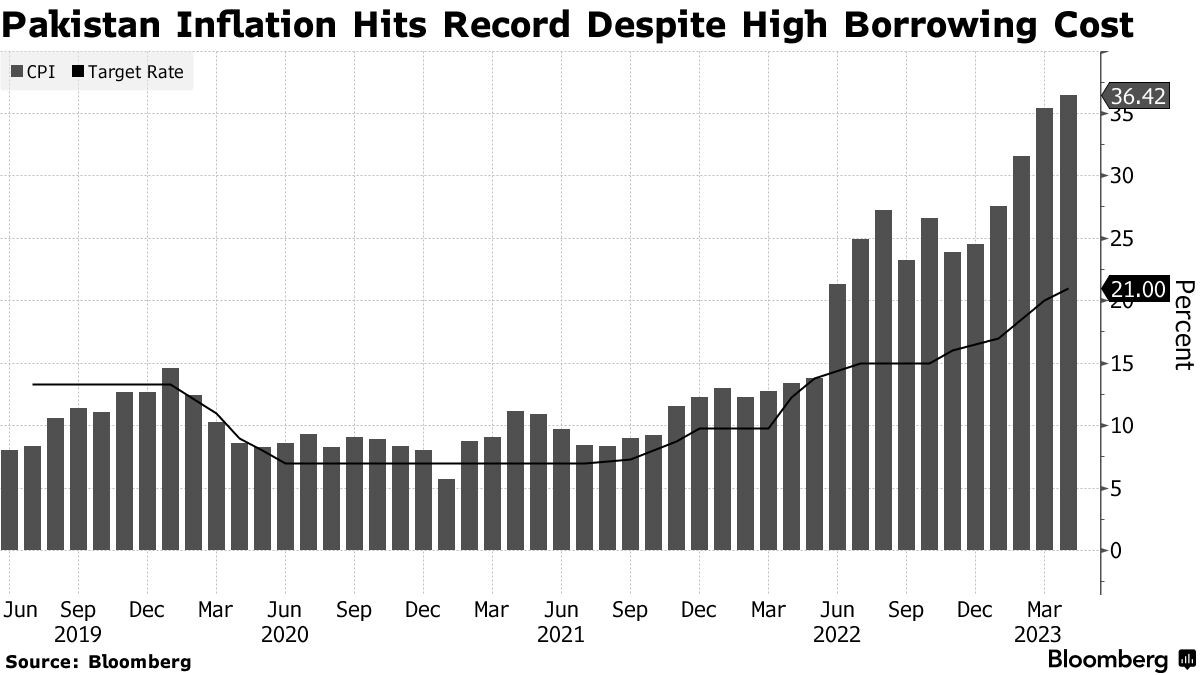

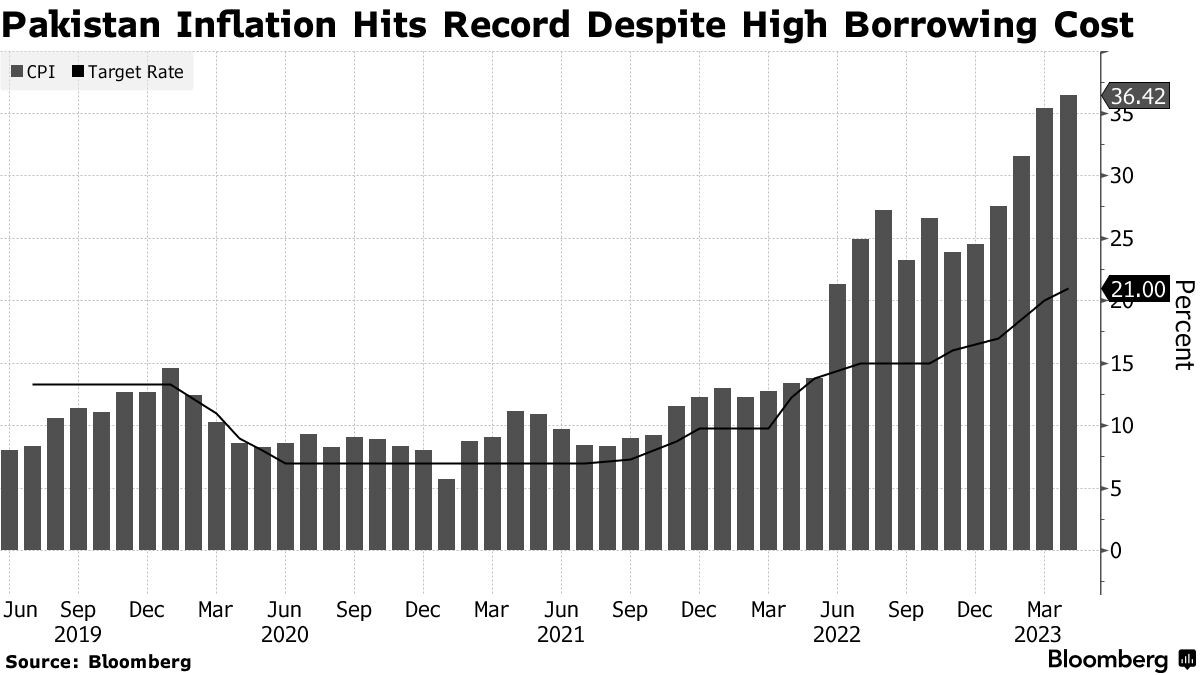

“Pakistan took the crown for Asia’s fastest inflation from Sri Lanka as a weaker currency and rising food and energy costs drove price gains to a record in April.” This statement from a recent Bloomberg article sums up the economic havoc created by severe mismanagement in the country.

The inflation rate, currently, is the highest for Pakistan in almost 60 years. Further, the Pakistani rupee has also significantly depreciated against the dollar, dropping by 20% so far in 2023, making imported goods more expensive.

