While the economic situation of the country looks bleak, there is some consensus amongst experts that a recovery would have to be led primarily by two sectors: agriculture and IT.

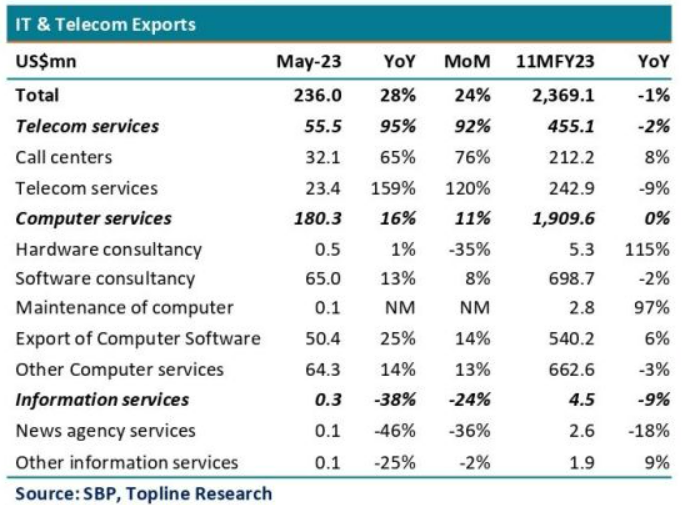

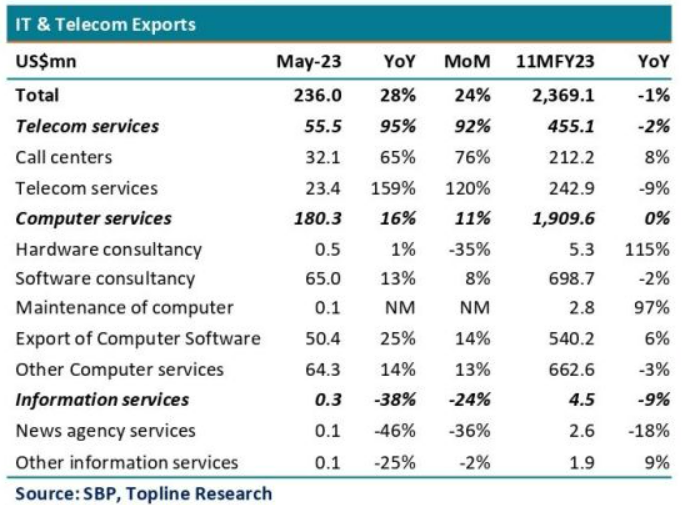

A recent report by Topline Securities highlighted that Pakistan's IT sector has shown significant growth in May 2023, with a 24% Month on Month (MOM) increase in IT exports. Specifically, telecom and computer services have seen notable MOM increases of 92% and 11%, respectively.

The report delved deeper into the numbers, revealing that among computer services, export of software, other services, and software consultancy have increased by 14%, 13%, and 8% MoM respectively.

This growth can be attributed to a higher number of working days in May 2023 compared to April 2023. However, IT export proceeds realization per working day has declined in May 2023 compared to April 2023.

The Topline analysis also highlighted that on a Year on Year (YoY) basis, IT exports for May 2023 have increased by 28% to US$236 million. However, in the 11 months of fiscal year 2023 (11MFY23), IT exports have marginally declined 1% YoY. Yet, the telecom service exports increased by 92% MoM and by 95% YoY to $55.5 million and computer services increased by 11% MoM and by 16% YoY to $180.3 million.

The total share of telecom - computer services exports for May 2023 stood at 24% - 76% respectively. Net IT exports for May 2023 have increased by 26% MoM and by 46% YoY to $211 million, while 11MFY23 net exports have increased by 16% YoY to $2.1 billion. In 11MFY23, IT exports as percentage of total exports stand at 7.3% compared to 6.7% in 11MFY22.

Doing and Undoing

As per experts, post-Covid, the IT sector saw a boom because central banks across jurisdictions printed money and pumped it into government backed schemes for promotion of business activity. Some of that demand was channeled to developing countries like Pakistan, where IT resources are available at a comparatively cheaper cost.

However, as interest rates started to rise across the globe and business activity slowed down, the trickle-down effect was felt by the IT sector. Yet, this is not the only reason for the slump in the sector’s performance. The restrictions on currency flow imposed by the SBP has resulted in many of the companies setting up holding companies overseas to receive their total billings, a fraction of which is remitted back to Pakistan, subsequently understating the actual value of exports.

Furthermore, the industry has its own flaws which halt progress. The typical business model for IT businesses in the country is based on labor arbitrage. They hire resources locally and bill clients for their services in a foreign currency at a significant margin.

As a result, the development of utility products and applications catering to a larger market is very limited. This leads to a lack of differentiation of local services when compared to competing regional economies.

“We as an industry are very reluctant to build and scale. Organic growth might not enable you to acquire that skill set; the M&A (mergers and acquisitions) will help the industry grow faster,” Asif Peer, CEO and managing director of Pakistani software company Systems Ltd, addressed the Board of Investments conference earlier this year.

