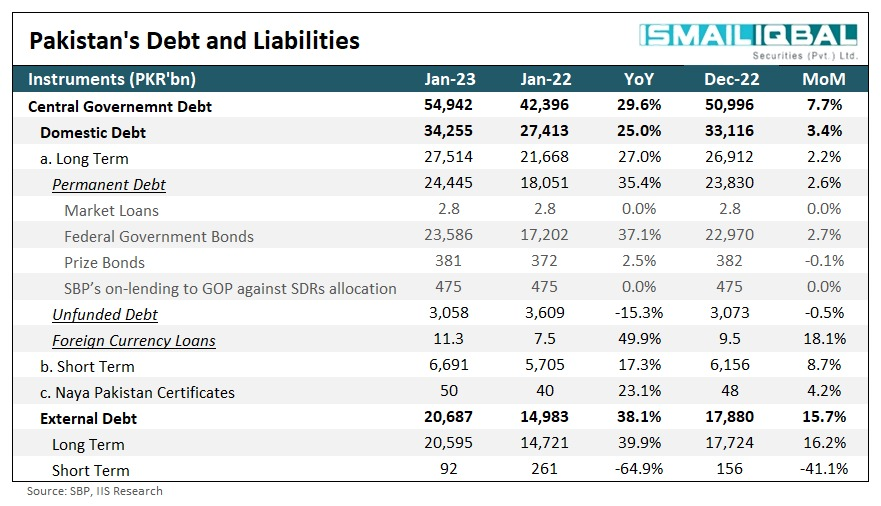

According to recent data published by the State Bank of Pakistan, the central government's debt rose to approximately Rs. 55 trillion by January 2023, showing a 30% increase from the previous year.

Further, external debt liabilities alone increased by 38% year on year, to close at around 20.7 trillion rupees. In comparison, domestic debt liabilities, primarily consisting of Pakistan Investment Bonds (PIBs) and Market Treasury Bills, grew by 25%.

Due to the massive rupee devaluation over the past few months, the government’s external debt has soared. While successive interest rate hikes will cause a surge in interest servicing costs on domestic debt in the coming months.

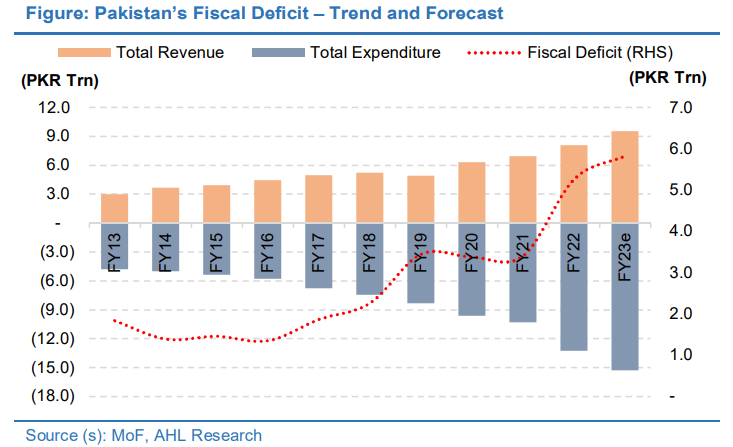

The majority of the debt servicing flows through to domestic lenders and due to successive rate hikes, there would be an incremental burden on the federation and the fiscal deficit is set to expand. Debt servicing costs in the current fiscal year stand at Rs 5.4 trillion, which is around 52% of the total budget. Coupled with the defense expenditure, it constitutes around 70% of the country’s budget.

Source: ARHL

Further, external debt payments of around 7 billion are due by the end of June 2023. Yet, it is expected that loan rollovers can provide some temporary relief on that front.

“The nation needs to repay about $3 billion dues in the upcoming payments, while $4 billion is expected to be rolled-over, the nation’s central bank Governor Jameel Ahmad said in an analyst briefing, adding that the nation is committed to make all debt payments,” Bloomberg reported.

Additionally, for domestic financing needs, the government would need to revise its strategy. “The Ministry of Finance wanted to borrow at least one-tenth of its financing needs through direct negotiations with commercial banks. It had planned to initially raise Rs 400 billion from conventional and Islamic banks, a move that the IMF principally opposed due to its adverse implications for the debt market,” Shahbaz Rana stated in his article for the Express Tribune.

The government is hopeful about the resumption of the IMF program amidst various developments. Although the Prime Minister and the Finance Minister have expressed that Pakistan is close to finalizing a deal with the IMF, the process is taking a lot longer than anticipated.

