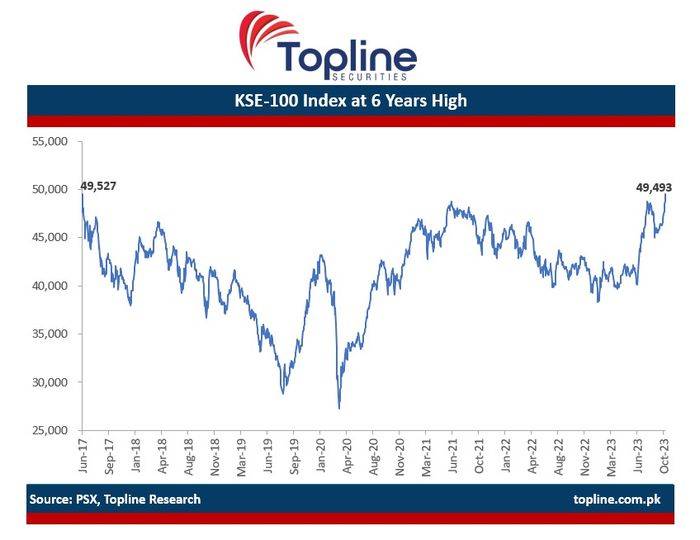

The Pakistan Stock Exchange (PSX) on Friday saw the bulls take charge, jumping by over 720 points to close out the week at a six-year high of 49.493.47 points.

The KSE-100 index on Friday capped off its 10th consecutive positive session, which saw it cross into the 49,000-point territory and continue that trajectory.

The market opened on Friday morning at 48,771.71 points and continued its recent trend of climbing upwards.

It gained 386.6 points and had already crossed the 49,000-point psychological barrier by midday, rising to 49,158.31 points.

By day end, the index had gained another 335.16 points to close the day up by 721.76 points. This was up by 17.60% compared to last year.

For the week ending October 13, the exchange gained a substantial 1999.9 points, up around seven percent from the previous week.

However, if we take a further step back, we see that an upward trajectory commenced at the beginning of September when the index was just at 45,002.42 points and in the six weeks since, it has managed to gain some 4,491.05 points.

The last time the index had climbed above 49,000 points was in June 2017 when it rose to 49,527 points. On Friday, however, the index came close to pushing past that marker as well, reaching an intraday trading high of 49,520.37 points.

Experts at Topline Securities suggested that record quarterly profits declared by companies for the first quarter of the fiscal year 2023-24, coupled with the continued appreciation of the rupee and the expectation that an upcoming review by the International Monetary Fund (IMF) will be completed smoothly contributed to the positive market sentiments.

The top market performers included K Electric (KEL), whcih saw nearly 135 million shares get traded as its share price rose by 9.83% or by Rs0.28 to Rs3.13.

It was followed by the Pakistan Telecommunication Company Ltd (PTC), which saw its share prices surge by 14.84% with some 48.4 million shares traded.

However, Cordoba Logistics and Ventures Limited (CLVL) saw the biggest jump in its share price on Friday, with prices rising by a full rupee, or 18.15%, to Rs6.51 with just 169,000 shares traded.

Rupee appreciates

Meanwhile, the rupee continued its trend of appreciating against the US dollar, rising by nearly a rupee on Friday.

In the interbank market, the rupee gained Rs0.96 or 0.35% against the dollar on Friday to appreciate from Rs278.58 on Thursday to close the week at Rs277.62.

Interbank closing #ExchangeRate for todayhttps://t.co/QIg5sty6p2#SBPExchangeRate pic.twitter.com/Bex2xUMoIx

— SBP (@StateBank_Pak) October 13, 2023

So far this week, the rupee has gained Rs5.07. Since September 5, it has gained Rs29.48.

Forex reserves

Data released by the State Bank on Friday showed that Pakistan's reserves remained stable at $13 billion, with only a reduction of just $700,000.

Total liquid foreign #reserves held by the country stood at US$ 13.03 billion as of October 06, 2023.

— SBP (@StateBank_Pak) October 13, 2023

For details https://t.co/WpSgomnKT3#SBPReserves pic.twitter.com/eV5q9paBeE

The data showed that for the week ending on October 6, 2023, reserves held with the central bank increased from $7.615 billion to $7.646 billion, an increase of $31.3 million.

At the same time, reserves held with private banks shrunk by $132 million, from $5.415 billion to $5.383 billion.