It seems the meetings and flurry of calls by Prime Minister Shehbaz Sharif to the Managing Director of the International Monetary Fund (IMF) in recent days and weeks has paid off after the global lender agreed to terms at the staff level for extending $3 billion to Pakistan.

In a statement on Friday morning, the IMF said that they had reached a staff-level agreement with Pakistani authorities " on policies to be supported by a Stand-By Arrangement (SBA)."

The staff-level agreement, however, is subject to approval by the IMF Executive Board, which is expected to convene and review the agreement by mid-July, the statement read.

"I am pleased to announce that the IMF team has reached a staff-level agreement with the Pakistani authorities on a nine-month Stand-by Arrangement (SBA) in the amount of SDR2,250 million (about $3 billion or 111 percent of Pakistan's IMF quota)," said IMF Pakistan Staff Team Lead Nathan Porter in the statement.

"The new SBA builds on the authorities' efforts under Pakistan's 2019 EFF-supported program, which expires end-June."

This agreement is subject to approval by the IMF's Executive Board, which is expected to consider this request by mid-July.

READ MORE: Malice Towards None & All: Pakistan’s Sordid Story Of Debt Enslavement

It added that the SBA would support Pakistan's efforts to stabilize the economy from recent external shocks, preserve macroeconomic stability and provide a framework for financing from multilateral and bilateral partners -- i.e. specifically for assuaging Pakistani fears that along with the IMF, it would also lose financing from friends such as Saudi Arabia, UAE and even China.

The statement added that the cash injection would create space for social and development spending through improved domestic revenue mobilization and careful spending execution to help address the needs of the Pakistani people.

Porter's comments, carried in the official statement, however, suggested that Pakistan and Ishaq Dar had failed to complete the ninth and tenth reviews under the Extended Fund Facility Program, which expired this month.

"Since the completion of the combined seventh and eighth reviews under the 2019 Extended Fund Facility (EFF) in August 2022, the economy has faced several external shocks, such as the catastrophic floods in 2022 that impacted the lives of millions of Pakistanis and an international commodity price spike in the wake of Russia's war in Ukraine," he said.

READ MORE: Condemned To Eternal Beggary

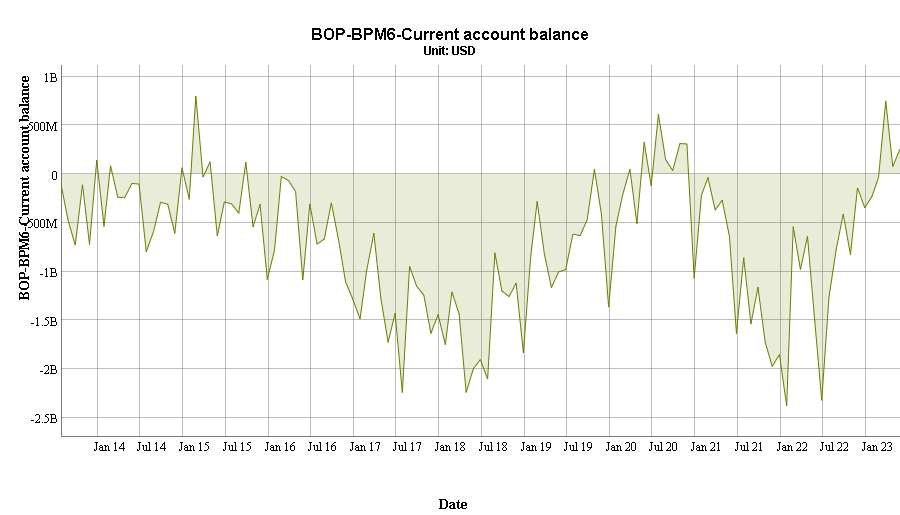

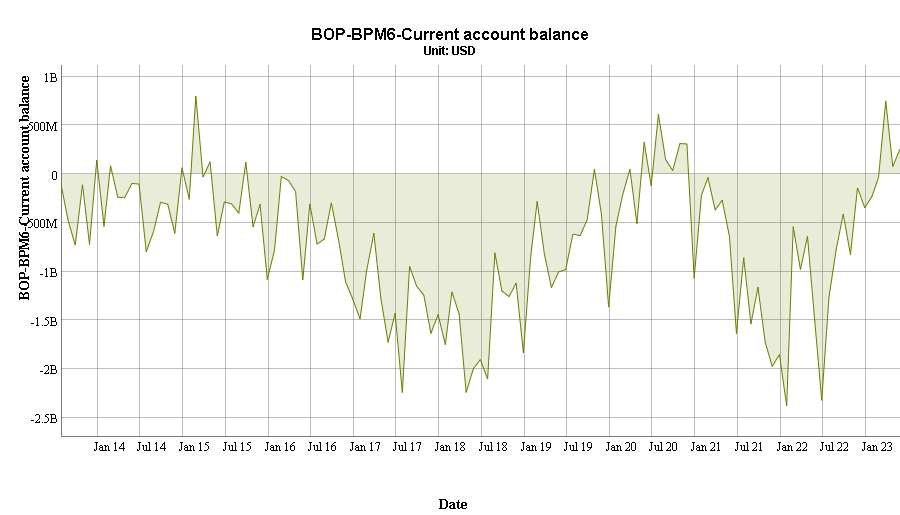

Porter continued that these shocks, as well as " policy missteps -- including shortages from constraints on the functioning of the FX (foreign exchange) market—economic growth has stalled. Inflation, including for essential items, is very high."

