Pakistan’s economy has been performing poorly during the rule of two democratic governments. The economic growth rate remained abysmally low except in the last year. This happened because the PML-N focused on infrastructure projects which boosted the growth rate in the last year. The same trend is expected in the ongoing fiscal year. However, both the PPP and PML-N can be held responsible for not undertaking structural reforms which would put the economy on a sustainable path.

It is unfortunate that when we do talk about economic challenges we are still narrowly focused on corruption, public debt, taxation, and balance of payments. What many people don’t get is that we need to understand that the root of many economic problems is a lack of private sector investment in the economy. Why can Pakistan not mobilize domestic and foreign investment and how does this hold us back?

Macroeconomics 101

In macroeconomics 101, every student studies the measurement of national output: Y=C+I+G. C is for consumption, I stands for investment, and G is government expenditure. We can talk about C and G later. In Pakistan, unfortunately, there is scant discussion on the low level of private sector investment in the country.

Why do we need investment? A country needs a higher level of investment to add more productive units to produce goods and services, to modernize existing products, services, factories, plants and farms to improve the quality of goods and services, and to create more jobs for people. A country like Pakistan needs substantive investment to transform itself from a factor-driven economy to an efficiency-driven economy and consequently to become a knowledge- and innovation-driven economy. All developed economies have taken this path.

How we are doing

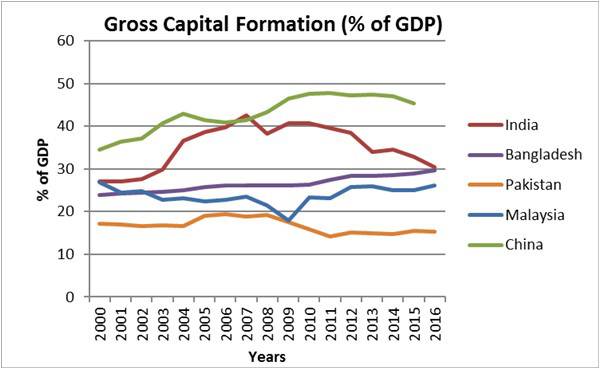

Pakistan is not doing well as our investment-to-GDP ratio has been continuously dropping from 20% in the mid-2000s to less than 15% in recent years. During this same period, China’s investment-to-GDP ratio was between 40% to 45%; India’s was around 30% to 40%; Bangladesh’s was around 25% to 30%; and Malaysia’s was between 20% to 30%.

Some people may argue that even consumption and government expenditure contribute to higher national output. But we need to understand that when economies are in the early stages of development, they need major investment to improve productivity, exports, quality of services, and job creation. The graph shows what this looks like in the countries mentioned from 2000 to 2016.

Pakistan’s domestic investors have not been investing in productive sectors for various reasons. First, the real estate market has become a very lucrative option if you want returns on investment. Many powerful players are involved in this sector which has kept it out of the tax net for so long. When the government tried to impose a capital gains tax, many such investors moved their investments to Dubai instead of investing in productive sectors of the Pakistani economy.

Second, Pakistan’s state (including bureaucracy and judiciary) is not oriented towards adopting the market economy model. They create numerous hurdles to restrict even legitimate profit-making by the private sector.

Third, state investment in research and the private sector’s competitiveness complement each other. Unfortunately, Pakistan has been providing rents to many powerful industrialists in the form of subsidies and tax incentives, but the country has not been investing in science and technology which can generate spillovers for the private sector.

According to World Bank data, Pakistan’s total research and development expenditures, by both the public and private sectors was around 0.3% of GDP while the same number is around 1% for India, Malaysia, Turkey, Brazil, and South Africa.

Fourth, foreign and domestic investors give key importance to contract enforcement regimes in a country. Pakistan’s judicial system treats both domestic and foreign investors badly for the commercial litigation that has been deterring investment in the country. Pakistan has a long history of either blocking buildings mid-way or quashing agreements with foreign investors through the judiciary as we saw in the cases of the Reko Diq gold mines, Rental Power Plants, and other privatization transactions.

Solutions

If we want to prioritize investment in the country, the very first thing we have to do is develop the state capacity to steer the market economy in the country. There is a need to reorient politicians, the bureaucracy, regulatory agencies, and the judiciary to support private investment and of course to make the necessary effort to safeguard consumer interests as well.

Second, Pakistan needs to enhance the level and quality of funding for research and development. Both defense and civil government organizations need to generously support universities in carrying out research for them. In the United States, for example, the National Science Foundation, National Institute of Health, Department of Energy, and Defense Advanced Research Projects Agency provide massive funds to universities to carry out basic and applied research. Subsequently, many modern technologies such as robotics, Global Positioning System, Multitouch screens, driverless cars and renewables have indeed emerged out of such research projects.

Third, we need to make our cities engines of growth. That can happen through devolution, professionalization of local governments, and addressing regulatory bottlenecks. Fourth, we have to promote investment in the construction industry to encourage vertical growth in cities that will enhance affordability in cities as well as discourage speculative investment in suburban housing schemes.

Fifth, greater efforts are needed to encourage young people to start entrepreneurial ventures. Recently, IGNITE, PITB, and LUMS among others have been doing a lot of work. The scale is still limited though. There is a need to put more efforts and resources into incentives for young people to start entrepreneurial ventures.

