Pakistani authorities are probing a Singapore-based housing developer for allegedly defrauding residents out of billions of rupees. The victims, though, are still waiting for the return of their money, nearly 18 years on.

Like several scandals in the country's history, this one too is linked to selling people grand promises of owning a luxury home in an upscale neighbourhood.

The project

The year was 2003, a time when Pakistan had seemingly discovered a whole new industry of building high-rises with luxury flats. Like a project in the federal capital located on Constitution Avenue, a similar project was announced over 1,200 kilometres away on the coast of the Arabian Sea in Karachi.

Singapore-based company Meinhardt Singapore Pte Limited announced to launch Pakistan's first 6-star project near the sea in Karachi's posh Defense Housing Authority (DHA). The project was titled Creek Marina.

Pakistan-origin Dr Shahzad Nasim, a representative of Meinhardt, signed an agreement with DHA Karachi for leasing 92,000 square yards of land (19 Acres) of prime waterfront land in the under-development Phase 8. The current value of this land is upward of $150 million.

According to their agreement, Meinhardt would design, construct, develop and market the luxury flats on the land within three years.

DHA undertook this risky enterprise witha company which had no prior experience in construction and development of residential projects, only in design and consultancy, with the remote hope that once the project is built, DHA would receive 15% of the apartments constructed.

Meinhardt set up a local company called Creek Marina Private Limited for the purpose. Through another shell company registered in Singapore, the company allegedly opened "fake" accounts in local banks without registering itself with the Board of Investment, the Securities Exchange Commission of Pakistan or the State Bank of Pakistan.

Meanwhile, the company started marketing the project as a 6-star project with eight towers of 24 floors, three and four-bedroom apartments, and several penthouses.

The project was promoted as a partnership between DHA and Meinhardt, which gave the public confidence to invest their hard-earned savings.

The project officially started selling apartments on June 20, 2007. As is with any housing project, the public was asked to deposit money as advance for booking flats and other commercial units. The price of a single flat was fixed at a whopping Rs30 million. Buyers could pay the money in instalments over 30 months - i.e. Rs1 million a month.

Investors were asked to deposit working capital against the promise of partnership.

More than 300 families deposited Rs2.5 billion in the company's accounts. However, authorities believe the transactions shown in the accounts are only partial, and the true sum is much more.

The company was supposed to complete the project and hand them over to buyers by December 31, 2009. The project could not be completed within the stipulated period.

Meinhardt, officials believe, silently transferred this money abroad instead of building the project as promised allegedly using non-banking channels violating foreign exchange laws.

When those, who had shelled out their hard-earned cash for the project to purchase flats worth millions, found out that the project was nothing but a vapour, they approached federal investigators against the fraud.

They told the Federal Investigation Agency (FIA) that they had booked apartments in the Creek Marina project, but despite the passage of 18 years, Meinhardt Singapore has not completed the project and handed over the flats.

Stalled construction and fallout with DHA

When the work on the project did not start as per their agreed timeline, the Karachi-based housing authority and the project's managers amended their agreement on May 5, 2005. Per this amended agreement, the project was to be completed over two phases to build eight towers instead of the initial two. Moreover, 19 acres of land were sub-leased in the name of Creek Marina Private Limited. Despite the amendments to the agreement, the project could not be completed in time.

A second amendment to the agreement was made on June 4, 2009. According to this amendment, DHA surprisingly agreed to reduce its share in apartments from 15% to 3.75% even though no significant progress had been made on building the project.

Under this new agreement, the project would be completed and delivered in three phases instead of two as originally planned. The first phase was to be completed by June 2011. The second phase would follow by December of the same year, and the third phase would be completed by June 2012.

Despite the significant discount by DHA, the company failed to complete the project in time.

The little construction work that was initiated ground to a halt in 2010 when the Chinese contractors hired by Creek Marina (Pvt) Limited abandoned the project.