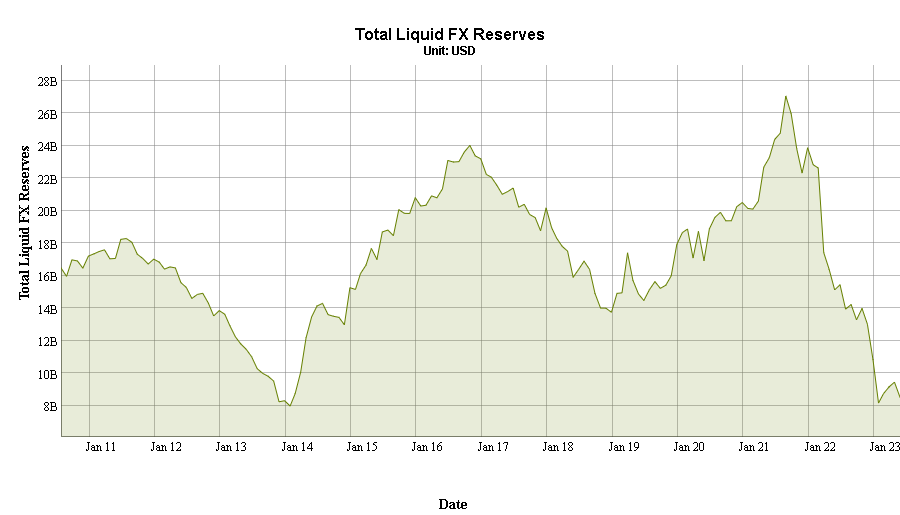

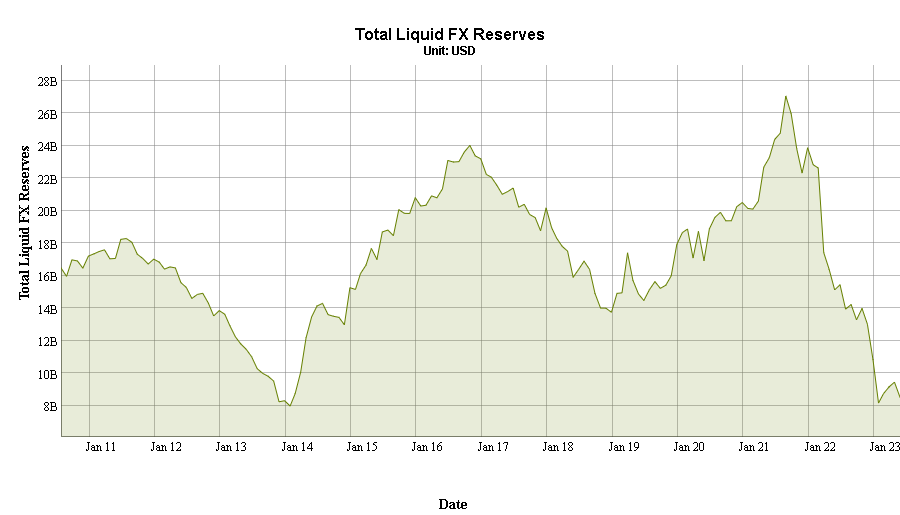

He added that even though Islamabad took steps to curtail imports and the trade deficit, the country's reserves have continued to plummet to a point where Pakistan did not have sufficient reserves to pay for a month's worth of imports.

"Liquidity conditions in the power sector also remain acute, with the further buildup of arrears (circular debt) and frequent load-shedding."

He hoped that the SBA would provide a policy anchor and a framework for financial support from multilateral and bilateral partners in the coming months.

The statement went on to recognize the steps taken by the government to enhance revenues, broaden the tax base and increase tax collection from the undertaxed sectors while increasing support through the BISP program.

"It will be important that the budget is executed as planned, and the authorities resist pressures for unbudgeted spending or tax exemptions in the period ahead," the IMF suggested.

It further noted that the government and the State Bank of Pakistan have agreed to drop the restrictive import regime and to allow the rupee's value against the US dollar to be determined by the market.

"Going forward, the SBP should remain proactive to reduce inflation, which particularly affects the most vulnerable, and maintain a foreign exchange framework free of restrictions on payments and transfers for current international transactions and multiple currency practices," it suggested, all but confirming rumours that prior to the recent emergency interest rate hike of 100 basis points, the IMF had suggested that the interest rate should be raised by seven percent to 28%.

READ MORE: Race Against Time To Revive Stalled IMF Program

It also seemed to discourage the government's attempts to offset pressures on its dollar reserves by opting for currency swap arrangements with several bilateral partners.

