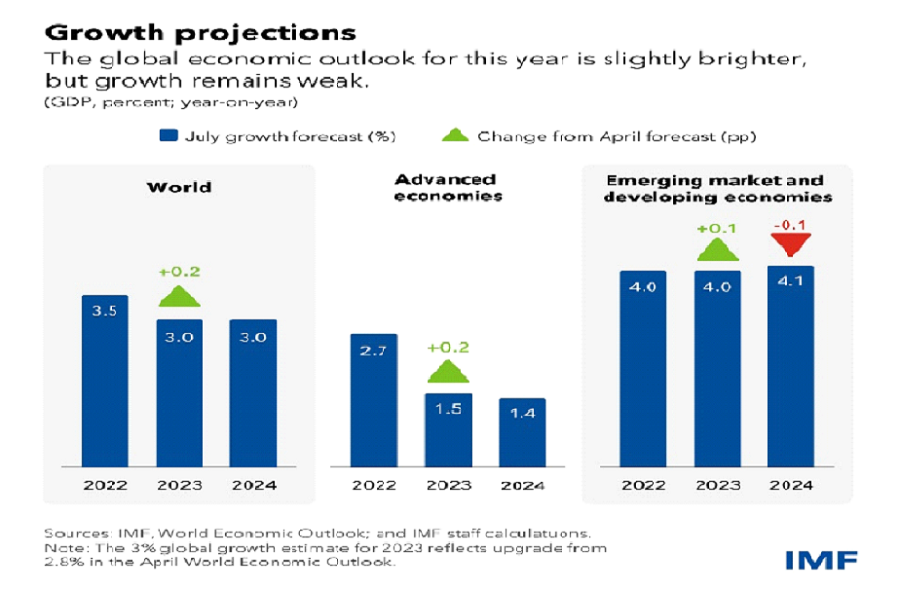

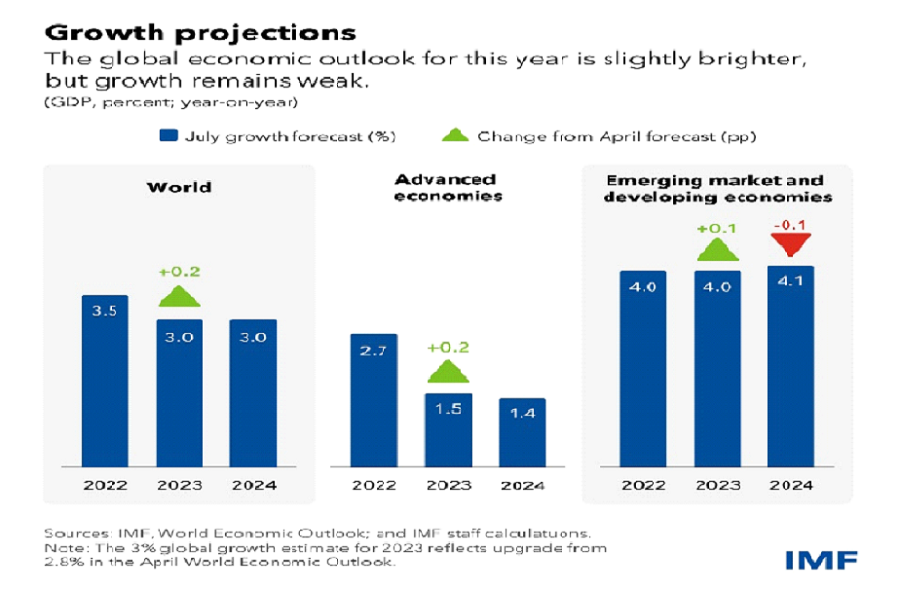

According to the latest world economic outlook published by the International Monetary Fund (IMF), the global economy is set on a path of recovery, marking the complete fading of the pandemic and its resulting disruptions in the supply chain. Economic activity in the first quarter demonstrated resilience, characterized by strong labour markets.

"Energy and food prices have come down faster than expected from the war-induced peaks. And financial instability following the March banking turmoil remains contained thanks to forceful actions by the U.S. and Swiss authorities," stated the fund officials.

In contrast, Pakistan faces a longer road to recovery despite being on a similar trajectory. The IMF predicts that the nation's growth will slowly improve in Fiscal Year (FY) 24, reaching around 2.5%. While the recovery will benefit from the positive effects of flood-related reconstruction, particularly in the agriculture and textile sectors, the process of reducing import restrictions and reopening closed factories will take time to significantly impact the economy. Furthermore, ongoing external challenges and the need for strict macroeconomic policies will further impede the recovery.

However, if Pakistan maintains consistent policy implementation, undertakes reforms, and receives adequate financial support from bilateral and multilateral partners, the IMF expects a gradual return to the country's potential growth rate of 5% over the medium term.

