The continuing travails of the Pakistan economy may have been the result of an unlucky combination of events – Covid 19, devastating floods in 2021 and 2022, war in Ukraine – but its structural weaknesses and lack of resilience have been visible for many years. These have manifested themselves in low productivity in both agriculture and industry, low levels of investment, poor human resources, and with low tax revenues and stagnant exports, high levels of internal and external indebtedness and, hence, an inability to withstand shocks.

However, notwithstanding the sui generic nature of Pakistan’s problems, several other economies, could also be classified as currently facing similar difficulties following the Covid 19 pandemic and impact of the war in Ukraine. In these economies, too, output growth has slowed, public debt has increased and inflationary pressures have ballooned.

Side-by-side, public services have been put under severe pressure, both as a result of increasing Covid and non-Covid-related demand for health spending and declining resource availability for financing other public services and for maintaining essential physical and non-physical infrastructure.

To take some recent examples at random, the most noteworthy economies are Bangladesh and Sri Lanka in South Asia, Egypt and Nigeria, two oil-exporting African countries and Argentina and Chile, two middle-income economies in Latin America, plus many small economies in Africa, Asia and Europe. All of them are under IMF tutelage at present.

Moreover, the evidence suggests that unless radical measures are taken to stimulate growth and increase spending on public services these countries face years of stagnation and growing social distress. An IMF programme is unlikely to deliver those radical measures.

The countries mentioned here are of all shapes and sizes, at different levels of development, natural resource -producers and non-natural resource-producers, and geographically spread across the world.

Indeed, if one casts one’s eyes on the global economy as a whole, the two decades since the beginning of the Millennium indicate that even the G7 economies have lost the momentum that characterized their economic performance in the pre-2000 years.

In their case, it seems that the ending of the so-called dot.com boom in 2001 and the impact of the financial crisis of 2007-08 had already produced a huge and lasting effect on their ability to overcome the financial instability and resultant decline in output growth.

In fact, even sharply lower interest rates and a flood of liquidity provided by QE have failed to stimulate their economies since the financial crisis. On the contrary, rising levels of public debt are affecting their creditworthiness including, incredible as it may seem, that of the US.

Thus, both developing and developed countries appear to have found that although new technology and the bigger markets that globalization has facilitated are positive phenomena, overall productivity growth, the main driver of long-term prosperity, has nevertheless slowed to a crawl and rent-seeking has become rife.

At the same time, income distribution has become heavily skewed in favour of the already well-off who own assets, while the impacts of environmental degradation and a warming climate are generating massive new dangers not only for them but for the world as a whole.

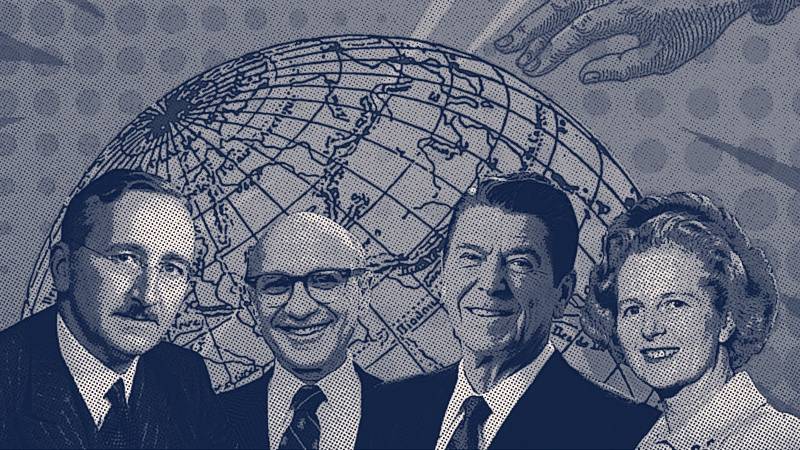

The question therefore arises as to how and why so many countries have simultaneously begun to perform so poorly. Why has economic management has become so difficult in these countries? Are the policies poorly designed or is the neoliberal, private sector, market-driven model of growth/development that became the norm in the 1980s and became part of the World Bank/IMF toolkit no longer fit for purpose?

Ever since the modern state became de rigueur as a unit of decision-making governments have taken on responsibility not only for providing security to people under their jurisdiction from internal and external threats but also to promote prosperity in their societies.

Since the later years of the 19th century managing the economy has become the core responsibility of governments and has entailed the establishment of an elaborate bureaucratic machinery with an array of functions, from security to education, public transport, roads, health services, old age pensions, the provision of child care and parks and museums.

Modern-day governments, unlike private enterprise, which is supposed to be exclusively in the pursuit of profits, have to confront an imposing array of trade-offs and choices, nearly always in the face of limited resources that are essentially limited to reluctantly-paid taxes and some borrowing that, too, is limited to what creditors think appropriate. They need an analytical framework, including economic modelling, and vast amounts of data and information with which to take their decisions. The schema within which these matters can be ‘objectively’ considered is provided by the precepts and analytical framework of Economics.

However, the intellectual and logical underpinnings for economic analysis are a mixture of objective reasoning plus a significant component of ideology, i.e. the ideas and preferences emanating from a particular segment of society, usually the ruling elite plus the intelligentsia. Their views become de facto mainstream via constant reiteration in schools and universities and repetition in the media. The ideas may, or may not, have universal application but their protagonists usually claim that they do.

In this respect, it needs to be stressed that Economics is not rigorous like a natural science, more a guide for common sense with a variety of subjective preferences thrown in. This is because economics deals with the essential unpredictability of human behaviour, the idiosyncrasies of national cultures and the onward march and uneven impact of technological progress on individual countries. Economics, even with its array of complex analytical tools, simply cannot create a framework that can take all this into account, be valid for all time and be applicable across the rich and poor worlds.

