On Friday, Finance Minister Ishaq Dar announced the much-anticipated federal budget for the fiscal year 2024. The 2024 budget includes ambitious revenue collection and financing targets, but also entails a massive fiscal deficit. However, there are also positive outcomes from the presentation. Firstly, allocation for development has expanded and sectors like IT and agriculture have become winners in the budget.

Budget Review

The government has allocated a total of Rs. 13.3 trillion for current expenditure in FY24, representing a 53% increase compared to the previous year's budget. The defense budget is set at Rs. 1.8 trillion, a 15.4% rise from last year. Debt servicing, for FY24 have surged by an astonishing 85% compared to last year, reaching Rs. 7.3 trillion. This constitutes 55% of the total current expenditure, making it the government's largest expense.

https://twitter.com/UzairYounus/status/1667194826880692224?t=XKWWIIyiHQitJcp1OhdxvA&s=09

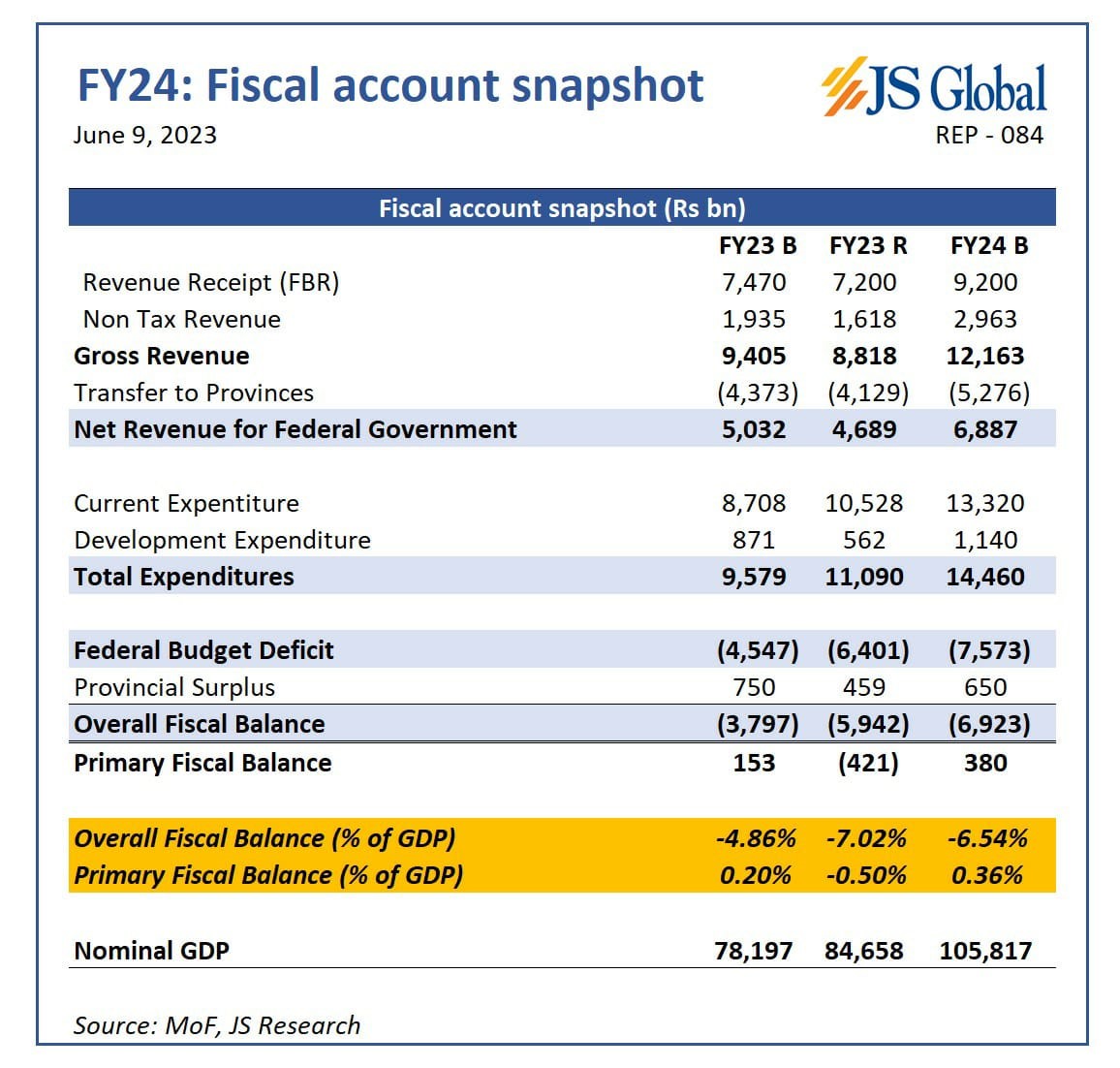

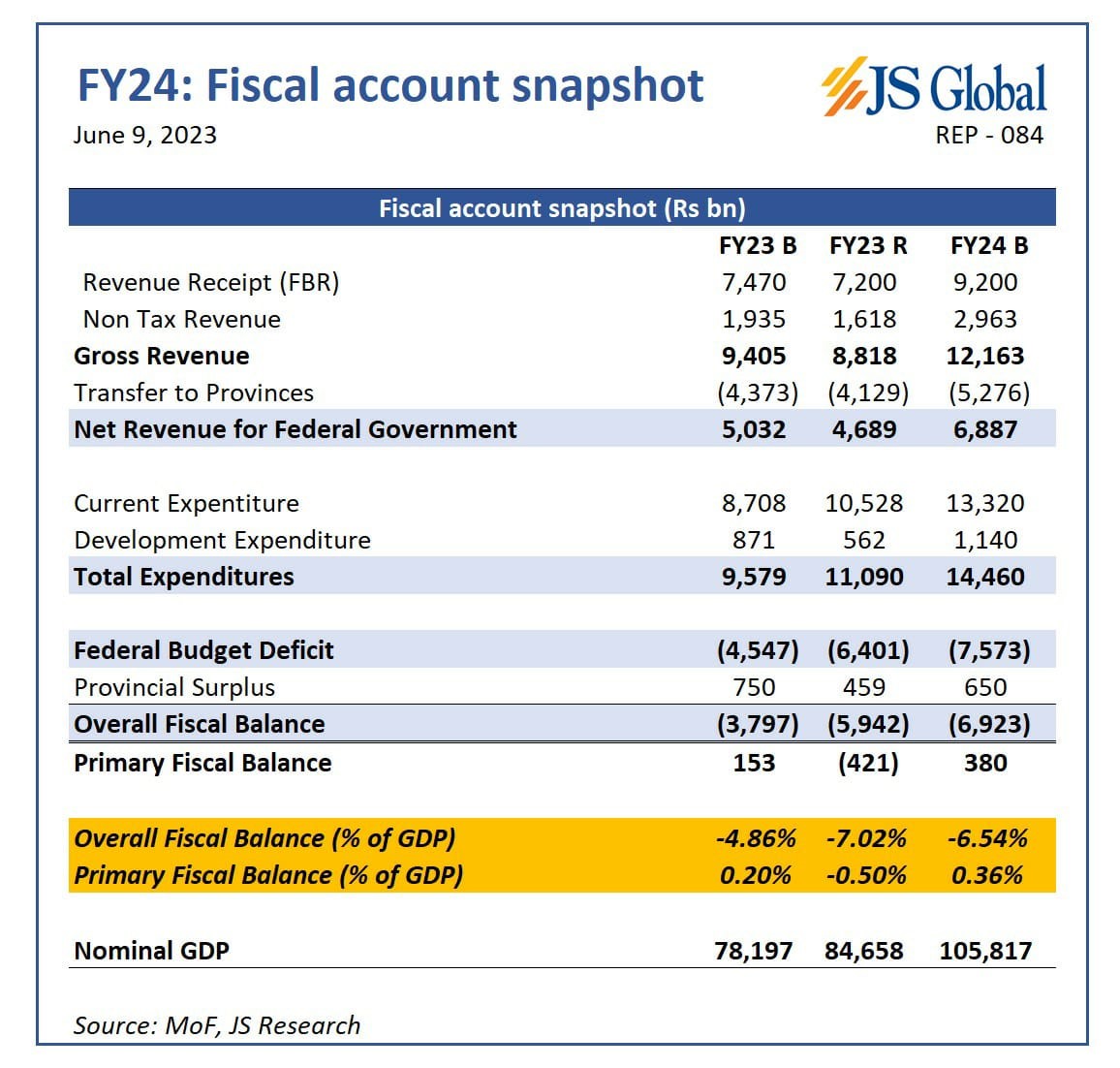

It has also set an ambitious target of Rs. 9.2 trillion in tax revenue for FY24, representing a more than 20% YoY growth from the FY23 budget. For FY24, the overall deficit is estimated at Rs. 6.9 trillion, an 82% increase from last year's Rs. 3.8 trillion. The fiscal deficit for this year is 6.54% of GDP, whereas last year, it was 4.9% of GDP.