Sixth, there is no doubt that transparency in foreign investment agreements is needed. However, once such investments have been made and investors are complying with the initial agreement, the state should not subvert such contracts.

Without undertaking the suggested reforms, Pakistan will continue to suffer due to a low level of investment and would, unfortunately, remain unable to resolve challenges in areas such as public debt, taxation, balance of payments, and low productivity. This is the time to recognize that low investment is holding Pakistan’s economy back.

The writer is a public policy advisor and research fellow with an interest in public-sector governance, competitive cities, and entrepreneurship. He tweets @navift

It is unfortunate that when we do talk about economic challenges we are still narrowly focused on corruption, public debt, taxation, and balance of payments. What many people don’t get is that we need to understand that the root of many economic problems is a lack of private sector investment in the economy. Why can Pakistan not mobilize domestic and foreign investment and how does this hold us back?

Macroeconomics 101

In macroeconomics 101, every student studies the measurement of national output: Y=C+I+G. C is for consumption, I stands for investment, and G is government expenditure. We can talk about C and G later. In Pakistan, unfortunately, there is scant discussion on the low level of private sector investment in the country.

Why do we need investment? A country needs a higher level of investment to add more productive units to produce goods and services, to modernize existing products, services, factories, plants and farms to improve the quality of goods and services, and to create more jobs for people. A country like Pakistan needs substantive investment to transform itself from a factor-driven economy to an efficiency-driven economy and consequently to become a knowledge- and innovation-driven economy. All developed economies have taken this path.

How we are doing

Pakistan is not doing well as our investment-to-GDP ratio has been continuously dropping from 20% in the mid-2000s to less than 15% in recent years. During this same period, China’s investment-to-GDP ratio was between 40% to 45%; India’s was around 30% to 40%; Bangladesh’s was around 25% to 30%; and Malaysia’s was between 20% to 30%.

Some people may argue that even consumption and government expenditure contribute to higher national output. But we need to understand that when economies are in the early stages of development, they need major investment to improve productivity, exports, quality of services, and job creation. The graph shows what this looks like in the countries mentioned from 2000 to 2016.

Pakistan’s domestic investors have not been investing in productive sectors for various reasons. First, the real estate market has become a very lucrative option if you want returns on investment. Many powerful players are involved in this sector which has kept it out of the tax net for so long. When the government tried to impose a capital gains tax, many such investors moved their investments to Dubai instead of investing in productive sectors of the Pakistani economy.

Second, Pakistan’s state (including bureaucracy and judiciary) is not oriented towards adopting the market economy model. They create numerous hurdles to restrict even legitimate profit-making by the private sector.

Third, state investment in research and the private sector’s competitiveness complement each other. Unfortunately, Pakistan has been providing rents to many powerful industrialists in the form of subsidies and tax incentives, but the country has not been investing in science and technology which can generate spillovers for the private sector.

According to World Bank data, Pakistan’s total research and development expenditures, by both the public and private sectors was around 0.3% of GDP while the same number is around 1% for India, Malaysia, Turkey, Brazil, and South Africa.

Fourth, foreign and domestic investors give key importance to contract enforcement regimes in a country. Pakistan’s judicial system treats both domestic and foreign investors badly for the commercial litigation that has been deterring investment in the country. Pakistan has a long history of either blocking buildings mid-way or quashing agreements with foreign investors through the judiciary as we saw in the cases of the Reko Diq gold mines, Rental Power Plants, and other privatization transactions.

Solutions

If we want to prioritize investment in the country, the very first thing we have to do is develop the state capacity to steer the market economy in the country. There is a need to reorient politicians, the bureaucracy, regulatory agencies, and the judiciary to support private investment and of course to make the necessary effort to safeguard consumer interests as well.

Second, Pakistan needs to enhance the level and quality of funding for research and development. Both defense and civil government organizations need to generously support universities in carrying out research for them. In the United States, for example, the National Science Foundation, National Institute of Health, Department of Energy, and Defense Advanced Research Projects Agency provide massive funds to universities to carry out basic and applied research. Subsequently, many modern technologies such as robotics, Global Positioning System, Multitouch screens, driverless cars and renewables have indeed emerged out of such research projects.

Third, we need to make our cities engines of growth. That can happen through devolution, professionalization of local governments, and addressing regulatory bottlenecks. Fourth, we have to promote investment in the construction industry to encourage vertical growth in cities that will enhance affordability in cities as well as discourage speculative investment in suburban housing schemes.

Fifth, greater efforts are needed to encourage young people to start entrepreneurial ventures. Recently, IGNITE, PITB, and LUMS among others have been doing a lot of work. The scale is still limited though. There is a need to put more efforts and resources into incentives for young people to start entrepreneurial ventures.

Sixth, there is no doubt that transparency in foreign investment agreements is needed. However, once such investments have been made and investors are complying with the initial agreement, the state should not subvert such contracts.

Without undertaking the suggested reforms, Pakistan will continue to suffer due to a low level of investment and would, unfortunately, remain unable to resolve challenges in areas such as public debt, taxation, balance of payments, and low productivity. This is the time to recognize that low investment is holding Pakistan’s economy back.

The writer is a public policy advisor and research fellow with an interest in public-sector governance, competitive cities, and entrepreneurship. He tweets @navift