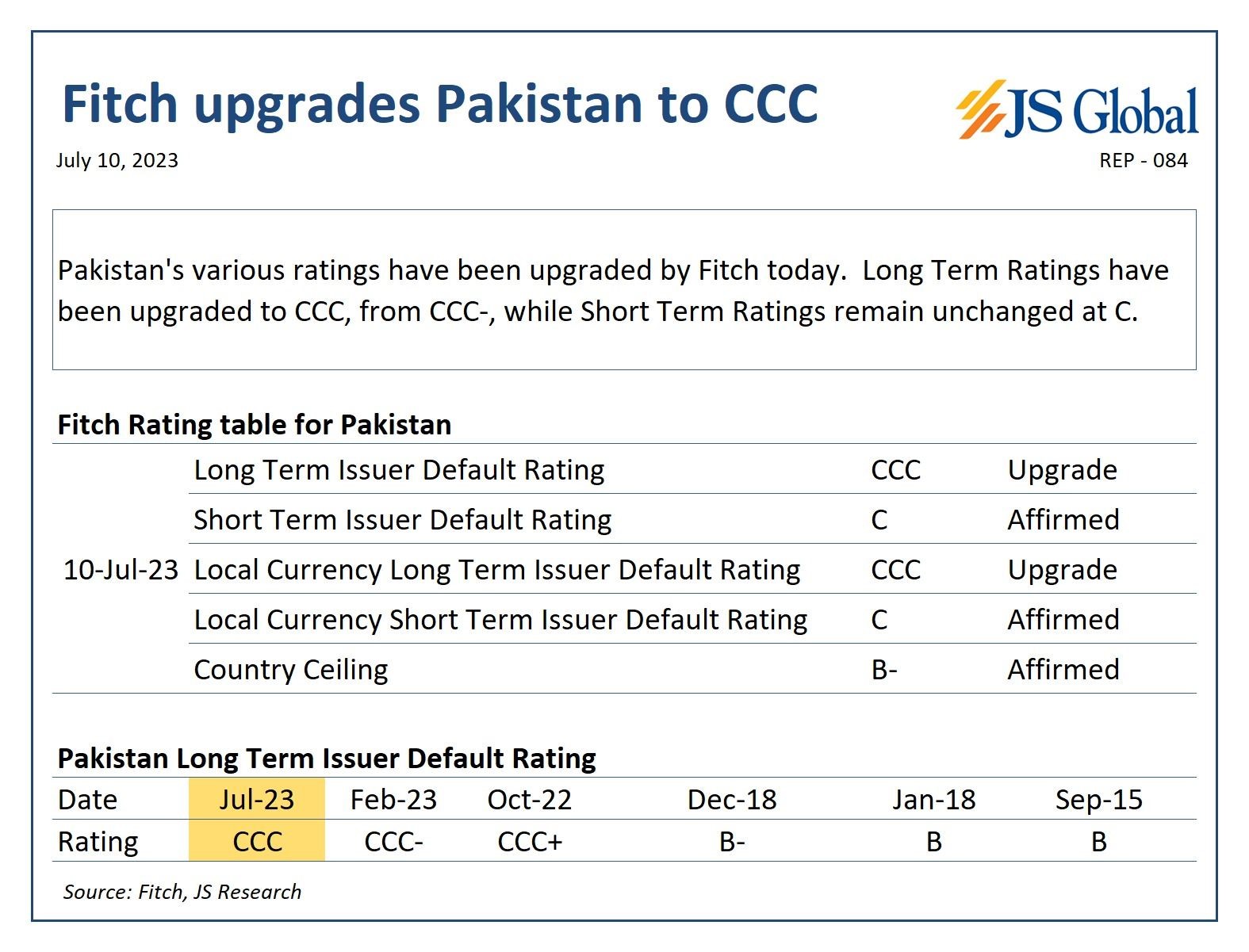

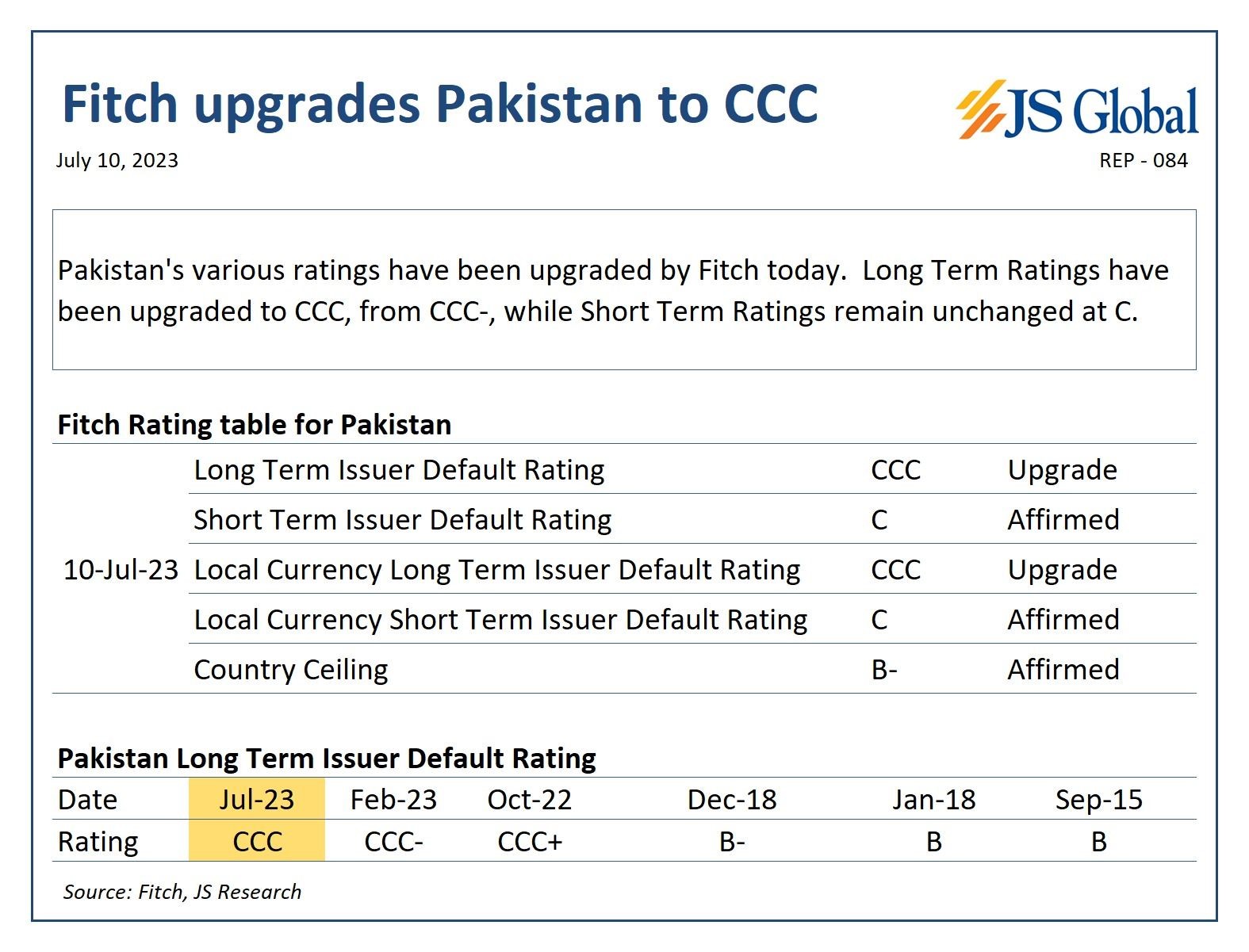

On Monday, global credit rating agency Fitch upgraded Pakistan's sovereign credit rating from CCC- to CCC on the basis of an improved liquidity situation after the staff level approval of the International Monetary Fund's (IMF) $3 billion Standby Agreement (SBA). This development comes to much of Pakistan’s relief as prior to this, the country has suffered two downgrades from Fitch over the past one year.

Given that Fitch usually does not provide outlooks to countries with a CCC+ rating and below, even after the upgrade, the agency's rating still reflects the dire condition of the country's external, fiscal, and economic metrics over the last 18 months. Last year, S&P Global reduced its long-term rating for Pakistan from B to CCC+ and Moody’s, earlier this year, downgraded Pakistan’s rating to Caa3.

The rating and the rationale?

Issuer ratings reflect a sovereign’s capacity to meet its senior unsecured debt and debt-like obligations. These ratings take into account any external assistance that is expected to apply to all current and future issuance of senior unsecured financial instruments and contracts.

As per Fitch, the CCC rating reflects substantial credit risk with a very low margin for safety and default being a real possibility.

The rating agency, attributed the upgrade to improvements in external liquidity and funding conditions, because of the Staff-Level Agreement with the IMF. The government has taken steps to address issues related to revenue collection, energy subsidies, and exchange rate policies that were not aligned with market-determined rates, read the official commentary.

However, as per Fitch, there are still risks associated with the implementation of the agreed-upon measures, considering Pakistan's track record of not fully meeting its commitments to the IMF in the past. Despite these risks, the approval of the Stand-by Arrangement by the IMF board will result in an immediate disbursement of $1.2 billion, with additional funds to follow after subsequent reviews.

The government has set a target of securing $25 billion in new external financing for FY24, including market issuance and borrowing from commercial banks. Pakistan's current account deficit has shown a narrowing trend, but there are concerns that import backlogs and post-flood reconstruction needs could cause it to widen again, noted the rating agency.

Further, Pakistan remains susceptible to external headwinds as the country's liquid net foreign exchange reserves remain low, however, it is anticipated that they will experience a modest recovery with the influx of new external financing. The political climate in Pakistan, particularly in the lead-up to elections, introduces volatility and policy uncertainties that could impact the implementation of the agreed-upon reforms.