The IMF noted that the government would need to continue its efforts to find new sources of external financing, such as the generous climate-related pledges from the January 2023 Conference on Climate Resilient Pakistan held in Geneva and securing the rollover of debts.

READ MORE: Government Could Earn Rs364 Billion Through Tobacco Tax In FY 2023-24

The global lender noted that the stand-by agreement would see Pakistan's efforts to strengthen the viability of the energy sector (including through a timely FY24 annual rebasing), improve governance of state-owned enterprises, and strengthen the public investment management framework, including for projects needed to build resilience to climate change.

The full and timely implementation of the program will be critical for its success in light of the difficult challenges, it stressed.

Later, Shehbaz welcomed the agreement, hoping it would help strengthen Pakistan's economy and put it on the path of sustainable growth.

https://twitter.com/CMShehbaz/status/1674670941060706304

In a statement on Friday morning, the IMF said that they had reached a staff-level agreement with Pakistani authorities " on policies to be supported by a Stand-By Arrangement (SBA)."

The staff-level agreement, however, is subject to approval by the IMF Executive Board, which is expected to convene and review the agreement by mid-July, the statement read.

"I am pleased to announce that the IMF team has reached a staff-level agreement with the Pakistani authorities on a nine-month Stand-by Arrangement (SBA) in the amount of SDR2,250 million (about $3 billion or 111 percent of Pakistan's IMF quota)," said IMF Pakistan Staff Team Lead Nathan Porter in the statement.

"The new SBA builds on the authorities' efforts under Pakistan's 2019 EFF-supported program, which expires end-June."

This agreement is subject to approval by the IMF's Executive Board, which is expected to consider this request by mid-July.

READ MORE: Malice Towards None & All: Pakistan’s Sordid Story Of Debt Enslavement

It added that the SBA would support Pakistan's efforts to stabilize the economy from recent external shocks, preserve macroeconomic stability and provide a framework for financing from multilateral and bilateral partners -- i.e. specifically for assuaging Pakistani fears that along with the IMF, it would also lose financing from friends such as Saudi Arabia, UAE and even China.

The statement added that the cash injection would create space for social and development spending through improved domestic revenue mobilization and careful spending execution to help address the needs of the Pakistani people.

Porter's comments, carried in the official statement, however, suggested that Pakistan and Ishaq Dar had failed to complete the ninth and tenth reviews under the Extended Fund Facility Program, which expired this month.

"Since the completion of the combined seventh and eighth reviews under the 2019 Extended Fund Facility (EFF) in August 2022, the economy has faced several external shocks, such as the catastrophic floods in 2022 that impacted the lives of millions of Pakistanis and an international commodity price spike in the wake of Russia's war in Ukraine," he said.

READ MORE: Condemned To Eternal Beggary

Porter continued that these shocks, as well as " policy missteps -- including shortages from constraints on the functioning of the FX (foreign exchange) market—economic growth has stalled. Inflation, including for essential items, is very high."

He added that even though Islamabad took steps to curtail imports and the trade deficit, the country's reserves have continued to plummet to a point where Pakistan did not have sufficient reserves to pay for a month's worth of imports.

"Liquidity conditions in the power sector also remain acute, with the further buildup of arrears (circular debt) and frequent load-shedding."

He hoped that the SBA would provide a policy anchor and a framework for financial support from multilateral and bilateral partners in the coming months.

The statement went on to recognize the steps taken by the government to enhance revenues, broaden the tax base and increase tax collection from the undertaxed sectors while increasing support through the BISP program.

"It will be important that the budget is executed as planned, and the authorities resist pressures for unbudgeted spending or tax exemptions in the period ahead," the IMF suggested.

It further noted that the government and the State Bank of Pakistan have agreed to drop the restrictive import regime and to allow the rupee's value against the US dollar to be determined by the market.

"Going forward, the SBP should remain proactive to reduce inflation, which particularly affects the most vulnerable, and maintain a foreign exchange framework free of restrictions on payments and transfers for current international transactions and multiple currency practices," it suggested, all but confirming rumours that prior to the recent emergency interest rate hike of 100 basis points, the IMF had suggested that the interest rate should be raised by seven percent to 28%.

READ MORE: Race Against Time To Revive Stalled IMF Program

It also seemed to discourage the government's attempts to offset pressures on its dollar reserves by opting for currency swap arrangements with several bilateral partners.

The IMF noted that the government would need to continue its efforts to find new sources of external financing, such as the generous climate-related pledges from the January 2023 Conference on Climate Resilient Pakistan held in Geneva and securing the rollover of debts.

READ MORE: Government Could Earn Rs364 Billion Through Tobacco Tax In FY 2023-24

The global lender noted that the stand-by agreement would see Pakistan's efforts to strengthen the viability of the energy sector (including through a timely FY24 annual rebasing), improve governance of state-owned enterprises, and strengthen the public investment management framework, including for projects needed to build resilience to climate change.

The full and timely implementation of the program will be critical for its success in light of the difficult challenges, it stressed.

Later, Shehbaz welcomed the agreement, hoping it would help strengthen Pakistan's economy and put it on the path of sustainable growth.

https://twitter.com/CMShehbaz/status/1674670941060706304