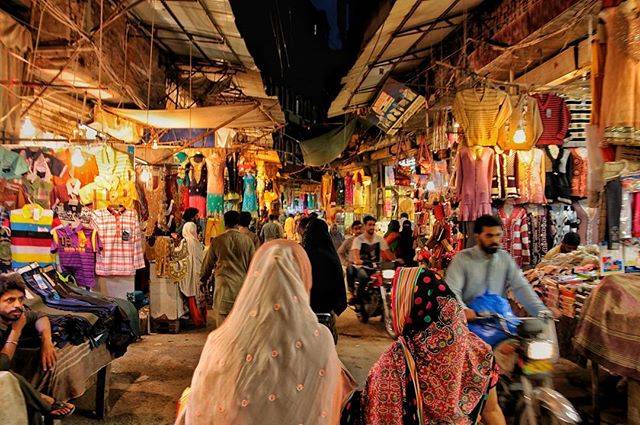

Much has been written in Pakistan about the mullah military alliance, but no attention has been given to document the enormous financial support to the clergy from the bazaar. The term bazaar in Pakistan refers to traders occupying big markets that have always played a pivotal role in the economics and politics of the country. These markets are well represented through traders’ bodies and chambers. Though their contribution in total tax collection is negligible, amounting to less than 2% of total collection, they are rich and mighty; always keen to contribute generously for any cause that is declared “scared” by the Mullah. It is thus not surprising that the mullah-bazaar alliance is the root cause of many ills in Pakistan, ranging from religious militancy to open tax defiance.

The bazaar—represented by all the chambers in country, All Pakistan Anjuman-e-Tajiran, Qaumi Tajir Ittehad and several other trade and commerce bodies—is united against the Federal Board of Revenue (FBR). For not paying taxes due from them, corruption in FBR is their main argument and pretext. They frequently call press conferences and arrange seminars and workshops to spew venom against FBR, especially against any move aimed at proper documentation of the economy. Each time, they successfully force the government to withdraw any law they do not like.

It is obvious that the immense power of the bazaar and corrupt officials of FBR are the main hurdle in the way of proper tax collection in Pakistan. Back in 2010, traders managed to defeat the introduction of Value Added Tax (VAT), later renamed as Reformed GST, and then Finance Minister, Abdul Hafeez Shaikh, while addressing convocation in Karachi, frankly conceded: “One-third of the country’s population is below the poverty line and the elite are still reluctant to pay taxes and are resisting reforms.”

The unholy alliance between the traders and tax collectors is depriving the state of billions of rupees. The seasoned and skillful tax administrators in the FBR wrongly suggest that they are at war with the traders. In fact, they manage to get concessions for them by posing that tough decisions are that suggested by successive finance ministers alone. Their tough posture towards traders is a tactical move to mint more money from the unscrupulous elements in business, trade and industry.

Recall that in the beginning of 2000, a shop-to-shop survey called the National Tax Survey was conducted with the Army’s help and there was hope that all the traders would be brought into tax net, but soon it proved to be yet another illusion. After a long-drawn battle, marred by bitterness, hostility and closure of businesses, the powerful military government and the traders finally concluded an agreement on August 22, 2000 in Islamabad. By virtue of agreement, it was decided that retailers and shopkeepers would be given an option to opt for a new slab of 1% turnover tax, without being registered under the sales tax regime.

It was really shocking that military regime of late General Pervez Musharraf, having no electoral obligations also succumbed to the pressure of the bazaar, and since then the bazaarwalas have defied all measures for documentation of economy under all governments.

All the regimes in Pakistan, military and civil alike, asserted that they would extend retail sales tax to all the exempted areas of economy, but failed to do so. After realizing that it might lead to tax revolt in the country, even the strong military regime of Pervez Musharraf decided to save its own skin by striking a deal with the powerful shutter lobby. The traders and retailers from the very beginning have maintained that they would not pay sales tax on each and every transaction—for this they even confronted the armed forces in 2000.

The bazaarwalas have always proven their strength. Documentation, despite being the main demand of the local tax experts and foreign lenders and donors, has proved to be yet another unrealized dream. The poor people of Pakistan are the real losers in the situation, the hapless masses have never had a voice in democratic or military eras alike. They have been left to face the unprecedented burden of rising cost of life, as the mighty sections of society are not ready to pay taxes. They have now not even the slightest doubt about the fact that this country is only meant for powerful men in robes, high-ranking civil military bureaucrats, corrupt politicians and profit-hungry bazaarwalas.

Pakistan, at the moment, is facing the most difficult time of its existence, as the ongoing economic meltdown is assuming dangerous proportions due to perpetual political instability. More than anything else, the country is locked in a struggle to overcome a monstrous fiscal deficit, just over Rs. 9 trillion this year, and come out of unsustainable debt burden, with the debt of the federal government having increased to nearly Rs. 55 trillion as of January 31, 2023 showing an increase of Rs. 7.2 trillion from the period between July 2022 to January 2023.

According to a press report quoting the debt bulletin issued by State Bank of Pakistan: “….the net federal income dropped by Rs 200 billion to Rs 400 billion less than the total interest expenses. For the current fiscal year, the net federal income is estimated at Rs 5 trillion while the cabinet last month approved a Rs5.2 trillion revised interest expenses bill for fiscal year 2022-23, ending in June. This is the first time that the net income is even less than the cost of debt servicing. Now, the entire defense budget and civilian government expenses are being covered through fresh loans. The net income is calculated after payment of provincial shares in the federal taxes”.

