In free market economies, the corporate sector routinely lobbies the governments to create an environment conducive to business growth. The premise is that if large corporations do well everyone does well. The jobs they create employ people who in turn spend money on everything from necessities to discretionary spending thereby contributing to the economy. Governments also benefit by way of additional tax revenues they receive.

There is no doubt that a strong and thriving corporate sector is essential for the economic growth and prosperity of a country. To that end, the governments must do everything reasonably possible to provide the necessary support to ensure their businesses can compete on a level playing field with their competitors, domestic or foreign.

Government support (read taxpayers’ support) to the corporate sector can take several forms such as fiscal and monetary policies to attract domestic and foreign investment, less restrictive regulatory regimes, lower tax rates, investment in infrastructure for the transportation of raw material and finished goods, and direct government subsidies and low-cost loans to encourage the establishment of new factories or modernization and expansion of the existing ones. In return, one would expect that the corporate sector would be grateful to the taxpayers whose hard-earned money the governments spend on them but that’s not the case most of the time.

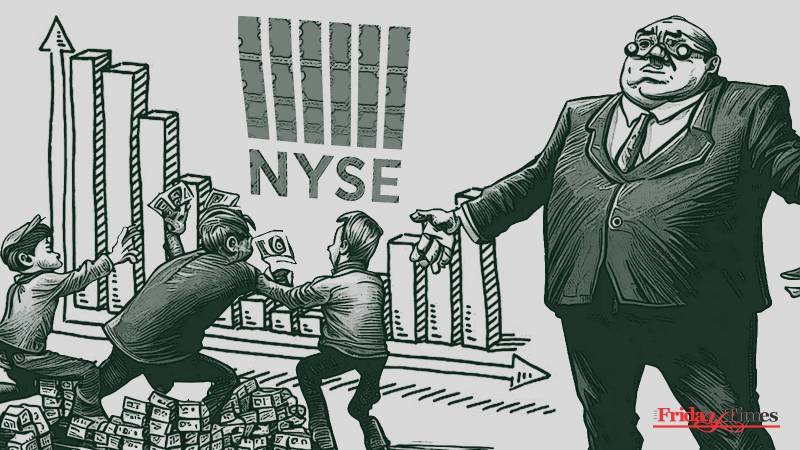

Large companies, both private and publicly traded, prioritize profit maximization at the expense of other considerations, such as ethical, social, or environmental concerns. Their primary responsibility seems to be to their shareholders to provide them with the highest possible return on their investment.

In general, large companies, both private and publicly traded, prioritize profit maximization at the expense of other considerations, such as ethical, social, or environmental concerns. Their primary responsibility seems to be to their shareholders to provide them with the highest possible return on their investment. This pressure can sometimes lead to short-term thinking and a focus on immediate financial gains at the expense of sustainable operations in the long term.

Some of the unfair and often illegal business practices that corporations engage in include anti-competitive practices such as price fixing, blocking competitors access to distribution channels, false and misleading advertising, tax avoidance by using creative accounting practices or using loopholes in the tax legislation, exploiting workers by paying them low wages and forcing them to work in unsafe conditions and ignoring environmental harm such as unsafe disposal of waste to save on costs.

There are numerous examples of how corporations cheat consumers and swindle the very taxpayers whose financial support they enjoy in one way or another. For example, in 2015, a major Canadian grocery company confessed to taking part in what the government alleged was an industry-wide scheme that involved several major grocers colluding to artificially inflate bread prices. In 2008, criminal charges were laid against several companies and individuals who were engaged in price fixing of gasoline at the gasoline stations in a certain region of Canada. They were accused of calling each other to agree on the price for several years. Most of the accused pleaded guilty and got away after paying the fines.

In a bizarre scheme, Kia Canada would not ship the cars to its dealerships near the end of the year 2023 even though these vehicles had arrived from overseas but were withheld at a large storage facility. Their rationale seemed to be to not show overperformance for the year as the sales target for the year was already achieved. Most of these cars were pre-sold to customers who had put a deposit on them and were waiting for months for the delivery of their vehicles. Clearly, Kia prioritized their corporate performance objectives over customer needs and hardships.

Most large corporations are doing very well financially and their executives’ compensation packages are breaking records after records. But when corporations face business downturns or financial difficulties, the easiest course of action for them seems to be to cut their workforce to reduce the costs, the very people who were supposed to be the backbone of their operations.

The latest trick or cheat the corporations are playing on consumers is known as ‘shrinkflation.’ This is a situation when the price of a product, mostly food and grocery, stays the same but its size or quantity gets smaller. Shrinkflation is a cunning way of raising prices without actually raising the price of the product you are buying. Examples include cereal boxes, chip bags, candy bars, and drink containers.

Generally speaking, most large corporations are doing very well financially and their executives’ compensation packages are breaking records after records. But when corporations face business downturns or financial difficulties, the easiest course of action for them seems to be to cut their workforce to reduce the costs, the very people who were supposed to be the backbone of their operations. Some corporations do show empathy to their affected employees and take steps to reduce the pain but for many others, their employees are simply dispensable in the course of business.

In other cases, corporations have gone into bankruptcies after improprieties were discovered such as fraudulent accounting methods to artificially raise share prices, hiding of big losses by the executives, risky investments, unrealistic forecasts of sales and revenues, internal corruption, and in some cases outright stealing of funds by company executives. At other times corporations mismanaged their affairs by sometimes making decisions that benefited executives personally but did not align with broader stakeholder interests. Large corporations such as Enron, Swissair, WorldCom, Nortel, Lehman Brothers, and several small and medium-sized banks fall into this category. They just disappeared from the corporate landscape leaving behind massive losses for their shareholders, creditors, and thousands of employees out of work.

Companies should clearly articulate their values emphasizing the importance of ethical behavior and social responsibility. Universities and institutions can play an important role by integrating business ethics education into business school curricula and corporate training programs to raise awareness about the importance of ethical decision-making.

Some corporations have become so big that their failure would affect not just their shareholders, employees, and other stakeholders but the overall economy at large, forcing the governments no choice but to intervene. For example, in 2008, the North American automotive industry faced severe business decline due to a combination of factors affecting the economy. This eventually forced the two big automakers – General Motors and Chrysler – to file for bankruptcy protection. They were eventually bailed out by a massive rescue package offered by the US and Canadian governments. Ironically, even in those dark days, the executives of these corporations did not show any humility in their lifestyle. They were grilled at Congressional hearings when it was disclosed that they traveled in private luxurious jets and stayed in five-star hotels when they arrived in Washington to plead for the government handout.

Combating corporate greed may involve a combination of regulatory measures, changes in corporate culture, and shifts in societal attitudes. Corporations must adopt an industry-wide code of conduct and implement and enforce strong corporate governance standards to ensure that they are managed in the best interests of all stakeholders, not just shareholders.

They must change corporate culture by promoting ethical leadership at all levels of a company. Companies should clearly articulate their values emphasizing the importance of ethical behavior and social responsibility. Universities and institutions can play an important role by integrating business ethics education into business school curricula and corporate training programs to raise awareness about the importance of ethical decision-making. Corporate accountability must be an integral part of corporate governance. Corporations must improve transparency by enhancing disclosure requirements, making it easier for stakeholders to understand a company's practices, including its social and environmental impact.

Corporations risk consumers' wrath if they don’t clean up their act. They should not underestimate the power of consumer activism. Thanks to social media it is now easier than ever for consumers to organize and take targeted action against offenders. The calls for economic justice are getting louder and louder.