Sri Lanka experienced massive economic turmoil after defaulting on its sovereign debt last year, causing concern in other debt-distressed countries like Pakistan. However, the island nation has made an impressive recovery since then, starting with the disbursement of a $2.9 billion International Monetary Fund (IMF) loan in March, coupled with the implementation of necessary reforms.

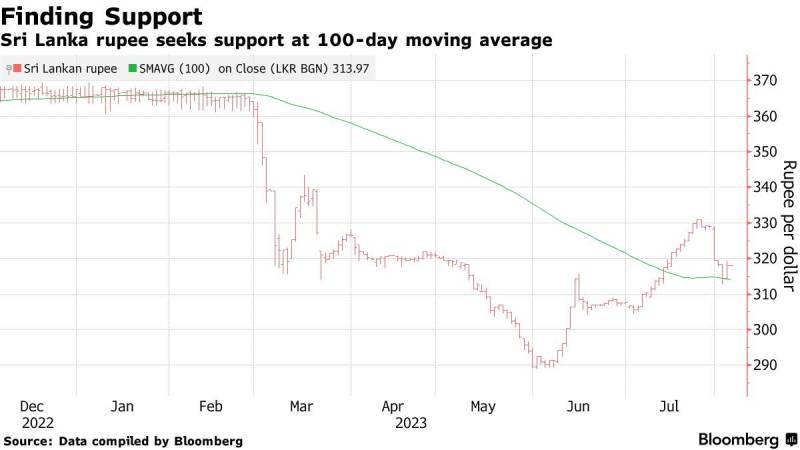

The proposed IMF reforms for Sri Lanka included introducing property tax and gift/inheritance tax by 2025, limiting growth in the public sector wage bill and pension spending, avoiding debt accumulation by State-Owned Entities, restructuring domestic commercial banks' FX loans, and refraining from exchange rate and import restrictions. Since the IMF deal, the country's trade deficit has contracted. There has been a gradual increase in remittances and tourist arrivals, and the exchange rate has stabilized and improved.

Yousuf Farooq, head of research at Chase Securities, commented, “Sri Lanka's post-default rebound has been notable, with the government swiftly implementing necessary reforms and focusing on reviving the tourism sector, which faced temporary challenges due to COVID-19. In an effort to address financial challenges and stimulate growth, Sri Lanka has also implemented taxation measures, including even taxing exporters.”

In terms of currency performance, the Sri Lankan Rupee has been the best-performing Asian currency in the first half of the current year (losing some ground post June). Additionally, inflation, which peaked at 70% last year, has now fallen to around 4% as of August 2023, although partially due to the high base effect after the government changed the base year for inflation calculation from 2013 to 2021.

Pakistan has also received a comparable amount of funds from the IMF, through a $3 billion stand-by arrangement approved in June. However, the stabilization of the Pakistani economy is still pending. The Pakistani rupee, despite making initial gains after the IMF disbursement, has now surpassed the 300 mark against the dollar for the first time in its history. The country continues to face high levels of inflation, with steep increases in fuel and electricity prices, making it challenging for the population to afford basic utilities.

Experts highlight the indecisiveness among decision-makers as the primary reason for the failure to implement necessary measures to stabilize the economy and facilitate recovery. On the other hand, some voices are less optimistic, emphasizing that the country is currently focused on damage control. There seems to be a lack of a clearly envisioned path to stability, as the current stand-by arrangement (SBA) primarily includes measures for damage control and imposes strict revenue and expenditure targets. The IMF has made it clear that if Pakistan fails to fulfill the requirements of the SBA, it may need to consider debt restructuring as an option.

Sri Lanka is currently engaged in negotiations for debt restructuring, while in Pakistan, it appears that those in charge are inclined to avoid taking that route. However, one unavoidable challenge that the country shares with its South Asian counterpart is the high cost of debt.

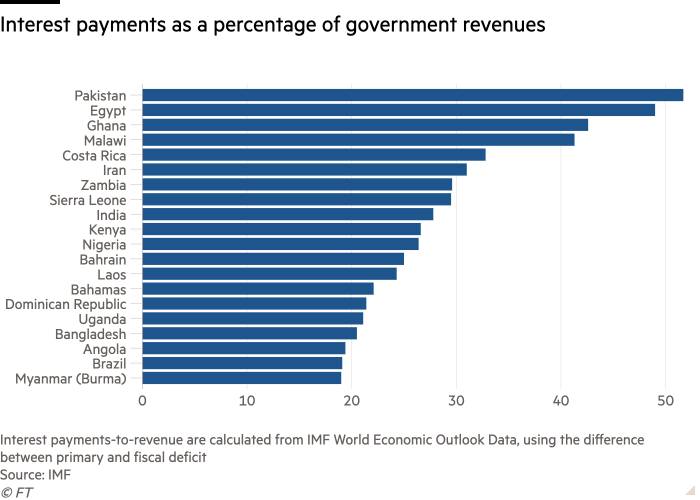

“The IMF’s revenue projections imply that Sri Lanka will spend about a third of its revenue on interest payments alone in years to come,” read an article in the Financial Times.

“According to the IMF, only four countries for which data is available in 2023 will spend more than a third of their revenue on interest payments: Pakistan, Egypt, Ghana, and Malawi. Ghana and Malawi are already undergoing debt restructurings. Egypt and Pakistan are in IMF programs and arguably should bite the bullet and restructure their debts too,” it added.

Graph Source: Financial Times

Dr. Reza Baqir, Former Governor of the State Bank of Pakistan, in a webinar, stated that a 10% reduction in the net present value of a low income debt distressed country can lead to 1-2% additional GDP growth in the years to follow. However, as per Dr. Baqir, these benefits tend to flatten out in 4-5 years post restructuring, thus, indicating that structural reforms are the only long-term solution.

However, Sri Lanka encounters significant challenges in its debt restructuring efforts. The targets set by the IMF may not fully confront the country's underlying problems, and the issue is further compounded by low tax collection and high interest payments. Moreover, navigating the complexities of dealing with multiple external creditor groups adds to the difficulties. Despite these obstacles, Sri Lanka remains hopeful and committed to successfully achieving debt restructuring.

Meanwhile, Pakistan has other plans, such as seeking investment from its allies in the Middle East. This approach, if successful, could potentially offer temporary relief from liquidity pressures and help tame the inflation.