As is well known, economics as an intellectual discipline is roughly 150 years old, although Adam Smith’s An Inquiry into the Nature and Causes of the Wealth of Nations and David Ricardo’s The Principles of Political Economy and Taxation came out somewhat earlier, in 1776 and 1817 respectively and influenced later thinking significantly. These writings were in the tradition of political philosophy that became a subject of enquiry in the 19th century with the advent of the industrial revolution in Britain but also dealt with matters that did not lie squarely within the ambit of political ideas, such as money, taxes, prices and trade.

Approximately contemporaneous with Smith and Ricardo were other political philosophers such as Locke, Hobbes, James and John Stuart Mill, Hume and Bentham. Their contributions and fame rests on their pronouncements on social and political issues, including how society should govern itself, and the pros and cons of popular participation in government embodied in the notion of democracy.

We have to wait until the end of the 19th century for the first systematic analysis of economic problems with the publication of Alfred Marshall’s Principles of Economics through which he is credited not just with the creation of the ‘marginalist’ school but with an analysis of the conditions, such as competitive markets, that are required to satisfy equilibrium, partial and general, in a country’s economy.

Economic equilibrium in this context means optimality in the use of resources, whether in individual sectors or in the economy as a whole. Assumed without qualification is that virtually everything that happens in an economy is done by the private sector driven by the profit motive.

The state is there merely as an enabler providing a platform of laws and regulations to enable individuals and corporate bodies to carry out whatever activities they choose to pursue without hindrance.

Although the ideas of Marshall were a major advance on what had been discussed before and enabled the marriage of political economy with the theory of the firm, consumer behaviour and the pursuit of utility maximization – signifying the birth of microeconomics - and Economics began to be described as a ‘science’ it was soon overtaken by events.

Following the end of World War I, the US economy, now the largest in the world, driven by new technology, such as railways and cars, and new methods of communication, such as the telephone and radio and powered by electricity, surged ahead of its European rivals. Its stock market enjoyed an extraordinary boom and share ownership created wealthy individuals at a scale unknown in human history.

But, in 1929 the US stock market crashed not only bankrupting countless individuals but bringing with it a prolonged downturn in the overall economy with unemployment reaching 30 per cent. The US Great Depression, as it came to be called, spread across the world as commodity prices collapsed and global trade flows dried up.

Economists now became preoccupied with the problems of boom and bust and it soon became evident that national economies were not only inter-linked through trade and capital flows but, more fundamentally, that there was no inherent or natural tendency for them to move towards equilibrium. Far from being self-correcting, these economies were prone to excess, either of investment or of consumption that had been financed by credit.

Such excesses began to occur with disturbing regularity often leading to prolonged downturns in investment and employment across the world. Economists now began to grapple with the phenomena of trade, or, business cycles, and how the resulting ups and downs in economic activity could be smoothed out.

At this point, Lord Keynes a British academic at Cambridge University, came up with the need for large-scale government intervention, via the budget, to counter the built-in tendency for national economies to be subject to the vagaries of the trade cycle.

Keynes was the author of numerous books, articles and pamphlets but his theories are best encapsulated in the book General Theory of Employment, Interest and Money that he published in 1936. Keynes was a polymath. He wrote about economic issues although by education he was a mathematician and he also dabbled in philosophy, most notably in his book Treatise on Probability. He was, above all, a humanitarian and rationalist.

In his writings on the need to stabilize economic activity he was acutely conscious of the need to mitigate the misery that unemployment created in society and was not unafraid to ask previously unasked questions, such as the role of the state in the economy, which he had done in the pamphlet The End of Laissez Faire. What Keynes said was that depressions that followed booms were the result of insufficient demand in the economy and, in sharp contrast to the prevailing wisdom of the time, could only be ended by the state borrowing funds and spending them on public works.

Thus, the idea of the active state as a central element in the management of the economy was born and became an essential sub-set in Economics under the heading ‘macroeconomics’.

Keynesian macroeconomics and the reconstruction following widespread destruction caused by World War II resulted in a long-lasting boom in the global economy that lasted from 1950 to 1980.

New technology and the rise of the welfare state – described by many observers as the golden age of capitalism – brought unprecedented prosperity not just in the developed countries but with some of the prosperity shared with the developing countries through trade and capital flows embodied in the rise of the TNC, the Trans National Corporation – an early form of globalization.

This long secular boom in the global economy however coincided with two oil shocks in 1973/74 and in 1979/80 that generated significant upward pressure on prices. These price pressures were further aggravated by US involvement in the Vietnam war and as the US authorities initially sought to contain them through monetary policy the higher interest rates created the unfamiliar phenomenon of ‘stagflation’ not only for policy-makers but for Economics as an explanatory schema. No one quite knew how to deal with stagflation at the policy level.

As a result, a great deal of economic research attempted to find a technical relationship between inflation and unemployment and came up with the concept of NAIRU or the non-accelerating inflationary rate of unemployment. In other words, simply to reduce inflation a significant part of the work force would need to become unemployed.

For the developing countries even the golden age of capitalism had a mixed impact. Higher growth in the developed countries generated new demand for commodities and for some manufactured items from the developing countries, principally textiles, but higher oil prices fed into higher domestic inflation and created balance of payments strains. Many developing countries ended up with higher domestic and external indebtedness creating new challenges for economic management in these countries. Some of the additional balance of payments pressures were reduced by the export of labour to the oil-producing countries – now flush with financial resources – but economic development gradually lost its focus in the affected developing countries. Instead, they became preoccupied with fighting the effects of internal and external instability. Both phenomena affected developed and developing countries alike. And in this fight the subject of Economics sought to go back to its classical roots, especially in the United States, and ‘neoliberal’ economics was born.