The rumor mill was finally put to rest in November 2022, when Bloomberg broke the news that Telenor was searching for a buyer to sell its Pakistani operations with a price tag of USD 1 billion. The move comes after a series of underwhelming financial results in Pakistan for the global telecom giant. Telenor, was for some time, deliberating on strategic realignment of its Pakistani operations as the Norwegian company gradually shifted focus to its domestic operations.

The bumpy ride

Telenor ventured into the Pakistani market back in 2005 and has since gone on to acquire a subscriber base of around 49 million customers. However, operating in a highly saturated market brings in its own set of challenges. One amongst the many is a steady decrease in the average revenue per user (ARPU), a matter of concern for the industry as a whole.

For the Norwegian company, ARPU was also under pressure due to its strategy of targeting low income, rural population with the aim of accumulating a significant consumer base within a short span of time.

However, if past track record is something to go by, a similar strategy for the company’s Indian operations didn’t work either. Telenor entered the neighboring market in 2008 and was growing significantly when it came across a legal hurdle which substantially reduced the size of its operations in the country. Subsequently, it restructured its operations and went for the low value customers catering their demand for voice and SMS services. However, as the 3G/4G revolution took over India, Telenor started to lose its crown jewel, Voice and SMS, to data services and OTT apps like WhatsApp. Eventually, the telco had no other option, but to exit the South Asian country in 2017.

The culmination of events that led to Telenor’s decision to bid farewell to the Pakistani market are quite similar to what happened across the border. At the strategy front, Telenor Pakistan was focused on the low income customers, however, when it came to buying a spectrum for its 3G/4G services, Telenor bought the 850 MHz spectrum at a massive price tag of $395 million. This investment, as per experts, didn’t bear the expected dividends as the frequency opted for was supported by relatively expensive smartphones which were beyond the affordability of the telco’s primary user base.

Yet, this was only part of the problem. A major issue for the telco like other players in the market was a lack of rationalization when it came to spectrum and license fee. One such example is the license renewal fee that Telenor had to pay for the spectrum which initially it did challenge in the supreme court, but the ruling, for them, was an adverse one. This, combined with the deteriorating macro-economic, conditions led to an impairment of $250 million by Telenor ASA of its Pakistani operations back in the second quarter of the financial year 2022. Therefore, as far as business strategy is concerned, it just didn’t make sense for Telenor to operate in Pakistan.

Further, the weighted average cost of capital (WACC) for operating in the country has increased significantly due to multiple interest rate hikes and deteriorating political climate. Simultaneously, the return on capital employed (ROCE) for the telco is on a downward trajectory. For instance, the WACC in 2021 stood at around 15% while ROCE was lurking around 12% (as per latest financial results). Since then, the WACC has soared up to 18% while returns have turned negative for Telenor. Therefore, an exit was a no brainer for the company’s financial managers.

The recent trends depicted the same results for Telenor. “In Pakistan, the underlying EBITDA decreased by 22%, which is driven by the energy cost, the FX headwinds, and we also, see some negative impact from the flooding on the top line,” stated Tone Hegland Bachke, EVP and CFO, Telenor ASA during an earnings call.

Yet, the decision to windup operations in Pakistan is partially based on the broader strategy of Telenor to liquidate assets in Asian markets to free up cashflows. Sigve Brekke, President and Group CEO Telenor ASA, briefed an earnings call saying, “As I mentioned in our Q2 presentation, we have started a strategic review in Pakistan, and I expect more clarity on our structural alternatives in the coming month. At our Capital Markets Day, we said that we want to focus on synergies and cash flow in Asia with a target of accumulated free cash flow of NOK 12 billion in the period up to 2025. We will shortly start reporting on cash flow generation from our Asian businesses.”

What’s next?

The nature and size of the transaction that would follow a successful bid for Telenor is a rare sight for frontier markets like Pakistan. However, successfully carrying out such a transaction would require a lot of groundwork and the price that Telenor is seeking might be challenged by potential acquirers. A recent example is that of Jazz.

The country’s largest telecom operator transferred 15% of its stake to Abu Dhabi Group (ADG) as a part of consideration for acquiring Warid. On September 24, 2020, ADG exercised its option for the to sell 15% stake in the Jazz, requiring the fair value of VEON’s (Jazz’s parent) business in Pakistan to be determined.

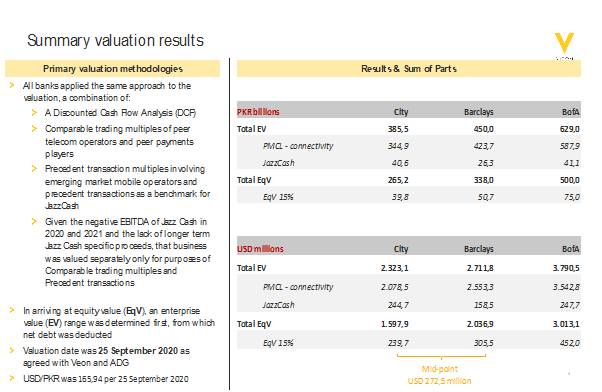

In accordance with the Shareholders’ Agreement, the parties each appointed an investment bank as expert valuer to determine the value of the shares; ADG appointed Bank of America (“BofA”) and VEON appointed Citibank (Also Telenor’s advisor). City valued Jazz at around USD 2.32 billion while BofA reached a valuation of 3.79 billion for the same entity. Therefore, a third bank (Barclays) was hired derive a mutually accepted valuation.

