Pakistan has been grappling with economic challenges for nearly two years. However, in the past few months, there have been signs of a potential course correction, offering a glimmer of hope for the country's future.

The hope stems from multiple developments on the economic front. The International Monetary Fund (IMF) program seems to be on track with further funding in the pipeline. Consequently, the risk of another round of severe liquidity crisis remains low.

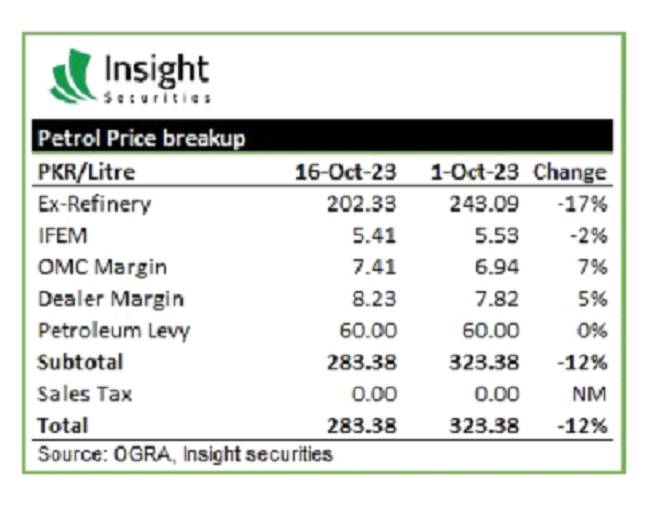

The resultant rupee appreciation, alongside the developments in the commodity markets, has meant that the public has been handed a massive relief in the form of the recently announced Rs40 petrol price reduction.

A similar pattern can be observed in the stock markets. Last week, the Pakistan Stock Exchange’s (PSX) KSE-100 index closed at a six-year high, nearing the 50,000 points benchmark.

While the feat achieved by the country’s bourse might indicate a massive recovery, experts caution against reading too much into it. They suggest that the underlying mechanics behind the surge in index value paint a slightly different picture.

Therefore, it is worth examining what has led to the index’s recovery and the risks to its sustainability.

Decoding the PSX Rally

The KSE-100 index is essentially a total return index, meaning that its value is derived from not only the stock prices but also the income generated by the stocks, particularly dividends.

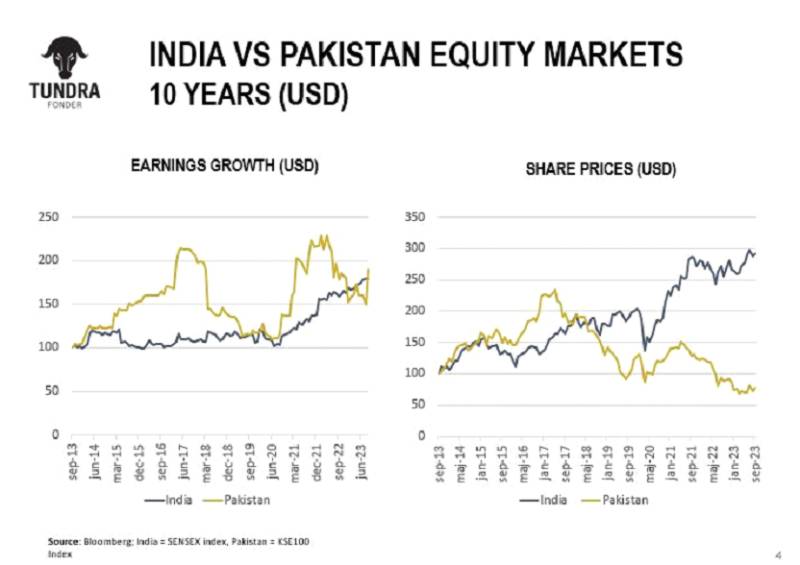

While the index value has surged, stock prices have been at historic lows. This essentially means that the surge in index value is driven by high corporate profitability, which has not transpired into stock prices due to investors being wary of the country’s dicey economic and political situation.

“Corporate profitability growth has been high over the years, but investors have not fully factored it in due to concerns about macro and political factors. Despite these concerns, growth has been observed in almost all sectors, driven by resilient margins and steady sales growth. This is noteworthy, especially considering the impact of higher taxes in recent years,” remarked Amreen Soorani, Head of Research at JS Global Capital.

Corporate profitability has been driven by multiple sectors, including the Banks, Oil and Gas Exploration, Cement, Chemical, Food and Personal Care Products, and Refineries. These sectors experienced growth due to a range of factors.

For instance, higher interest rates contributed to increased profitability in the Commercial Banks sector, while the Oil and Gas Exploration sector benefited from higher oil prices and exchange gains. The Cement sector saw growth through the use of cheaper coal and higher retention prices. M&A activity played a role in the growth of the Chemical sector, while improved margins contributed to the profitability of the Food and Personal Care Products sector. The Refinery sector experienced growth due to higher gross refining margins.

While the general trend in the long run is for share prices to move in tandem with the earnings growth, Pakistan does present an anomaly to this case. Further, the recent rupee appreciation has also had an impact on the market.

"The PSX rally is quite broad-based, and the optimism is stemming from the recent appreciation of the rupee against the greenback. The market was closely watching the dollar kerb market, which reached a high of Rs340 at one point, and it was expected that the interbank rates would follow suit. With a difference of almost Rs52 or nearly 15% from Rs340 to Rs278, the impact on inflation can be significant. Consequently, the correlation between PSX and inflation, as well as interest rates, is significant, leading to the prevailing optimism," remarked Zubair Ghulam, CEO at Insight Securities.

What’s Next?

The approval of the IMF tranche and subsequent funding will be a key determinant of market performance in the near term. Historically, the PSX has shown a significant correlation with the external liquidity situation, and any improvement in this aspect is expected to provide the necessary boost and momentum.

As per Mustafa Pasha, Chief Investment Officer at Lakson Investments, “The market may have already factored in the approval of the second IMF tranche to some extent. However, if it is accompanied by additional inflows from multilateral sources or bilateral partners, an extended rally can be expected. Moreover, if there is a sentiment that the interest rate has peaked, there might be a chance of some hot money flows towards the end of this year. However, this outcome largely depends on whether investors believe there would be policy consistency in Pakistan.”

Yet, there are significant downside risks, “The market is currently incorporating the normalization of the economic situation, as well as the expectation of lower inflation and interest rates in the second half of Fiscal Year (FY) 2024. However, a significant appreciation of the rupee could potentially result in higher imports, which remains a risk. Additionally, political and security risks, along with the situation in the Middle East, present significant challenges,” commented Yousuf Farooq, Head of Research at Chase Securities.

This is how the petrol price decrease will pan out:

— Ammar Khan (@rogueonomist) October 15, 2023

Prices are sticky, so prices of other goods won't decline. A few weeks later, oil is going to shoot, PKR will depreciate, and petrol price will increase more

Congratulations, you have unlocked another round of inflation.

While Pakistan has still not recovered from the economic fallout of the Russia-Ukraine war, another potential conflict looms on the horizon. The escalation of the Israel-Hamas conflict in the Middle East poses a significant threat to the global economy. Developing nations, including Pakistan, may bear a disproportionate cost in terms of the economic fallout caused by this conflict.