This week marks the end of the sixteen-month rule of the PDM coalition led by Prime Minister Shahbaz Sharif. The caretaker Prime Minister, Anwar ul-Haq Kakar, takes the baton from Sharif with the primary challenge of executing the elections in 90 days. However, as analysts have been speculating, the elections might be delayed, as the powers that be will want a favourable political and economic climate before the country heads towards polls.

Further, the restoration of the economy would serve as a significant electoral slogan that the PML-N aims to utilize to garner support during the upcoming election campaign. However, the ground reality presents a starkly different picture.

The tenure that commenced after the removal of Imran Khan in April of last year was marred by indecisiveness and delayed decision-making, largely due to conflicting views between Shahbaz Sharif and his elder brother Nawaz.

Additionally, the country underwent a challenging back-and-forth with the International Monetary Fund (IMF), but to the credit of the government, they managed to avert default and maintain a working relationship with the Fund.

However, in the final days of Sharif's rule and with the support of his allies, the military's influence became more pronounced and entrenched within the country's economic affairs.

Dar arrived with his familiar rhetoric of controlling the exchange rate and refusing to take dictation from the Fund. This sparked a nine-month-long game of cat and mouse with the IMF

The Timeline

The PDM government inherited a distressed economy that was facing a liquidity crisis at the end of a two-year economic boom cycle that began in 2020. The situation was exacerbated by the exogenous shocks of the Russia-Ukraine war, which inflated Pakistan's energy and food import bill. In addition, the government was also responsible for salvaging an ongoing IMF program, which former Prime Minister Imran Khan had been determined to derail as his removal from office became inevitable.

"Although in December last year, the PTI government had restarted the much-needed IMF programme, in February, faced with a vote of no-confidence, it opted to sacrifice the national interest for political interest and scuttled the IMF programme, giving unfunded subsidies for electricity and petrol, and another amnesty to business. It was this breaking of the IMF agreement that set in motion the upward trend in our default risk," Miftah Ismail wrote in his article for Dawn.

However, Miftah, who was also responsible for rescuing the economy as the incumbent Finance Minister, was unable to reverse the energy subsidies until several months later due to the fear of public backlash among his party.

Eventually, he was able to meet the IMF's demands which greenlighted a much-needed loan tranche in July 2022, with the amount being disbursed in the following month. Nonetheless, this marked the end of Miftah's brief tenure at the Q-block, as he was subsequently replaced by Ishaq Dar.

One of the prominent features of the PDM tenure was the implementation of import restrictions aimed at managing the liquidity situation. However, these restrictions came at the cost of suppressing economic activity in the country

Dar arrived with his familiar rhetoric of controlling the exchange rate and refusing to take dictation from the Fund. This sparked a nine-month-long game of cat and mouse with the IMF, during which Ishaq Dar had to concede on his demands while the Fund held firm on most of its primary requests.

"Dar's return in September 2022 was yet another piece of evidence that the prime minister wasn't really the one calling the shots, and it was an open secret that Dar was coming to Islamabad to represent the head honcho of the PML-N, Nawaz Sharif. While he did succeed in shouting down the dollar in the first few days of his return — in October, he claimed that the dollar would soon fall below Rs200 — Dar was less Batman and more like Joker returning to Gotham." writes Uzair Younus in his article for Dawn.

While all this was unfolding, Pakistan was hit by one of the most devastating natural disasters in its history, the 2022 floods, which exacerbated the country's economic woes.

Economic indicators

One of the prominent features of the PDM tenure was the implementation of import restrictions aimed at managing the liquidity situation. However, these restrictions came at the cost of suppressing economic activity in the country and leading to a decline in the GDP. The import-dependent large-scale manufacturing sector was particularly affected, with frequent plant closures observed.

Furthermore, these import limitations constrained the government's ability to generate additional revenue, as a significant portion of taxation is derived from duties on imported goods. On the expenditure side, the record-high interest rates resulted in more than 50 percent of revenues being allocated to debt servicing, leaving limited resources for public development projects.

Further, the country experienced consistent pressure on its exchange rate over the past sixteen months, leading to a depreciation of more than 50 percent. However, during the same period, the adherence to the controversial Dar peg resulted in significant losses for the national exchequer.

concise estimate, but those who have a good understanding of forex markets estimate a loss of around $5-6 billion (flows through illegal channels). Additionally, his useless bravado in context of IMF cost us much in terms of our standing and credibility (whatever was left 15/16

