In the Third Five Years Plan, the military government of General Ayub Khan made the unequal distribution of income resulting from outcomes of national production processes the central plank of its economic policy. The Third Five Years Plan was contained in a document published in book form. The later historians and economic experts picked one sentence in the document to argue that unequal distribution of income was an inherent part of the plan, “It is clear that the distribution of national production should be such as to favor the savings sectors” reads, The Third Five Year Plan, 1965-70 published by Planning Commission of Pakistan.

Much later, Pakistan’s eminent economist, Dr. Akmal Hussein, writing about this part of Ayub Khan’s economic policy—in PAKISTAN NATIONAL HUMAN DEVELOPMENT REPORT 2003 POVERTY, GROWTH, AND GOVERNANCE, published by UNDP—said that this policy to promote the unequal distribution of income was based on the assumption that the upper classes or capitalists in the society would save more thus will contribute in the national saving rates, which was considered essential for domestic investment and industrial growth. This assumption was the basis of the military government’s “deliberate policy of concentrating national income in the hands of the upper-income groups”.

The economic basis of this policy was the assumption that the rich would save a larger proportion of their income and hence a higher national savings rate could be achieved with an unequal distribution of income. The Ayub Khan government’s target savings rate is 25 percent of GDP, according to Dr Akmal Hussein. “In practice, while the policy of distributing incomes in favor of the economic elite succeeded, the assumption that it would raise domestic savings over time failed to materialise. Griffin points out for example that 15 percent of the resources annually generated in the rural sector were transferred to the urban industrialists and 63 to 85 percent of these transferred resources went into increased urban consumption.

Far from raising the domestic savings rate to 25 percent, the actual savings rate never rose above 12 percent” Dr. Akmal Hussein stated in his above-mentioned research report for UNDP. Perhaps, it was the first instance of the government making unequal distribution of income the stated objective of its economic policy in Pakistan’s early history. This element of Ayub Khan’s economic policy was part of a larger integrated policy of creating a social and economic class of industrial entrepreneurs, whose industrial units could serve as a source of revenue for cash-starved Pakistani states. Pakistan in the initial years was completely dependent on American and Western financial assistance to run the state expenditures, and development expenses and to create a fake class of industrial entrepreneurs with the help of loans and technical assistance offered to them by the state and foreign economic advisors.

According to the Marxist perspective, the state doesn’t give rise to social inequalities and classes—social classes are the outcome of production processes that exist in society. According to other sociological and Marxist perspectives, “the state does not directly "create" social classes, but rather reflects and reinforces existing class structures within society by enacting policies that benefit the ruling class and potentially suppress the lower classes, effectively maintaining the social hierarchy through its power dynamics; therefore, the state plays a significant role in perpetuating social class divisions”. So, your social class will be determined by your relation to the production processes that are underway in the society of which you are part. Marx himself described the industrial society to be constituted of bourgeoisie (capitalists) and proletarians (working class). Marx’s class analysis was not a simple one, in his myriads of writings he mentioned several intermediate classes that according to him existed in the society of his times. However, he believed that these several intermediate classes would merge into either bourgeois or proletariat with the development and expansion of the capitalist mode of production.

The process of production is central to Marx's idea of social inequalities and class along with his insistence that these classes will always be engaged in antagonistic relations—hence the Marxist concept of class struggle. In Pakistan, the state and government got into the business of creating inequalities and social classes from the very beginning. Pakistan, at the time of its creation, inherited a middle class like lawyers, doctors, teachers, and government servants who were employed by the colonial government before independence. The Ayub Khan government needed these social classes and the new middle class that emerged during the Ayub era as its supporters in its endeavors to introduce modernity in Pakistani society. The fact that these middle classes emerged in Karachi, Punjab’s urban areas and erstwhile NWFP, and not in East Pakistan speaks volumes about how not only inter-personal inequalities but regional inequalities were the creation of Ayub’s military regime.

We are still a feudal society where there is a permanence attached to your social and economic status—a permanence which is believed to stem from divine provenance

To this day the government policies and the language and idioms in which these policies are written, are never mentioned, social inequalities are a political problem or a social evil that exists in our society. Pakistani governments devote a large space of their policy documents to talking about poverty in society. However, the state and its institutions are extremely wary of mentioning social or economic inequalities as a social evil or a political problem. For instance, the Ayub Khan regime made a lot of efforts to reduce poverty in rural areas by its efforts to introduce the Green Agriculture Revolution in the rural areas. This might have produced insignificant results. But this same military government was deliberately embarking on an economic policy to promote economic and social inequalities. Poverty is bad and helping the poor is a pious act, while creating inequalities is good for economic growth. The mindset that gave rise to such policies has persisted in Islamabad since those early days. This mindset doesn’t make endeavors to create affluence as a general trend in society; it wants to restrict affluence to a limited number of people who are loyal to the incumbents.

