At first, neoliberal economics seemed to be an understandable response to the problem of chronic inflation and to the suboptimal use of resources that it appeared to cause in the developed economies. A succession of fiscal deficits had, indeed, added to liquidity and generated price pressures – with too much money chasing too few goods – but believers in neoliberalism ignored its cost push causes and conflated the need to tame inflation with the need to create a much smaller state, including through the privatization of publicly-owned assets and the reduction of social welfare spending.

However, belief in capitalism’s automatic market-driven stabilisers, on the one hand, and for minimal state intervention in the economy, on the other, created an intellectual aura, ostensibly in favour of simply more efficiency in the economy, whereby the competing objectives of social justice and even sustainable development were pushed into the background. In other words, the neoliberals claimed implausibly that maximizing efficiency by reducing taxes, easing regulations and privatizing publicly-owned assets would also take care of social justice and sustainable development.

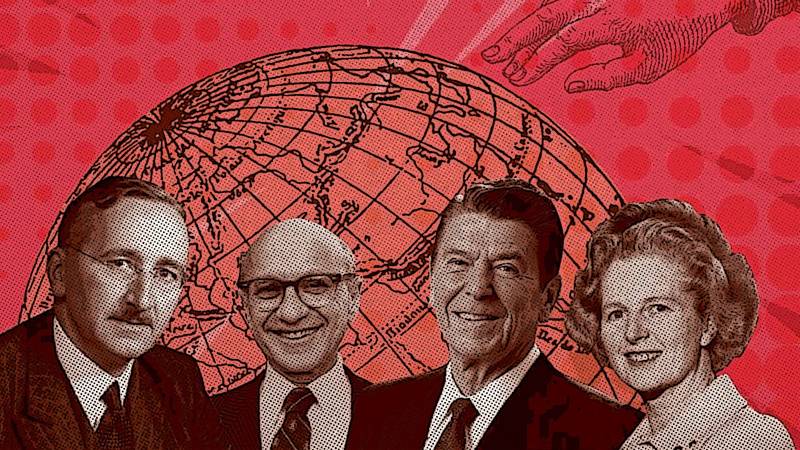

These ideas were then sold to the developing countries not only via the international development institutions, led by the IMF, but also through changes in university curricula. The progenitors and promoters of this climate of opinion were many but two names stand out: Friedrich Hayek and Milton Friedman, both of whom were rewarded with Nobel prizes, the former in 1974 and the latter in 1976.

Hayek, an Austrian economist, was the author of many books but his most important contribution to the revival of neoliberalism had been made in his book The Road to Serfdom, a polemic against socialism, that had been published in 1944. This was followed by The Constitution of Liberty published in 1960 and Law, Legislation and Liberty (published in three volumes between 1973 and 1979).

Milton Friedman, the creator of the Chicago school, had begun his attacks on the prevailing post-war Keynesian consensus in a series of books, such as Capitalism and Freedom in 1962, A Monetary History of the United States in 1963 and Free to Choose in 1980. Both Hayek and Friedman painted any form of state intervention in the economy as the beginning of totalitarianism while the latter was opposed, more remarkably, even to the civil rights movement in the US in the 1960s on the same grounds.

The neoliberal philosophy of a reliance on markets and a greatly reduced role of the state received a massive political boost with the election of Margaret Thatcher as Prime Minister of the UK in 1979 and of Ronald Reagan as President of the US in 1980.

Now, not only would neoliberal ideas be converted into policies but Economics as an intellectual discipline itself would undergo radical change with huge financial support in the form of neoliberal-supporting think tanks and the building of a new political consensus in favour of neoliberal ideas. Teaching in schools and universities also began to present neoliberal Economics as orthodox, while describing contrarian or other schools of thought as heterodox, non-rigorous and against individual agency.

And the principal vehicle chosen to promote this point of view was Econometrics or Mathematical Economics so that the ideas of the neoliberal ideologues could be presented as ‘science’. It is worth remembering here that in the 1980s and 1990s the majority of Economics Nobel Prizes were awarded to economists pushing neoliberal views making such views effectively non-controversial.

Long before the names of Ragnar Frisch and Jan Tinbergen, winners of the first Nobel prize in Economics in 1969, became known to their wider academic peers and to the general public, the French mathematician Augustin Cournot who lived between 1801 and 1877 had been grappling with price and cost curves and had been analysing the effects of oligopoly, duopoly and monopoly on competition.

However, until Alfred Marshall came along, Cournot had generated not even a token level of curiosity in these matters; it was political economy that continued to generate the majority of intellectual output on the subject. A hundred or more years later, Frisch’s and Tinbergen’s work attempted to use mathematics, primarily differential calculus, to understand trade cycles and to test other hypotheses with statistics and mathematics, including in economic planning. Simultaneously, Wassily Leontief, a Russian from Leningrad had been working on Input-Output Economics. He, too, was awarded the Nobel prize in 1973.

All three had been struck by the interdependence of the various sectors of the economy and the complexity of their interrelationships which, in their view could only be understood within a mathematical framework. The latter really was the Gordian knot which had to be cut before the structure of any economy could be broken down to yield enough useful information on how the full economy worked to serve as a basis for policy recommendations. Leontief’s solution was to use matrix algebra to understand how an economy functioned at the aggregate level and to trace the effects of change in any one variable on all the others.