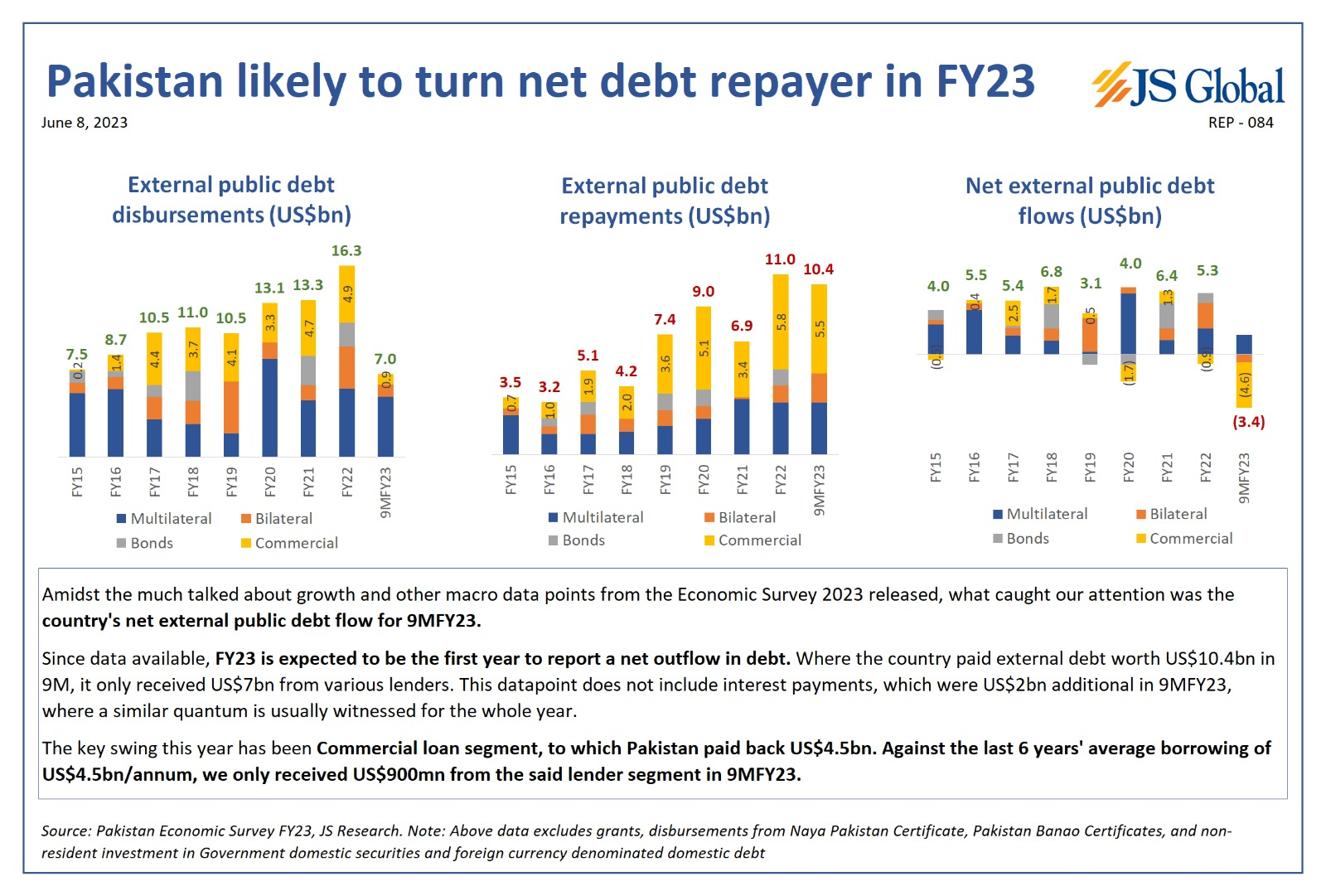

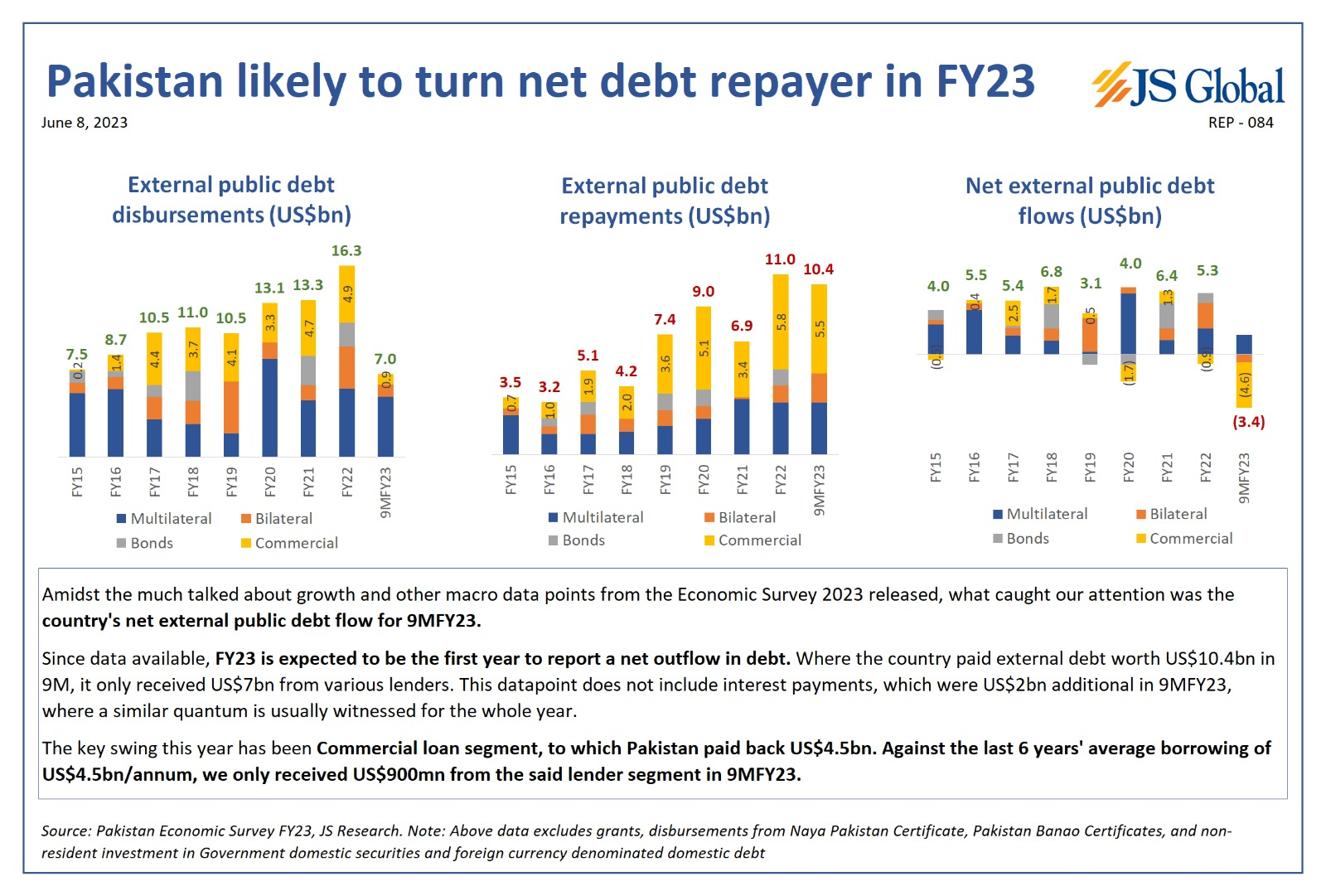

What stands out in this budget is the substantial amount of debt repayment that has already increased during the current fiscal year.

What stands out in this budget is the substantial amount of debt repayment that has already increased during the current fiscal year.

“FY23 is expected to be the first year to report a net outflow in debt. Where the country paid external debt worth US$10.4bn in 9M, it only received US$7bn from various lenders. This datapoint does not include interest payments, which were US$2bn additional in 9MFY23, where a similar quantum is usually witnessed for the whole year. The key swings this year have been in the commercial loan segment, to which Pakistan paid back US$4.5bn. Against the last 6 years' average borrowing of US$4.5bn/annum, we only received US$900mn from the said lender segment in 9MFY23,” read a report by JS Global.

The budget also targets an inflation rate of 21% for the upcoming fiscal year. Retired federal government employees are set to receive a pension hike of 17.5%. Furthermore, a 35% increase in salaries