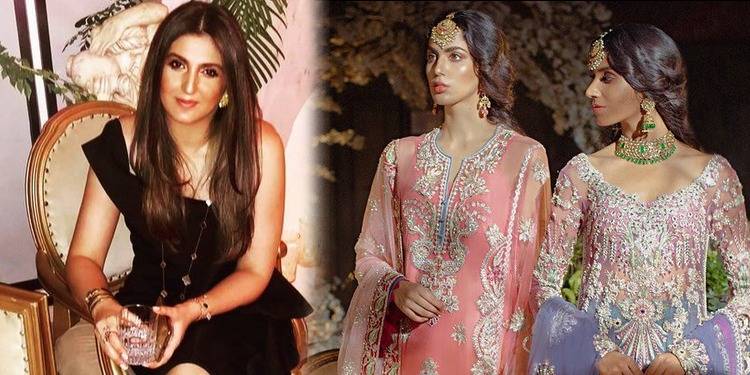

The deal is valued at Rs800 million, according to business magazine Profit. Élan, founded in 2004 by Khadija Shah, is said to be in Rs700 million debt. The company is said to be mired in a cash-flow crisis attributed to an unsustainable culture alongside an "over-ambitious growth strategy", according to the magazine.

Shah will be paid Rs100 million in cash in the deal which envisages her handing over full-management control and 50 percent equity to SEFAM. The magazine claimed Élan has a reputation for below-par corporate governance.

A non-committal Shah told the magazine on being reached that Élan was open to looking into external financing to facilitate rapid growth. "Nobody will invest in Élan at a depressed price. They will invest in it, or in any brand for that matter, at exactly what its deserved valuation would be. Having said that, I want to clearly state that Élan is now at a stage in its growth trajectory where we are now open to considering external injection of finances to help us grow rapidly."

She said she could neither confirm nor deny the reported development. "We can’t confirm or deny any news or any figures relating to Sefam partnering with us. If and when we do partner with someone, we will announce it officially ourselves.”

The deal is valued at Rs800 million, according to business magazine Profit. Élan, founded in 2004 by Khadija Shah, is said to be in Rs700 million debt. The company is said to be mired in a cash-flow crisis attributed to an unsustainable culture alongside an "over-ambitious growth strategy", according to the magazine.

Shah will be paid Rs100 million in cash in the deal which envisages her handing over full-management control and 50 percent equity to SEFAM. The magazine claimed Élan has a reputation for below-par corporate governance.

A non-committal Shah told the magazine on being reached that Élan was open to looking into external financing to facilitate rapid growth. "Nobody will invest in Élan at a depressed price. They will invest in it, or in any brand for that matter, at exactly what its deserved valuation would be. Having said that, I want to clearly state that Élan is now at a stage in its growth trajectory where we are now open to considering external injection of finances to help us grow rapidly."

She said she could neither confirm nor deny the reported development. "We can’t confirm or deny any news or any figures relating to Sefam partnering with us. If and when we do partner with someone, we will announce it officially ourselves.”