Additionally, supply side issues restrict the capacity of the sector to meet external demand. As per industry insiders, most IT graduates from local universities lack technical skills, including basic communication skills, which makes it very difficult to hire “billable” talent. This also explains why even after the rapid depreciation of rupee, the IT export hasn’t grown at the same level.

Gonzalo Varela, a senior World Bank economist, explained this phenomenon in a podcast interview: “Pakistani exports react slowly to the depreciation of the currency, as it takes time to scale up (financing, machinery etc.) whenever there is a surge in demand due to price competitiveness.”

Budget for the IT sector

The recent budget has given special attention to Pakistan's IT sector, recognizing it as the way forward to overcome current economic roadblocks. As evidence of its importance, freelancers in the sector have brought in $397 million in remittances in FY23. The government's proposed exemptions from sales tax registration and filings for freelancers who earn up to $24,000 annually and simplified tax returns will be provided to increase the ease of doing business. As per a report by Karandaaz, the budget includes three major proposals for the IT sector, including tax exemptions for imports of hardware and software equal to 1% of their exports, a reduced 5% sales tax on IT services and IT-enabled services in the Capital Territory and reduced taxation on markup income of banks from 39% to 20% for the loans disbursed to the sector.

A recent report by Topline Securities highlighted that Pakistan's IT sector has shown significant growth in May 2023, with a 24% Month on Month (MOM) increase in IT exports. Specifically, telecom and computer services have seen notable MOM increases of 92% and 11%, respectively.

The report delved deeper into the numbers, revealing that among computer services, export of software, other services, and software consultancy have increased by 14%, 13%, and 8% MoM respectively.

This growth can be attributed to a higher number of working days in May 2023 compared to April 2023. However, IT export proceeds realization per working day has declined in May 2023 compared to April 2023.

The Topline analysis also highlighted that on a Year on Year (YoY) basis, IT exports for May 2023 have increased by 28% to US$236 million. However, in the 11 months of fiscal year 2023 (11MFY23), IT exports have marginally declined 1% YoY. Yet, the telecom service exports increased by 92% MoM and by 95% YoY to $55.5 million and computer services increased by 11% MoM and by 16% YoY to $180.3 million.

The total share of telecom - computer services exports for May 2023 stood at 24% - 76% respectively. Net IT exports for May 2023 have increased by 26% MoM and by 46% YoY to $211 million, while 11MFY23 net exports have increased by 16% YoY to $2.1 billion. In 11MFY23, IT exports as percentage of total exports stand at 7.3% compared to 6.7% in 11MFY22.

Doing and Undoing

As per experts, post-Covid, the IT sector saw a boom because central banks across jurisdictions printed money and pumped it into government backed schemes for promotion of business activity. Some of that demand was channeled to developing countries like Pakistan, where IT resources are available at a comparatively cheaper cost.

However, as interest rates started to rise across the globe and business activity slowed down, the trickle-down effect was felt by the IT sector. Yet, this is not the only reason for the slump in the sector’s performance. The restrictions on currency flow imposed by the SBP has resulted in many of the companies setting up holding companies overseas to receive their total billings, a fraction of which is remitted back to Pakistan, subsequently understating the actual value of exports.

Furthermore, the industry has its own flaws which halt progress. The typical business model for IT businesses in the country is based on labor arbitrage. They hire resources locally and bill clients for their services in a foreign currency at a significant margin.

As a result, the development of utility products and applications catering to a larger market is very limited. This leads to a lack of differentiation of local services when compared to competing regional economies.

“We as an industry are very reluctant to build and scale. Organic growth might not enable you to acquire that skill set; the M&A (mergers and acquisitions) will help the industry grow faster,” Asif Peer, CEO and managing director of Pakistani software company Systems Ltd, addressed the Board of Investments conference earlier this year.

Additionally, supply side issues restrict the capacity of the sector to meet external demand. As per industry insiders, most IT graduates from local universities lack technical skills, including basic communication skills, which makes it very difficult to hire “billable” talent. This also explains why even after the rapid depreciation of rupee, the IT export hasn’t grown at the same level.

Gonzalo Varela, a senior World Bank economist, explained this phenomenon in a podcast interview: “Pakistani exports react slowly to the depreciation of the currency, as it takes time to scale up (financing, machinery etc.) whenever there is a surge in demand due to price competitiveness.”

Budget for the IT sector

The recent budget has given special attention to Pakistan's IT sector, recognizing it as the way forward to overcome current economic roadblocks. As evidence of its importance, freelancers in the sector have brought in $397 million in remittances in FY23. The government's proposed exemptions from sales tax registration and filings for freelancers who earn up to $24,000 annually and simplified tax returns will be provided to increase the ease of doing business. As per a report by Karandaaz, the budget includes three major proposals for the IT sector, including tax exemptions for imports of hardware and software equal to 1% of their exports, a reduced 5% sales tax on IT services and IT-enabled services in the Capital Territory and reduced taxation on markup income of banks from 39% to 20% for the loans disbursed to the sector.