is proposed for federal government employees in grades 1-16, and a 30% increase for those in grades 17-22. The Public Sector Development Programme (PSDP) has been set at Rs. 1,150 billion. Additionally, the government has allocated Rs. 30 billion for the conversion of 50,000 tubewells to solar power and proposed the removal of import taxes and duties on hybrid seeds.

The budget also targets an inflation rate of 21% for the upcoming fiscal year. Retired federal government employees are set to receive a pension hike of 17.5%. Furthermore, a 35% increase in salaries is proposed for federal government employees in grades 1-16, and a 30% increase for those in grades 17-22. The Public Sector Development Programme (PSDP) has been set at Rs. 1,150 billion. Additionally, the government has allocated Rs. 30 billion for the conversion of 50,000 tubewells to solar power and proposed the removal of import taxes and duties on hybrid seeds.

The corporate sector is expected to bear the burden of additional financing needs, according to a report by Ismail Iqbal Securities. Significant taxation changes that will impact the sector include the reimposition of a 10% final tax on issuance of bonus shares, a reduction in minimum tax on turnover from 1.25% to 1.0% for listed companies. Moreover, up to 50% additional tax on income, profit, and gains is levied on persons with extraordinary gains due to exogenous factors (FX/commodity price fluctuation) from 2019-23.

Further, as per a report by Topline Securities, the budget proposes the rationalization of Super Tax, which will now apply to all individuals with income above Rs. 150 million, including the insertion of three new income slabs. These new slabs, ranging from Rs. 350 million to Rs. 500 million, will be taxed at 6%, 8%, and 10%, respectively.

In the previous tax year (2022), companies engaged in various sectors such as automobiles, beverages, cement, chemicals, cigarette, tobacco, fertilizer, iron and steel, LNG terminal, oil marketing, oil refining, petroleum and gas exploration and production, pharmaceuticals, sugar and textiles were required to pay a super tax of 10% if their income exceeded Rs. 300 million. However, these sectors later contested the measure in court and were asked to pay only 50% of the tax.