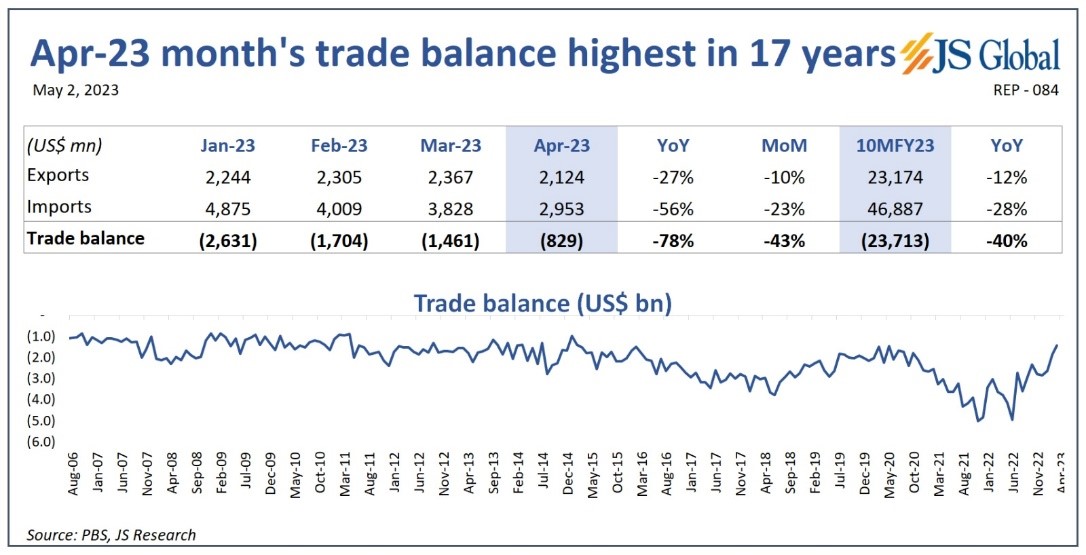

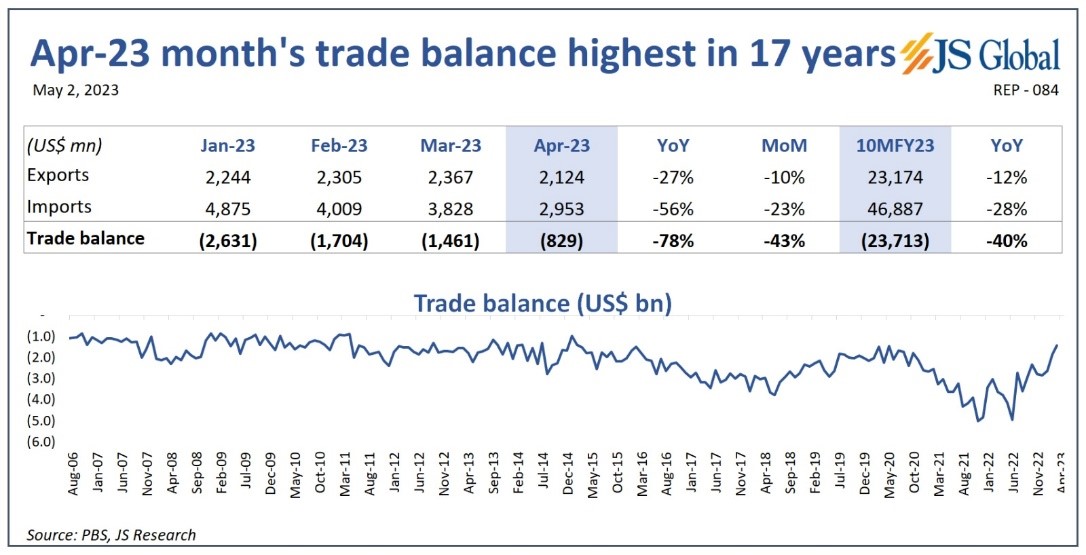

The government is exploring various measures to address liquidity concerns, and one of the primary measures is to impose import restrictions. “Pakistan posted a CAS of US$654 million during March and the currency has stabilized. We anticipate monthly CPI inflation to soften after May 2023 and gradually decline over the next 12 months majorly because of base effect along with tight monetary and fiscal policy,” read a report by Topline Securities. However, this approach has choked the economic activity and looks unsustainable in the long run.

All this information upfront paints a bleak picture of the country’s economy and the condition, indeed, is an abysmal one.

