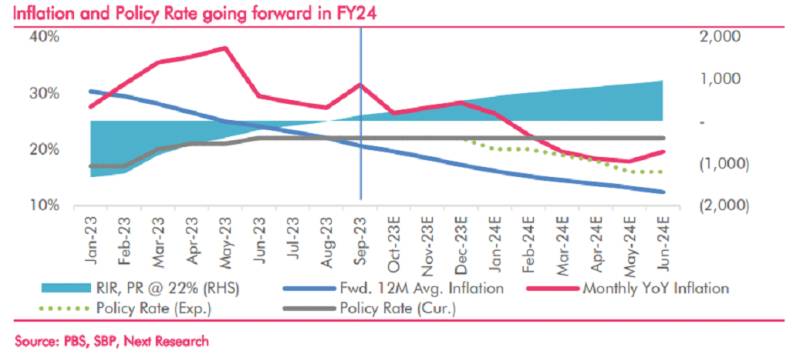

The State Bank of Pakistan (SBP), during its Monetary Policy Committee (MPC) meeting on Monday, decided to maintain the policy rate at 22% for the second time consecutively. The central bank provided reassurance that although headline inflation saw an increase in September, it is expected to decrease in October and continue on a downward trajectory. However, these projections depend on certain risks related to inflation and the current account not materialising.

These risks include the volatility of global oil prices, the potential disproportionate impact of the recent gas tariff increase, and the ability to secure targeted funding from bilateral and multilateral sources. Nonetheless, the SBP has highlighted the upside of continued fiscal consolidation, improved market availability of key commodities, and the alignment of interbank and open market exchange rates as factors that could help mitigate these risks.

As per a report by Next Capital, “Year on Year (YoY) inflation numbers are expected to remain in the range of 26-29% during Oct’23-Jan’24, before the high-base effect starts taking the YoY readings downward from Feb’24 with an expected bottom for the year in May’24 at around 18%. Our estimate for average FY24 inflation stands at 24.1%.”

The MPC also highlighted the need to maintain a tight monetary policy stance and considers the real policy rate to be appropriate to effectively bring down inflation to the medium-term target. Further, recent indicators point towards moderate growth in economic activity, with improved crop output estimates and a recovery in key sectors such as cement, POL, and auto sales.

“The year after floods, crop yields are generally better. Better crops would lead to lower imports and reduce pressure on the current account. This would lead to support to the currency and lower inflation,” remarked Yousuf Farooq, the Head of Research at Chase Securities.

Another key metric highlighted in the MPC statement was the slowdown in Broad money supply and Currency in Circulation (CIC).

According to an analysis by JS Global Capital, “After marking a 23-quarter high Quarter on Quarter (QoQ) growth of 11% in 2QCY23, currency in circulation (CIC) stock has reported a steep decline of 9% QoQ in 3QCY23 (data available till 22nd Sep). A pace of decline not witnessed in many decades. On the other hand, deposit mobilisation under broad money supply (M2) has continued during the same period. The same, however, did not suffice to expand the total broad money supply stock, resulting in M2 to report a 1% QoQ decline during 3QCY23.”

“While higher savings rate could be among the key reasons of shift from cash to deposits, other possible factors such as ongoing crackdown on various segments of the economy, relative stability in the rupee parity etc, cannot be ruled out. The key contributing segments to deposit growth during 3QCY23 have been the Personal, Power, (Non-Banking Financial Institutions) NBFIs and Non-Financial Public Sector Enterprises (NFPSEs),” the report added.

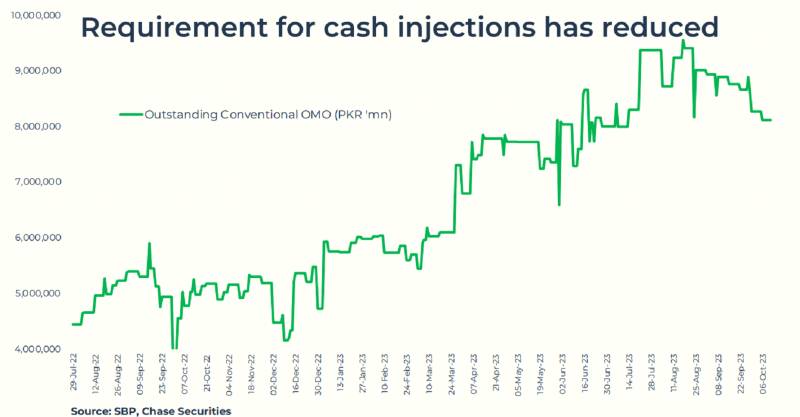

Further, the strict fiscal discipline necessitated by the International Monetary Fund (IMF) and the subsequent reduction in government borrowing has led to the easing out of money supply growth.

