On Tuesday, global ratings agency Fitch downgraded Pakistan's sovereign credit rating from CCC+ to CCC-, citing concerns about policy, high refinancing risks, critically low reserves, and the International Monetary Fund's (IMF) stringent conditions. This is the second such downgrade since October 2022, when Fitch first reduced Pakistan's rating from B- to CCC+.

Given that Fitch usually does not provide outlooks to countries with a CCC+ rating and below, the agency's downgrade reflects a worsening of the country's external, fiscal, and economic metrics over the last 12 months. Further, S&P Global has already reduced its long-term rating for Pakistan from B to CCC+.

What does the rating mean?

Issuer ratings reflect a sovereign’s capacity to meet its senior unsecured debt and debt-like obligations. These ratings take into account any external assistance that is expected to apply to all current and future issuance of senior unsecured financial instruments and contracts.

As per Fitch, the CCC- rating reflects substantial credit risk with a very low margin for safety and default being a real possibility.

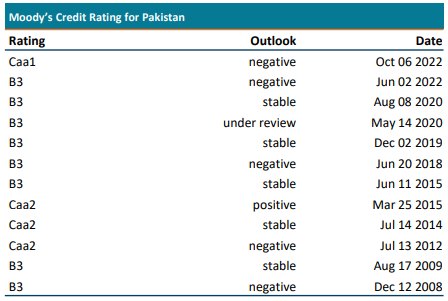

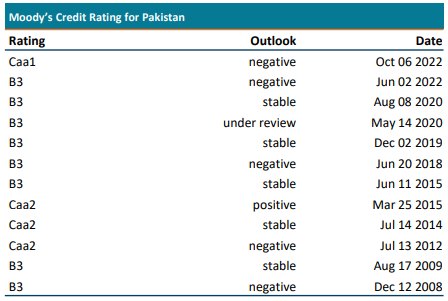

“The ratings refer to debt repayment capacity and normally deteriorate way before deliberation on restructuring starts. Once the restructuring is executed, the old bonds are withdrawn from the market and new bonds are introduced to be re-rated. Subsequently, the ratings are ascertained by evaluating multiple factors including the debt relief, fiscal position and the future outlook of the country,” Elena Duggar, Chair of Moody's Macroeconomic Board, stated in an IMF panel discussion held on October 2022.

Why has the rating deteriorated?

A downgrade in rating comes after the country’s foreign exchange reserves have fallen below $3 billion and the IMF tranche has still not been confirmed. These recent develop has further dented Pakistan’s ability to meet its external obligations.

Source: Fitch Ratings

“In a separate development, Moody's has shown concerns over Pakistan’s ability to secure external funding to meet its financing requirement for the next few years. They have stated that funding from the IMF is crucial and that delay in securing external funding will result in a further decline in reserves,” read a report by Topline securities.

Source: Topline securities

The Topline report further added, “In the next few months while the IMF program is being finalized and approved, there is a possibility that international rating agencies could further downgrade Pakistan’s rating, which will have far-reaching consequences. The government should proactively take the rating agencies on board with the regard to the IMF negotiations and its plans to steer the country towards a strong economic recovery.”

Given that Fitch usually does not provide outlooks to countries with a CCC+ rating and below, the agency's downgrade reflects a worsening of the country's external, fiscal, and economic metrics over the last 12 months. Further, S&P Global has already reduced its long-term rating for Pakistan from B to CCC+.

What does the rating mean?

Issuer ratings reflect a sovereign’s capacity to meet its senior unsecured debt and debt-like obligations. These ratings take into account any external assistance that is expected to apply to all current and future issuance of senior unsecured financial instruments and contracts.

As per Fitch, the CCC- rating reflects substantial credit risk with a very low margin for safety and default being a real possibility.

“The ratings refer to debt repayment capacity and normally deteriorate way before deliberation on restructuring starts. Once the restructuring is executed, the old bonds are withdrawn from the market and new bonds are introduced to be re-rated. Subsequently, the ratings are ascertained by evaluating multiple factors including the debt relief, fiscal position and the future outlook of the country,” Elena Duggar, Chair of Moody's Macroeconomic Board, stated in an IMF panel discussion held on October 2022.

Why has the rating deteriorated?

A downgrade in rating comes after the country’s foreign exchange reserves have fallen below $3 billion and the IMF tranche has still not been confirmed. These recent develop has further dented Pakistan’s ability to meet its external obligations.

| Serial | Key drivers for downgrade | Description |

| 1 | Further Worsening in Liquidity, Policy Risks | The downgrade reflects further sharp deterioration in external liquidity and funding conditions, and the decline of foreign-exchange (FX) reserves to critically low levels. |

| 2 | Reserves Under Pressure | Liquid net FX reserves of the State Bank of Pakistan were about USD2.9 billion on 3 February 2023, or less than three weeks of imports, down from a peak of more than USD20 billion at end-August 2021. |

| 3 | Large Refinancing Risks | External public-debt maturities in the remainder of the fiscal year ending June 2023 (FY23) amount to over USD7 billion and will remain high in FY24. |

| 4 | CAD Declining, but May Widen Again | Pakistan's CAD was USD3.7 billion in 2H22, down from USD9 billion in 2H21. Reported backlogs of unpaid imports in Pakistan's ports indicate that the CAD could increase once more funding becomes available. |

| 5 | Difficult IMF Conditions | Shortfalls in revenue collection, energy subsidies and policies inconsistent with a market-determined exchange rate have held up the 9th review of Pakistan's IMF programme, which was originally due in November 2022. |

| 6 | Challenging Political Context | The IMF's conditions are likely to prove socially and politically difficult amid a sharp economic slowdown, high inflation, and the devastation wrought by widespread floods last year. Elections are due by October 2023, and former prime minister Imran Khan, whose party will challenge the incumbent government in the elections, earlier rejected an invitation by Prime Minister Shehbhaz Sharif to hold talks on national issues, including IMF negotiations. |

| 7 | Funding Contingent on IMF Program | Recent funding stress has been marked by the apparent reluctance of traditional allies - China, Saudi Arabia and the United Arab Emirates - to provide fresh assistance in the absence of an IMF programme, which is also critical for other multilateral and bilateral funding. |

Source: Fitch Ratings

“In a separate development, Moody's has shown concerns over Pakistan’s ability to secure external funding to meet its financing requirement for the next few years. They have stated that funding from the IMF is crucial and that delay in securing external funding will result in a further decline in reserves,” read a report by Topline securities.

Source: Topline securities

The Topline report further added, “In the next few months while the IMF program is being finalized and approved, there is a possibility that international rating agencies could further downgrade Pakistan’s rating, which will have far-reaching consequences. The government should proactively take the rating agencies on board with the regard to the IMF negotiations and its plans to steer the country towards a strong economic recovery.”