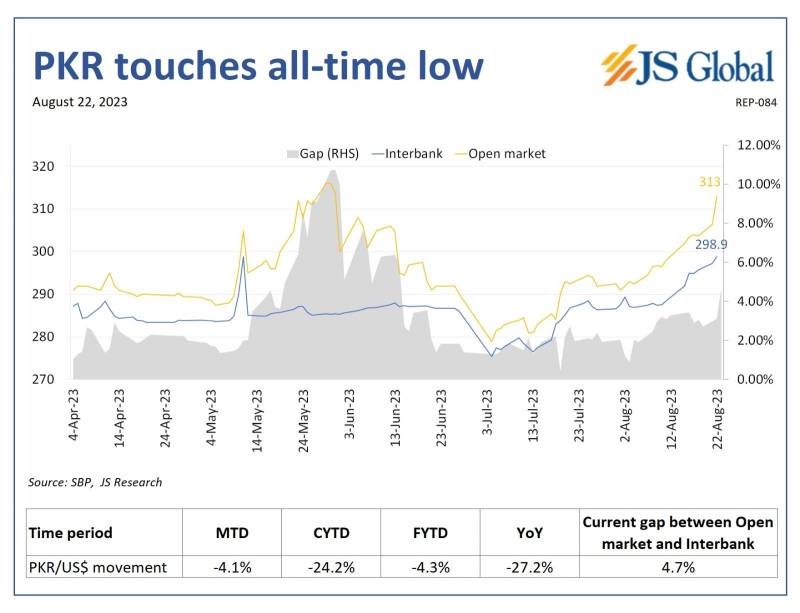

The Pakistani rupee hit a record low of 299 against the US dollar in the interbank market on Tuesday. This recent depreciation can be attributed to the current account shifting from a surplus to a deficit in July, breaking a streak of four consecutive surplus months.

Moreover, the open market rate has approached 313, which is still in breach of the 1.25% limit set by the International Monetary Fund (IMF). Closing in this disparity between the two rates has also contributed to the depreciation. Additionally, the removal of import restrictions, another requirement of the IMF deal, has increased pressure on the currency as a massive backlog of payments is being cleared.

However, the rupee has remained under consistent pressure for the past two years, and there are multiple factors that have led the currency to the 300 mark against the greenback.

The Road to 300

The recent devaluation can be attributed to two factors: the IMF's requirement to narrow the gap between the open market rate and the return of a $809 million deficit in July after a four-month gap.

Therefore, with around 25% depreciation this year alone, the Pakistani rupee is Asia’s worst performing currency.

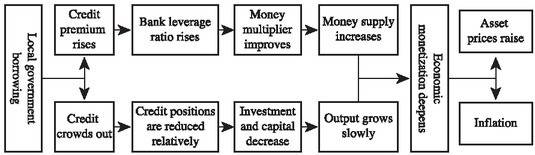

However, the dramatic fall in the currency's value against the greenback cannot solely be attributed to recent events. Experts suggest that the significant increase in money supply over the past three years, coupled with a surge in demand, has led to unprecedented inflationary pressure and contributed to the depreciation of the rupee.

“Both inflation and currency devaluation are results of growth in domestic money supply in the absence of a similar growth in the supply of goods and foreign exchange. The money supply grows if the government borrows directly from the central or commercial banks to finance its rupee-denominated deficit,” reads an article in Dawn

Source: Muneeb Sikander

Additionally, the country is also facing the impact of a globally strong dollar following the US Federal Reserve's decision to raise the interest rates to a historical high. As per IMF economists, “In emerging market economies, a 10 percent US dollar appreciation, linked to global financial market forces, decreases economic output by 1.9 percent after one year, and this drag lingers for two and a half years.”

Furthermore, the presence of a grey market for the greenback in the country, supported by questionable economic practices like the Dar-peg and the smuggling of currency to Afghanistan, is a noteworthy concern. Some argue that halting this leakage is exceptionally challenging, while others highlight the involvement of the state whose strategic agendas are allegedly financed by the smuggled currency.

The Consequence

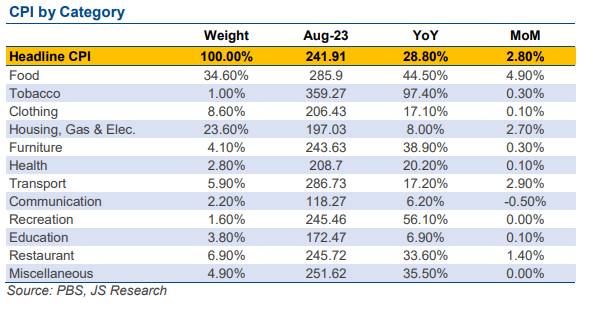

Every round of currency depreciation is followed by an inflationary wave led by energy and food price hikes.

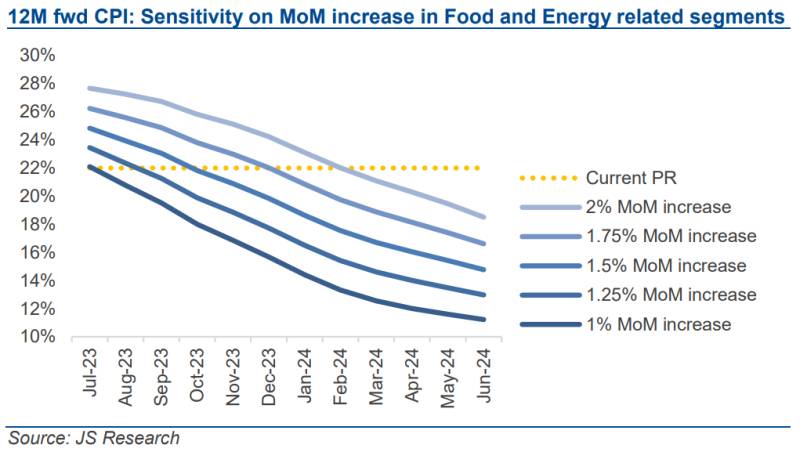

Hence, the recent devaluation is also expected to have an impact on inflation rates, potentially surpassing 28% for August 2023. Consequently, this could lead to a shift in the monetary policy outlook and a subsequent increase in the interest rate.

“The timely inflow of external support is crucial for maintaining stability in the Pakistani rupee. However, it is important to note that further increases in imports and the outflow of pent-up dividends would only serve to add more pressure to the currency,” remarked Amreen Soorani, Head of Research, JS Capital.

Therefore, in the given scenario, the purchasing power of the Pakistani population, particularly those with fixed incomes, is expected to be further impacted.