Think of our country as a large corporation in deep trouble. It is essentially in the business of providing livelihoods, delivering social services and governance for its customers, the people of Pakistan. But right now, its business model has broken down. Analysts say that it has made large and imprudent capital investments but does not have a matching revenue stream to show for it. And it is not generating enough cash flow to pay down the loans and interest to fund these investments. At the same time, it chose to expand its discretionary spending at precisely the point at which it needed to be prudent and make savings. Losses are mounting as the bottom line is squeezed between a rigid top line and ever expanding business and financial costs. The result: a fast depleting balance sheet. Consequence: the previous board and management has been voted out at the last AGM and the newly-elected board has promised a complete turnaround and, beyond that, a vision of creating 10 million jobs and building five million homes in five years.

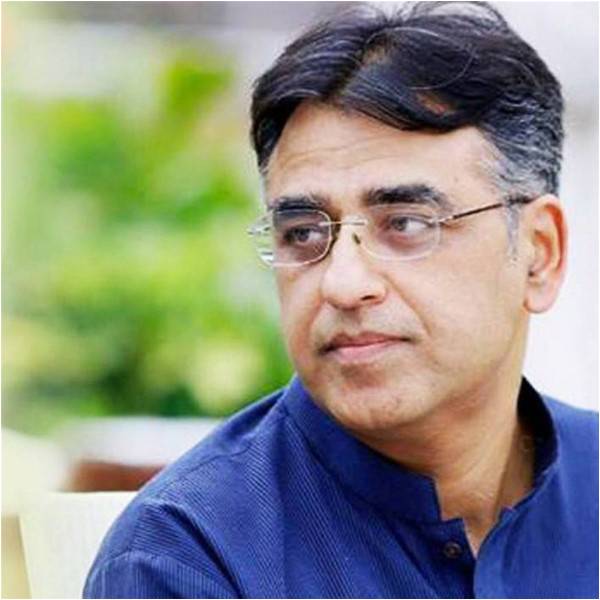

Why am I using this analogy? Principally because analogies are a great way of understanding and explaining complex issues. A second, more honest reason is that Asad Umar the incoming ‘CEO’ is very likely to identify with the situation because he has been here before. He very well knows that if the company can be refinanced and the business model fixed, one can come back from the brink. This is comforting except that this time around, he is not riding a thoroughbred like Engro Corporation but learning to drive a rickety coach and four horses. The wheels are about to come off, the horses are unruly and pulling in different directions and the road dark, bumpy and without directions.

The Pakistan Tehreek-e-Insaf’s (PTI) 100 day agenda identifies most critical issues correctly but reads very much like wonted motherhood statements that are put up at the start of any strategy discussion. Whilst big and audacious thinking is emotionally compelling and useful for the ‘Vision Thing’, it has also dialled up expectations of urgent and palpable change. Time is the enemy here. Passion and promise, rather than performance ruled the election hustings, but it is performance that will come into the reckoning when the rubber hits the road in coming weeks and months. Nevertheless, optimism is the essence of leadership and it is only natural that a new beginning inspires hope and goodwill. In this, we are as one with the new government and cynics need to hold their horses. In any case, it is also the season for unsolicited advice. So why hold back?

Let us examine the realistic options in front of a beleaguered future finance minister, weighed down as he is, by the burden of expectations. To begin, the incumbent will not have the luxury of choice since much of the agenda will be enforced by circumstances. The previous government can be fairly accused of playing politics with the economy as many of its remedies were a case of too-much or too-little and almost always, too late. Continuing with our analogy, the CEO will begin with very voluble (and often times justified) criticism of the previous incumbent. This tactic buys thinking time and space to put plans into action. The next step is to create a sense of crisis to deflect criticism and lighten the burden of expectation of your shareholders. This pushes out the day of reckoning. A burning deck theme works well as it enables the CEO to present problems with candour and galvanise his management as well as the company’s owners to accept unpopular measures that will inevitably be required to bring about austerity. It also impresses potential financiers and your existing debt holders that problems are being tackled pragmatically and on a war footing. The banks play hardball and insist on a fire sale of assets and haircuts for bond holders. And still more austerity and delivery of specific, tough to achieve milestones. Doubts begin to emerge as management worries about cutting costs too close to the bone, disabling any growth potential. Meanwhile, audits are instituted in efforts to plug leakages and fraud and renegotiate onerous contracts. Precious resources have to be spent to fund non-productive expenditures like consultancies and legal fees whilst existing projects flounder as they are starved of money. New faces are inducted, rumours abound, uncertainty becomes rife, and somehow through all this, the shareholders have to be placated.

