The supply of petrol and diesel in the country saw an artificial shortage at a few stations across the country as petrol pumps started hoarding oil & diesel in an anticipation of a fuel price hike on the 1st of February.

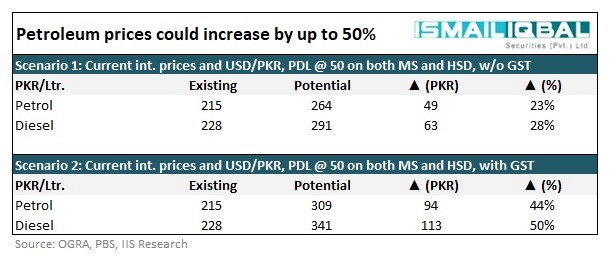

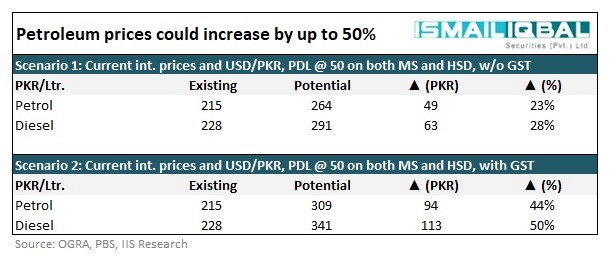

The expected hike is on the back of a record devaluation of the rupee and a likely implementation of a Rs.50 Petroleum Development Levy on diesel in line with the commitments to the IMF. Further, the Fund has also demanded a levy of 17 percent on petroleum products in the form of General Sales Tax (GST).

“Petroleum prices can increase by up to 28%, if impact of international prices and exchange rate depreciation is passed on to consumers. It can increase by up to 50% if GST is also imposed,” tweeted, Fahad Rauf, Head of Research, Ismail Iqbal Securities.

Earlier, there were reports claiming that the country was heading towards a fuel shortage as Oil Marketing Companies were unable to open LCs to import fuel.

However, Oil and Gas Regulatory Authority (OGRA) has assured that the situation is under control. “It has been observed that speculative prices of petrol and diesel are being reported in the print and electronic media since last evening that is misleading and incorrect,” OGRA spokesman Imran Ghaznavi said in a brief press statement. Further, OGRA has also refuted the rumors of fuel shortage in the country, claiming that stocks amounting to 18 days of oil and 37 days of diesel requirement were available in the country.

As per sources, Shell received a fuel shipment last week, and two other shipments have also docked and are awaiting LC clearance.

As far as the impact of the devaluation is concerned, it would fully reflect in the petroleum prices after 15 February as the weighted average price of the dollar in January was around Rs 240.

KP’s interim Chief Minister, Azam Khan, has taken notice of the artificial shortage created on the basis of speculations and has ordered the deputy commissioners of the province to submit a detailed report.

On the international front, petroleum prices are likely to rise further as China’s economy opens up after three years of strict Covid restrictions. “China’s reopening is also expected to drive up demand for oil. The International Energy Agency said in a report last week that global demand could surge to an all-time high of 101.7 million barrels per day this year, with China accounting for almost half of that increase,” reported CNN.

However, Pakistan is also agreeing to terms of trade with Russia for importing oil and other petroleum products. “Independent Russian oil refiner Forteinvest has clinched a deal that will see Russian gasoline sent to Pakistan by land for the first time, two industry sources said on Friday, as Russian refiners seek alternative markets for motor fuels days before an EU import ban,” as per Reuters.

The expected hike is on the back of a record devaluation of the rupee and a likely implementation of a Rs.50 Petroleum Development Levy on diesel in line with the commitments to the IMF. Further, the Fund has also demanded a levy of 17 percent on petroleum products in the form of General Sales Tax (GST).

“Petroleum prices can increase by up to 28%, if impact of international prices and exchange rate depreciation is passed on to consumers. It can increase by up to 50% if GST is also imposed,” tweeted, Fahad Rauf, Head of Research, Ismail Iqbal Securities.

Earlier, there were reports claiming that the country was heading towards a fuel shortage as Oil Marketing Companies were unable to open LCs to import fuel.

However, Oil and Gas Regulatory Authority (OGRA) has assured that the situation is under control. “It has been observed that speculative prices of petrol and diesel are being reported in the print and electronic media since last evening that is misleading and incorrect,” OGRA spokesman Imran Ghaznavi said in a brief press statement. Further, OGRA has also refuted the rumors of fuel shortage in the country, claiming that stocks amounting to 18 days of oil and 37 days of diesel requirement were available in the country.

As per sources, Shell received a fuel shipment last week, and two other shipments have also docked and are awaiting LC clearance.

As far as the impact of the devaluation is concerned, it would fully reflect in the petroleum prices after 15 February as the weighted average price of the dollar in January was around Rs 240.

KP’s interim Chief Minister, Azam Khan, has taken notice of the artificial shortage created on the basis of speculations and has ordered the deputy commissioners of the province to submit a detailed report.

On the international front, petroleum prices are likely to rise further as China’s economy opens up after three years of strict Covid restrictions. “China’s reopening is also expected to drive up demand for oil. The International Energy Agency said in a report last week that global demand could surge to an all-time high of 101.7 million barrels per day this year, with China accounting for almost half of that increase,” reported CNN.

However, Pakistan is also agreeing to terms of trade with Russia for importing oil and other petroleum products. “Independent Russian oil refiner Forteinvest has clinched a deal that will see Russian gasoline sent to Pakistan by land for the first time, two industry sources said on Friday, as Russian refiners seek alternative markets for motor fuels days before an EU import ban,” as per Reuters.