— Shahid Mehmood (@ShahidMohmand79) August 11, 2023

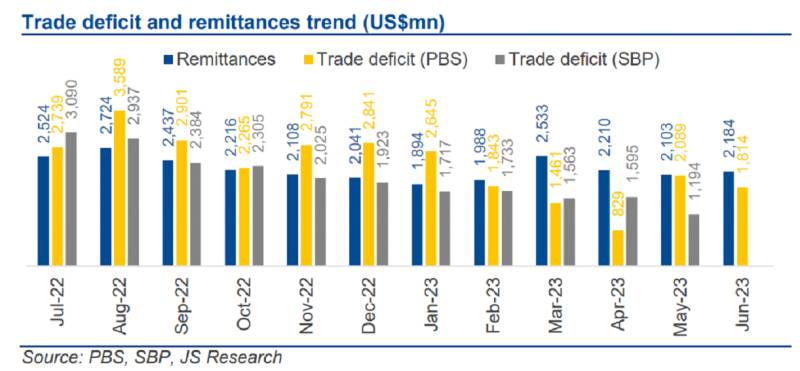

The pegging of the rupee also gave rise to an informal currency market, which facilitated activities such as currency hoarding, smuggling and the redirection of remittances through unofficial channels, resulting in a decline in reported figures.

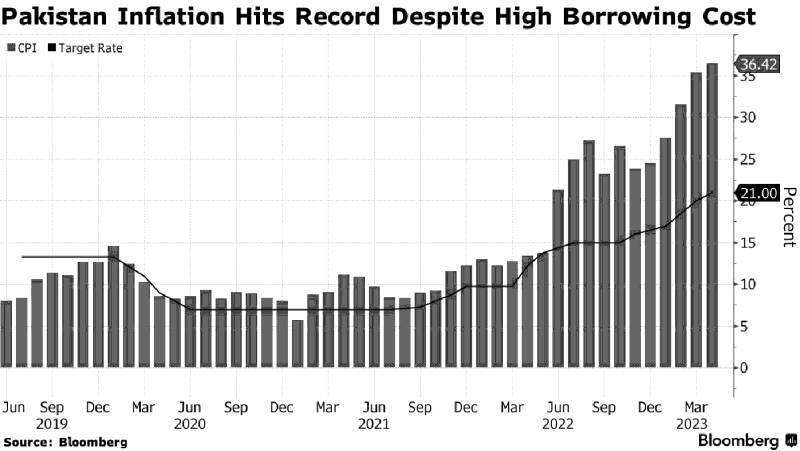

Simultaneously, when the PDM government took charge, inflation was on the rise due to global commodity shocks and the devaluation of the rupee. These pressures persisted throughout their tenure.

Therefore, to curb inflation, the interest rate was increased multiple times, eventually reaching 22 percent as of August 2023 compared to 12.25 percent in April 2022.

However, these measures proved inadequate as inflation levels exceeded 30 percent during the latter half of the outgoing government's tenure and remained above 20 percent for almost the entirety of its tenure, making the country the worst-performing economy in Asia in terms of price control, even falling behind the default-stricken Sri Lanka.

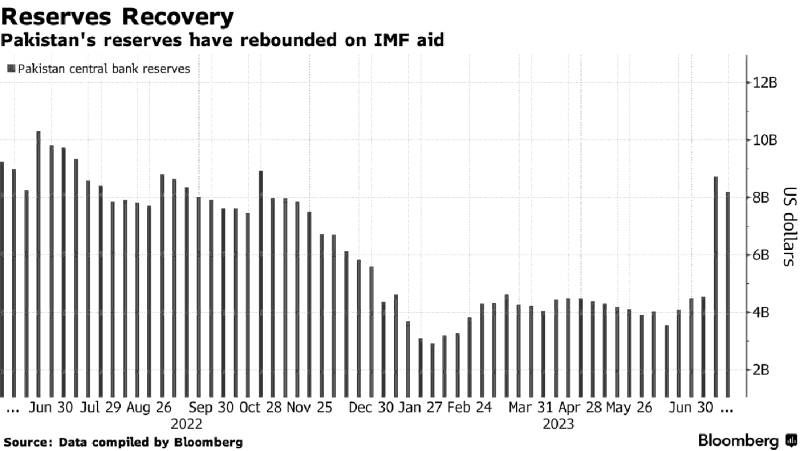

However, the PDM government's biggest economic challenge was to avoid default, which it successfully managed to do. While in the initial months of 2023, the country's reserves dropped below $4 billion, but following the latest standby agreement with the IMF and subsequent funding from Gulf states, they rebounded to levels closer to what was inherited initially.

However, during its final days in office, the Shahbaz-led government enacted a series of legislation, including the establishment of the Special Investment Facilitation Council (SIFC). The purpose of SIFC is to attract investments in multiple sectors and increase Foreign Direct Investment (FDI) to alleviate liquidity pressures. The controversial aspect of this and similar legislation arises from their potential to institutionalize the military's involvement in the economy, further strengthening their influence over the country.

Therefore, the coalition government during its tenure has few achievements to highlight and can only be credited for successfully avoiding an impending default. Apart from that, it leaves behind an economy that is in a worse state than when it initially assumed power.