The State Bank of Pakistan (SBP) has resorted to extreme measures to limit US dollars leaving the country. This month, Pakistan foreign exchange reserves fell to USD 6.7 billion, its lowest level since January 2019. It is enough to cover about one month of imports. Therefore, the government doubled down on its policy of restricting dollar outflow.

The policy is a hindrance to not only importers, but also to students studying abroad - like myself. Prior to the pandemic, transferring money to the US or paying for my university expenses used to be a much easier task.

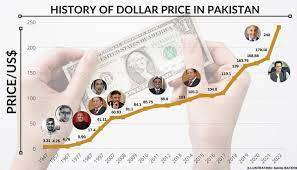

Since I went abroad to study in 2017, PKR has lost over 50% of its worth. Therefore, I need double the amount in Pakistani rupees to pay for the same things.

Most banks in Pakistan have imposed a restriction on direct deposit abroad, stating the state bank’s new instructions. They require additional documentation to prove my student status. Despite all that, banks refuse account holders to pay and execute the transaction themselves.

To control dollar outflow, they disallow third party vendors that many students use to pay in installments instead of the entire semester. Such obstacles lay in the way of overseas Pakistanis seeking outward remittance.

Ironically, no such restrictions apply to credit card payments. Apart from a standard transaction fee, no documentation is required for payment under your credit limit. The catch word here is - credit limit.

Most top banks, such as HBL and Bank Alfalah, have their platinum card capped at two million rupees or USD 9,000. The average per year cost of college in the US is over USD 35,500. Most payments are due per semester, requiring a one-time payment of around $18,000. This number is double of most credit card caps.

Last month, the state bank issued another notice limiting cross-border transactions. They further restricted the debit/credit card annual limit to USD 30,000. This attempt was to ensure the government has enough dollar supplies to complete next month's payment cycle for mineral fuels.

Earlier this month, the state bank reduced the limit for outward remittance to USD 50,000, stating, “such speculative transactions lead to excessive demand in the open market”.

As additional curtailments are imposed on the banking channel, money transfer operators such as Western Union and Moneygram lie as alternative options. If USD 1 = 225 PKR today, these operators would provide a rate of around 240 PKR. Henceforth, this mode of transfer is expensive.

To this day, PayPal doesn’t operate in Pakistan.

With all options considered, the banking channel remains the most reliable, cheaper and unrestricted mode.

The continued struggle of balance of payments is the biggest economic challenge the country faces. Since 1973, we have been producing a current account deficit. SBP data for the fiscal year 2021-22 revealed a current account deficit of USD 17.41 billion. The staggering number highlights the dire economic situation, henceforth the measures to restrict dollar outflow. However, it isn’t a solution the government should resort to.

As students, like myself, leave the country to study abroad, we send back remittances upon finding employment. In 2020, foreign remittance was 8.69% of the total GDP. Pakistan meets a large portion of its dollar needs via remittances. Restrictions on student payments abroad will have a ripple effect on dollar inflow in the long-run.

Ideally, the government should subsidize its productive industries, such as IT, textile. The seeds for an export-driven economy will yield dividends in the long-term.

In the meanwhile, the government should develop a mechanism for safe, easy and costless transactions for educational expenses abroad. The state bank should initiate a committee to prepare such a channel. The restrictions on educational expenses should be eased and the limit for transactions be increased to USD 100,000 per year.

According to an estimate, every year over 10,000 Pakistani students go abroad for higher education. The government should take notice of this undiscussed challenge and assist the future of the country.

The policy is a hindrance to not only importers, but also to students studying abroad - like myself. Prior to the pandemic, transferring money to the US or paying for my university expenses used to be a much easier task.

Since I went abroad to study in 2017, PKR has lost over 50% of its worth. Therefore, I need double the amount in Pakistani rupees to pay for the same things.

Most banks in Pakistan have imposed a restriction on direct deposit abroad, stating the state bank’s new instructions. They require additional documentation to prove my student status. Despite all that, banks refuse account holders to pay and execute the transaction themselves.

To control dollar outflow, they disallow third party vendors that many students use to pay in installments instead of the entire semester. Such obstacles lay in the way of overseas Pakistanis seeking outward remittance.

Ironically, no such restrictions apply to credit card payments. Apart from a standard transaction fee, no documentation is required for payment under your credit limit. The catch word here is - credit limit.

Most top banks, such as HBL and Bank Alfalah, have their platinum card capped at two million rupees or USD 9,000. The average per year cost of college in the US is over USD 35,500. Most payments are due per semester, requiring a one-time payment of around $18,000. This number is double of most credit card caps.

Last month, the state bank issued another notice limiting cross-border transactions. They further restricted the debit/credit card annual limit to USD 30,000. This attempt was to ensure the government has enough dollar supplies to complete next month's payment cycle for mineral fuels.

Earlier this month, the state bank reduced the limit for outward remittance to USD 50,000, stating, “such speculative transactions lead to excessive demand in the open market”.

As additional curtailments are imposed on the banking channel, money transfer operators such as Western Union and Moneygram lie as alternative options. If USD 1 = 225 PKR today, these operators would provide a rate of around 240 PKR. Henceforth, this mode of transfer is expensive.

To this day, PayPal doesn’t operate in Pakistan.

With all options considered, the banking channel remains the most reliable, cheaper and unrestricted mode.

The continued struggle of balance of payments is the biggest economic challenge the country faces. Since 1973, we have been producing a current account deficit. SBP data for the fiscal year 2021-22 revealed a current account deficit of USD 17.41 billion. The staggering number highlights the dire economic situation, henceforth the measures to restrict dollar outflow. However, it isn’t a solution the government should resort to.

As students, like myself, leave the country to study abroad, we send back remittances upon finding employment. In 2020, foreign remittance was 8.69% of the total GDP. Pakistan meets a large portion of its dollar needs via remittances. Restrictions on student payments abroad will have a ripple effect on dollar inflow in the long-run.

Ideally, the government should subsidize its productive industries, such as IT, textile. The seeds for an export-driven economy will yield dividends in the long-term.

In the meanwhile, the government should develop a mechanism for safe, easy and costless transactions for educational expenses abroad. The state bank should initiate a committee to prepare such a channel. The restrictions on educational expenses should be eased and the limit for transactions be increased to USD 100,000 per year.

According to an estimate, every year over 10,000 Pakistani students go abroad for higher education. The government should take notice of this undiscussed challenge and assist the future of the country.