It has to be said that econometrics has been, and undoubtedly remains, a valid technique to enhance understanding of the economy and of some of processes within it. However, it is only a technique.

Above all, it is a technique of simplification, perhaps even of over-simplification. It cannot in itself solve problems or give direction to economic policy. The result of any mathematical application can only be regarded as ‘raw material’ to which a much fuller analytical dialectic has to be applied. Without such an application the mathematical analysis leaves untouched the prevailing political and social ethos/context and even primary factors that give rise to cultural preferences ab initio and the profound impact they have on consumer and corporate behaviour and on the political process. Econometrics thus should be regarded as subordinate to political economy and to the relative power and, therefore preferences, of different economic agents in any society.

Keynes understood this very well as he conveyed to Tinbergen: “Am I right in thinking that the method of multiple correlation essentially depends on the economist having furnished a complete list of causes. For example, suppose three factors are taken into account in any calculation. If there is a further factor, not taken into account, then the method cannot discover the relative importance of the first three. In that case, the method is only applicable where the statistician can have beforehand a correct and complete list of all significant factors”. Tinbergen’s response is not known.

Notwithstanding such misgivings, the use of mathematics in economic analysis has continued apace. Some have called this ‘physics envy’ in that economists, mostly neoliberal, have sought to elevate the importance of their work by pretending that it is a science and its methodology is comparable to, if not on par with, natural science.

But, in the process, many fundamental areas of political economy have been relegated into the background. In this respect the areas of greatest neglect are the theory of value, the determination of factor rewards and the treatment of market failures, monopolies and externalities, all questions that are fundamental to understanding the functioning of society. It is now accepted that one of the cardinal sins of econometrics has been to create the impression of precision in relationships within an economy when in fact nothing of the kind exists in real life.

Looking at the world today, the areas that underlie the massive problems of today, such as the inherent instability of markets, the persistence of poverty, the problem of free ridership and rise of inequality and widespread environmental degradation are not considered to be part of mainstream economics but regarded as part of the political process.

But, in reality, even to understand the practical relevance of neoliberal ideas on their own terms there can be no escape from the precepts of political economy, and mathematical economics with its supposed rigour is of little help. It has to be stressed, too, that society does not function with efficiency alone; it needs to subsume efficiency within a pursuit of prosperity that is, in turn, qualified by the objectives of social justice and the sustainability of earth’s natural systems. Economics, as an intellectual discipline, is ultimately a study of society that must reflect this tripod of objectives.

The subject cannot simply be reduced to being a branch of applied mathematics in the pursuit of rigour in which the only policy choices available are fiscal consolidation, lower taxation, privatization, some action against monopolies and a sharp curtailment of the role of the state.

But no amount of rigour in these areas can be a substitute for devising an analytical framework that enhances our understanding of the trade-offs involved in policy decisions that give due importance to equity in society.

If we look at the broad sweep of ideas over the previous 150 years, Economics has essentially reacted or responded to the pressures/conflicts building up in society. But, it is also the case that the reacting and responding has been in the hands of those who were not, in general, disinterested observers but came with the baggage of their own interests and prejudices. It cannot therefore be put on par with the development or evolution of the natural sciences where verifiable knowledge was the method that came to be used across the whole world.

Our understanding of society cannot follow the same path exactly but it can distinguish between objective reality and ideology masquerading as science. The resurgence of neoliberalism since the 1980s only reflects reality in part, say, for example, inflation, but more ideologically-driven perceptions, for example, belief in the alleged benefits of markets and a small state have proved to be chimeras. Who can deny that when phenomena like monopoly, market failure and externalities have appeared, regulating such phenomena has proved to be largely ineffective.

Furthermore, neoliberalism tends either to ignore the existence of inequality and deprivation and unequal access to opportunity or glibly asserts that the efficient use of resources will eventually tackle them.

In confronting now, this supposedly ‘new’ framework for Economics and the need for states or governments to re-examine their responsibilities, like the neoliberals, we too, must return to fundamentals. The fundamentals now should not be the fundamentals of the neoliberals, which are that all change is, or should be, driven by markets and the private sector, but of a new social contract that is based upon a new relationship between the state and the citizens that does not reduce social justice and the future of the planet to a side-show.

An ideal system obviously would seem to be a mirage but ethically there can nonetheless be many equally acceptable systems. Indeed, even the neoliberals do not regard their own prescriptions as permanently valid as they have happily accepted the huge increase in public debt round the world in the wake of the 2008 financial crisis and 2020 Covid pandemic.

In her book Freedom and Necessity: An Introduction to the Study of Society, the Cambridge economist Joan Robinson quotes Mao Ze Dong: “Where do correct ideas come from? Do they drop from the skies? No. Are they innate in the mind? No. They come from social practice.” In taking this statement further we, too, must return to the old classical arguments regarding the origin of ideas that explain the creation of value and how the three factors of production, land, labour and capital, are actually rewarded in creating this value. To use a rather clumsy neologism we must now become neo-neoliberals.