External Debt Sustainability

The infusion of new funding from the IMF and the subsequent disbursements from bilateral partners provide some relief for Pakistan. However, the country's significant debt obligations are expected to pose challenges in the near future.

The concerns have also been reiterated by Moody’s and Fitch. As per the rating agencies, Pakistan will need substantial additional financing, in addition to the disbursements from the IMF, in order to manage its debt maturities and support economic recovery. While it is likely that the IMF has sought and received assurances for such funding, there remains a risk that it might not be adequate, particularly if there is a widening of current account deficits.

“The SBA with the IMF doesn’t solve any of our problems except for giving us more time for making up our mind on how we want to restore debt sustainability. It also allows enough time for the new government to take control before deciding on the way forward. However, as SBA nears its end in a few months’ time, our debt repayment issues will surface once again,” remarked, senior economist, Dr Ahmed Jamal Pirzada.

Therefore, as per experts, one possible solution would be to acquire long-term debt to address short-term debt obligations or reprofile the existing short-term debt over a longer term to create some fiscal space which is currently shrinking due to debt repayment pressures.

In line with the aforementioned, the government is already considering seeking extensions on the maturities of loans from non-Paris Club bilateral creditors, as part of its efforts to manage its debt. This could also have a positive impact on the ratings of Pakistan’s commercial papers and subsequently, improve its ability to access international financial markets.

Given that Fitch usually does not provide outlooks to countries with a CCC+ rating and below, even after the upgrade, the agency's rating still reflects the dire condition of the country's external, fiscal, and economic metrics over the last 18 months. Last year, S&P Global reduced its long-term rating for Pakistan from B to CCC+ and Moody’s, earlier this year, downgraded Pakistan’s rating to Caa3.

The rating and the rationale?

Issuer ratings reflect a sovereign’s capacity to meet its senior unsecured debt and debt-like obligations. These ratings take into account any external assistance that is expected to apply to all current and future issuance of senior unsecured financial instruments and contracts.

There are still risks associated with the implementation of the agreed-upon measures, considering Pakistan's track record of not fully meeting its commitments to the IMF in the past.

As per Fitch, the CCC rating reflects substantial credit risk with a very low margin for safety and default being a real possibility.

The rating agency, attributed the upgrade to improvements in external liquidity and funding conditions, because of the Staff-Level Agreement with the IMF. The government has taken steps to address issues related to revenue collection, energy subsidies, and exchange rate policies that were not aligned with market-determined rates, read the official commentary.

However, as per Fitch, there are still risks associated with the implementation of the agreed-upon measures, considering Pakistan's track record of not fully meeting its commitments to the IMF in the past. Despite these risks, the approval of the Stand-by Arrangement by the IMF board will result in an immediate disbursement of $1.2 billion, with additional funds to follow after subsequent reviews.

The government has set a target of securing $25 billion in new external financing for FY24, including market issuance and borrowing from commercial banks. Pakistan's current account deficit has shown a narrowing trend, but there are concerns that import backlogs and post-flood reconstruction needs could cause it to widen again, noted the rating agency.

Further, Pakistan remains susceptible to external headwinds as the country's liquid net foreign exchange reserves remain low, however, it is anticipated that they will experience a modest recovery with the influx of new external financing. The political climate in Pakistan, particularly in the lead-up to elections, introduces volatility and policy uncertainties that could impact the implementation of the agreed-upon reforms.

External Debt Sustainability

The infusion of new funding from the IMF and the subsequent disbursements from bilateral partners provide some relief for Pakistan. However, the country's significant debt obligations are expected to pose challenges in the near future.

“The SBA with the IMF doesn’t solve any of our problems except for giving us more time for making up our mind on how we want to restore debt sustainability."

The concerns have also been reiterated by Moody’s and Fitch. As per the rating agencies, Pakistan will need substantial additional financing, in addition to the disbursements from the IMF, in order to manage its debt maturities and support economic recovery. While it is likely that the IMF has sought and received assurances for such funding, there remains a risk that it might not be adequate, particularly if there is a widening of current account deficits.

“The SBA with the IMF doesn’t solve any of our problems except for giving us more time for making up our mind on how we want to restore debt sustainability. It also allows enough time for the new government to take control before deciding on the way forward. However, as SBA nears its end in a few months’ time, our debt repayment issues will surface once again,” remarked, senior economist, Dr Ahmed Jamal Pirzada.

Therefore, as per experts, one possible solution would be to acquire long-term debt to address short-term debt obligations or reprofile the existing short-term debt over a longer term to create some fiscal space which is currently shrinking due to debt repayment pressures.

In line with the aforementioned, the government is already considering seeking extensions on the maturities of loans from non-Paris Club bilateral creditors, as part of its efforts to manage its debt. This could also have a positive impact on the ratings of Pakistan’s commercial papers and subsequently, improve its ability to access international financial markets.