Pretty dispiriting stuff! Of course, sovereign states have more options since they can print their own money but I would wager that going down that path will be painful in the extreme and take many times more than 100 days to get a grip on the economy. Worse, we will not even have begun to repair the ‘business model’ before disenchantment sets in. The electorate has bought into the mantra of a pro-poor welfare state and wants action as it has little understanding of sophisticated explanations of doom and failure. So, unless the PTI is feeling suicidal, there will have to be an alternative out-of-the-box solution and soon.

Is an IMF programme inevitably the only short run solution? I am admittedly not qualified to say but one way or the other, the current BOP crisis will need to be resolved. The munificence of our friends will presumably need to be tested yet again, despite pledges to break the begging bowl. How well that goes will be the new prime minister’s first test. The rupee will need to find its stable value as new capital controls and austerity measures are instituted and unnecessary imports further restricted. Difficult decisions are best taken while new governments have political capital at home and abroad. These should help to stave off the emergent crisis especially as we are likely to see an improving trend in exports and inward remittances as the impact of devaluation takes effect after a time lag. Thereafter, the economic team would do well to devise and negotiate an entrepreneur’s approach towards sustaining growth and remain wary of accepting the unimaginative and bureaucratic multilateral institutional dictates which have a short-term focus and do not address the root cause. Generally, that should translate into growth policies that are more inclusive and less capital intensive.

The Asian Development Bank has estimated that going forward, Pakistan’s working age population will increase by 27.5 million in 10 years. This aligns with a requirement to grow at 7 percent per annum and create at least 2 million jobs every year but is a complete mismatch with the scarcity of growth capital. The government just does not have the resources to meet this challenge. Hence, it must provide the facilitation and an enabling environment across the entire country for individuals and entities to pool their energies and put their shoulders to the wheel. The foremost requirement is money, and yes, before we put on our holier than thou attitude, I mean all sorts of money, regardless of its hue and colour; so far as it can be put to work and brought into the mainstream economy. After all, the currently pristine looking economies of the West were built amongst other things, on slave trading and labour, the loot and plunder of colonists, wars and famines, unfair trading, speculation, bootlegging and even drugs. Is the alternative of high inflation, which robs the poor the most, not morally more reprehensible?

Officially, the country’s savings and investment rates are respectively a pathetic 12 percent and 16 percent. But look around and it seems lots of people have pots of money but this is either going into consumption or into unproductive property assets. Or else into acquiring assets abroad where the same people happily pay taxes in foreign jurisdictions! Why then is there this propensity to hide wealth and make no contribution to the betterment of the country? How can this abundance in the so-called black economy be tapped and brought into the regulated sector? The short answer is that when corruption combines with inefficiency as it does in our FBR, it creates a reinforcing negative dynamic. People do not pay taxes because they distrust the government and fear harassment more than parting with their due tax liability. It is also a needlessly complicated business in the context of our economy. An inefficient FBR failing at its target of broadening the tax base turns to coercion and regressive indirect taxation and withholding of refunds providing further disincentive for people to come clean. And so on. Of course, Asad Umar understands this perfectly but the trick, in my view, is to liberate abundance whether of talent, energy or money and put it to use by simplifying, easing, reducing, incentivising, deregulating the financial and tax administration of the country. For starters, simply allow people to become filers without having to provide a 10-year history and onerous documentation. We can worry about collecting taxes in later years.

The author is a former CEO of Dawood Hercules Corporation Ltd, and can reached at shahid@prachas.net

Why am I using this analogy? Principally because analogies are a great way of understanding and explaining complex issues. A second, more honest reason is that Asad Umar the incoming ‘CEO’ is very likely to identify with the situation because he has been here before. He very well knows that if the company can be refinanced and the business model fixed, one can come back from the brink. This is comforting except that this time around, he is not riding a thoroughbred like Engro Corporation but learning to drive a rickety coach and four horses. The wheels are about to come off, the horses are unruly and pulling in different directions and the road dark, bumpy and without directions.

The Pakistan Tehreek-e-Insaf’s (PTI) 100 day agenda identifies most critical issues correctly but reads very much like wonted motherhood statements that are put up at the start of any strategy discussion. Whilst big and audacious thinking is emotionally compelling and useful for the ‘Vision Thing’, it has also dialled up expectations of urgent and palpable change. Time is the enemy here. Passion and promise, rather than performance ruled the election hustings, but it is performance that will come into the reckoning when the rubber hits the road in coming weeks and months. Nevertheless, optimism is the essence of leadership and it is only natural that a new beginning inspires hope and goodwill. In this, we are as one with the new government and cynics need to hold their horses. In any case, it is also the season for unsolicited advice. So why hold back?