Alongside agriculture, the IT sector is a significant winner in the budget. Exporters registered with the Pakistan Software Export Board will be exempt from sales tax on imported IT equipment. Furthermore, the current concessionary fixed tax rate of 0.25% for IT & ITeS exports will continue from tax years 2024 to 2026. The sales tax return filing requirement for availing concessionary fixed tax rate of 0.25% for IT and ITeS has also been removed. Additionally, the sector is encouraged through reduced (20%) taxes on banking companies' income from additional advances (loans) to IT & ITeS. Furthermore, a Rs. 5 billion fund is set up to finance IT sector ventures, as announced by the Finance Minister, to further support the sector.

According to Amreen Soorani, the Head of Research at JS Capital, “The budget speech contained many incentives for the IT sector, which highlights the government's focus on increasing exports from this segment. Additionally, the government plans to increase development spending aggressively this year to support economic growth. However, the tax targets seem ambitious, and it remains to be seen how the government will meet them.”

External Flows

The government aims to manage liquidity partially by relying on projected inflows from exports and remittances. The target for inflows from exports is $30 billion, while the target for remittances is $33 billion.

Further, a significant amount of external debt is likely to be accumulated for the same reason. “Cash-strapped Pakistan has budgeted raising a whopping Rs5.51 trillion or approximately $19 billion in fiscal year 2023-24 through loans from external sources,” reported the Business recorder.

The financing, as per the report, can be divided into $500 million in short-term loans from Islamic Development Bank (IDB), $500 million in short-term loans from Islamic Development Bank (IDB), deposits of $3 billion from Saudi Arabia and United Arab Emirates, $1.5 billion through Euro bonds and international Sukuk, $4.5 billion from commercial banks, $4 billion in the coming fiscal through Safe China Deposit and $2.4 billion in IMF loan for budgetary support.

The budget has a few shining points, but is mostly a standard affair. However, it is noteworthy that the IMF is a key stakeholder this time and, in all likelihood, that boat might just have already sailed. The government has presented a highly ambitious plan that may require rectification through mini-budgets in the future.

Budget Review

The government has allocated a total of Rs. 13.3 trillion for current expenditure in FY24, representing a 53% increase compared to the previous year's budget. The defense budget is set at Rs. 1.8 trillion, a 15.4% rise from last year. Debt servicing, for FY24 have surged by an astonishing 85% compared to last year, reaching Rs. 7.3 trillion. This constitutes 55% of the total current expenditure, making it the government's largest expense.

https://twitter.com/UzairYounus/status/1667194826880692224?t=XKWWIIyiHQitJcp1OhdxvA&s=09

It has also set an ambitious target of Rs. 9.2 trillion in tax revenue for FY24, representing a more than 20% YoY growth from the FY23 budget. For FY24, the overall deficit is estimated at Rs. 6.9 trillion, an 82% increase from last year's Rs. 3.8 trillion. The fiscal deficit for this year is 6.54% of GDP, whereas last year, it was 4.9% of GDP.

What stands out in this budget is the substantial amount of debt repayment that has already increased during the current fiscal year.

What stands out in this budget is the substantial amount of debt repayment that has already increased during the current fiscal year.“FY23 is expected to be the first year to report a net outflow in debt. Where the country paid external debt worth US$10.4bn in 9M, it only received US$7bn from various lenders. This datapoint does not include interest payments, which were US$2bn additional in 9MFY23, where a similar quantum is usually witnessed for the whole year. The key swings this year have been in the commercial loan segment, to which Pakistan paid back US$4.5bn. Against the last 6 years' average borrowing of US$4.5bn/annum, we only received US$900mn from the said lender segment in 9MFY23,” read a report by JS Global.

The budget also targets an inflation rate of 21% for the upcoming fiscal year. Retired federal government employees are set to receive a pension hike of 17.5%. Furthermore, a 35% increase in salaries is proposed for federal government employees in grades 1-16, and a 30% increase for those in grades 17-22. The Public Sector Development Programme (PSDP) has been set at Rs. 1,150 billion. Additionally, the government has allocated Rs. 30 billion for the conversion of 50,000 tubewells to solar power and proposed the removal of import taxes and duties on hybrid seeds.