Further, an actual transaction might take some time to materialize, given that it has been more than a year and Telenor is still looking for a buyer for Telenor Microfinance Bank and Easypaisa.

The writer is a Financial Analyst and a Business Journalist. He can be reached at ahtasamahmad@yahoo.com or at https://twitter.com/AhtasamAhmad

The bumpy ride

Telenor ventured into the Pakistani market back in 2005 and has since gone on to acquire a subscriber base of around 49 million customers. However, operating in a highly saturated market brings in its own set of challenges. One amongst the many is a steady decrease in the average revenue per user (ARPU), a matter of concern for the industry as a whole.

For the Norwegian company, ARPU was also under pressure due to its strategy of targeting low income, rural population with the aim of accumulating a significant consumer base within a short span of time.

However, if past track record is something to go by, a similar strategy for the company’s Indian operations didn’t work either. Telenor entered the neighboring market in 2008 and was growing significantly when it came across a legal hurdle which substantially reduced the size of its operations in the country. Subsequently, it restructured its operations and went for the low value customers catering their demand for voice and SMS services. However, as the 3G/4G revolution took over India, Telenor started to lose its crown jewel, Voice and SMS, to data services and OTT apps like WhatsApp. Eventually, the telco had no other option, but to exit the South Asian country in 2017.

The culmination of events that led to Telenor’s decision to bid farewell to the Pakistani market are quite similar to what happened across the border. At the strategy front, Telenor Pakistan was focused on the low income customers, however, when it came to buying a spectrum for its 3G/4G services, Telenor bought the 850 MHz spectrum at a massive price tag of $395 million. This investment, as per experts, didn’t bear the expected dividends as the frequency opted for was supported by relatively expensive smartphones which were beyond the affordability of the telco’s primary user base.

Yet, this was only part of the problem. A major issue for the telco like other players in the market was a lack of rationalization when it came to spectrum and license fee. One such example is the license renewal fee that Telenor had to pay for the spectrum which initially it did challenge in the supreme court, but the ruling, for them, was an adverse one. This, combined with the deteriorating macro-economic, conditions led to an impairment of $250 million by Telenor ASA of its Pakistani operations back in the second quarter of the financial year 2022. Therefore, as far as business strategy is concerned, it just didn’t make sense for Telenor to operate in Pakistan.

Further, the weighted average cost of capital (WACC) for operating in the country has increased significantly due to multiple interest rate hikes and deteriorating political climate. Simultaneously, the return on capital employed (ROCE) for the telco is on a downward trajectory. For instance, the WACC in 2021 stood at around 15% while ROCE was lurking around 12% (as per latest financial results). Since then, the WACC has soared up to 18% while returns have turned negative for Telenor. Therefore, an exit was a no brainer for the company’s financial managers.

The recent trends depicted the same results for Telenor. “In Pakistan, the underlying EBITDA decreased by 22%, which is driven by the energy cost, the FX headwinds, and we also, see some negative impact from the flooding on the top line,” stated Tone Hegland Bachke, EVP and CFO, Telenor ASA during an earnings call.

Yet, the decision to windup operations in Pakistan is partially based on the broader strategy of Telenor to liquidate assets in Asian markets to free up cashflows. Sigve Brekke, President and Group CEO Telenor ASA, briefed an earnings call saying, “As I mentioned in our Q2 presentation, we have started a strategic review in Pakistan, and I expect more clarity on our structural alternatives in the coming month. At our Capital Markets Day, we said that we want to focus on synergies and cash flow in Asia with a target of accumulated free cash flow of NOK 12 billion in the period up to 2025. We will shortly start reporting on cash flow generation from our Asian businesses.”

What’s next?

The nature and size of the transaction that would follow a successful bid for Telenor is a rare sight for frontier markets like Pakistan. However, successfully carrying out such a transaction would require a lot of groundwork and the price that Telenor is seeking might be challenged by potential acquirers. A recent example is that of Jazz.

The country’s largest telecom operator transferred 15% of its stake to Abu Dhabi Group (ADG) as a part of consideration for acquiring Warid. On September 24, 2020, ADG exercised its option for the to sell 15% stake in the Jazz, requiring the fair value of VEON’s (Jazz’s parent) business in Pakistan to be determined.

In accordance with the Shareholders’ Agreement, the parties each appointed an investment bank as expert valuer to determine the value of the shares; ADG appointed Bank of America (“BofA”) and VEON appointed Citibank (Also Telenor’s advisor). City valued Jazz at around USD 2.32 billion while BofA reached a valuation of 3.79 billion for the same entity. Therefore, a third bank (Barclays) was hired derive a mutually accepted valuation.

Further, an actual transaction might take some time to materialize, given that it has been more than a year and Telenor is still looking for a buyer for Telenor Microfinance Bank and Easypaisa.

The writer is a Financial Analyst and a Business Journalist. He can be reached at ahtasamahmad@yahoo.com or at https://twitter.com/AhtasamAhmad