As the dust settles on the recent budget debate, it’s worth analyzing the components that have generally been overlooked in mainstream coverage. The financial roadmap for the upcoming fiscal year has been prepared with the goal of reviving the International Monetary Fund (IMF) program.

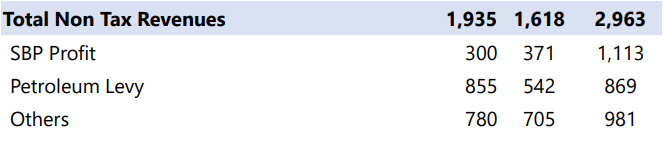

The revised tax revenues of Rs 9.4 trillion appear ambitious; therefore, the generous expenditure estimates may not hold true. However, an important component of the overall budget is non-tax revenues.

According to a report by JS Global, “Non-tax collection reflects a jump, targeted to almost double in FY24, from FY23’s revised base.”

The key contribution comes from SBP profits, which are expected to grow three times YoY, most likely due to piling repurchase agreements on prevailing record-high interest rates. It’s worth noting that SBP profits in Fiscal Year (FY) 23 were reported at 9MFY22 levels.

Additionally, the petroleum levy is expected to grow by 60% YoY, and given PDL on MS & HSD remain at Rs 50/ltr (revised at Rs 60/ltr), the target is likely to be achieved even at low single-digit volumetric growth in POL products.

Source: JS Global (Rs Billion)

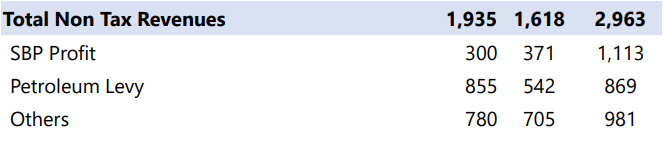

Another source of revenue for the federal government would be dividend income from listed and unlisted corporations.

“For FY24, the segment (dividend income) is budgeted to provide an income of Rs 121 billion (+50% YoY), 1% of the total revenue size of Rs 12 trillion. Out of these, more than 70% of the dividend stream pertains to listed companies, where almost 50% are subjected to a single company - Oil & Gas Development Ltd (OGDC). The target could face headwinds, similar to historical trend - unless extraordinary dividends are paid by energy companies,” remarked Amreen Soorani, Head of Research at JS Global.

As per the JS Global report, it’s apparent that company-wise budgeted dividends have consistently fallen short of both the actual dividends announced by corporates and the revised dividend income provided by the government in budget documents.

As of 9MFY23, the total collection from dividends of listed companies amounted to Rs 27 billion, compared to the budgeted amount of Rs 56 billion.

OGDCL is the largest contributor to actual dividend income, accounting for almost 80% of the actual dividend income from listed companies. This stands in contrast to high dividend-paying companies like Fauji Fertilizer (FFC) and Mari Petroleum (MARI), where the government holds less than 20% stake in both.

As a result, any deficit in funding may need to be financed through increased domestic borrowing, with the expanding fiscal deficit once again dependent on the banking sector to fund two-thirds of the deficit. The government has continued to increase the banking sector's contribution to total domestic loans, heavily relying on banks to finance its expenditures.

Source: JS Global (Rs Billion)

The revised tax revenues of Rs 9.4 trillion appear ambitious; therefore, the generous expenditure estimates may not hold true. However, an important component of the overall budget is non-tax revenues.

According to a report by JS Global, “Non-tax collection reflects a jump, targeted to almost double in FY24, from FY23’s revised base.”

The key contribution comes from SBP profits, which are expected to grow three times YoY, most likely due to piling repurchase agreements on prevailing record-high interest rates. It’s worth noting that SBP profits in Fiscal Year (FY) 23 were reported at 9MFY22 levels.

Additionally, the petroleum levy is expected to grow by 60% YoY, and given PDL on MS & HSD remain at Rs 50/ltr (revised at Rs 60/ltr), the target is likely to be achieved even at low single-digit volumetric growth in POL products.

Source: JS Global (Rs Billion)

Another source of revenue for the federal government would be dividend income from listed and unlisted corporations.

“For FY24, the segment (dividend income) is budgeted to provide an income of Rs 121 billion (+50% YoY), 1% of the total revenue size of Rs 12 trillion. Out of these, more than 70% of the dividend stream pertains to listed companies, where almost 50% are subjected to a single company - Oil & Gas Development Ltd (OGDC). The target could face headwinds, similar to historical trend - unless extraordinary dividends are paid by energy companies,” remarked Amreen Soorani, Head of Research at JS Global.

As per the JS Global report, it’s apparent that company-wise budgeted dividends have consistently fallen short of both the actual dividends announced by corporates and the revised dividend income provided by the government in budget documents.

As of 9MFY23, the total collection from dividends of listed companies amounted to Rs 27 billion, compared to the budgeted amount of Rs 56 billion.

OGDCL is the largest contributor to actual dividend income, accounting for almost 80% of the actual dividend income from listed companies. This stands in contrast to high dividend-paying companies like Fauji Fertilizer (FFC) and Mari Petroleum (MARI), where the government holds less than 20% stake in both.

As a result, any deficit in funding may need to be financed through increased domestic borrowing, with the expanding fiscal deficit once again dependent on the banking sector to fund two-thirds of the deficit. The government has continued to increase the banking sector's contribution to total domestic loans, heavily relying on banks to finance its expenditures.

Source: JS Global (Rs Billion)