Poverty as a divinely sanctioned status gives a permanent place to the poor in social stratification to those who live a life below the poverty line. So, under this kind of arrangement, there are permanent poor and permanent rich in society and the rich give alms and the poor receive it. Let me give you an example, there are a large number of studies on the state of poverty in Pakistan that recommend that the poor should be afforded the opportunities to create or purchase assets. For instance, a plot of land for agricultural laborers would greatly reduce poverty in rural areas. This is not the solution that makes an appearance in the policy documents of the Pakistani state. Pakistani policymakers often come up with large white elephant projects like programs of cash transfers i.e. Benazir Income Support programs, which are a permanent burden on the national economy and have hardly done anything for the poor. Theirs’ is a policy framework that intends to keep poor people poor. They don’t want to create affluence. They only want to pretend to be pious and attract votes.

An affluent farmer with a plot of land might not be as malleable as a poor village that regularly receives pennies from the Benazir Income Support Program. Technically we are still a feudal society where there is a permanence attached to your social and economic status—a permanence which is believed to stem from divine provenance. Not only that but this permanence is also accorded legal and political sanctions by the power of the state. A modern capital mode of production, where new social classes emerge with the expansion of capital and where anyone with entrepreneurial stills and proclivities could grab an opportunity and change her or his social class, is still a far cry. Especially for the poor, there is still no chance or opportunity to change their social class—they are undernourished, under or unemployed, property less with few educational or skill development opportunities.

The concepts of a state, a set of laws, institutions, territory, and people—are numerous in modern political thought. The Marxist concept of a state gives an overly dominant role to dominating social and economic classes. It says the state is there to serve the interest of the dominant social and economic classes in a society. Until the 1980s Pakistani society had a vibrant left-oriented intellectual tradition, which had produced poets like Faiz Ahmed Faiz, social thinkers like Sibt-e-Hassan, and political analysts like Hamza Alvi. It is appropriate to talk about how Hamza Alvi analysed a post-colonial state like Pakistan. Relevant to the topic under discussion, Alvi projected Pakistan state as an overdeveloped state, which has developed the capacity to function independently of the dominant classes in the society. Some present-day analysts think Hamza Alvi’s analysis is not relevant in present-day Pakistan.

To a non-expert like me, it is very difficult not to review Alvi’s statement in light of how the Pakistani state goes out of the way to support and subsidise the riches of the Pakistani capitalist’ classes. UNDP, Pakistan published, “Pakistan National Human Development Report 2020 The three Ps of Inequality: Power, People, and Policy”. In this report, the author narrates the story of how the Pakistani state went out of its way to subsidise the business, agriculture, and industrial operations of the dominant classes. I will reproduce a small portion of the Research which is as follows:

a) The feudal class Pakistan’s feudal elite constitute just 1.1 percent of its population but own 22 percent of its farm area. They have disproportionate access to political representation in National and Provincial Assemblies, enabling them to safeguard the tax benefits and special concessions they are granted. These benefits include favored tax treatment for agricultural income and land revenues, low irrigation water charges despite Pakistan’s water-stressed status, preferential access to bank credit, subsidies for fertilisers, and the provision of electricity for tube wells. Overall, in 2017–2018, Pakistan’s feudal class enjoyed privileges totaling PKR 370 billion.

b) The corporate sector: The corporate sector encompasses Pakistan’s growing number of business owners and shareholders. Businesspersons are often members of federal and provincial cabinets. Moreover, large associations and embassies protect the interests of multinational corporations that operate in the country. Overall, the corporate sector benefits from a host of privileges, such as the recent reduction of corporate tax on profits, the withdrawal of the Super Tax (meant for the extremely wealthy), and industry-specific concessions such as low er sales tax rates on production and sales, exorbitant import duties, and more.2 Overall, in 2017–2018, Pakistan’s corporate sector enjoyed privileges totaling PKR 724 billion.

c) Exporters In an attempt to redress Pakistan’s increased trade deficit and the worrying fall in reserves, exporters have benefitted from growing incentives in recent years. These include tax breaks, with the presumptive income tax on the value of export earnings fixed at just 1 percent. They also enjoy reductions in sales tax liabilities, as well as zero import duties on the raw materials and intermediate goods they use. Exporters also have access to a special credit line from the State Bank of Pakistan, with an interest rate substantially lower than prevailing market rates. Overall, in 2017–2018, exporters in Pakistan enjoyed privileges totaling PKR 248 billion.

d) Large-scale traders’ Large-scale trades include commercial importers, wholesalers, and retailers in the domestic market. Given the trading community’s large size and key role in sustaining day-to-day activities, especially in Pakistan’s metropolitan cities, traders have acquired a measure of political power that they have translated into substantial privileges. These include paying presumptive income taxes on their electricity bills, under-invoicing (frequently with the help of customs authorities), and withholding taxes set as low as 1 to 5 percent. Overall, in 2017–2018, large-scale traders in Pakistan enjoyed privileges totaling PKR 348 billion.