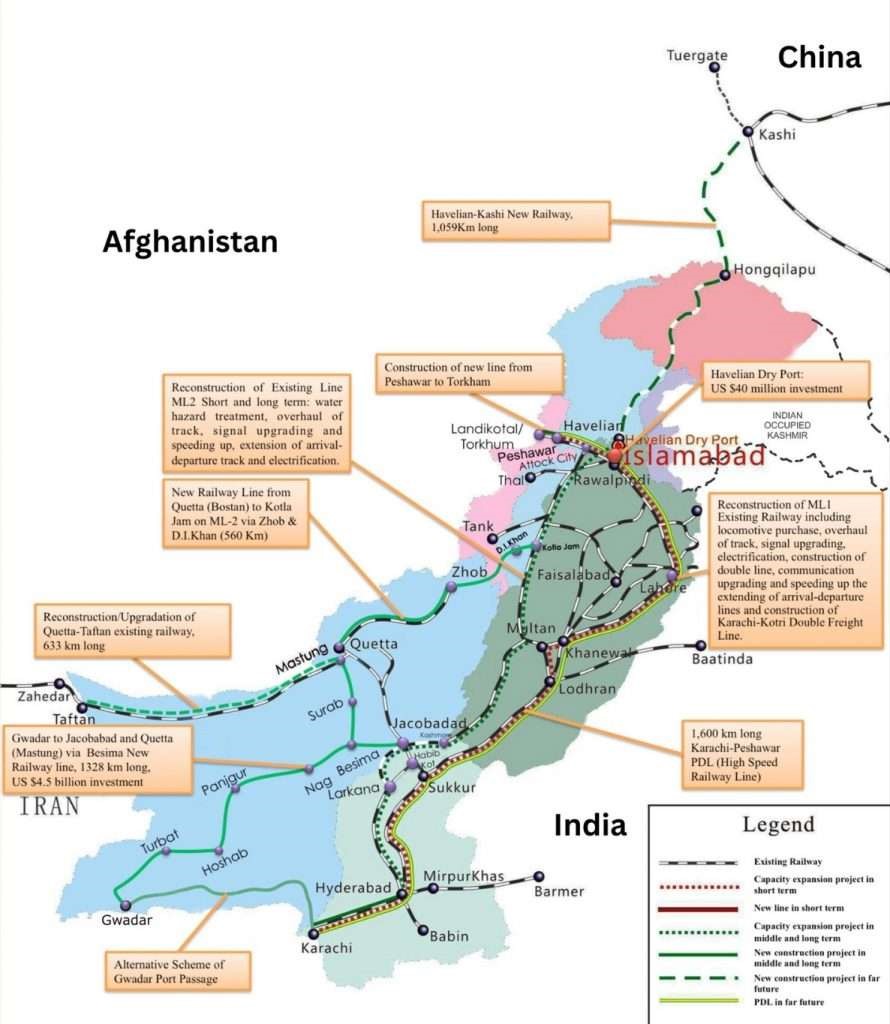

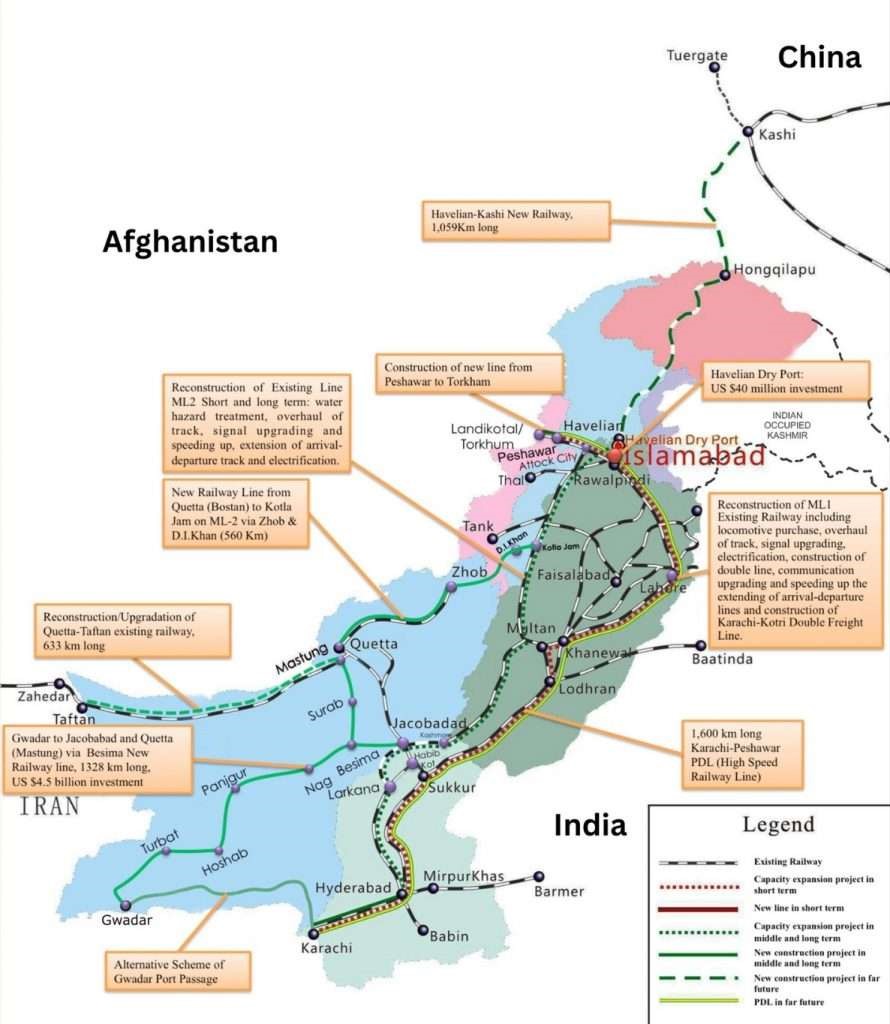

Amidst all the chaos, last week, a report by the South China Morning Post (SCMP) revealed that a Chinese feasibility study, funded by the government and published in a journal, proposed the development of a $58 billion railway project linking China's landlocked Xinjiang region to Gwadar, the Arabian Sea port in Pakistan.

This, naturally, led to wave of excitement amongst the Pakistani populace and specially the officials that were quick to celebrate a supposed achievement.

Source: Twitter

However, the celebrations were short lived as it turns out that study published by the Chinese language publication was mostly based on conjecture.

Poor feasibility

The proposed railway plan is not the only idea being considered recently. There have also been efforts to revive the $10 billion, 1,872km ML-1 railway track project, which is one of the most ambitious initiatives under the China Pakistan Economic Corridor (CPEC) framework. However, despite being in the works for eight years, the project has stalled. It had to be primarily financed by Chinese loans and is intended to be executed by Chinese companies.

