Pakistan and the International Monetary Fund (IMF) are set to resume negotiations on Monday, 13th February. The meetings will take place virtually as the South Asian nation strives to restart the stalled $6.5 billion IMF bailout program initially signed in 2019.

The ongoing negotiations are for a $1.1 billion loan tranche that the country desperately needs to beef up its reserves, currently at below $3 billion, and to obtain the confidence of other bilateral/multilateral partners that have held back their funding.

Subsequent to this tranche, $1.4 billion still remains under the current IMF bailout program that ends in June 2023. Experts believe that given the precarious liquidity position of the country, the government would need to draw upon the remaining amount immediately after the ongoing negotiations are concluded.

Yet, everything is dependent on the successful completion of the ongoing review which if further delayed, for even a few weeks, would result in the country running out of forex reserves.

However, the government looks confident as it has started devising a plan to implement the pending IMF conditionalities. These include discontinuing the Kissan Package, removal of power subsidy to the export sector, beefing up tax collections through raising the general sales tax rate from 17 percent to 18 percent and introducing other tax measures including withholding taxes and excise duties on non-essential items like tobacco.

On the energy front, the Economic Coordination Committee (ECC) of the cabinet has approved a hike in electricity tariffs, while the government has also agreed on containing the circular debt flow to Rs 340 billion.

However, as days pass by, pressures on the dwindling reserves are mounting due to the goods stuck at the ports awaiting LC clearance, multinational companies queued up to repatriate profits back to their country of origin and most importantly, loan repayments and interest servicing obligations falling due.

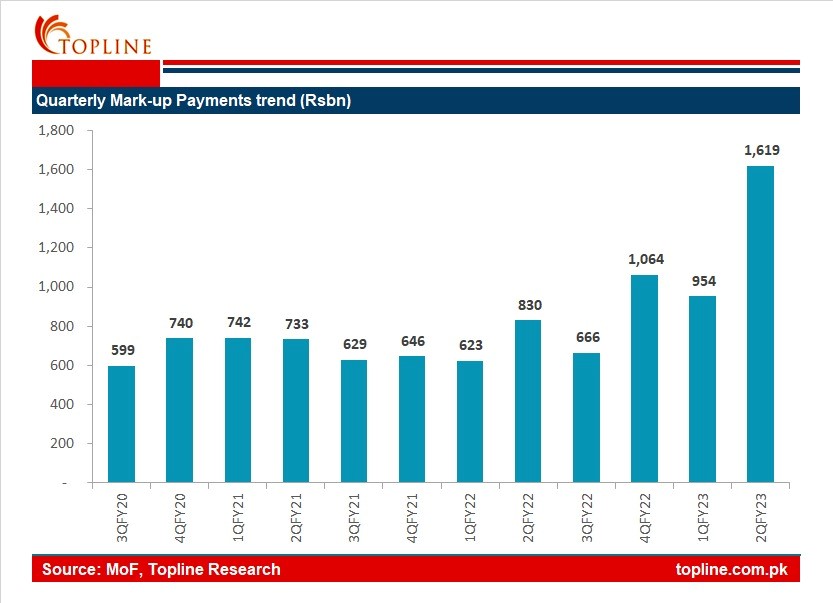

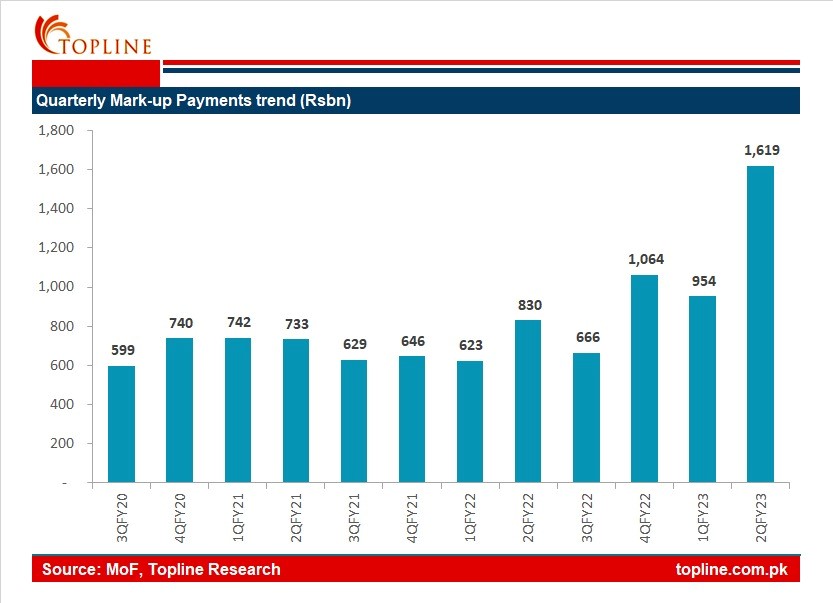

“Pakistan government interest payment in the last quarter almost doubled to Rs1.6tr. 60% of revenue goes in paying a markup on debt due to non-stop borrowing at this interest rate,” tweeted, o CEO Topline Securities, Sohail Mohammed.

https://twitter.com/ajpirzada/status/1624792469698232323

Pakistan’s IMF Addiction

Pakistan has entered 23 IMF programs since 1958, averaging a program almost every three years. This makes the country the most frequent visitor to the global lender with Argentina being a close second as it has sought the IMF’s help 21 times.