Monetary tightening and the financial sector

The IMF has reiterated its concerns regarding core inflation, which still exceeds the targets set by global central banks, indicating that the battle against inflation continues. Despite tight labour markets, wage inflation tends to lag behind price inflation in most countries, resulting in a decline in real wages.

READ MORE: China’s EXIM Bank Rolls Over $2.4bn Loan to Pakistan

However, the report suggests that the gap between nominal wage growth and price inflation is starting to narrow. Furthermore, financial conditions have eased despite monetary policy tightening, providing some relief for emerging and developing countries. Nevertheless, there remains a risk of significant repricing if inflation surprises on the upside or the global risk appetite deteriorates. This could lead to higher borrowing costs and increased debt distress.

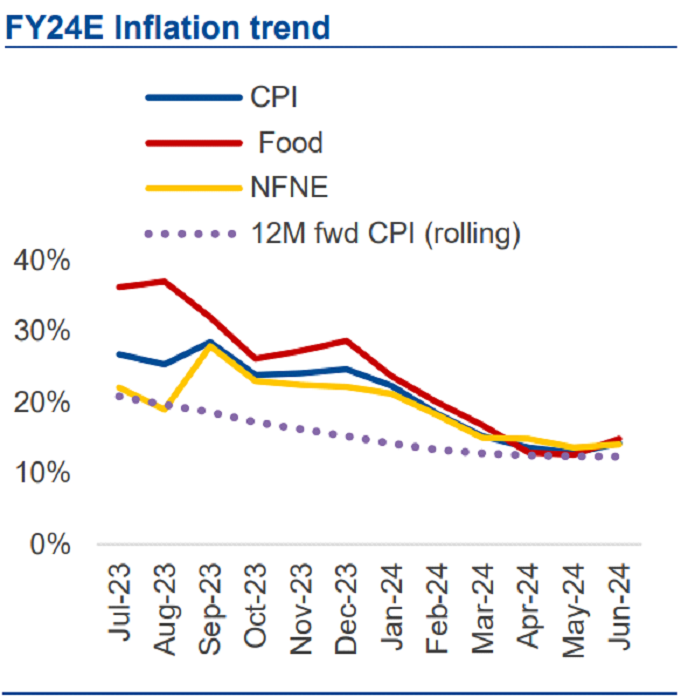

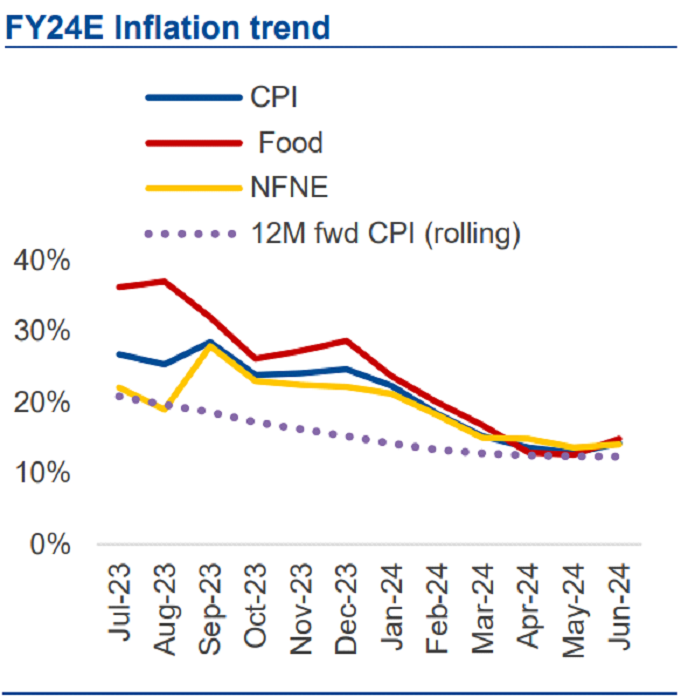

For Pakistan, the IMF, in its recent Stand By Agreement (SBA) review report, states that the country is also expected to experience a decrease in headline inflation. This is mainly due to the base effects of the previous year's rise in fuel and electricity prices, as well as a decline in the global price of food items. However, it is projected that price pressures will remain high, partly due to the delayed monetary tightening by the State Bank of Pakistan (SBP). As a result, the average headline inflation is expected to stay above 25 percent in FY24.

Source: JS Global

The IMF has issued a warning regarding the significant challenges presented by geoeconomic fragmentation and the insufficient progress made on the climate transition. It emphasizes the crucial role of multilateral cooperation in ensuring a safe and prosperous global economy. The report further suggests the necessity of restoring fiscal buffers and establishing sustainable debt dynamics. Implementing targeted fiscal consolidation measures, such as phasing out energy subsidies, is also a key remedial factor pointed out by the fund.