“The ML-1 begins in the port of Karachi, Pakistan’s largest city and its economic engine. The line then moves through the country’s major population centers in the province of Punjab and ends in the city of Peshawar, near the border with Afghanistan. The ML-1 also has a spur in northern Pakistan that leads toward the border with China, but remains quite distant from it,” read an article in Globely News.

Source: Globely News

Unfortunately, several critical factors have hindered its progress. One amongst many is the history of Pakistan Railways (PR), which has been marred by massive losses and incompetence to manage such projects. Furthermore, China, which is the largest lender to Pakistan with an existing debt portfolio comprising of approximately 30% of Pakistan’s foreign debt, has a supervisory role in the project, which could lead to additional complications.

These concerns were also highlighted in an article by the Business Recorder, “in the absence of a viable business model, which could sustain a loan of around $ 10 billion, ML-1 project is unlikely to work in public interest and may lead to another debt trap. Moreover, with the IMF (International Monetary Fund) insisting upon Pakistan to get its existing loans rescheduled from China, it is unlikely that global lender will allow Islamabad a new debt burden of $ 10 billion.”

Therefore, another railway project that requires more than five times the estimated investment of the ML-1 project would not be a logical decision by any means.

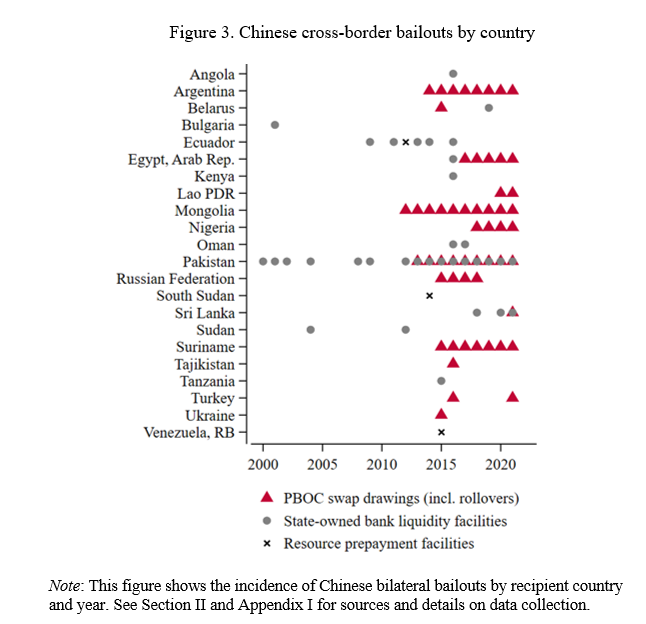

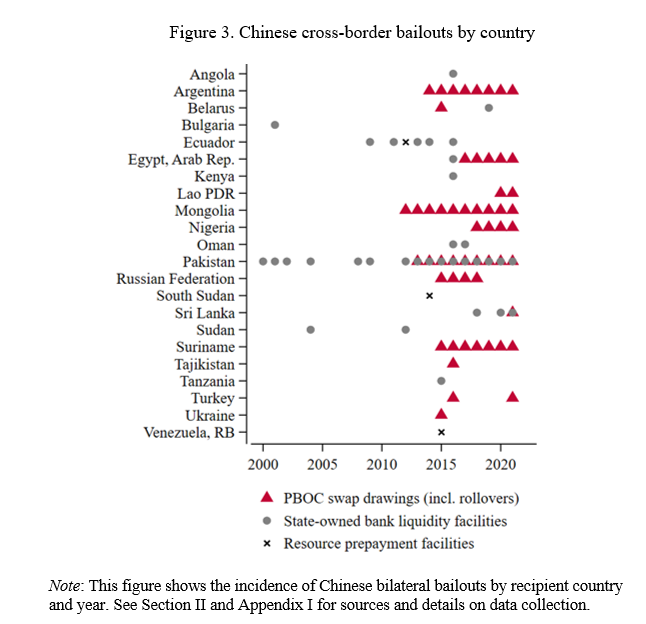

The Chinese government may not support a large-scale railway project in Pakistan due to the challenges faced by Chinese Independent Power Producers (IPPs) in recovering payments from the Pakistani government. Additionally, Chinese banks may be unwilling to provide funding for such a project. China, which is the largest bilateral lender to developing countries, is already investing heavily in safeguarding its Belt and Road Infrastructure (BRI) projects. According to a recent research paper, China has spent $240 billion between 2008 and 2021 to bail out 22 countries, with Pakistan alone receiving $48.5 billion in assistance, among the highest recipients.