Explaining the reason behind Pakistan’s frequent visits to the Fund, Murtaza Syed, former governor of State Bank of Pakistan, posted, “A country typically goes to the IMF because it has run out of foreign exchange reserves. Foreign exchange reserves are used to pay for imports and to pay back money borrowed from foreign countries, the IMF and World Bank, and foreign residents. A country builds foreign exchange reserves either by (1) running a current account surplus (exports plus remittances exceeding imports) OR (2) attracting foreign currency inflows that exceed a current account deficit (reverse of surplus).”

“In our history, we have hardly ever run a current account surplus (unlike the Asian tiger economies). Sometimes these deficits have been very large (more than 3% of our economy). Whenever this has happened, we have typically had to go to the IMF shortly after. Our current account deficits occur because our exports have always been very weak. As a share of our economy, they are only around 10%; in successful countries, they are more like 20-30%,” he further added.

The former governor went on to explain the dynamics of our deficit which has caused a recurring liquidity problem. He pointed out that our current account deficits are not beneficial, as they do not come from investing too much, but rather from saving and consuming too little.

Our investment as a percentage of the economy stands at only 15%, far below the 30-40% of successful countries. Moreover, our consumption is even higher than that of the United States, which is a society hooked on consumption. This over-consumption causes an increase in imports and prevents us from being able to build up exports. As a result, we are not able to borrow funds from abroad to make investments that will generate future growth and bring in export revenues.

The ongoing negotiations are for a $1.1 billion loan tranche that the country desperately needs to beef up its reserves, currently at below $3 billion, and to obtain the confidence of other bilateral/multilateral partners that have held back their funding.

Subsequent to this tranche, $1.4 billion still remains under the current IMF bailout program that ends in June 2023. Experts believe that given the precarious liquidity position of the country, the government would need to draw upon the remaining amount immediately after the ongoing negotiations are concluded.

Yet, everything is dependent on the successful completion of the ongoing review which if further delayed, for even a few weeks, would result in the country running out of forex reserves.

However, the government looks confident as it has started devising a plan to implement the pending IMF conditionalities. These include discontinuing the Kissan Package, removal of power subsidy to the export sector, beefing up tax collections through raising the general sales tax rate from 17 percent to 18 percent and introducing other tax measures including withholding taxes and excise duties on non-essential items like tobacco.

On the energy front, the Economic Coordination Committee (ECC) of the cabinet has approved a hike in electricity tariffs, while the government has also agreed on containing the circular debt flow to Rs 340 billion.

However, as days pass by, pressures on the dwindling reserves are mounting due to the goods stuck at the ports awaiting LC clearance, multinational companies queued up to repatriate profits back to their country of origin and most importantly, loan repayments and interest servicing obligations falling due.

“Pakistan government interest payment in the last quarter almost doubled to Rs1.6tr. 60% of revenue goes in paying a markup on debt due to non-stop borrowing at this interest rate,” tweeted, o CEO Topline Securities, Sohail Mohammed.

https://twitter.com/ajpirzada/status/1624792469698232323

Pakistan’s IMF Addiction

Pakistan has entered 23 IMF programs since 1958, averaging a program almost every three years. This makes the country the most frequent visitor to the global lender with Argentina being a close second as it has sought the IMF’s help 21 times.

Explaining the reason behind Pakistan’s frequent visits to the Fund, Murtaza Syed, former governor of State Bank of Pakistan, posted, “A country typically goes to the IMF because it has run out of foreign exchange reserves. Foreign exchange reserves are used to pay for imports and to pay back money borrowed from foreign countries, the IMF and World Bank, and foreign residents. A country builds foreign exchange reserves either by (1) running a current account surplus (exports plus remittances exceeding imports) OR (2) attracting foreign currency inflows that exceed a current account deficit (reverse of surplus).”

“In our history, we have hardly ever run a current account surplus (unlike the Asian tiger economies). Sometimes these deficits have been very large (more than 3% of our economy). Whenever this has happened, we have typically had to go to the IMF shortly after. Our current account deficits occur because our exports have always been very weak. As a share of our economy, they are only around 10%; in successful countries, they are more like 20-30%,” he further added.

The former governor went on to explain the dynamics of our deficit which has caused a recurring liquidity problem. He pointed out that our current account deficits are not beneficial, as they do not come from investing too much, but rather from saving and consuming too little.

Our investment as a percentage of the economy stands at only 15%, far below the 30-40% of successful countries. Moreover, our consumption is even higher than that of the United States, which is a society hooked on consumption. This over-consumption causes an increase in imports and prevents us from being able to build up exports. As a result, we are not able to borrow funds from abroad to make investments that will generate future growth and bring in export revenues.