READ MORE: After A Year, PSX Crosses 46,000 Point Barrier

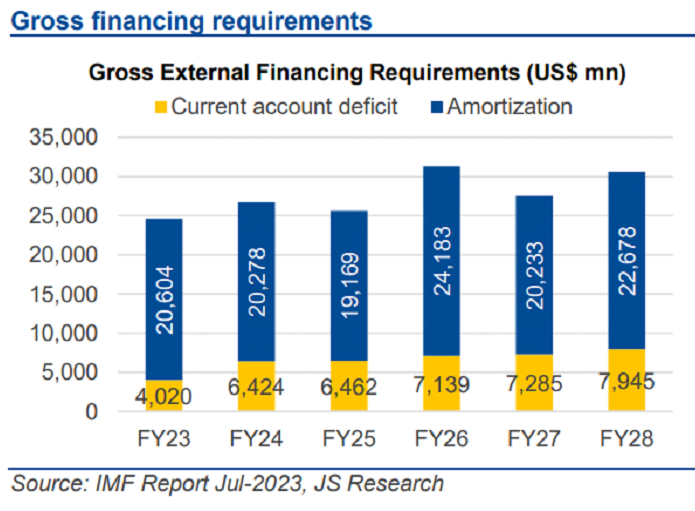

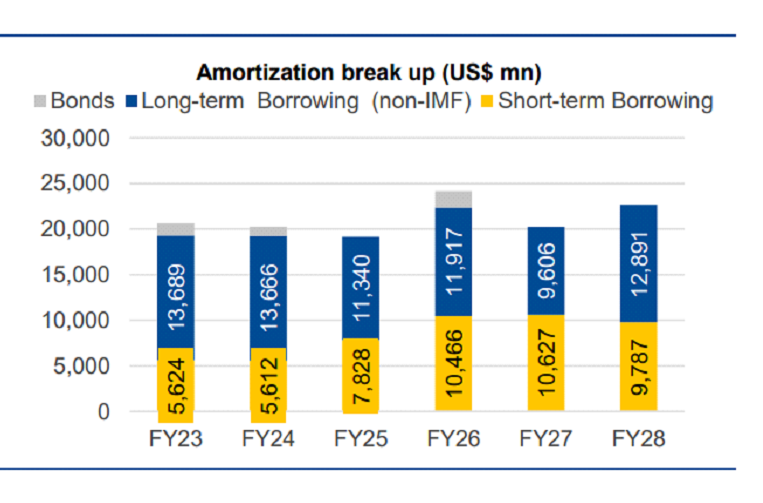

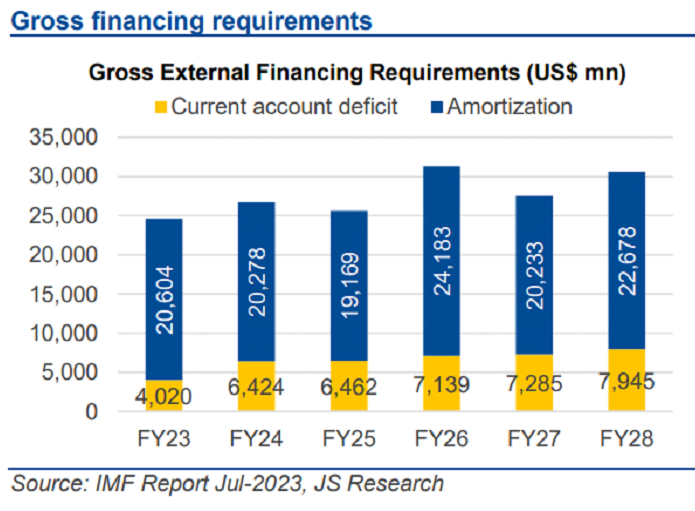

The warning mentioned above resonates with Pakistan's current crisis, as the country has experienced a decline in its historical geo-strategic leverage with the Western nations. Simultaneously, Pakistan is grappling with the burden of an unsustainable level of debt. Furthermore, there are significant fiscal leakages occurring at the level of state-owned enterprises (SOEs) and within the energy sector, where the circular debt has now reached a record amount of Rs. 2.5 trillion.