Let us examine the realistic options in front of a beleaguered future finance minister, weighed down as he is, by the burden of expectations. To begin, the incumbent will not have the luxury of choice since much of the agenda will be enforced by circumstances. The previous government can be fairly accused of playing politics with the economy as many of its remedies were a case of too-much or too-little and almost always, too late. Continuing with our analogy, the CEO will begin with very voluble (and often times justified) criticism of the previous incumbent. This tactic buys thinking time and space to put plans into action. The next step is to create a sense of crisis to deflect criticism and lighten the burden of expectation of your shareholders. This pushes out the day of reckoning. A burning deck theme works well as it enables the CEO to present problems with candour and galvanise his management as well as the company’s owners to accept unpopular measures that will inevitably be required to bring about austerity. It also impresses potential financiers and your existing debt holders that problems are being tackled pragmatically and on a war footing. The banks play hardball and insist on a fire sale of assets and haircuts for bond holders. And still more austerity and delivery of specific, tough to achieve milestones. Doubts begin to emerge as management worries about cutting costs too close to the bone, disabling any growth potential. Meanwhile, audits are instituted in efforts to plug leakages and fraud and renegotiate onerous contracts. Precious resources have to be spent to fund non-productive expenditures like consultancies and legal fees whilst existing projects flounder as they are starved of money. New faces are inducted, rumours abound, uncertainty becomes rife, and somehow through all this, the shareholders have to be placated.

The Asian Development Bank has estimated that going forward, Pakistan's working age population will increase by 27.5 million in 10 years. This aligns with a requirement to grow at 7 percent per annum and create at least 2 million jobs every year

Pretty dispiriting stuff! Of course, sovereign states have more options since they can print their own money but I would wager that going down that path will be painful in the extreme and take many times more than 100 days to get a grip on the economy. Worse, we will not even have begun to repair the ‘business model’ before disenchantment sets in. The electorate has bought into the mantra of a pro-poor welfare state and wants action as it has little understanding of sophisticated explanations of doom and failure. So, unless the PTI is feeling suicidal, there will have to be an alternative out-of-the-box solution and soon.

Is an IMF programme inevitably the only short run solution? I am admittedly not qualified to say but one way or the other, the current BOP crisis will need to be resolved. The munificence of our friends will presumably need to be tested yet again, despite pledges to break the begging bowl. How well that goes will be the new prime minister’s first test. The rupee will need to find its stable value as new capital controls and austerity measures are instituted and unnecessary imports further restricted. Difficult decisions are best taken while new governments have political capital at home and abroad. These should help to stave off the emergent crisis especially as we are likely to see an improving trend in exports and inward remittances as the impact of devaluation takes effect after a time lag. Thereafter, the economic team would do well to devise and negotiate an entrepreneur’s approach towards sustaining growth and remain wary of accepting the unimaginative and bureaucratic multilateral institutional dictates which have a short-term focus and do not address the root cause. Generally, that should translate into growth policies that are more inclusive and less capital intensive.

The Asian Development Bank has estimated that going forward, Pakistan’s working age population will increase by 27.5 million in 10 years. This aligns with a requirement to grow at 7 percent per annum and create at least 2 million jobs every year but is a complete mismatch with the scarcity of growth capital. The government just does not have the resources to meet this challenge. Hence, it must provide the facilitation and an enabling environment across the entire country for individuals and entities to pool their energies and put their shoulders to the wheel. The foremost requirement is money, and yes, before we put on our holier than thou attitude, I mean all sorts of money, regardless of its hue and colour; so far as it can be put to work and brought into the mainstream economy. After all, the currently pristine looking economies of the West were built amongst other things, on slave trading and labour, the loot and plunder of colonists, wars and famines, unfair trading, speculation, bootlegging and even drugs. Is the alternative of high inflation, which robs the poor the most, not morally more reprehensible?

Officially, the country’s savings and investment rates are respectively a pathetic 12 percent and 16 percent. But look around and it seems lots of people have pots of money but this is either going into consumption or into unproductive property assets. Or else into acquiring assets abroad where the same people happily pay taxes in foreign jurisdictions! Why then is there this propensity to hide wealth and make no contribution to the betterment of the country? How can this abundance in the so-called black economy be tapped and brought into the regulated sector? The short answer is that when corruption combines with inefficiency as it does in our FBR, it creates a reinforcing negative dynamic. People do not pay taxes because they distrust the government and fear harassment more than parting with their due tax liability. It is also a needlessly complicated business in the context of our economy. An inefficient FBR failing at its target of broadening the tax base turns to coercion and regressive indirect taxation and withholding of refunds providing further disincentive for people to come clean. And so on. Of course, Asad Umar understands this perfectly but the trick, in my view, is to liberate abundance whether of talent, energy or money and put it to use by simplifying, easing, reducing, incentivising, deregulating the financial and tax administration of the country. For starters, simply allow people to become filers without having to provide a 10-year history and onerous documentation. We can worry about collecting taxes in later years.

The author is a former CEO of Dawood Hercules Corporation Ltd, and can reached at shahid@prachas.net