Moreover, it is becoming increasingly apparent that there is a significant power imbalance in Pak-China economic relations.

Former Pakistani diplomat, Husain Haqqani, in an article for the Foreign Affairs Magazine, writes, “The initial euphoria that greeted Chinese investment is dissipating. Pakistani leaders are beginning to look warily at the scale of the country’s debt obligations, especially as China has become more reluctant over the last two years to invest more in Pakistan because of security concerns and worries about returns on investment.”

The inflation rate, currently, is the highest for Pakistan in almost 60 years. Further, the Pakistani rupee has also significantly depreciated against the dollar, dropping by 20% so far in 2023, making imported goods more expensive.

The government is exploring various measures to address liquidity concerns, and one of the primary measures is to impose import restrictions. “Pakistan posted a CAS of US$654 million during March and the currency has stabilized. We anticipate monthly CPI inflation to soften after May 2023 and gradually decline over the next 12 months majorly because of base effect along with tight monetary and fiscal policy,” read a report by Topline Securities. However, this approach has choked the economic activity and looks unsustainable in the long run.

All this information upfront paints a bleak picture of the country’s economy and the condition, indeed, is an abysmal one.

Amidst all the chaos, last week, a report by the South China Morning Post (SCMP) revealed that a Chinese feasibility study, funded by the government and published in a journal, proposed the development of a $58 billion railway project linking China's landlocked Xinjiang region to Gwadar, the Arabian Sea port in Pakistan.

This, naturally, led to wave of excitement amongst the Pakistani populace and specially the officials that were quick to celebrate a supposed achievement.

Source: Twitter

However, the celebrations were short lived as it turns out that study published by the Chinese language publication was mostly based on conjecture.

Poor feasibility

The proposed railway plan is not the only idea being considered recently. There have also been efforts to revive the $10 billion, 1,872km ML-1 railway track project, which is one of the most ambitious initiatives under the China Pakistan Economic Corridor (CPEC) framework. However, despite being in the works for eight years, the project has stalled. It had to be primarily financed by Chinese loans and is intended to be executed by Chinese companies.

“The ML-1 begins in the port of Karachi, Pakistan’s largest city and its economic engine. The line then moves through the country’s major population centers in the province of Punjab and ends in the city of Peshawar, near the border with Afghanistan. The ML-1 also has a spur in northern Pakistan that leads toward the border with China, but remains quite distant from it,” read an article in Globely News.

Source: Globely News

Unfortunately, several critical factors have hindered its progress. One amongst many is the history of Pakistan Railways (PR), which has been marred by massive losses and incompetence to manage such projects. Furthermore, China, which is the largest lender to Pakistan with an existing debt portfolio comprising of approximately 30% of Pakistan’s foreign debt, has a supervisory role in the project, which could lead to additional complications.

These concerns were also highlighted in an article by the Business Recorder, “in the absence of a viable business model, which could sustain a loan of around $ 10 billion, ML-1 project is unlikely to work in public interest and may lead to another debt trap. Moreover, with the IMF (International Monetary Fund) insisting upon Pakistan to get its existing loans rescheduled from China, it is unlikely that global lender will allow Islamabad a new debt burden of $ 10 billion.”

Therefore, another railway project that requires more than five times the estimated investment of the ML-1 project would not be a logical decision by any means.

The Chinese government may not support a large-scale railway project in Pakistan due to the challenges faced by Chinese Independent Power Producers (IPPs) in recovering payments from the Pakistani government. Additionally, Chinese banks may be unwilling to provide funding for such a project. China, which is the largest bilateral lender to developing countries, is already investing heavily in safeguarding its Belt and Road Infrastructure (BRI) projects. According to a recent research paper, China has spent $240 billion between 2008 and 2021 to bail out 22 countries, with Pakistan alone receiving $48.5 billion in assistance, among the highest recipients.

Moreover, it is becoming increasingly apparent that there is a significant power imbalance in Pak-China economic relations.

Former Pakistani diplomat, Husain Haqqani, in an article for the Foreign Affairs Magazine, writes, “The initial euphoria that greeted Chinese investment is dissipating. Pakistani leaders are beginning to look warily at the scale of the country’s debt obligations, especially as China has become more reluctant over the last two years to invest more in Pakistan because of security concerns and worries about returns on investment.”