The Pakistani stock exchange (PSX) has experienced an extended rally in recent weeks, with the KSE-100 index surpassing the 56,000 points mark, the highest it has been in around six years. However, the driving forces behind this surge do not necessarily indicate a significant increase in economic activity or a macro-level turnaround. Instead, it appears to be a combination of market sentiment and the mechanics of the stock market that have contributed to the recent surge.

The devaluation of the rupee over the past four weeks indicates that dollar liquidity remains challenging. Broader economic data on growth, exports, and employment reinforces the notion that the stock market is not a reliable indicator of an economy's overall health.

The Rally and Bond Yields

Before delving deeper into the performance of the stock market, it is necessary to familiarise ourselves with a few technical terms that can help us better understand what is happening at the country's bourse.

The KSE-100 index is essentially a total return index, meaning that its value is derived from not only the stock prices but also the income generated by the stocks, particularly dividends.

While the index value has surged, stock prices have been at historic lows. This essentially means that the surge in index value is driven by high corporate profitability, which has not transpired into stock prices due to investors being wary of the country’s dicey economic and political situation.

Additionally, another market that has been at the forefront of the recent shift in sentiment is the bond market, where debt securities are traded. Unlike in equity markets, where participants acquire ownership through buying shares in a company, bonds are essentially promises for repayment of principal at a later date, along with the payment or accrual of interest.

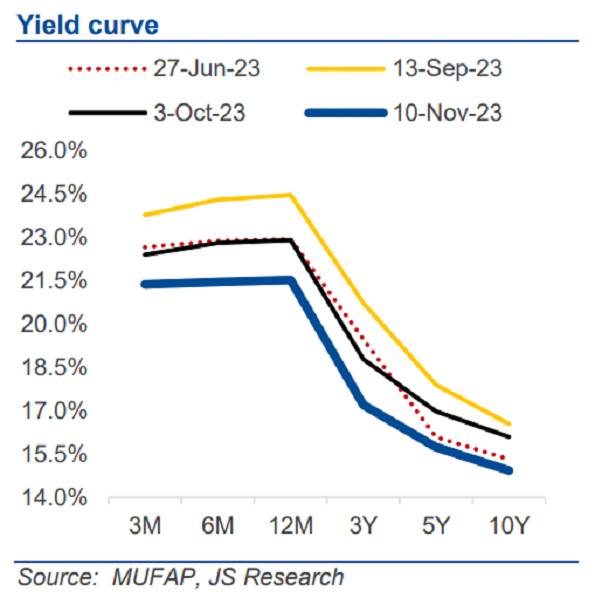

The yield curve

The yield curve is a graphical representation of the yields, or interest rates, of bonds with different maturities. It plots the relationship between the interest rate on the vertical axis and the time to maturity on the horizontal axis.

A normal, upward-sloping yield curve typically indicates that longer-term bonds have higher yields compared to shorter-term bonds. This reflects the market's expectation of increasing interest rates over time as compensation for holding bonds for a longer duration.

An inverted yield curve occurs when shorter-term bonds have higher yields than longer-term bonds. In other words, it is a downward-sloping yield curve. This phenomenon can happen when market participants start anticipating a decrease in interest rates in the future.

The inverted yield curve is often viewed as a potential warning sign of an economic slowdown or even a recession. However, in Pakistan's case, the inverted yield curve has historically been a lagging indicator pointing towards a shift from a period of economic slowdown to recovery.

Pakistan’s bond markets are dominated by government securities, such as Treasury bills and Pakistan International Bonds (PIBs). Typically, investors expect a higher interest rate for longer-term bonds due to its greater uncertainty. However, in recent months, the rates on these bonds have been lagging behind the returns on short-term bonds.

The reason for this is that market participants are expecting an interest rate cut in the near term, which results in lower returns on long-term investments. This sentiment was further reinforced by the recent PIB auction, which witnessed a high level of participation in fixed long-term securities.

"Bond yields are lower than expected due to the market anticipating that interest rates have reached their peak. Additionally, there has been a scarcity of bond supply. However, the pace and quantum of monetary easing will primarily rely upon forex reserves and US dollar liquidity over the next few months," remarked Mustafa Pasha, the Chief Investment Officer at Lakson Investments.

Big fall in Pakistan bond yields signal market now expecting a rate cut may be sooner than expected. And also at a faster pace than earlier expectations

— Mohammed Sohail (@sohailkarachi) November 9, 2023

Yesterday, the PIB auction witnessed massive participation, and that too at lower yields

3 year PIB yield is already down…

The question, however, remains. What does this have to do with the stock market?

The dividend yield of stocks is often compared to the bond yields, particularly the 12-month, 3-year, and 5-year yields, as they are considered the most comparable asset class in terms of returns. So, if the returns generated from one of the asset classes fall, investors might be prompted to opt for the other one.

As per an analysis by Amreen Soorani, Head of Research at JS Global Capital, “An inverted yield curve prevailing since 2QCY22 has dispersed the spread (difference) trend between D/Ys (dividend returns) and yields of various tenors (bond returns). The declining yields have already led to an average price performance of 17% in high D/Y stocks in the past one month.”

The analysis further states that while spreads will normalize during the monetary easing cycle, select stocks have the potential for further capital gain. Additionally, their recurring dividend yields are expected to closely align with longer-term bond yields.

Lastly, does that mean that the stock market rally will continue?

As per Pasha, “The extended rally may have more potential than initially anticipated, as many institutional investors, particularly in the insurance sector and mutual funds, have available liquidity that is currently invested in treasury bills. In the past, these players have allocated a larger portion of their portfolio to equity markets compared to their current holdings. Consequently, a strategic shift in their investment approach could also contribute to prolonging the rally.”

The Economy

The stock market might be performing well, but the overall economy is not. Persistent high inflation has resulted in suppressed demand and decreased economic activity. Furthermore, the employment figures paint a grim picture, and exports have also decreased.

Due to significant repayments coming due in the second half of the fiscal year, Pakistan needs another International Monetary Fund (IMF) program next year.

The short-lived rupee appreciation has been followed by continued depreciation against the US dollar despite the country recording a current account surplus and stable remittances.

This depreciation is primarily due to exporters hedging their receipts by selling in the forward market, resulting in limited available volumes for importers to make payments.

Adding to the concerns, a recent report from Moody's labels Pakistan as one of the most vulnerable economies in South Asia when it comes to a balance of payment crisis.

This accurately summarizes the current state of the economy, and relying solely on one indicator might not be a wise decision.