Global petroleum giant Shell has sold its operations in Pakistan to Saudi fuel retailer Wafi Energy LLC.

According to a statement issued on Wednesday by the Shell Petroleum Company Limited, it had sold its majority 77.42% majority shares in Shell Pakistan Limited (SPL).

The sale will see Wafi Energy take over Shell's more than 600 mobility sites, 10 fuel terminals, a lubricant oil blending plant and 26% shareholding in the Pak-Arab Pipeline Company Limited.

Shell had been looking to dispose of its Pakistan operations for months, having announced its intentions in this regard on Capital Markets Day in June 2023.

Shell said that the sale was part of its strategy to "high-grade" its mobility network.

Subject to to regulatory approvals and other formalities, the sale is expected to be completed by the fourth quarter of 2024.

At that point, it would bring to an end the 76-year partnership between Shell and Pakistan.

Shell, however, said that its brand will remain in Pakistan despite the sale through a series of brand licensing agreements whereby customers will still be able to purchase Shell’s premium fuel and lubrication products.

Wafi Energy LLC is a wholly-owned affiliate of Asyad Holding Group. It is a leading fuel retailer in Saudi Arabia and last year signed a license agreement to operate mobility sites under the Shell brand in the kingdom.

The decision to sell Pakistan operations has long been contemplated by Shell as it realigns its strategy to increase shareholder returns and divest from underperforming businesses worldwide.

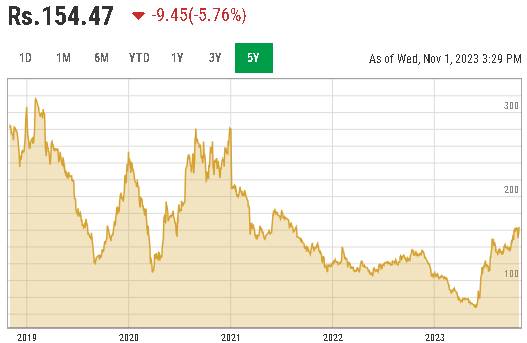

On Wednesday, Shell Pakistan Limited -- which is listed on the stock exchange -- opened trading at Rs163.50 but it then suffered a crash to Rs151.63 before recovering to Rs157.49 and then stabilising to Rs154.47 upon news of its sale. Around 5.6 million shares traded hands. Its five-year trend graph showed that Shell had seen highs of Rs314.91 per share in February 2019, which bottomed out to Rs68.36 per share in May of this year, prompting the decision of the board to sell.