The budget also targets an inflation rate of 21% for the upcoming fiscal year. Retired federal government employees are set to receive a pension hike of 17.5%. Furthermore, a 35% increase in salaries is proposed for federal government employees in grades 1-16, and a 30% increase for those in grades 17-22. The Public Sector Development Programme (PSDP) has been set at Rs. 1,150 billion. Additionally, the government has allocated Rs. 30 billion for the conversion of 50,000 tubewells to solar power and proposed the removal of import taxes and duties on hybrid seeds.The corporate sector is expected to bear the burden of additional financing needs, according to a report by Ismail Iqbal Securities. Significant taxation changes that will impact the sector include the reimposition of a 10% final tax on issuance of bonus shares, a reduction in minimum tax on turnover from 1.25% to 1.0% for listed companies. Moreover, up to 50% additional tax on income, profit, and gains is levied on persons with extraordinary gains due to exogenous factors (FX/commodity price fluctuation) from 2019-23.

Further, as per a report by Topline Securities, the budget proposes the rationalization of Super Tax, which will now apply to all individuals with income above Rs. 150 million, including the insertion of three new income slabs. These new slabs, ranging from Rs. 350 million to Rs. 500 million, will be taxed at 6%, 8%, and 10%, respectively.

In the previous tax year (2022), companies engaged in various sectors such as automobiles, beverages, cement, chemicals, cigarette, tobacco, fertilizer, iron and steel, LNG terminal, oil marketing, oil refining, petroleum and gas exploration and production, pharmaceuticals, sugar and textiles were required to pay a super tax of 10% if their income exceeded Rs. 300 million. However, these sectors later contested the measure in court and were asked to pay only 50% of the tax.

Alongside agriculture, the IT sector is a significant winner in the budget. Exporters registered with the Pakistan Software Export Board will be exempt from sales tax on imported IT equipment. Furthermore, the current concessionary fixed tax rate of 0.25% for IT & ITeS exports will continue from tax years 2024 to 2026. The sales tax return filing requirement for availing concessionary fixed tax rate of 0.25% for IT and ITeS has also been removed. Additionally, the sector is encouraged through reduced (20%) taxes on banking companies' income from additional advances (loans) to IT & ITeS. Furthermore, a Rs. 5 billion fund is set up to finance IT sector ventures, as announced by the Finance Minister, to further support the sector.

According to Amreen Soorani, the Head of Research at JS Capital, “The budget speech contained many incentives for the IT sector, which highlights the government's focus on increasing exports from this segment. Additionally, the government plans to increase development spending aggressively this year to support economic growth. However, the tax targets seem ambitious, and it remains to be seen how the government will meet them.”

External Flows

The government aims to manage liquidity partially by relying on projected inflows from exports and remittances. The target for inflows from exports is $30 billion, while the target for remittances is $33 billion.

Further, a significant amount of external debt is likely to be accumulated for the same reason. “Cash-strapped Pakistan has budgeted raising a whopping Rs5.51 trillion or approximately $19 billion in fiscal year 2023-24 through loans from external sources,” reported the Business recorder.

The financing, as per the report, can be divided into $500 million in short-term loans from Islamic Development Bank (IDB), $500 million in short-term loans from Islamic Development Bank (IDB), deposits of $3 billion from Saudi Arabia and United Arab Emirates, $1.5 billion through Euro bonds and international Sukuk, $4.5 billion from commercial banks, $4 billion in the coming fiscal through Safe China Deposit and $2.4 billion in IMF loan for budgetary support.

The budget has a few shining points, but is mostly a standard affair. However, it is noteworthy that the IMF is a key stakeholder this time and, in all likelihood, that boat might just have already sailed. The government has presented a highly ambitious plan that may require rectification through mini-budgets in the future.