Creek Marina eventually encashed the Performance Guarantees provided by the Chinese Contractors. Instead of releasing around Rs1 billion to complete the project, the company attempted to relocate it to Singapore allegedly through fake accounts of a sister concern, Creek Marina Singapore Pte Ltd.

This Singapore-based company allegedly attempted to extract the money in favour of a local partner Aftabuddin Qureshi.

When DHA caught wind of what was happening, they lodged cases in the Sindh High Court against the builder, accusing it of money laundering and fraud. As a result, the court issued a stay order, effectively blocking the accounts. But the cases were later withdrawn despite the severity of the allegations.

In April 2011, the Sindh High Court decided that Rs1 billion should be obtained as a guarantee from the Chinese contractor in an escrow account by the project developers to resume the construction work. The court further developed a lengthy modality based on which project funds can be used transparently while DHA was given a supervisory role.

Despite this mechanism, construction on the project could not be completed.

Meanwhile, a hundred allottees - nearly half of all the allottees, formed the Creek Marina Action Committee headed by Yousaf Mirza. This body decided to approach DHA and CMPL to resolve the issue.

The committee members met with the company's owner Dr Shahzad Nasim in Dubai in May 2012, where they were convinced that if they cooperated and completed their payments, their apartments would be handed over within three years.

But the committee did not believe Dr Nasim and approached the National Accountability Bureau (NAB) with a complaint. NAB launched a probe which resulted in further litigation.

During litigation, NAB reportedly brokered a settlement between the Creek Marina Action Committee and Dr Nasim. The agreement settled that the NAB inquiry would be closed and the project would be partly delivered by June 2022.

NAB closed its case in 2019, but little progress was made on the project since, and the allottees were left with little recourse but to return to NAB.

Legal sparring between DHA and development project management

In 2014, DHA lodged an FIR against the company's owner, a citizen of Singapore, over the project and other companies. In the FIR, DHA accused them of fraud and money laundering to the tune of Rs3 billion.

Despite the serious allegations, the charges were withdrawn and DHA and Creek Marina entered into a third amendment to the project agreement, dated June 18, 2019. Under this agreement, all project funds would be kept in an escrow account, and the project would be fast-tracked. Per this agreement, DHA's 15% share was restored.

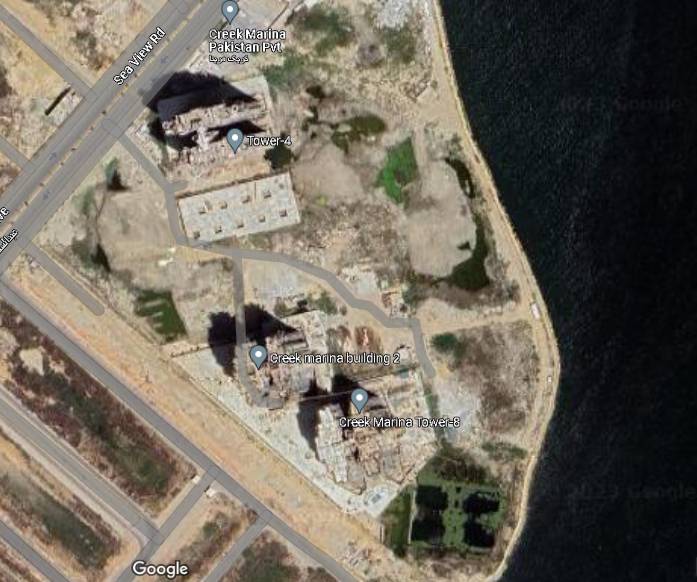

Meanwhile, three semifinished towers remain standing at the site.

A new game

After the third agreement, the company appointed Ayesha Warsi as its chief executive officer. At the same time, the new staff was hired and the process of selling the remaining apartments in the project resumed.

Allottees, who had booked and deposited money in 2005, were issued notices to deposit additional money at new rates. Allottees were told that unless they complied with the new rules, their bookings would be cancelled, and the apartments would relisted at a higher rate.