Graph Source: JS Global

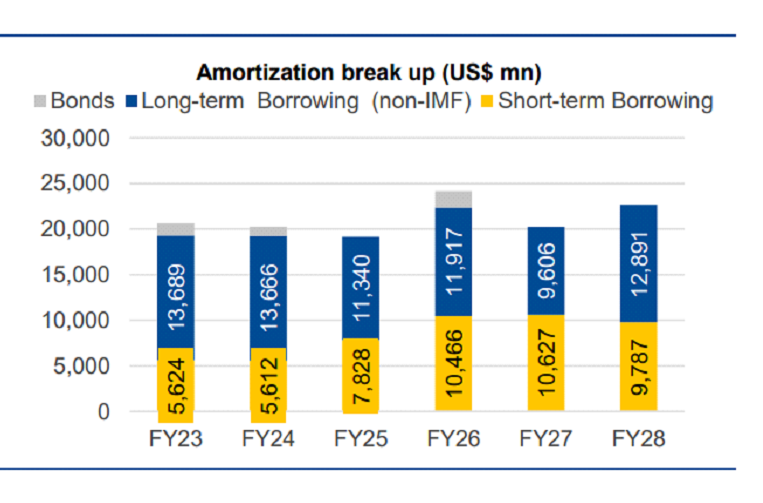

Graph Source: JS Global

Therefore, for Pakistan, the matter of utmost importance remains political stability, which is a prerequisite for the country's economic recovery. Furthermore, the 9-month SBA signed in July with the IMF only offers enough leeway for the country to reinstate political order and prepare for the forthcoming economic challenges.

"Energy and food prices have come down faster than expected from the war-induced peaks. And financial instability following the March banking turmoil remains contained thanks to forceful actions by the U.S. and Swiss authorities," stated the fund officials.

In contrast, Pakistan faces a longer road to recovery despite being on a similar trajectory. The IMF predicts that the nation's growth will slowly improve in Fiscal Year (FY) 24, reaching around 2.5%. While the recovery will benefit from the positive effects of flood-related reconstruction, particularly in the agriculture and textile sectors, the process of reducing import restrictions and reopening closed factories will take time to significantly impact the economy. Furthermore, ongoing external challenges and the need for strict macroeconomic policies will further impede the recovery.

If Pakistan maintains consistent policy implementation, undertakes reforms, and receives adequate financial support from bilateral and multilateral partners, the IMF expects a gradual return to the country's potential growth rate of 5% over the medium term

However, if Pakistan maintains consistent policy implementation, undertakes reforms, and receives adequate financial support from bilateral and multilateral partners, the IMF expects a gradual return to the country's potential growth rate of 5% over the medium term.

Monetary tightening and the financial sector

The IMF has reiterated its concerns regarding core inflation, which still exceeds the targets set by global central banks, indicating that the battle against inflation continues. Despite tight labour markets, wage inflation tends to lag behind price inflation in most countries, resulting in a decline in real wages.

READ MORE: China’s EXIM Bank Rolls Over $2.4bn Loan to Pakistan

However, the report suggests that the gap between nominal wage growth and price inflation is starting to narrow. Furthermore, financial conditions have eased despite monetary policy tightening, providing some relief for emerging and developing countries. Nevertheless, there remains a risk of significant repricing if inflation surprises on the upside or the global risk appetite deteriorates. This could lead to higher borrowing costs and increased debt distress.

The country is also expected to experience a decrease in headline inflation. This is mainly due to the base effects of the previous year's rise in fuel and electricity prices, as well as a decline in the global price of food items.

For Pakistan, the IMF, in its recent Stand By Agreement (SBA) review report, states that the country is also expected to experience a decrease in headline inflation. This is mainly due to the base effects of the previous year's rise in fuel and electricity prices, as well as a decline in the global price of food items. However, it is projected that price pressures will remain high, partly due to the delayed monetary tightening by the State Bank of Pakistan (SBP). As a result, the average headline inflation is expected to stay above 25 percent in FY24.

Source: JS Global

The IMF has issued a warning regarding the significant challenges presented by geoeconomic fragmentation and the insufficient progress made on the climate transition. It emphasizes the crucial role of multilateral cooperation in ensuring a safe and prosperous global economy. The report further suggests the necessity of restoring fiscal buffers and establishing sustainable debt dynamics. Implementing targeted fiscal consolidation measures, such as phasing out energy subsidies, is also a key remedial factor pointed out by the fund.

READ MORE: After A Year, PSX Crosses 46,000 Point Barrier

The warning mentioned above resonates with Pakistan's current crisis, as the country has experienced a decline in its historical geo-strategic leverage with the Western nations. Simultaneously, Pakistan is grappling with the burden of an unsustainable level of debt. Furthermore, there are significant fiscal leakages occurring at the level of state-owned enterprises (SOEs) and within the energy sector, where the circular debt has now reached a record amount of Rs. 2.5 trillion.

Graph Source: JS Global

Graph Source: JS GlobalTherefore, for Pakistan, the matter of utmost importance remains political stability, which is a prerequisite for the country's economic recovery. Furthermore, the 9-month SBA signed in July with the IMF only offers enough leeway for the country to reinstate political order and prepare for the forthcoming economic challenges.