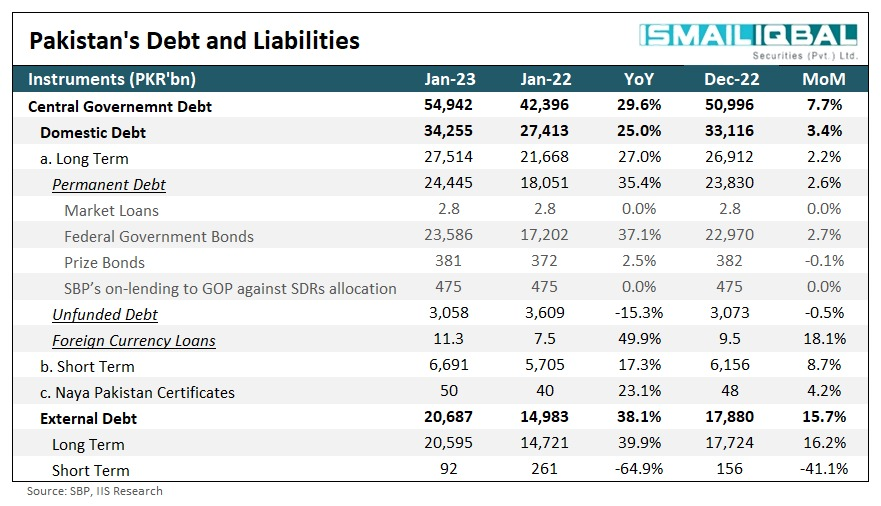

Further, external debt liabilities alone increased by 38% year on year, to close at around 20.7 trillion rupees. In comparison, domestic debt liabilities, primarily consisting of Pakistan Investment Bonds (PIBs) and Market Treasury Bills, grew by 25%.

Due to the massive rupee devaluation over the past few months, the government’s external debt has soared. While successive interest rate hikes will cause a surge in interest servicing costs on domestic debt in the coming months.

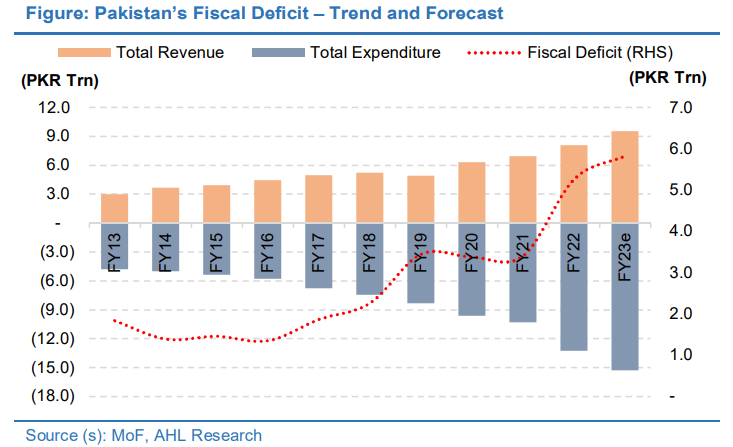

The majority of the debt servicing flows through to domestic lenders and due to successive rate hikes, there would be an incremental burden on the federation and the fiscal deficit is set to expand. Debt servicing costs in the current fiscal year stand at Rs 5.4 trillion, which is around 52% of the total budget. Coupled with the defense expenditure, it constitutes around 70% of the country’s budget.

Source: ARHL

Further, external debt payments of around 7 billion are due by the end of June 2023. Yet, it is expected that loan rollovers can provide some temporary relief on that front.

“The nation needs to repay about $3 billion dues in the upcoming payments, while $4 billion is expected to be rolled-over, the nation’s central bank Governor Jameel Ahmad said in an analyst briefing, adding that the nation is committed to make all debt payments,” Bloomberg reported.

Additionally, for domestic financing needs, the government would need to revise its strategy. “The Ministry of Finance wanted to borrow at least one-tenth of its financing needs through direct negotiations with commercial banks. It had planned to initially raise Rs 400 billion from conventional and Islamic banks, a move that the IMF principally opposed due to its adverse implications for the debt market,” Shahbaz Rana stated in his article for the Express Tribune.

The government is hopeful about the resumption of the IMF program amidst various developments. Although the Prime Minister and the Finance Minister have expressed that Pakistan is close to finalizing a deal with the IMF, the process is taking a lot longer than anticipated.