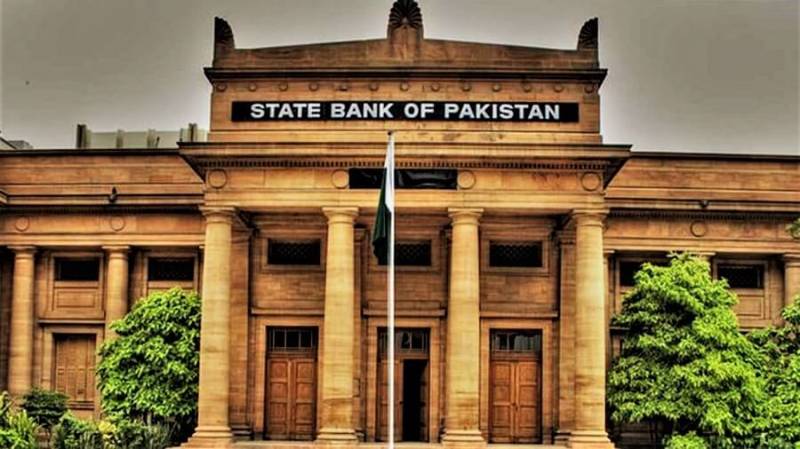

Despite expectations, a hike in gas prices kept inflation at a higher level in November, and consequently, on Tuesday, the State Bank of Pakistan decided to keep the interest rate unchanged at 22%.

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) met on Tuesday to review the country's current state of interest rates.

In a statement released after its meeting, the committee stated that the gas price hike had impacted inflation in November and kept it relatively higher than expected.

The MPC noted that the higher-than-expected increase in gas prices contributed 3.2 percentage points to the 29.2% year-on-year inflation in November 2023. But core inflation remained sticky at 21.5% during the month, only slightly lower from its peak of 22.7% in May 2023.

As a result, the inflation expectations of consumers and businesses remain elevated despite showing some improvement in recent months.

"Barring further sizable increase in administered prices, the MPC continues to expect that headline inflation will decline significantly in the second half of FY24 due to contained aggregate demand, easing supply constraints, moderation in international commodity prices and favourable base effect," it said.

The committee noted that there have been positive developments elsewhere in the form of the first review being successfully completed for a staff-level agreement with the International Monetary Fund (IMF) under the Standby Arrangement (SBA). It is now expected that the executive board will accord its nod to release the next loan tranche in early January. These funds would help improve the foreign exchange reserves held with the State Bank of Pakistan.

1/4 The Monetary Policy Committee (MPC) decided to maintain the policy rate at 22 percent in its meeting today. See https://t.co/hmLGPgsZq3#SBPMonetaryPolicy pic.twitter.com/GLMsRZbEXM

— SBP (@StateBank_Pak) December 12, 2023

Further, SBP said that the first quarter economic results were in line with the committee's expectations, reflecting a "moderate economic recovery".

Initial estimates, the MPC said, showed that the Gross Domestic Product (GDP) grew by 2.1% year on year in the first quarter. This was up from 1% in the same period last year. Recovery in agriculture was the major driver of this growth, with manufacturing recording a moderate recovery. Large-scale manufacturing ended in the positive region after contracting in the previous four quarters. However, it noted that the services sector was quite subdued.

This was also reflected in improved sentiments of recent consumer and business confidence surveys.

"Taking stock of these developments, the committee assessed that the current monetary policy stance is appropriate to achieve the inflation target of 5%-7% by end-FY25," it said.

However, the committee stressed that their assessment depended on continued fiscal consolidation and the timely arrival of planned external inflows.

It noted that during the first quarter between July-October of the fiscal year 2024, the country managed to narrow its current account deficit by 65.9% year on year to $1.1 billion thanks to a dip in imports and a slight increase in exports, with rice a major contributor.

October to November also saw a better inflow of remittances from overseas Pakistanis than last year. The central bank attributed this improvement to greater transfer of funds through formal channels in the wake of the interbank and open markets reaching near parity in rates.

However, the central bank said that weak inflows and debt repayments have impacted its foreign exchange reserves of the US dollar. However, the committee hoped the release of the next tranche of the SBA would help improve this situation.

On the revenue front, the Federal Bureau of Revenue recorded a 29.6% increase in tax collection, while non-tax revenues had also increased following a substantial increase in the petroleum development levy.

"The MPC emphasised the importance of continuing the ongoing fiscal consolidation, preferably through broadening the tax base and restraints on non-essential expenditures, for achieving macroeconomic stability," it said.