Investors at the Pakistan Stock Exchange on Thursday cast a negative vote on the confidence they have in the interim government's ability to manage the economy with their investment decisions as the bourse lost over a thousand points, falling by 2.7 percent.

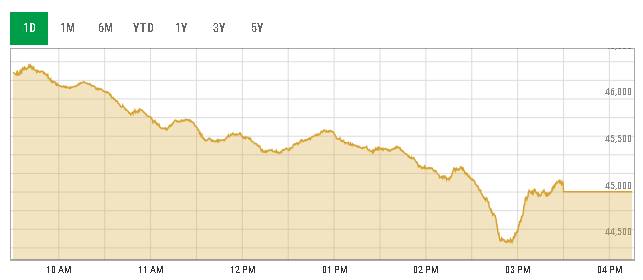

After a battering week, the Karachi Stock Exchange -100 index started the day at 46,244.55 points. But things were about to get worse.

The index began to slide after an initial rise of around 113.46 points in the opening hour.

This trend continued into the second session. But by then, the index had already lost over 620.19 points.

In the second session, just before the cut-off for stop-loss for smaller traders kicked in, the index sharply declined, taking a sudden plunge of around 803.35 points within 30 minutes as the index fell to a low of 44,459.62 points.

However, the index did recover after that, recouping around 547.04 points in just 15 minutes. But by then, the damage had been done.

The index went on to close the day at 45,002.41 points.

The biggest sector contributing to Thursday's crash was the energy sector on the back of hikes in electricity, gas and impending fuel prices amid continued devaluation of the Rupee.

According to securities firm Topline, the concerns over energy prices and continued devaluation have shaken investor confidence in the country's economic condition, with investors fearing that it would push the State Bank of Pakistan (SBP) to hike the interest rates far beyond the current highest-ever rates, slowing down economic activity. The central bank is expected to review the policy rate in its upcoming monetary policy announcement scheduled for September 14.

Major contributions to the index came from banks MCB and UBL, followed by Hub Power Company (HUBC), Meezan Bank Limited (MEBL) and Pakistan Petroleum Limited (PPL) as they weighed the index down by -433 points.

Other energy companies that saw major declines were the Oil Gas Development Company (OGDC), Pakistan Refineries Limited (PRL), and Cnergyico PK Limited (CNERGY).

Traded volume and value for the day stood at 287 million shares worth Rs12.3 billion.

World Call Telecom (WTL) was today's volume leader, with around 32 million shares traded.

Meanwhile, two cement manufacturers announced lower-than-expected earnings owing to higher taxes imposed by the government.

In its fourth-quarter earnings, Kohat Cement Company (KOHC) showed they were lower than industry expectations due to higher-than-estimated effective tax rates.

It was similar for Dera Ghazi Khan Cement (DGKC), whose fourth-quarter earnings showed a loss due to the high tax rate and lower gross margin.

Month of decline

With Thursday being the last day of trading for August, data showed that the index had fallen by 6.3% on a month-on-month basis.

According to Topline Securities, the decline in monthly trading can be attributed to the profit-taking attitude of investors where investors came to sell as the interim government took charge and the impact of reforms agreed with the International Monetary Fund (IMF) started coming in, specifically the removal of import restrictions to temporarily buoy the exchange. However, these policy changes meant that the pressure increased on the Rupee (which fell 6.2% on a month-on-month basis, past the Rs300 psychological barrier), and a hike in energy prices (electricity/fuel) to arrest a hike in circular debt resulted in higher inflation.

Other major developments during the month were:

1) Consumer price index for July clocking in at 28.3% year on year, as compared to 29.4% in June 2023,

2) Remittances for July 2023 coming in at $2 billion (down by 7% quarter on quarter and 19% year on year) and

3) Current Account deficit for July 2023 coming in at $809mn after four consecutive months in which the current account was in surplus.

The average daily traded value and volume during August was around 297 million shares daily, with a market value of Rs11.5 billion.

In August, insurance companies and foreign corporations bought equities worth $30 million, $18.76 million and $12.26 million respectively.

At the same time, mutual funds, banks, individuals and brokers sold equities worth $18.24 million, $17.49 million, $10.72 million and $4.53 million, respectively.