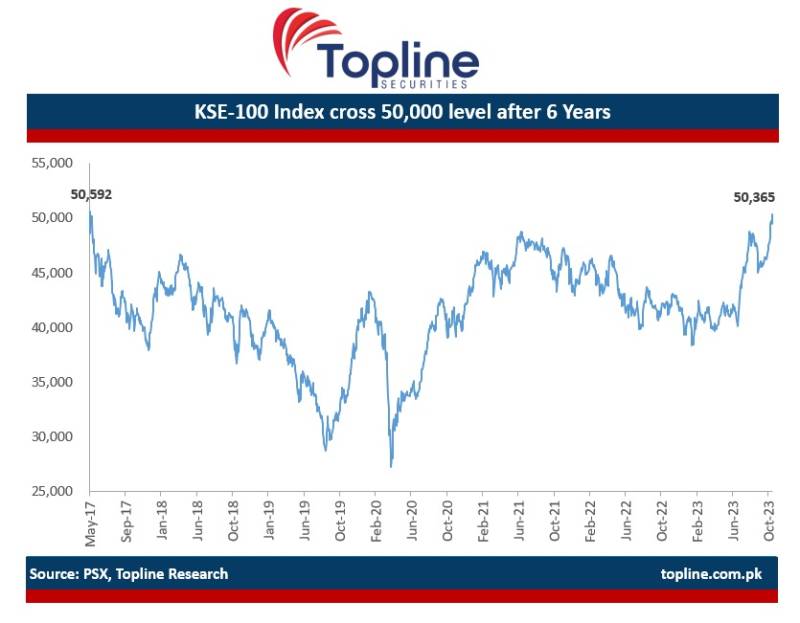

Earnings in line with or higher than market expectations saw the bulls firmly take charge at the Pakistan Stock Exchange on Thursday, driving it firmly past the 50,000-point psychological barrier and a trading milestone for the first time in over six years.

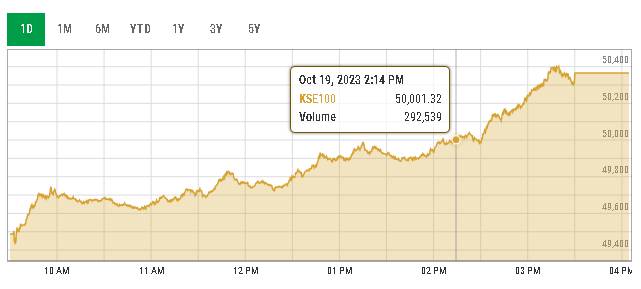

Data from the Pakistan Stock Exchange showed a consistent upward trend of the stock worm as it rose by 568.53 points to smash past the 50,000-point barrier in the afternoon session.

By 3:30 pm, the index had climbed by 930.46 points (1.88%) to the level of 50,361.93 points. By the close of trading at 4 pm, the index settled at 50,365.15 points, or up by 933.68 points. This was the highest level achieved by the bourse in six years, with the last time these figures were seen on May 31, 2017.

The highest-ever level reached by the index was 53,124 points on May 25, 2017.

It is pertinent to note that this is not the first time that the index has crossed the 50,000 mark in the past week. On Tuesday, it had briefly crossed past the 50,000 points mark. For a short while, the index rose to 50,017 points before it settled at 49,531 points, around 200 points lower than the previous close.

The last time the index had stayed above 50,000 points was on June 7, 2017.

Among the key drivers of the index was the positive earnings posted by various companies.

One of the surprises was the higher-than-expected earnings by the Pak Suzuki Motor Company for the third quarter of the fiscal year 2023, announcing a profit of Rs3.8 billion as its board approved the company's voluntary delisting from the stock exchange. The company posted equity per share (EPS) of Rs46.25. This was up from the EPS of the same quarter last year of Rs30.25, while in the second quarter of 2023, the EPS was Rs39.36, with a quarter-on-quarter increase of 17%.

The nine-month loss for 2023 was Rs71.34, compared to Rs30.46 for the nine months of 2022.

These results were higher than the industry expectations which expected gross margins to be around 12% following the previous quarter's profit of 10%. However, the company managed to post 14% in gross margins thanks to appreciation of the rupee.

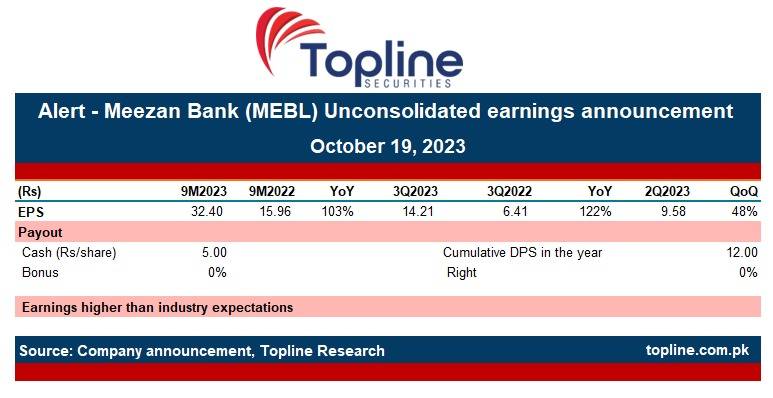

Moreover, Meezan Bank also posted its earnings, which were up 103% year-on-year, with third-quarter 2023 EPS at Rs14.21, up year-on-year by 122%, together with a third-quarter dividend per share of Rs5 and nine-month dividend at Rs12 in line with market expectations.