As per a report by Chase Securities, “The government of Pakistan has been borrowing amounts that have been higher than the increase in bank deposits. To fill the gap, the central bank injects cash into the system through Open Market Operations, increasing money supply. This government borrowing being financed by new money has caused inflation. Total amount injected through OMO has stalled and declined after peaking in August 2023.”

On the external front, Pakistan remains extremely vulnerable and dependent on the materialising of expected inflow from multilateral and bilateral sources.

“Despite the recent appreciation of the Rupee, the level of foreign exchange reserves has decreased. Additionally, given the upcoming debt payments in the second half of the year, it is crucial for Pakistan to secure additional funding from both bilateral and multilateral sources. The IMF's requirement of having reserves of approximately $10 billion by fiscal year-end is also necessary, and given the quantum of our external commitments, the $10 billion amount is also approximately what we must raise within the next eight months to plug the funding gap,” remarked Mustafa Pasha, the Chief Investment Officer at Lakson Investments.

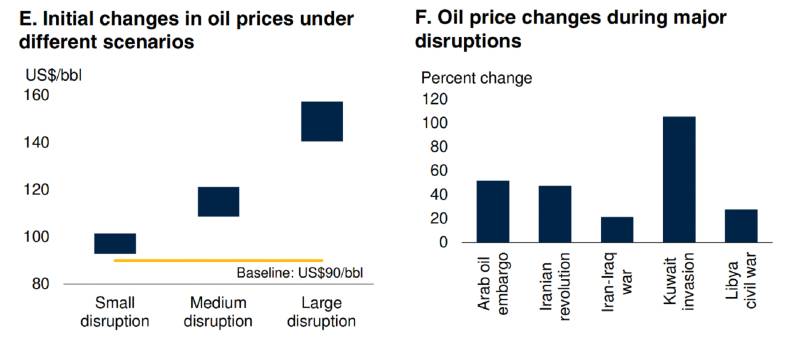

Further, the conflict in the Middle East poses a real threat in terms of a possible commodity market disruption if the war spills over into the region.

As per the World Bank, if the crisis escalates into a regional conflict or larger, it would significantly disrupt oil supply. There could be a notable decline in global oil supply, ranging from 6 to 8 million barrels per day (approximately 6% to 8% of the 2023 supply).

This scenario is reminiscent of the initial disruption caused by the Arab oil embargo in 1973, which resulted in a loss of nearly 7.5% of the global oil supply at that time. If such a scenario occurs, oil prices would initially experience a considerable increase, with prices rising by 56% to 75% ($50/bbl to $67/bbl) above the baseline level of the fourth quarter of 2023.

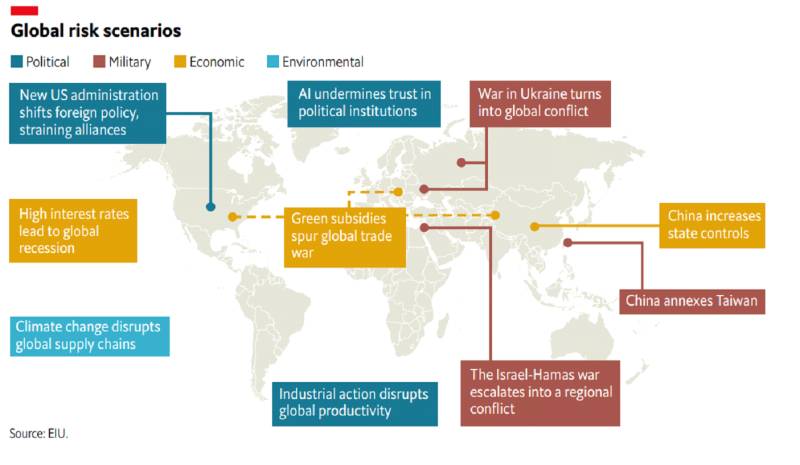

Additionally, there are other risks which haunt the global economy and can have a direct impact on the Pakistani economy. As per a report by the Economic Intelligence Unit, Since early 2022, major central banks around the globe have responded to the high inflation by implementing interest rate hikes and initiating the reduction of their balance sheets. Based on the established disinflation trend, the forecasts assume that the tightening of monetary policy has now concluded. However, there remains a moderate risk that inflation might accelerate again in 2024. This could be driven by robust global demand, as labour markets continue to be tight and workers maintain bargaining power, alongside an increase in key commodity prices due to supply shortages.

The potential re-acceleration of inflation could lead central banks to prolong their tightening measures well into the following year, resulting in higher interest rates. This, in turn, could potentially trigger a significant decline in consumer and investment demand. In emerging markets like Pakistan, higher-than-expected interest rates could also lead to severe currency depreciations, further exacerbating inflation and impeding economic growth.

Therefore, while the SBP is indicating positive signs in terms of inflation easing out, the country remains vulnerable to exogenous shocks, as well as global political and economic volatility. This context makes it challenging to declare victory over inflation, at least for now.