e) High net worth individuals: the top 1 percent of Pakistan’s population has 9 percent of the country’s total personal income.3 The average income of high-net-worth households is six times the income of an average Pakistani household. Despite this, high net-worth individuals evade taxes worth PKR 168 billion. They also enjoy substantial concessions, such as tax credit provisions which reduce their personal income tax liability, and the separation of taxes into different types of income (from securities, shares, bank deposits, etc.) which reduce the progressivity of the tax system. Overall, in 2017–2018, high-net-worth individuals in Pakistan enjoyed privileges totaling PKR 368 billion

f) The military establishment Today, the military establishment represents the largest conglomerate of business entities in Pakistan, besides being the country’s biggest urban real estate developer and manager, with wide-ranging involvement in the construction of public projects. The military’s business activities are essentially run through two entities, the Fauji Foundation (FF) and the Army Welfare Trust (AWF), with high net profits and rapid growth. The military’s Defence Housing Authorities (DHAs) also enjoy significant privileges in terms of federal sales tax exemptions and the earmarking of property tax, which goes solely to cantonment boards. Overall, in 2017–2018, Pakistan’s military establishment enjoyed privileges totalling PKR 257 billion.

Our problem is that our intellectuals are simply barren in identifying social inequalities as the main cause of our social and political problems and unrest and outrightly failed to develop an ideology that can address this problem

Poverty carries a social stigma on which the state stamps a seal of permanence with its economic policies--changing the social and economic status of the poor requires a policy different from making the poor addicted to subsidies and cash transfers. Policies of subsidies and cash transfers originate from the mindset that wants to see the poor as a permanent social category-- a social category providing foot soldiers and hapless voters for political lords. Why is there no robust debate about social inequalities in our society? Maybe because the traditional left is dead in Pakistani society. But apart from that the fact that our intellectuals, media, and political players are unwittingly deeply under the influence of a neo-liberal mode of thought could be cited as the biggest reason why we don't see any debate about inequality. The state doesn't even talk about inequalities. We talk about poverty; we talk about corruption, and we talk about bad economic conditions, but we never talk about social inequalities. In the United States, it's not the left that is championing the cause of social inequality-- Joseph Stiglitz the Nobel prize-winner economist who has been advocating against inequalities in American society is no less free marketer than any other liberal in the USA. He is no communist or left-oriented intellectual and yet he has devoted all his intellectual efforts to fight against inequalities.

Our problem is that our intellectuals are simply barren in identifying social inequalities as the main cause of our social and political problems and unrest and outrightly failed to develop an ideology that can address this problem. We are so hopeless that we employ the world's most egalitarian religion, Islam, in the cause of justifying the most extreme forms of inequalities in the name of religion.

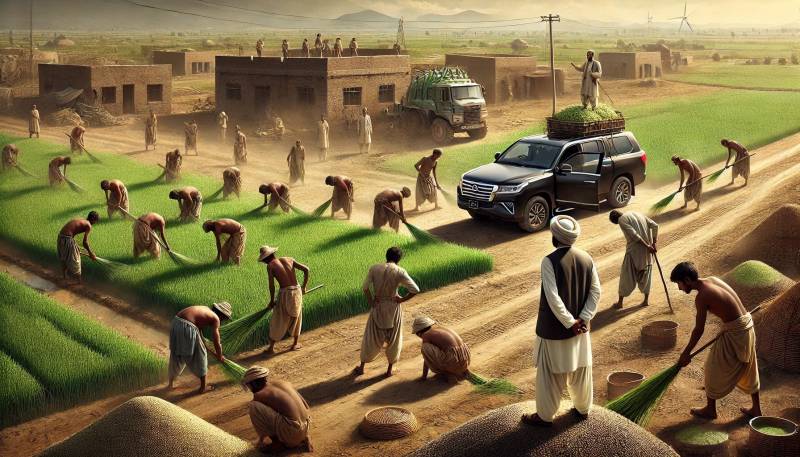

Most Pakistani poor are in rural areas and it is in rural areas that the most extreme forms of inequalities could be witnessed. The majority of Pakistani poor are in rural areas and the most cited reason for their poverty is the unavailability of cultivable land for agricultural labor. Power is so distributed in Pakistani rural areas that the hapless agriculture laborer does not get payment for his or her labor proportionate to the work they do for the landlord—who is powerful, and who controls access to land and access to justice. This feature of our rural economy is well documented. The problem is that the landlord which presides over these exploitative economic and social structures of domination provides the foundation of power structures of our society on which the powers of government, military, and the states rest.

To set the poor free from these shackles we must radically change the power structure of the country. The question is whether change will come through the natural evolutionary political process or a bloody revolution. Destruction of social and economic structures may be a necessity, but violent revolution could lead to anarchy.