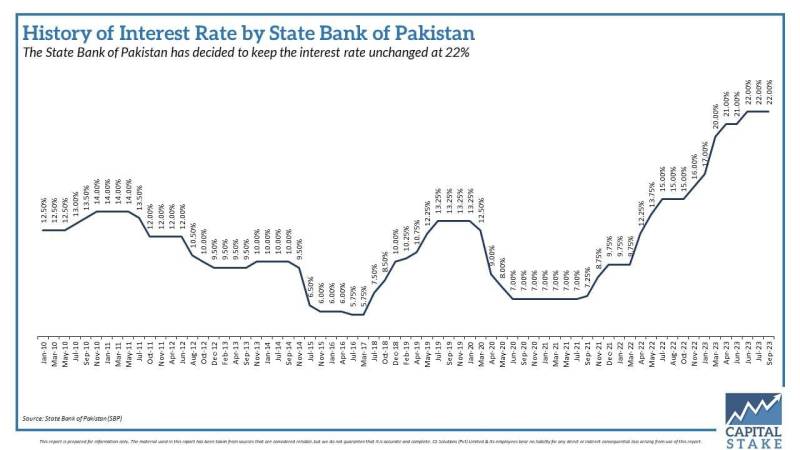

The State Bank of Pakistan Thursday decided to keep the interest rate in the country unchanged at 22 percent, citing the narrowing of the gap between the interbank and open market exchange rates.

In a statement issued by the central bank, it said that its Monetary Policy Committee met on Thursday. The committee, it said, noted four key developments in the local economy since its last meeting in July.

First, it said that the agricultural outlook of the country had improved, based on the latest data on cotton production. It said that better input conditions had resulted in healthy vegetation of other crops, satellite data indicated.

Past concerns related to floods have subsided, and cotton arrivals have almost doubled from last year.

Second, it said that global fuel prices have been rising in recent weeks and are currently hovering over $90/barrel level, which could impact fuel prices at home. Though at home, it noted that there had been a slight uptick in imports of petroleum products.

Third, the statement said that the current account posted a deficit of $809 million in July after remaining in surplus for the last four months of the previous fiscal year. The central bank said that the deficit partly reflected the impact of the recent ease in import restrictions.

The MPC noted that overall, imports are expected to remain constrained, supported by the favourable trend in non-oil commodity prices, moderate domestic demand and improved cotton production.

The committee expected the country's current account deficit to remain within its projected range for FY24.

Lastly, it said that the administrative and regulatory measures taken by the government to improve the availability of essential food commodities and curb illegal activities -- especially in the foreign exchange market -- have begun to yield results.

"This has helped in narrowing the gap between the interbank and open market exchange rates.

The committee will continue to monitor inflation and will take action to maintain price stability.

The MPC also stressed "maintaining a prudent fiscal stance to keep aggregate demand in check. This is necessary to bring inflation down sustainably and achieve the medium-term target of 5 – 7 percent by end-FY25."

The monetary policy committee further assessed that domestic demand will remain contained due to the impact of monetary tightening and envisaged fiscal consolidation.

On inflation, it said that the reduction in inflation was lower than expected due to

the surge in global oil prices and their subsequent impact on energy prices.

The committee, however, expected inflation to increase significantly in September due to the base effect and the adjustment in energy prices.

"It is expected that inflation will subsequently decline in October and maintain its downward trajectory from thereon."