In these circumstances, the government, instead of succumbing to pressures from vested interests, must ensure proper compliance of taxes. It must negotiate with traders’ bodies and chambers ensuring them that if bazaarwalas pay taxes honestly and diligently, the same will be spent for the welfare of the masses and not for the personal comforts and luxuries of a handful few. A national consensus on a fair and just tax policy is the only hope for coming out of fiscal deficit and debt enslavement.

The bazaar—represented by all the chambers in country, All Pakistan Anjuman-e-Tajiran, Qaumi Tajir Ittehad and several other trade and commerce bodies—is united against the Federal Board of Revenue (FBR). For not paying taxes due from them, corruption in FBR is their main argument and pretext. They frequently call press conferences and arrange seminars and workshops to spew venom against FBR, especially against any move aimed at proper documentation of the economy. Each time, they successfully force the government to withdraw any law they do not like.

It is obvious that the immense power of the bazaar and corrupt officials of FBR are the main hurdle in the way of proper tax collection in Pakistan. Back in 2010, traders managed to defeat the introduction of Value Added Tax (VAT), later renamed as Reformed GST, and then Finance Minister, Abdul Hafeez Shaikh, while addressing convocation in Karachi, frankly conceded: “One-third of the country’s population is below the poverty line and the elite are still reluctant to pay taxes and are resisting reforms.”

It is thus not surprising that the mullah-bazaar alliance is the root cause of many ills in Pakistan, ranging from religious militancy to open tax defiance.

The unholy alliance between the traders and tax collectors is depriving the state of billions of rupees. The seasoned and skillful tax administrators in the FBR wrongly suggest that they are at war with the traders. In fact, they manage to get concessions for them by posing that tough decisions are that suggested by successive finance ministers alone. Their tough posture towards traders is a tactical move to mint more money from the unscrupulous elements in business, trade and industry.

Recall that in the beginning of 2000, a shop-to-shop survey called the National Tax Survey was conducted with the Army’s help and there was hope that all the traders would be brought into tax net, but soon it proved to be yet another illusion. After a long-drawn battle, marred by bitterness, hostility and closure of businesses, the powerful military government and the traders finally concluded an agreement on August 22, 2000 in Islamabad. By virtue of agreement, it was decided that retailers and shopkeepers would be given an option to opt for a new slab of 1% turnover tax, without being registered under the sales tax regime.

The bazaarwalas have always proven their strength. Documentation, despite being the main demand of the local tax experts and foreign lenders and donors, has proved to be yet another unrealized dream.

It was really shocking that military regime of late General Pervez Musharraf, having no electoral obligations also succumbed to the pressure of the bazaar, and since then the bazaarwalas have defied all measures for documentation of economy under all governments.

All the regimes in Pakistan, military and civil alike, asserted that they would extend retail sales tax to all the exempted areas of economy, but failed to do so. After realizing that it might lead to tax revolt in the country, even the strong military regime of Pervez Musharraf decided to save its own skin by striking a deal with the powerful shutter lobby. The traders and retailers from the very beginning have maintained that they would not pay sales tax on each and every transaction—for this they even confronted the armed forces in 2000.

The bazaarwalas have always proven their strength. Documentation, despite being the main demand of the local tax experts and foreign lenders and donors, has proved to be yet another unrealized dream. The poor people of Pakistan are the real losers in the situation, the hapless masses have never had a voice in democratic or military eras alike. They have been left to face the unprecedented burden of rising cost of life, as the mighty sections of society are not ready to pay taxes. They have now not even the slightest doubt about the fact that this country is only meant for powerful men in robes, high-ranking civil military bureaucrats, corrupt politicians and profit-hungry bazaarwalas.

Pakistan, at the moment, is facing the most difficult time of its existence, as the ongoing economic meltdown is assuming dangerous proportions due to perpetual political instability. More than anything else, the country is locked in a struggle to overcome a monstrous fiscal deficit, just over Rs. 9 trillion this year, and come out of unsustainable debt burden, with the debt of the federal government having increased to nearly Rs. 55 trillion as of January 31, 2023 showing an increase of Rs. 7.2 trillion from the period between July 2022 to January 2023.

According to a press report quoting the debt bulletin issued by State Bank of Pakistan: “….the net federal income dropped by Rs 200 billion to Rs 400 billion less than the total interest expenses. For the current fiscal year, the net federal income is estimated at Rs 5 trillion while the cabinet last month approved a Rs5.2 trillion revised interest expenses bill for fiscal year 2022-23, ending in June. This is the first time that the net income is even less than the cost of debt servicing. Now, the entire defense budget and civilian government expenses are being covered through fresh loans. The net income is calculated after payment of provincial shares in the federal taxes”.

In these circumstances, the government, instead of succumbing to pressures from vested interests, must ensure proper compliance of taxes. It must negotiate with traders’ bodies and chambers ensuring them that if bazaarwalas pay taxes honestly and diligently, the same will be spent for the welfare of the masses and not for the personal comforts and luxuries of a handful few. A national consensus on a fair and just tax policy is the only hope for coming out of fiscal deficit and debt enslavement.