It now appears that Warsi has resigned from her post on July 1, 2023, even as an FIA probe continues.

FIA launches probe

Despite DHA withdrawing its cases, the FIA has started their own independent investigations into the matter.

Officials with knowledge of the FIA investigation thus far said that all those involved are subjects of interest. Moreover, the agence is said to have put the company's owners, Dr Nasim and his son Umar Shehzad, on their watch list. Meanwhile warrants for their arrest have been issued in a separate criminal case.

It should be noted that both father and son are citizens of Singapore and have not visited Pakistan since 2019.

According to the FIA Anti-Money Laundering Wing, Meinhardt Singapore allegedly obtained and shifted more than Rs3 billion abroad through questionable tactics.

The FIA said it was investigating actions of the company owners, and Creek Marina Pakistan CEO Ayesha Warsi. An individual named Nudrat Mand Khan is also being investigated.

Officials believe that the probe could expand to cover several other individuals who may be involved including bankers, contractors and other employees.

The FIA said its money laundering investigations against Creek Marina management remain underway.

Moreover, a second investigation has been launched with respect to banking crimes. Sources in the FIA have revealed that another company, by the name of Creek Marina Singapore Pte Limited, incorporated in Pakistan, has been undertaking business in Karachi, and significant local funds were diverted through its accounts in local banks.

Sources reveal that these accounts were operated despite the fact that Creek Marina Singapore Pte Limited had not obtained the requisite permissions required from the Board of Investment, the Securities Exchange Commission of Pakistan and the State Bank of Pakistan. Sources further claim that their activity contravenes the Companies Act, 2017, the Foreign Exchange Regulations and several other laws of the land.

Officials have suspicions about the alleged involvement of Dr Nasim, Umer Shahzad, Nudrat Mand Khan and Richard Coventry and several people in the banking industry who may have facilitated them.

According to FIA's investigation, funds to be received by Creek Marina Singapore PTe were transferred to various individuals, including Nudrat Mand Khan, Ayesha Warsi, Salman Mand, Dr Shahid Nasim and Umar Shahzad, Syed Asghar Ali Shah, Aftabuddin Qureshi and Akber Ali Shakir. The amount transferred, though, was not reflected in the financial statements of Creek Marina Private Limited or Creek Marina Singapore Pte Ltd.

Some of these indviduals are believed to have originated transactions worth hundreds of thousands of dollars to individuals aborad and offshore company accounts.

The FIA believe an alleged money laundering scheme was run through illegal accounts.

Who really owns Creek Marina and Panama connections?

From the record available, it appears that several offshore shell companies own Creek Marina Pvt Limited, with there being a link unearthed in the Panama Papers.

The record presented before the Public Accounts Committee in their latest session indicates that an intricate web of offshore companies. There are suggestions that an English banker heavily mentioned in the Panama Papers, is the architect of this offshore scheme.

It appears that the those vested in the project were owned by a company registered in the British Virgin Islands.

According to records of the securities exchange commission, Creek Marina Private Limited was wholly owned by a Singaporean company, Creek Marina Singapore Pte Ltd. In turn, Creek Marina Singapore was wholly owned by a shell company called Swiftearn Holding Limited in the British Virgin Islands secretly owns.

Victims approach Public Accounts Committee

Meanwhile, the victims have approached a parliamentary oversight committee, seeking a probe. They wrote to Public Accounts Committee Chairman Noor Alam Khan.

They urged Noor to ensure that the ongoing investigations are not derailed through manipulations and interference by influential individuals.

One of the affected allottees, Syed Danish Ghazi, presented to the PAC that he had booked an apartment worth Rs20 million.

Of this, he had paid Rs16.8 million over four years. He further stated that now, the developer has started demanding extra money from him. When he had asked for assurances, the company did not provide any and instead cancelled his allotment through a letter from a renowned law firm.

Against such prejudicial treatment from a member of his own legal fraternity, he had filed a suit before the high court where a stay is operating over the apartment for which he had been waiting for 18 years.